Tuesday Color - ISM plunge, currency flight to safety, eurozone surprises

Here's what's piquing my interest as markets continue their see-saw pattern of the past week.

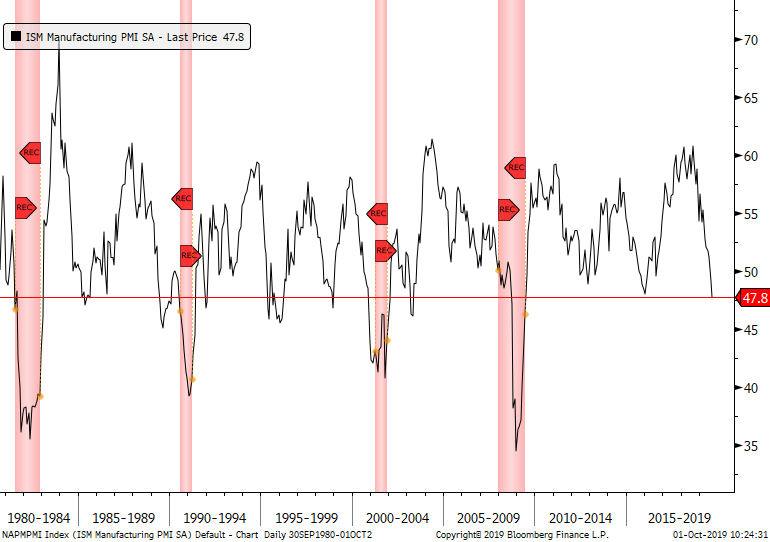

Manufacturing Woes

The big worry this morning is the plunge in manufacturing data. Troy has noted consistently in recent weeks that this is the weakest part of the economic data we monitor, though its impact on future returns is either mixed or heavily delayed.

Today's drop in the ISM Manufacturing survey marks the lowest reading in years.

