Treasury Yields Break Tight Range As Metal Sentiment Sours

This is an abridged version of our Daily Report.

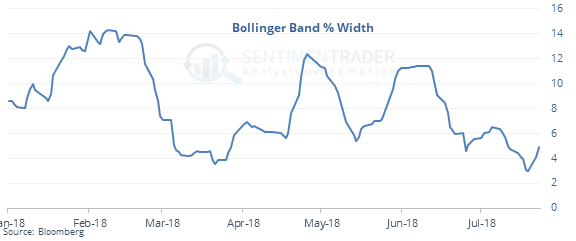

Treasury yield range expansion

The Bollinger Bands on 10-Year yields tightened the most since 2007 as bonds drifted for a month.

But then yields broke decisively to the upside, which has usually led to still-higher rates.

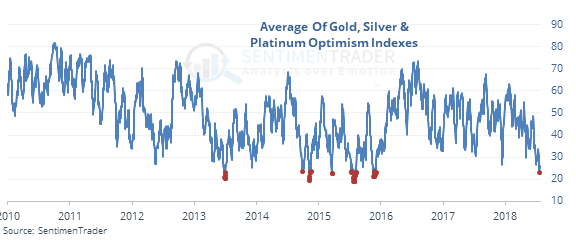

Precious metal depression

Combined sentiment on gold, silver, and platinum now ranks among the worst since 1990.

Similarly depressed sentiment led to excellent returns in silver, along with several metal mining funds.

Negative (?) reversal

The Nasdaq 100 fund, QQQ, gapped up more than 1% to a 52-week high then reversed enough to trade at or below Monday’s close. It looks nasty on a chart, but it has done something similar 7 other times, all leading to higher prices over the next two weeks.

Weird

The S&P 500 closed at a 100-day high, but the McClellan Oscillator is still negative, showing poor momentum in the market’s underlying breadth. This has only happened 14 times since 1962.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |