Trend indicators for the S&P 500 shift to a bullish status

Key points:

- A composite that contains ten trend-following indicators cycled from negative to positive

- Comparable reversals over the past 90 years preceded robust returns for the S&P 500

- Growth-oriented sectors consistently exhibit the highest composite trend scores

Trend-following indicators point toward a resumption of the uptrend

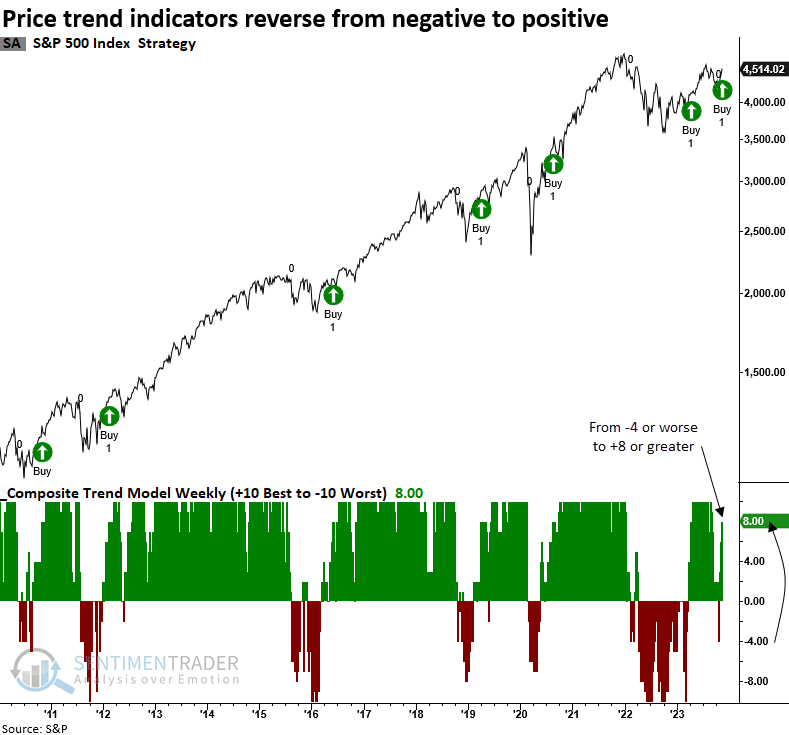

In April, I published a research note highlighting a bullish reversal for a composite that contains ten trend-following indicators. The shift in price trends provided a timely alert as the S&P 500 steadily rose over the following three months.

As the July to October drawdown persisted, the composite score steadily dropped, hitting the reset threshold at -4. However, since late October, the subsequent rebound in price trends propelled the trend score to +8, triggering a new buy signal.

The recent alignment of internal and external price trends paints an encouraging picture for the seasonally strong months of November and December.