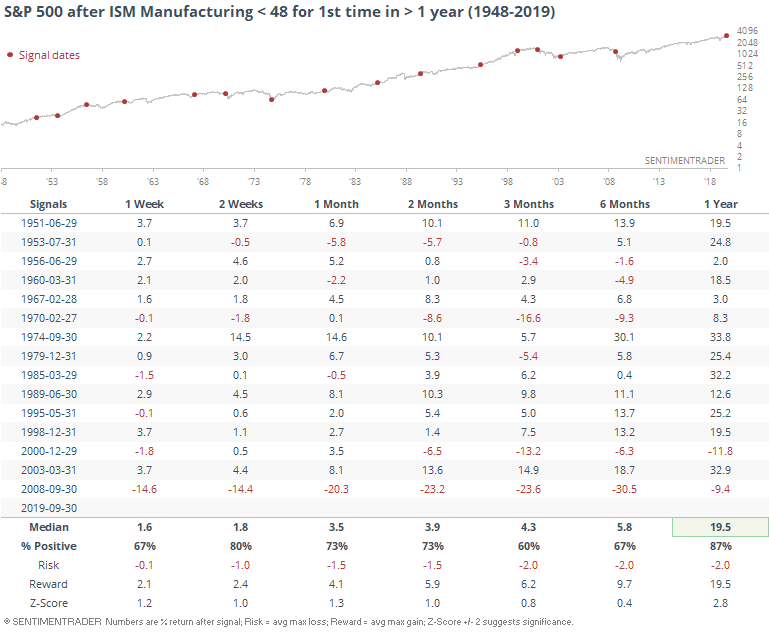

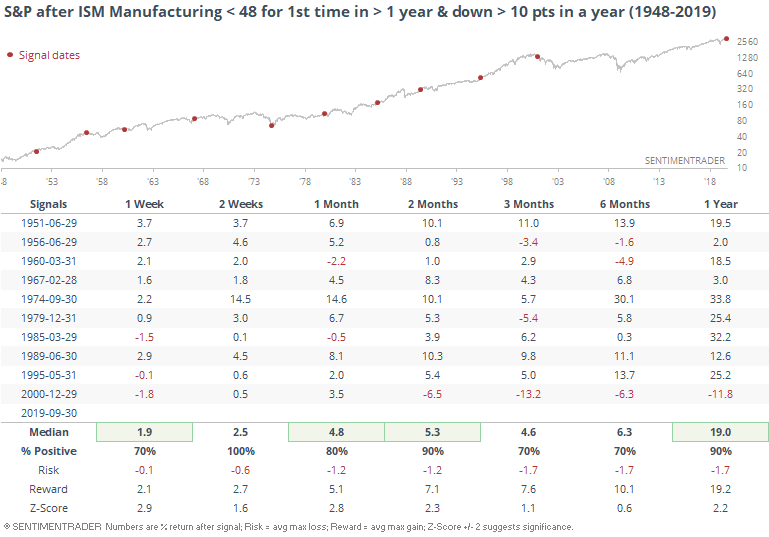

Over the past 70 years, though, by the time the ISM survey drops to this low of a level, stocks had already suffered much of their correction (if there was one). Clearly, there were exceptions, but generally it did not do well to sell the S&P 500 because of this bad of a reading.

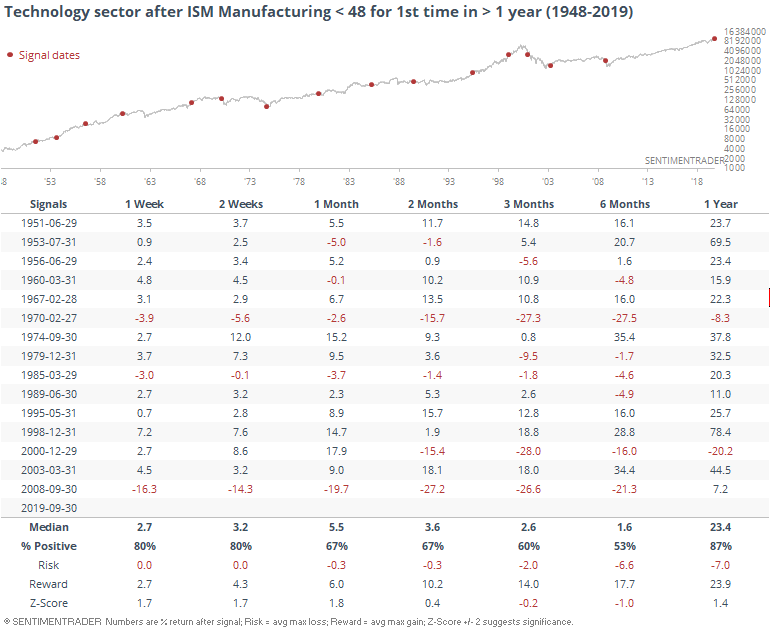

Tech stocks didn't do that well over the next 6 months, but a year later still only had 2 losses.

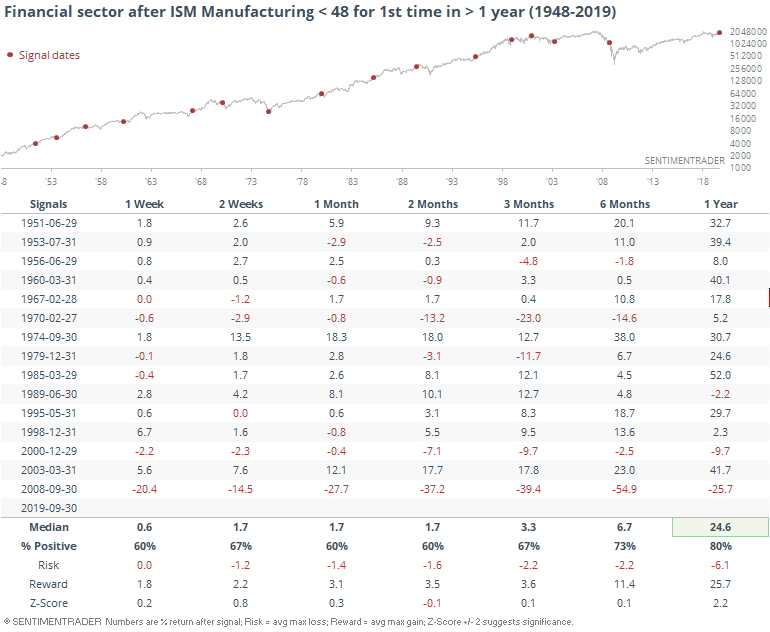

Financials weren't especially hard-hit, either.

If we add the condition that not only has the ISM survey dropped, but it's kind of collapsed over the past year by losing more than 10 points, then we get the following returns.

Again, it's hard to make the case that this data on its own is an explicit negative for stocks.

