Tuesday Color - Big Managers Get Bullish, Gold/Dollar Correlation Spike, Repo Rate, Volatility Premium

Here's what's piquing my interest so far on this meandering day.

Survey Says

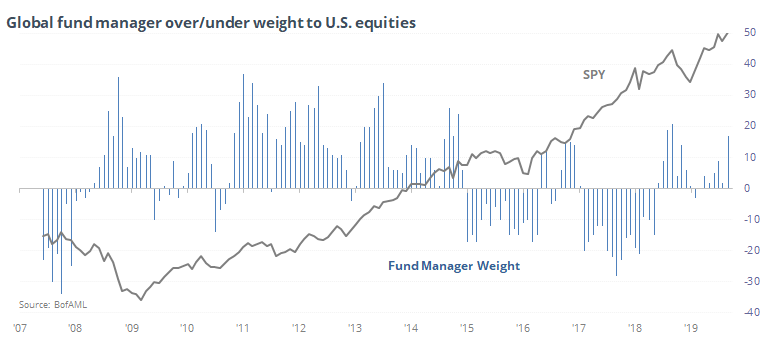

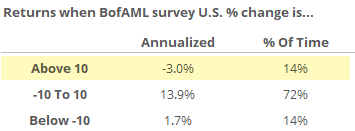

The latest survey of large money managers from BoAML shows a relatively big jump in optimism toward U.S. stocks. At 17% overweight, it's one of their most aggressive positions in the past four years.

The last time they we were this much overweight was at the peak in the fall of 2018, but the time prior to that was as stocks were bottoming in late 2016, so good luck trying to conclude anything from the last two signals.

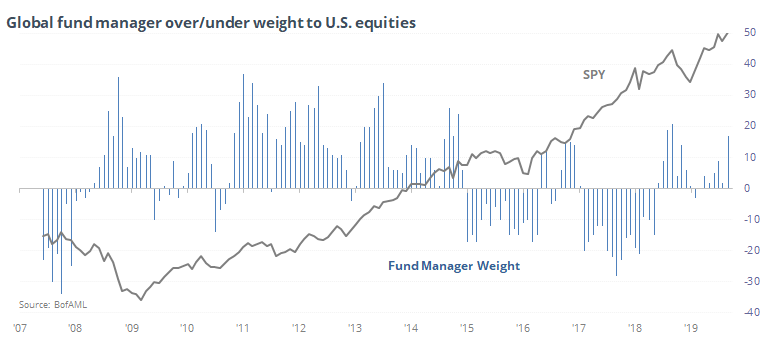

Long-term, there is this, though (edit: a previous version of this report under-reported the return).:

Since 2007, when the managers were more than 15% overweight, the annualized return on SPY was -25.2%, so that's a warning.

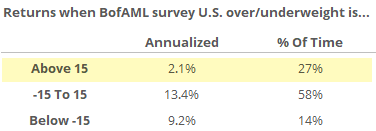

It's also notable that there was a big swing in sentiment from last month, with managers upping their optimism by 15%, one of the largest amounts ever.

That has also led to unusually negative returns going forward (edit: a previous version of this report under-reported the return).

"Big money" is usually thought of as "smart money" but as we see so often with these kinds of surveys, they're not much different than other populations. When group-think sets in, markets typically don't accommodate.