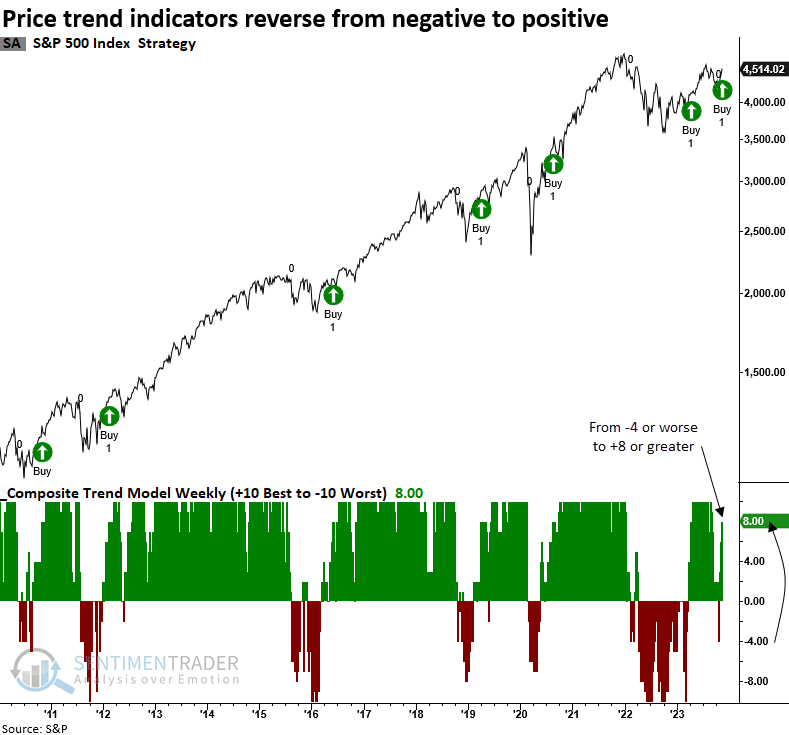

How I construct the weekly composite trend model

The composite assigns an individual score of +1 or -1 to each component in the model based on the following conditions.

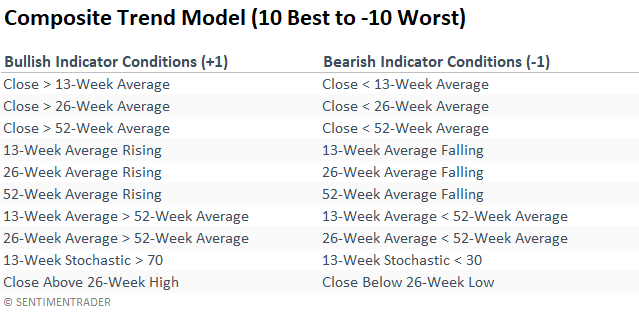

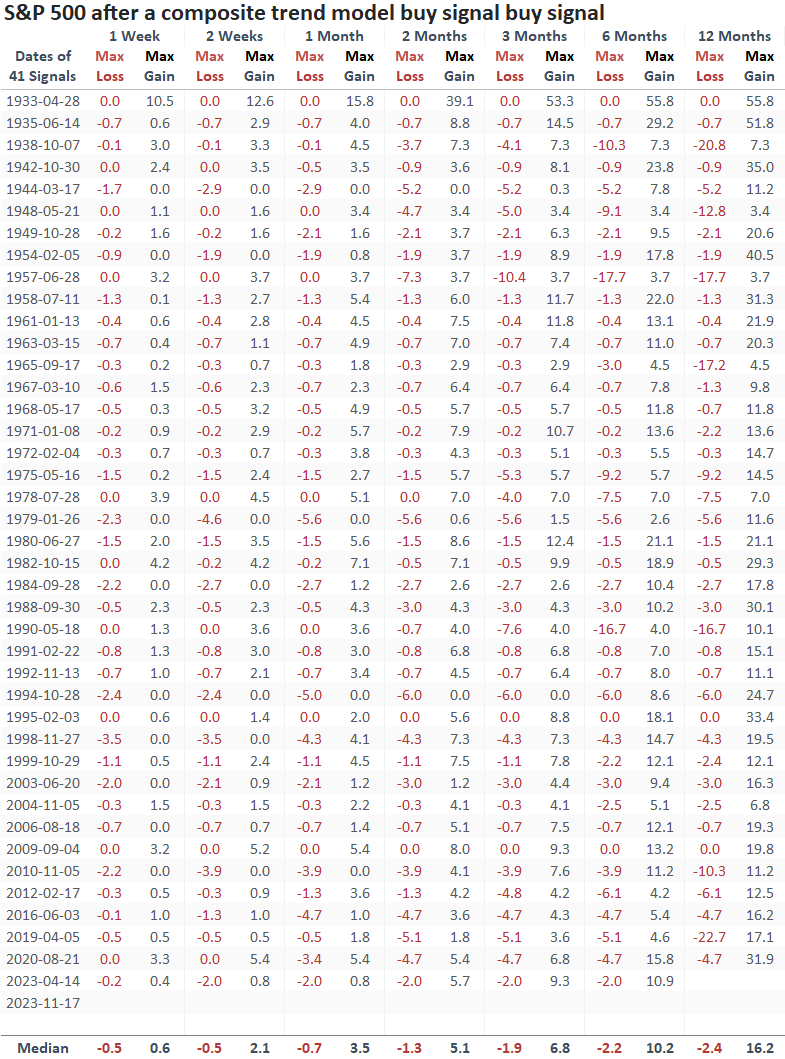

Similar reversals preceded outstanding results

When the composite trend model cycled from -4 or worse to +8 or better, the S&P 500 rose 90% of the time over the subsequent six months.

The previous signal in April saw the S&P 500 struggle in the first month, with a max loss of -2%. Sometimes, a trend change shift leads to a short-term pause. However, that precedent recovered nicely, with a max gain of 10.9% over the following six months.

The skew between the median max gain and loss overwhelmingly favors the bullish case across all time frames, and the number of 10%+ drawdowns over the subsequent six and twelve months was minimal, with only three and seven precedents.

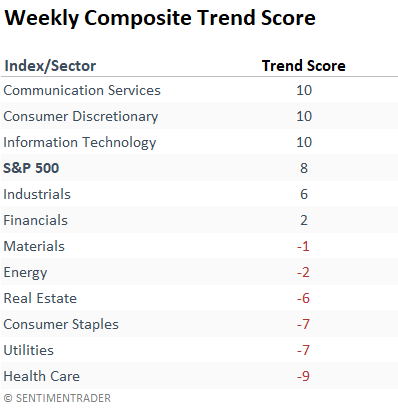

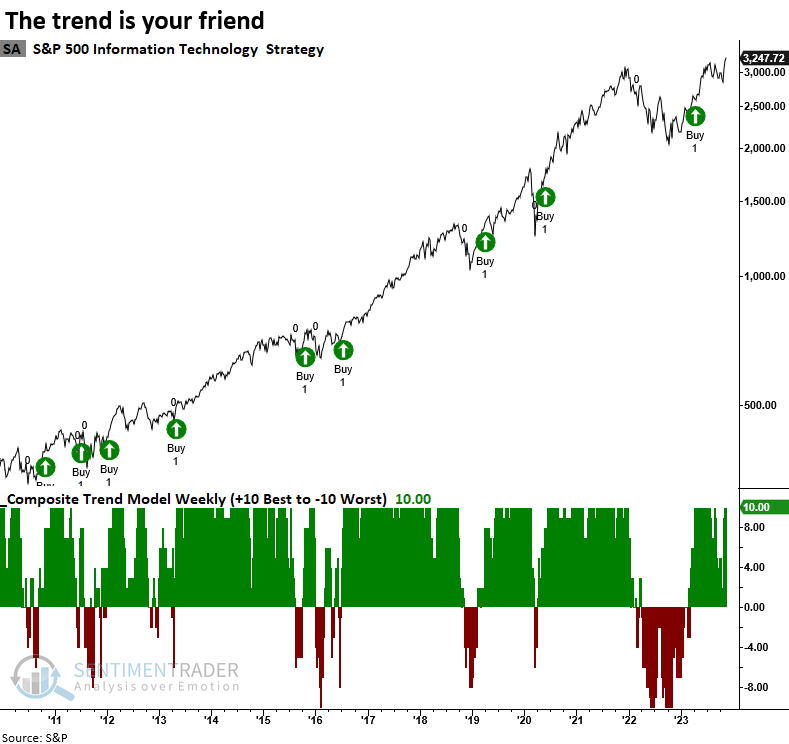

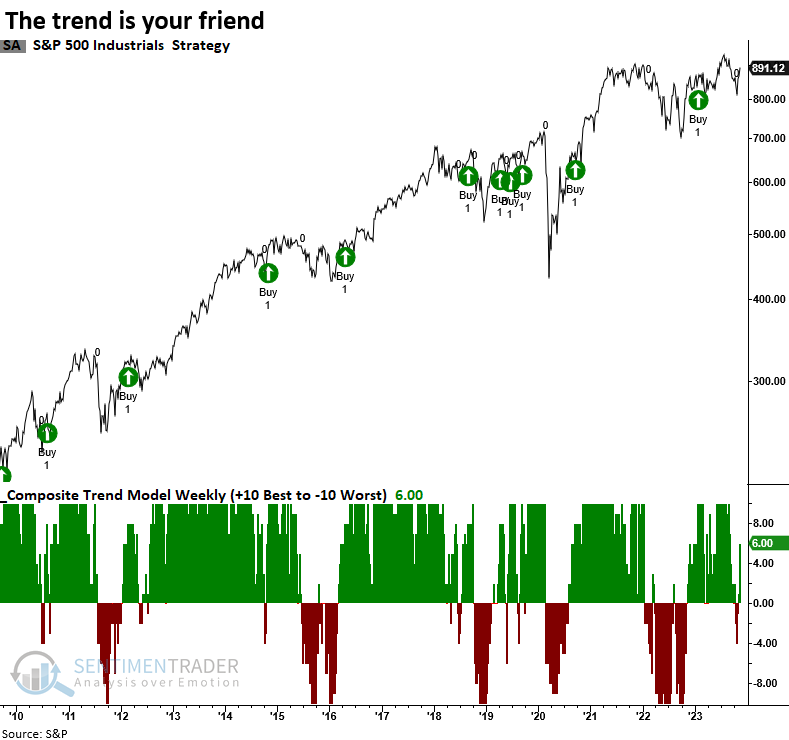

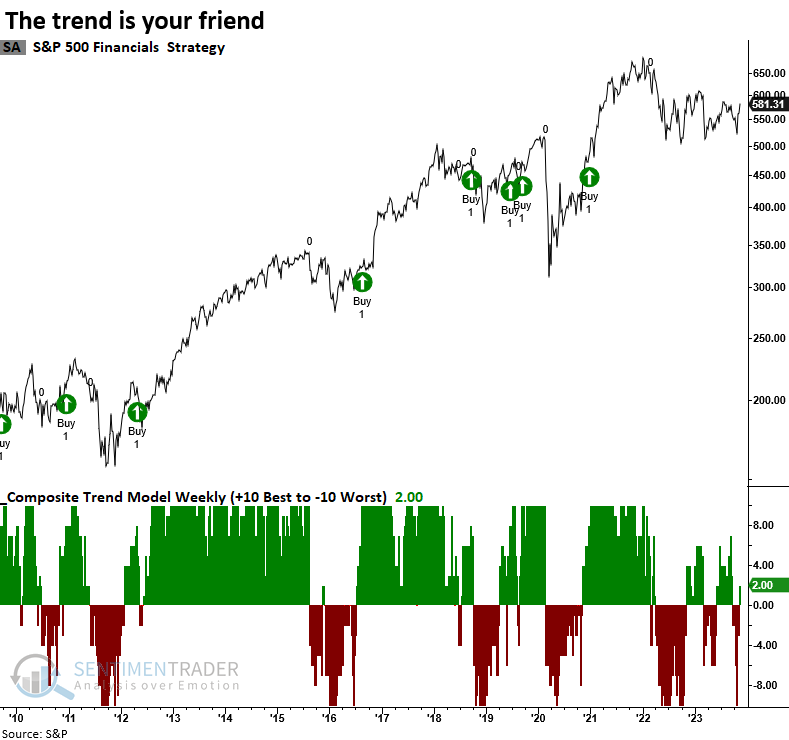

Sector trend scores

Trend scores for S&P 500 sectors overwhelming favor growth-oriented groups. In contrast, defensive and commodity-related sectors suggest a less favorable trend backdrop.

