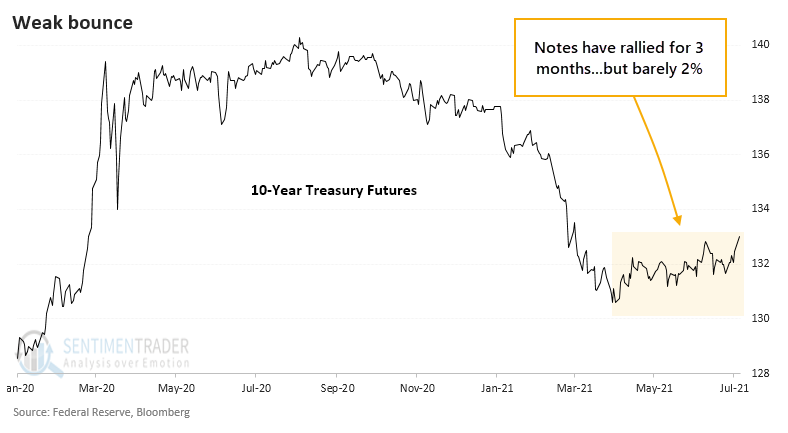

Treasury Market Sees a Dead Cat, and It's Bouncing

After Treasury notes and bonds took a tumble into April, sentiment soured, and inflation was on the tip of seemingly every investor's tongue.

That has quieted down quite a bit in recent weeks as economic data has been mixed and yields retreated from their highs. If yields are declining, that means note and bond prices are rising.

For 10-year Treasury notes, the rally off the bottom has gone 65 days. Some old trend-following systems suggested that if a market goes this long without setting a new low, then the trend has changed.

What's notable about this rally, though, is that it has a 'dead cat' feel to it. Note prices haven't even bounced 2% from the low, making it the 7th-weakest rally since futures began trading 30 years ago.

After these 'dead cat' bounces, there was a consistent tendency for notes to revert to a downtrend. Over the medium-term, prices continued to rally only once. All the other signals showed a loss on one of the multi-month time frames.

When we contrast that to times when notes had stronger rallies, at least 3.5%, then there was quite a big difference in future returns.

For stocks, weak rebounds in 10-year Treasuries didn't mean much. The S&P 500 showed mixed returns in the months ahead, as did most sectors and factors, with only a few standouts.

What else we're looking at

- Full returns in 10-year Treasuries after 'dead cat' bounces

- Detailed returns after these signals in the S&P 500, sectors, and factors

- Investigating a potential options trade in the EEM emerging markets fund based on a recent signal

- Taking a peak at seasonality in the yen

- There has been an upside reversal signal in an often-overlooked industry that has an 83% win rate

| Stat box On Thursday, there were 75 more 52-week lows than 52-week highs on the Nasdaq, within 7 days of the Nasdaq Composite closing at a record high. This triggers a technical warning sign that has tripped only twice before in the past year, in September 2020 and April 2021. |

Etcetera

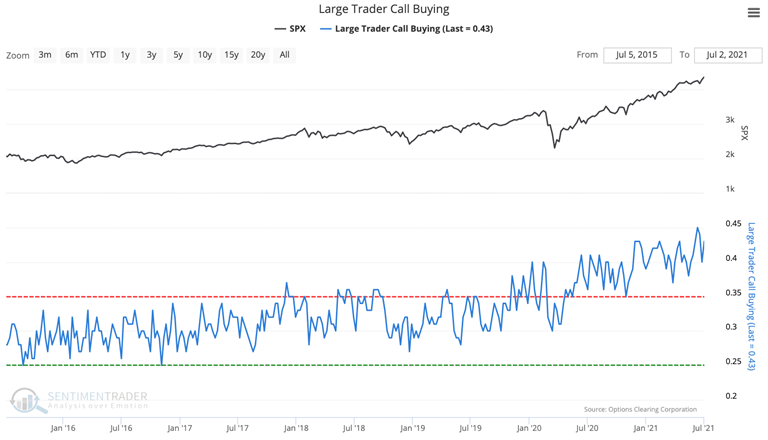

Call off. Large traders have been buying call options to open at a steadily increasing pace since 2016, and have now tied for their second-highest percentage of total volume in over 20 years.

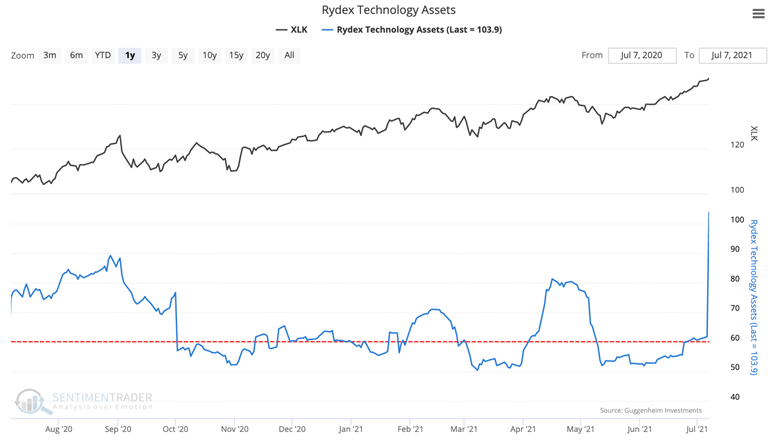

Skyrocket. Rydex Technology Assets have gone vertical, jumping from $61 to $104 million in a day. Somebody's betting that tech stocks are going to keep soaring.

Drain the rink. The Canada Fund Flow saw its largest withdraw since 2009, with the EWC fund losing more than $400 million in a single day.