TSLA Options Update

In this piece, dated 10/27, I highlighted 3 example trades using options on TSLA. In the three trading days since TSLA has (what else!?) rocketed 17.9% higher.

Let's take a follow-up look at how this explosive move impacted the example trades.

OVERVIEW

- At the time the three trades were highlighted, TSLA was trading at $1,024.86 a share

- One trade (TSLA YES) would benefit if TSLA moved up to $1,175

- The second trade (TSLA NO) would benefit if TSLA fell to $875

- The third trade (TSLA MAYBE) would benefit if TSLA stayed within a range of roughly $811 and $1,313

One other real-world trading note: Unlike longer-term investments, short-term options trades typically require that a much greater degree of attention be paid.

With our example trades, action is required when specific price targets are met to avoid giving back a significant profit. Because we are using end-of-day data, TSLA stock price has already moved past the ideal exit point for two of the trades by the end of the day.

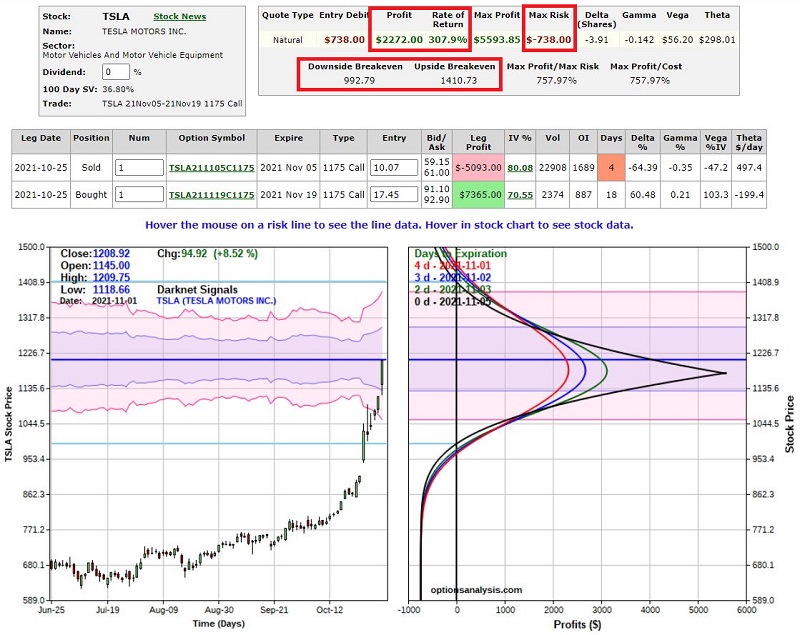

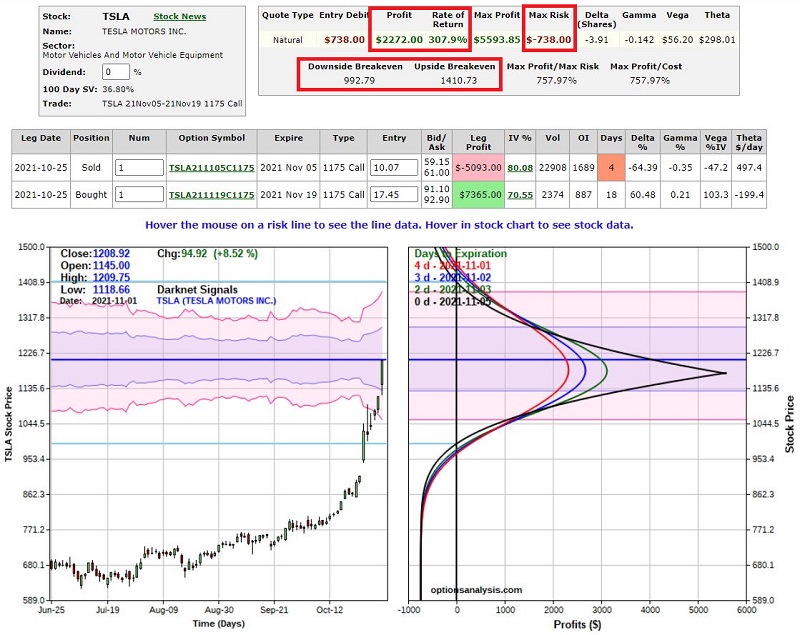

"TSLA YES" UPDATE

The screenshot below captures the status of our bullish Nov19-Nov05 1175 TSLA calendar spread near the close on 11/1.

This trade has a substantial open profit (+308% in 3 days) thanks to the following:

This trade has a substantial open profit (+308% in 3 days) thanks to the following:

- Spike higher in price

- An increase in implied volatility

A close look at the risk curves reveals that the price has already moved past $1,175. If the price continues to spike higher, this particular trade will watch its profit decline and possibly go negative if TSLA rallies beyond $1,400 a share.

TRADING ACTION: Ideally, a trader would have already exited this trade as TSLA neared $1,175 a share

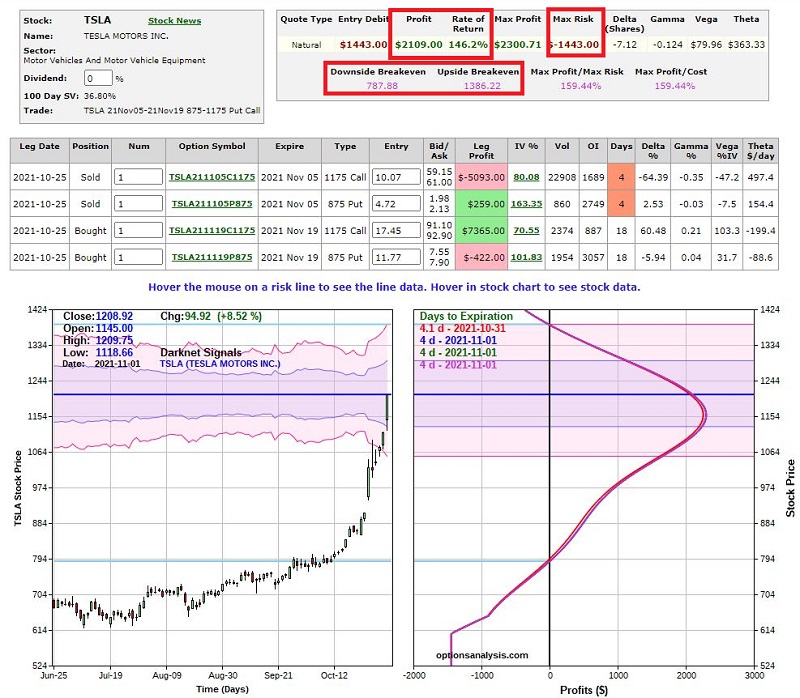

"TSLA MAYBE" UPDATE

The screenshot below captures the status of our combined trade (combining the bullish 1175 call calendar spread AND the bearish 875 put calendar spread).

TRADING ACTION: Ideally, a trader would have already exited this trade as TSLA neared $1,175 a share

"TSLA NO" UPDATE

The bearish 875 put calendar spread is presently underwater. No surprise here, given the explosive move higher by TSLA stock.

TRADING ACTION: A trader holding this position has several choices.

Choice #1: Exit the trade with a small loss and free up capital to pursue another trade

Choice #2: If a trader initially determined that they were willing to risk the entire maximum risk of $705 AND if they firmly believe that TSLA will reverse and decline just as quickly as it rose, there is nothing wrong with holding on a little longer. If TSLA were to reverse, it could do so in a dramatic fashion. Additionally, if TSLA did start to fall hard, a further increase in implied volatility is a strong (and very favorable) possibility.

There are no "right" or "wrong" answers for a trader holding this position, only decisions to be made.

MORE REAL-WORLD TRADING THOUGHTS

For a trader holding either of the first two positions, this turned out to be something of a "windfall." 100% to 300% profits in 3 days are typically rare, even for the best traders. A feeling of euphoria often accompanies this type of winning trade. The danger is that the trader gets "hooked" on this feeling and begins pursuing and expecting every trade to work out the same. This is an invitation to overtrading, mistakes based on greed, and disappointment (when future trades do not meet this unrealistically high expectation).

Bottom line: Enjoy the big win, but do not let it affect your thinking and approach to subsequent trades.

For a trader holding the bearish put calendar spread, exiting with a small dollar loss can be viewed as what I refer to as "winning while losing." Losing trades are inevitable, and one of the biggest mistakes a trader can make is to beat themselves up over a well-managed loss. Likewise, consider a scenario where:

- You are confident enough that a stock will decline that you risk actual money on that opinion

- That stock subsequently thumbs its nose at you and spikes 18% in the three days after you placed your bet

- Yet you only lose -$163 in the process

Again - because trading is ultimately as much a "mind game" as anything else - the wrong response is to beat yourself up, wondering, "How could my timing be so bad!?" The proper response is to:

- Recognize that (paraphrasing here) "stuff happens" sometimes

- Congratulate yourself that you positioned your trade so that your loss would be small if things went the wrong way

- Possibly revisit your timing criteria as dispassionately as possible to avoid a repeat in the future