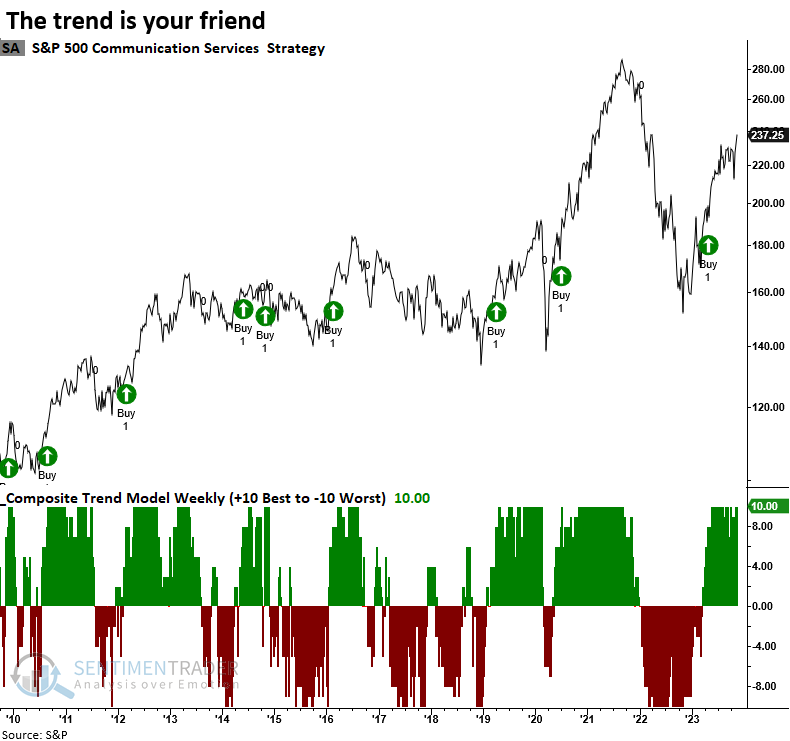

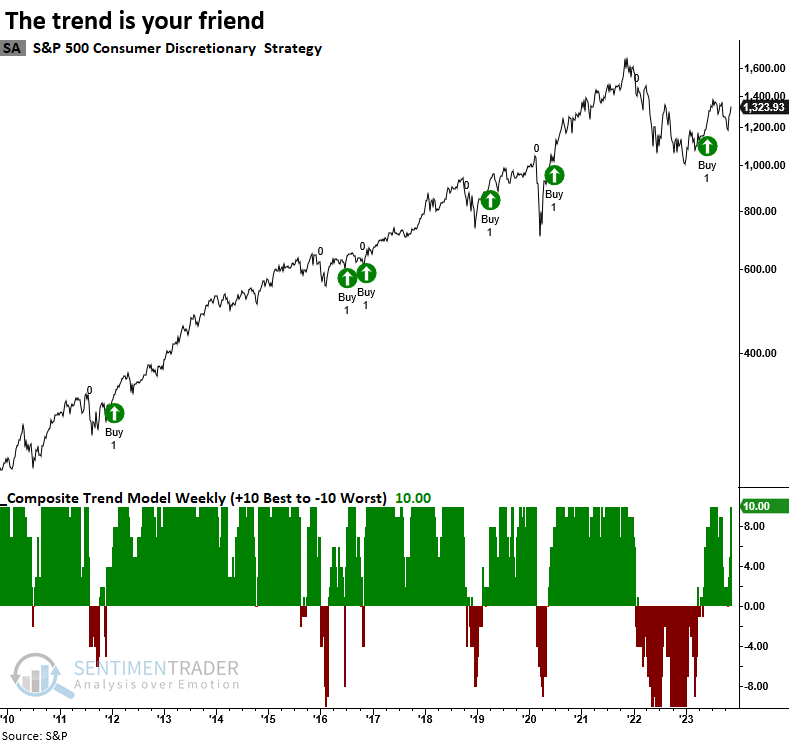

Charts for sectors with positive trend scores

What the research tells us...

A composite trend model for the S&P 500 reversed from negative to positive, triggering a buy signal for the world's most benchmarked index. Similar signals saw the S&P 500 rise 90% of the time over the following six months, including the most recent alert from April. Analyzing trend scores for sectors suggests a more favorable environment for growth-oriented groups.