Tuesday Midday Color

Here's what's piquing my interest so far today.

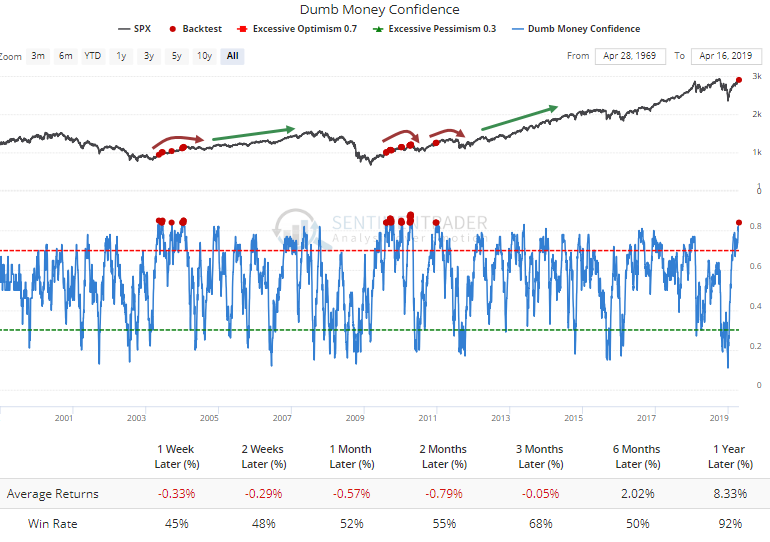

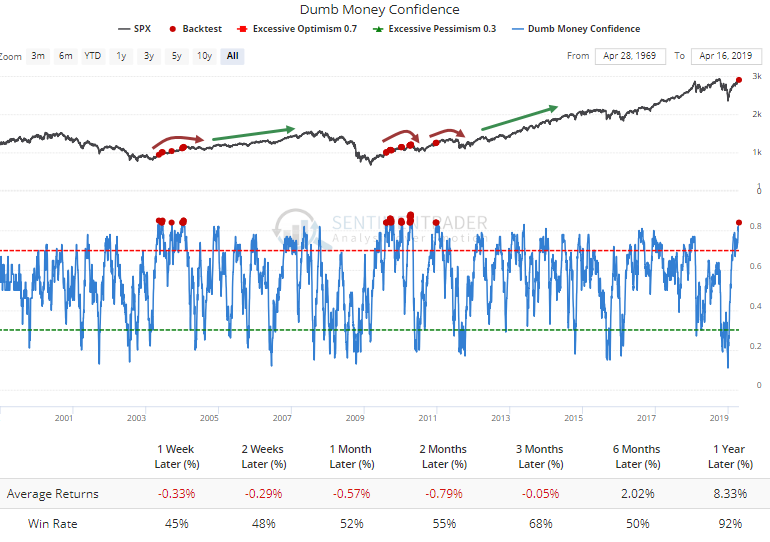

Super Confident

Dumb Money Confidence has entered a "super extreme" phase. In the 20 year history of the model, only two distinct time periods can compare - the recoveries from the last two major bear markets. That was a good long-term sign of returning risk appetite, but in the short- to medium-term, it was hard for buyers to sustain this kind of enthusiasm.

Economic Divergence

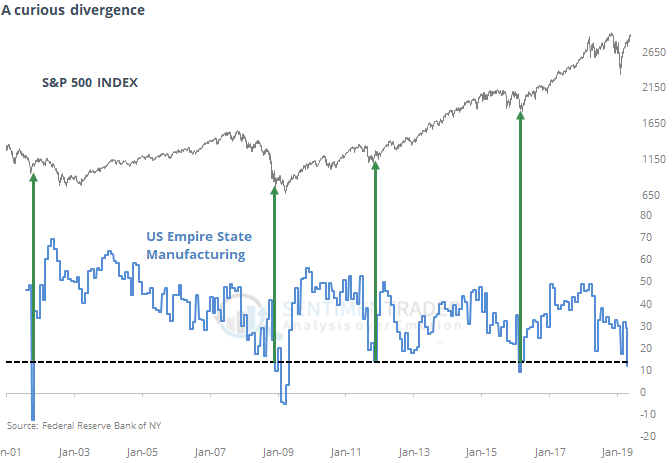

Quite a few people have pointed out the odd divergence we're seeing now with some economic indicators. It's part of the reason why economic surprise indexes have been collapsing.

The latest is the NY state survey on manufacturers' outlook on future business conditions. It has plunged to one of the lowest levels in its 18-year history. The curious part about this is that it has an exceptionally high positive correlation to changes in the stock market over a multi-month time period. Until now.

Ever other time the survey dropped to this low of a level, it coincided with bottoming action in stocks. But this is the only time in history when it plunged while stocks were rallying. I don't know if this is a good or a bad thing.