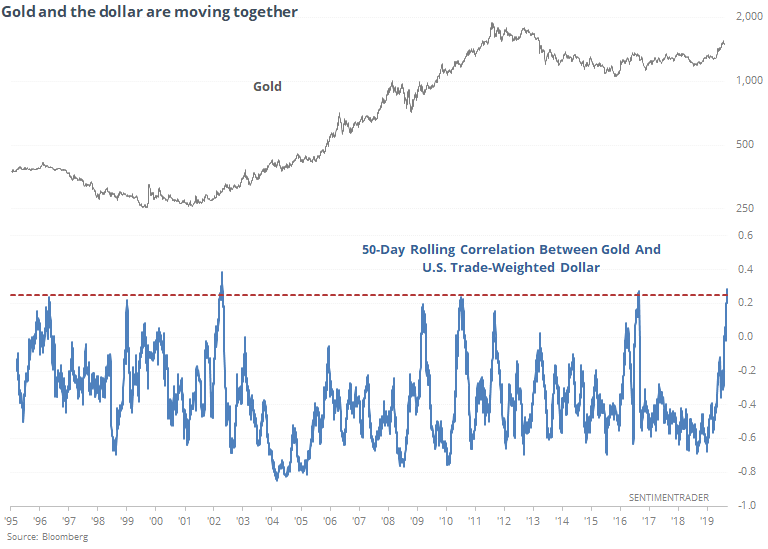

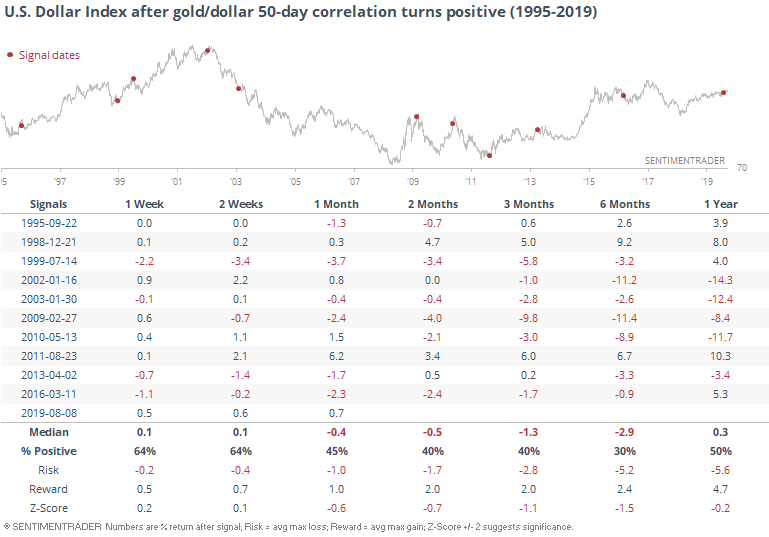

Correlation Crash

Twitterers are raising concerns about rising correlations between haven assets like gold and the dollar. Correlations in general tend to rise during periods of anxiety, though between those two in particular it's even more unusual. The 50-day rolling correlation between gold and the buck is nearing a 25-year high.

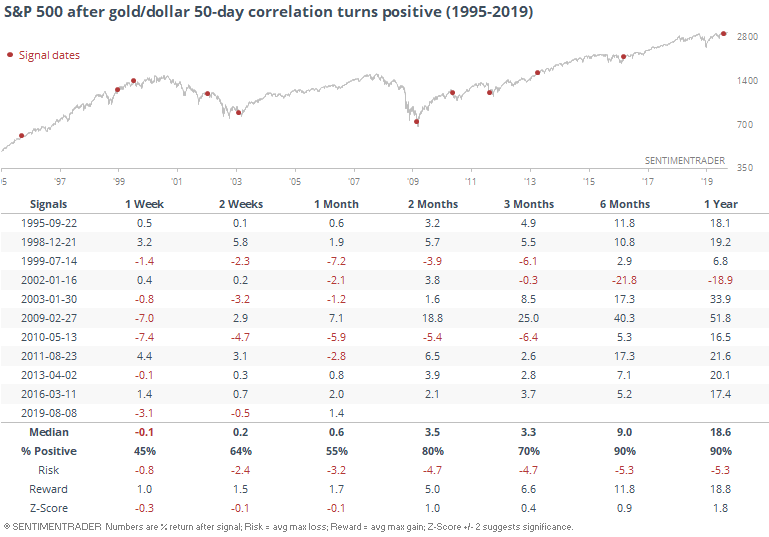

While this might happen during some crises, it was not a consistent sign that stocks were about to fall.

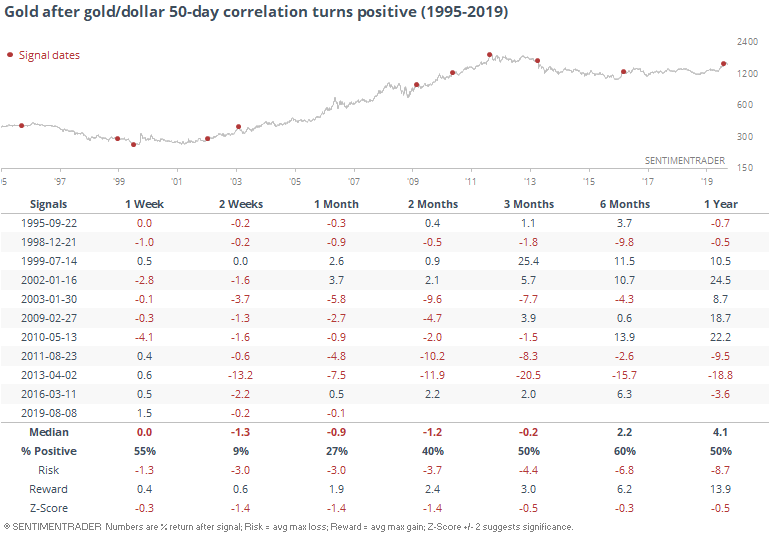

It was NOT, however, a good sign for gold. Ooof.

It wasn't an especially good sign for the dollar, either.

Repo'ed

There was a surge in the overnight repo rate, as Bloomberg notes. Not sure what that is? Me neither, not really, but we'll see plenty of experts expounding on what it means.

I have a nephew who's a repo man, an honest-to-goodness one like people see on TV. It's a simple business - you don't pay your debts, he (and his large frame) show up and take back the collateral.

That's not what we're talking about here. Per Investopedia:

What Is a Repurchase Agreement?

A repurchase agreement (repo) is a form of short-term borrowing for dealers in government securities. In the case of a repo, a dealer sells government securities to investors, usually on an overnight basis, and buys them back the following day.

There are so many influences to what that rate is, and technical reasons why it might change suddenly, that trying to pin down a sole reason is...challenging. I've read a lot about this market for a decade and still don't feel like I have a good handle on it.

Regardless of what it is or what it means, doomsayers will surely pounce on it as yet another sign of a looming crash.

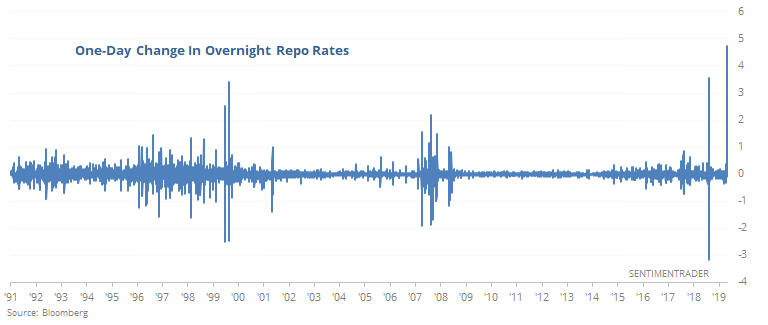

Today's move is an outlier, for sure, with the largest one-day change (so far) since at least 1991.

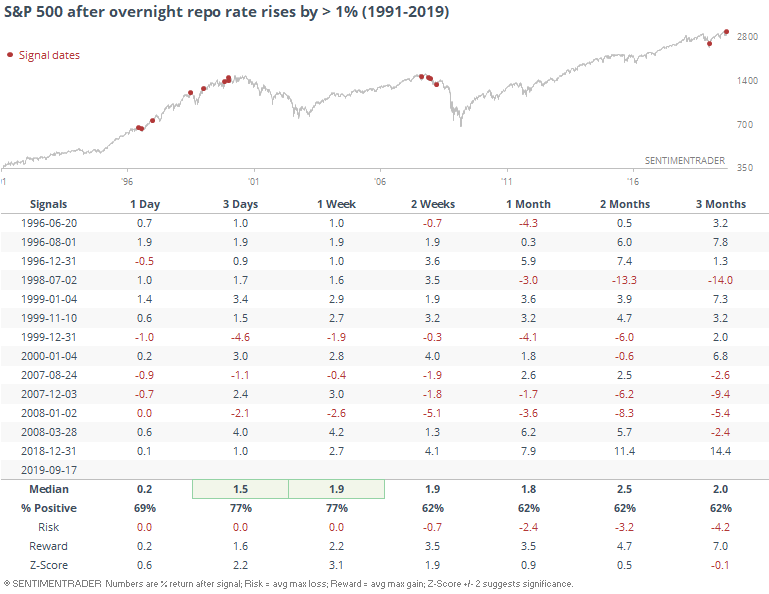

Here is how the S&P 500 fared in the days and weeks following larger than 1% jumps in the overnight rate.

There isn't much there to suggest it's a consistent sign of impending doom.

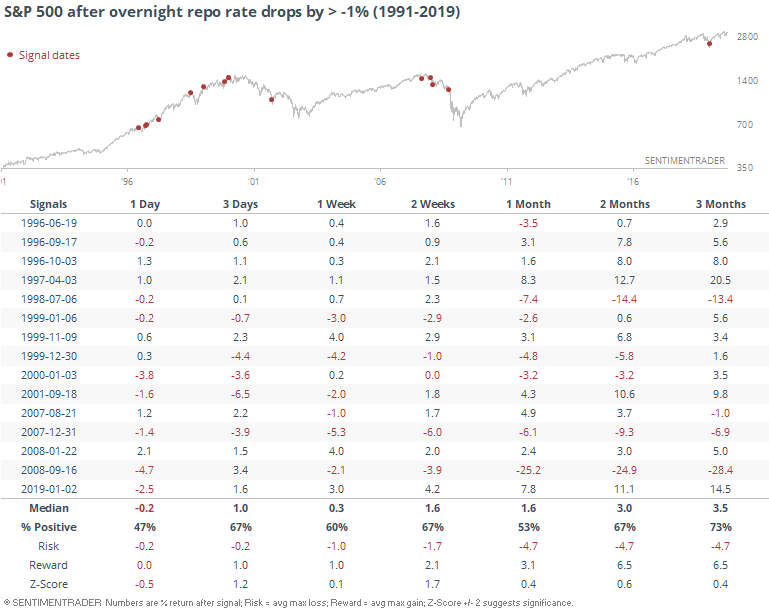

The S&P's returns were actually worse when the repo rate dropped by a large amount.

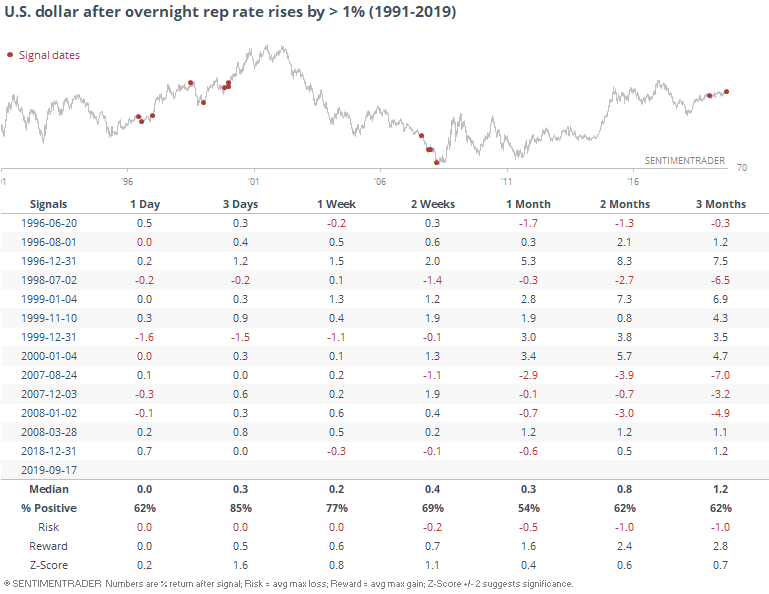

Supposedly these jumps in the repo rate might have something to do with the dollar, so let's check there, too.