Flight To Safe Currencies

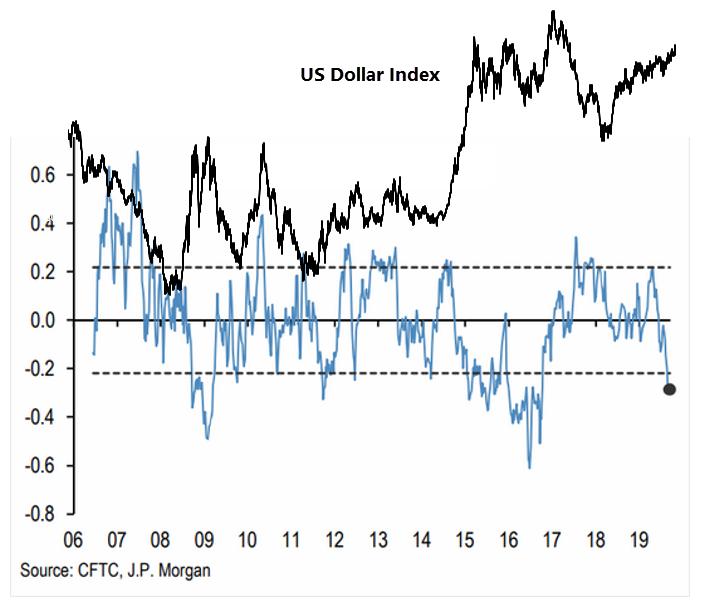

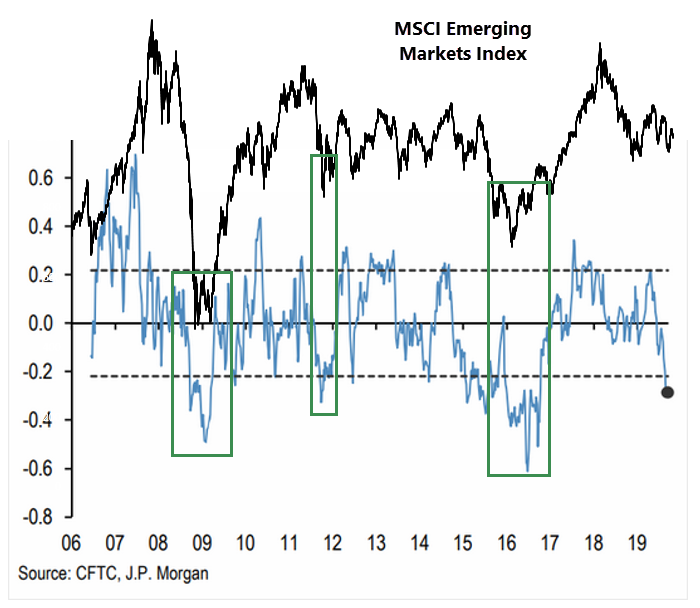

JP Morgan, via the WSJ, notes that speculators have moved into "safe" currencies at the expense of "risky" ones. The difference between them is the largest in a couple of years.

If we superimpose price action for the U.S. dollar over the speculators' positions, there hasn't been a consistent relationship.

But there has been a relationship between these positions and emerging markets.

Based on prior movements, this should be a good sign for funds like EEM.