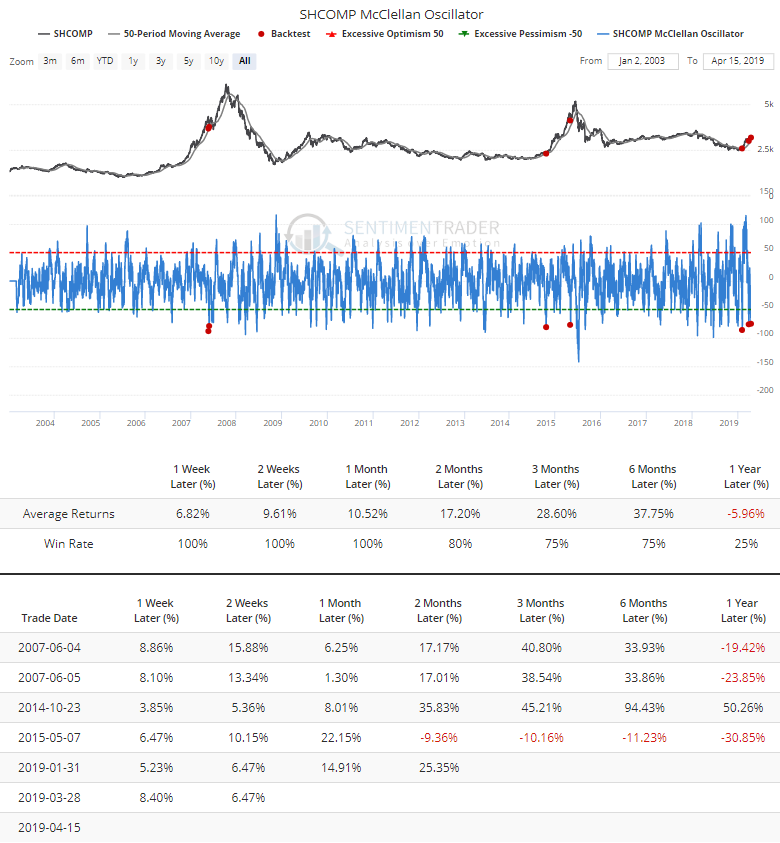

Breadth Review

We saw yesterday that negative reversals in the Shanghai have been a poor sell signals. The minor selling has been enough to push the McClellan Oscillator for the index down to -75, which we haven't seen often when the index is still trading above its 50-day average. The others came during breathers between major rallies.

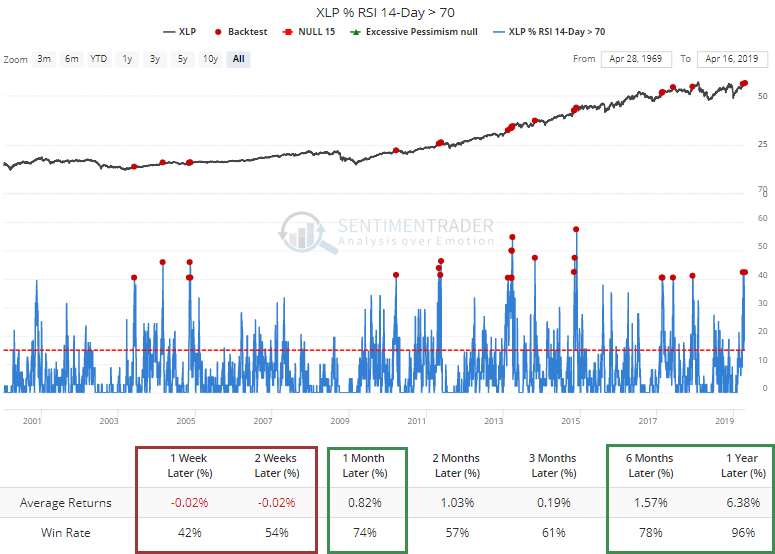

In the U.S., once again more than 40% of consumer staples stocks are overbought.