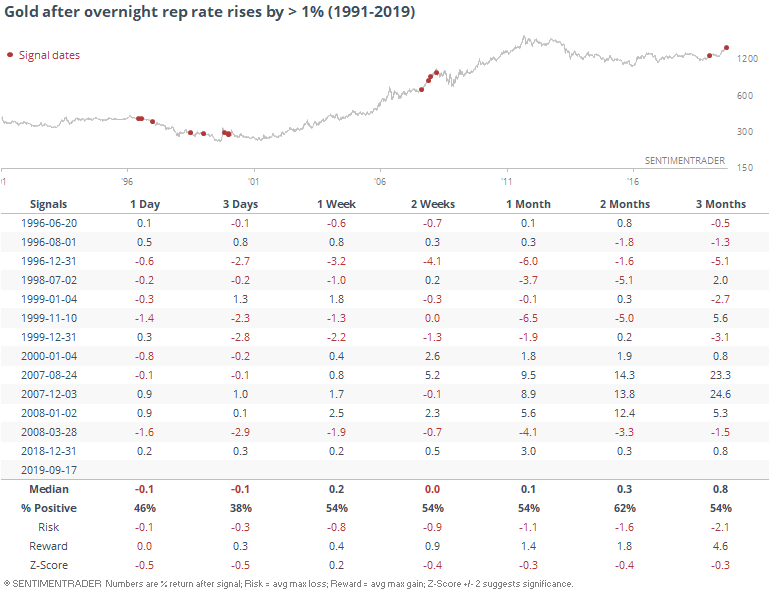

Not much there. For gold, either - maybe a little weak.

Volatility Oddness

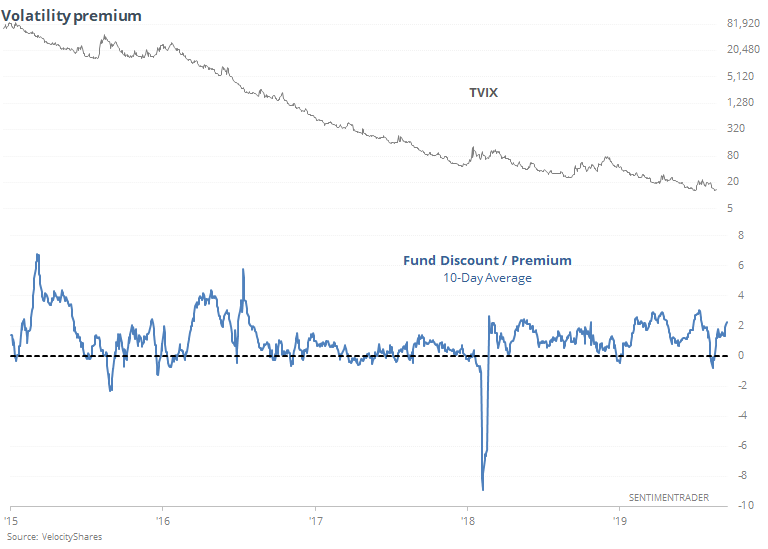

As Reuters notes, the VelocityShares Daily 2x VIX Short-Term ETN keeps trading at a premium to its net asset value. The tongue-twisting name doesn't seem to be putting off any traders, who apparently love to use one of the worst products in history.

This is getting traders nervous because something similar happened right before the volatility tsunami when XIV blew up. Or something.

Its recent premium isn't even that unusual.

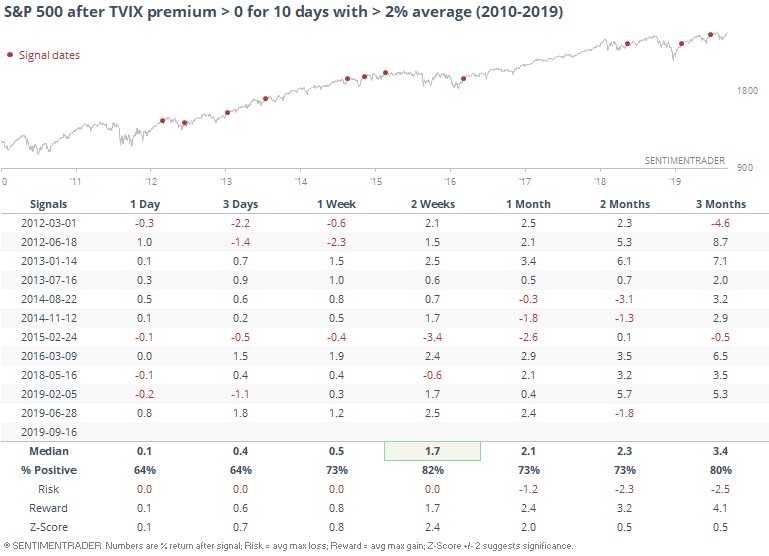

Here is every time since the fund's inception that it traded at a premium to its NAV for at least 10 straight days, with an average premium of more than 2% over that span.

Like the repo rate, lots of folks can sound smart about it, especially in terms of raising fear, but historically it has been a very questionable reason to worry.