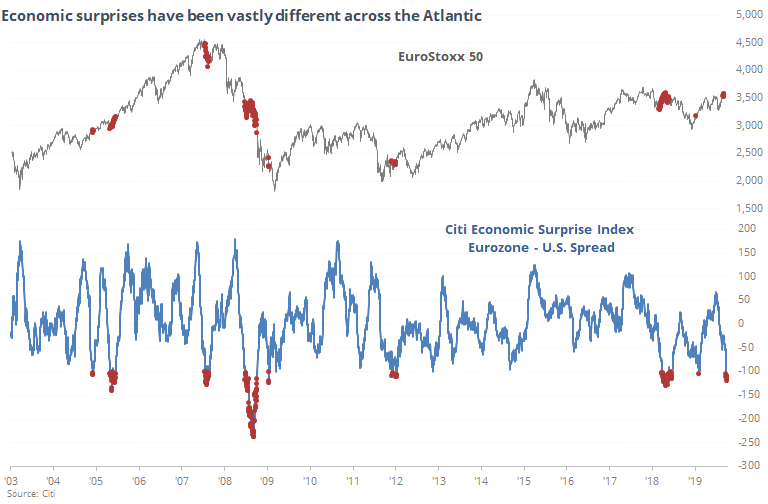

Eurozone Surprises

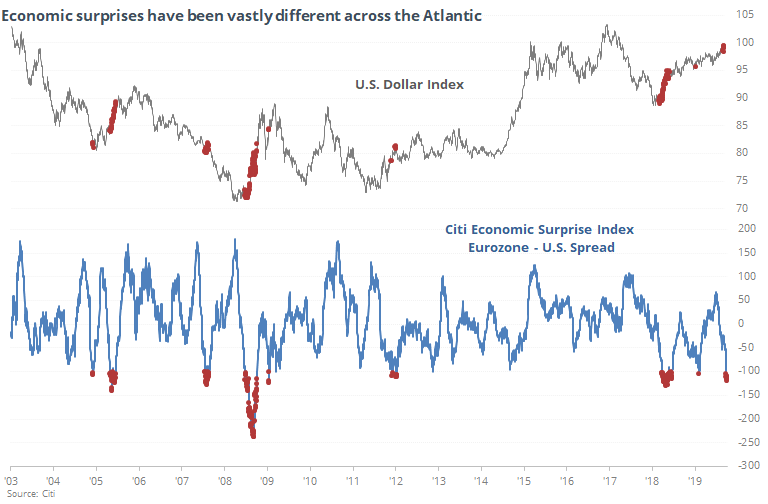

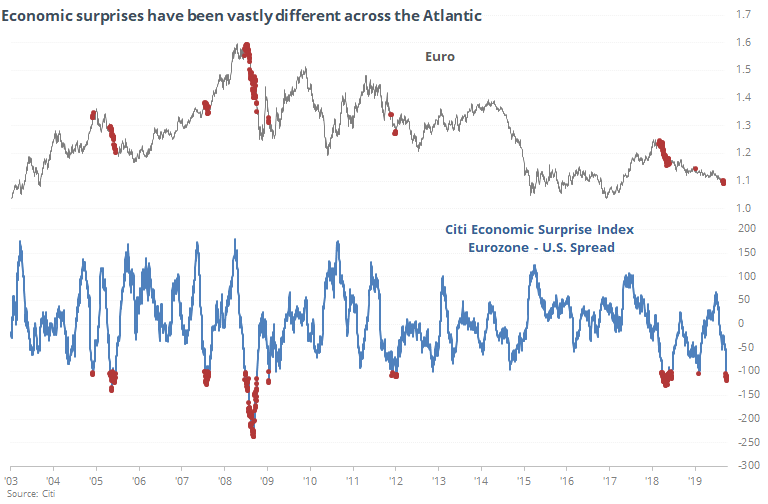

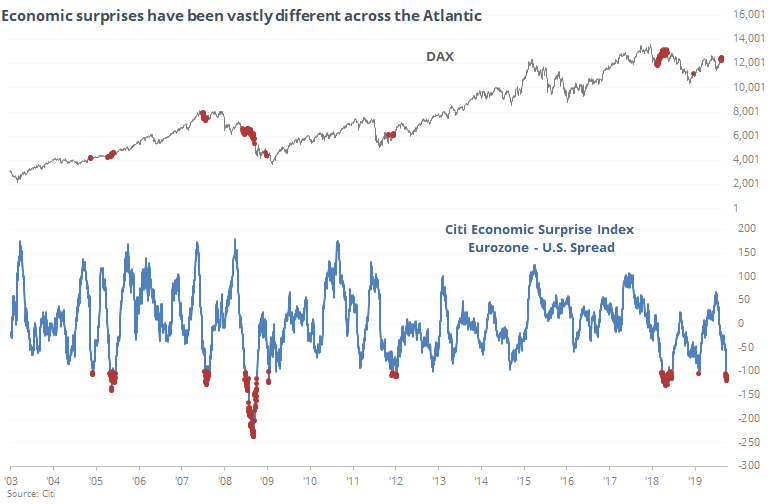

The Journal also notes that part of the reason for the positioning is likely the vastly different results in recent economic reports compared to economists' expectations across countries. In the U.S., surprises have been steadily to the upside; in the eurozone, quite the opposite.

The spread between surprises in the two regions is nearing an all-time extreme. That has usually coincided with a period of a rising dollar, until the spread evens out or swings back to the opposite extreme.

Not surprisingly, the euro has typically been in decline when this happens.

It's been a mixed blessing for overseas indexes, like the DAX.

Same with the EuroStoxx.