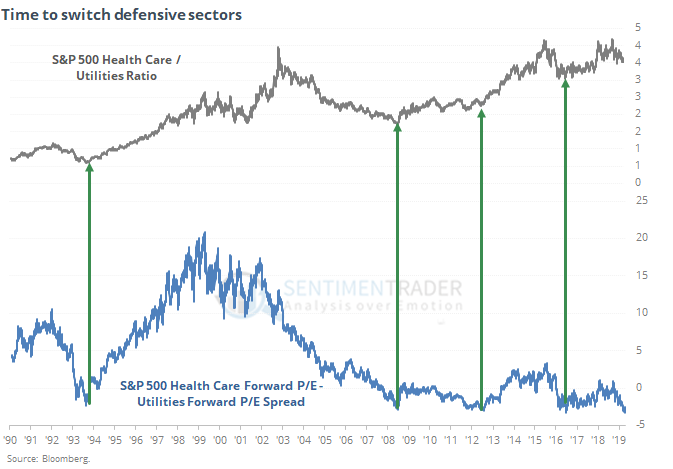

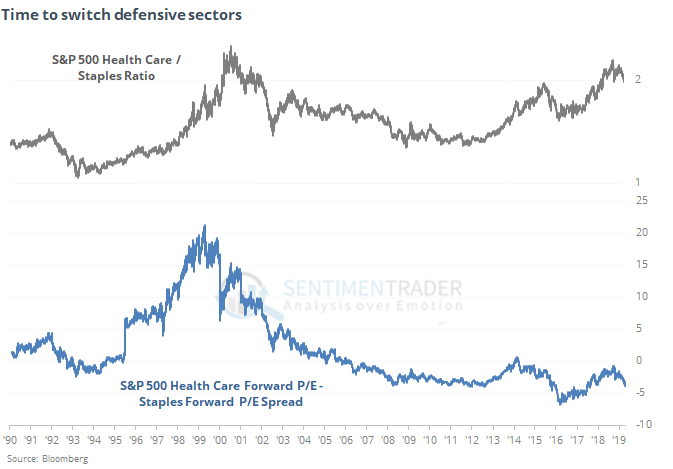

Switching Defensives

The WSJ notes that health care stocks have greatly lagged the market this year, and have even lagged other defensive sectors. As a result, the multiple places on forward earnings has come down significantly.

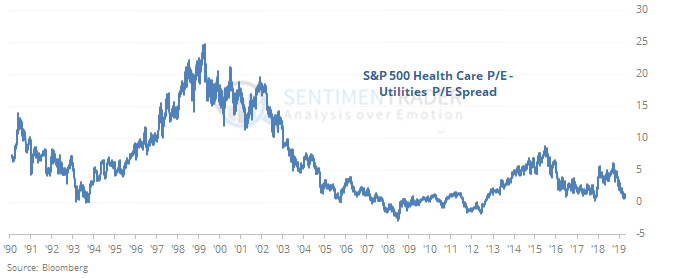

If we go back to 1990 and look at the spread between the forward P/E on health care versus another defensive sector, utilities, we can see that it has reached an extreme.

Wall Street can get ahead of itself, so if we look at current earnings instead of forward estimates, then the spread isn't quite as extreme, but still in line with times that health care outperformed utilities going forward.

Maybe it's time to focus on health care as a potential defensive play rather than utes.

It's not as extreme when compared against the other primary defensive sector, staples, but really only 2016 was more extreme.

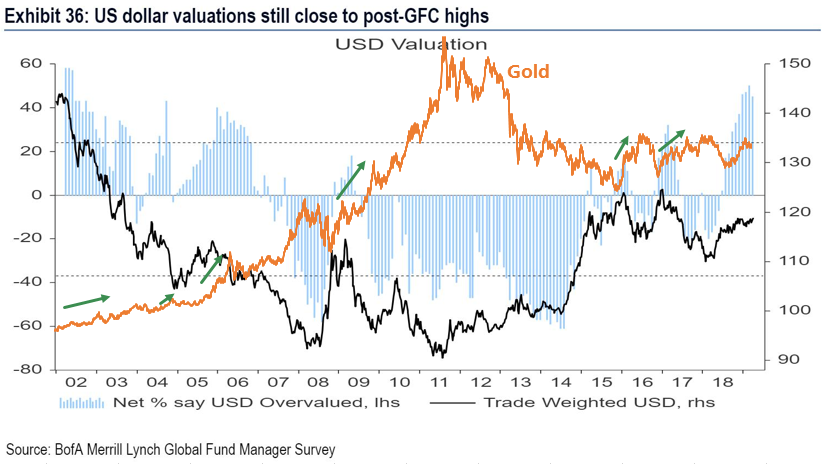

Dollar Bulls

The latest BofAML survey of fund managers shows that they continue to strongly believe the U.S. dollar is overvalued. They've usually been correct in the past (about this, anyway). When more than a net 20% of them believe the buck is due for a fall, it usually has. That's also usually been a pretty good sign for gold.

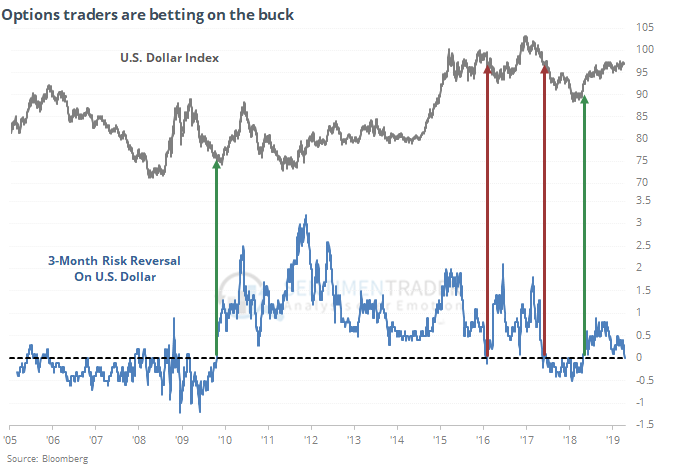

Also troubling for the U.S. dollar, notes Bloomberg, is that options traders are starting to change their bets on the buck.

In options markets, protection against a falling greenback is getting more expensive. Risk reversals, an indicator of market bias and option positioning, show investors have begun paying more for puts on the dollar than for calls versus the euro, and its other major peers.

When the 3-month risk reversal changes regimes from above 0 to below, and vice-versa, it has coincided with changes in trend for the dollar.