Treasury bonds trigger an optimism index buy signal

Key points:

- The Optimism Index for the 20+ year treasury bond ETF (TLT) reversed higher relative to its recent range

- A trading model that uses the Optix Index triggered a new buy signal

- The TLT ETF has rallied 69% of the time after other signals

Using the optimism index to identify bullish sentiment reversals

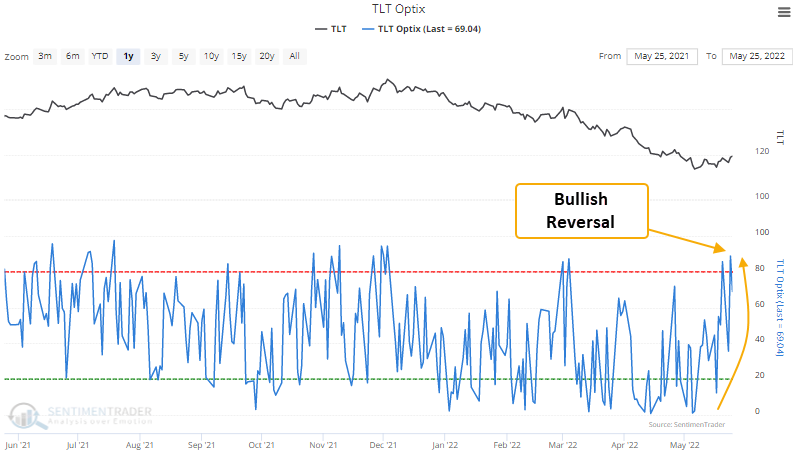

A trading model that uses the Optimism Index (Optix) to pinpoint when sentiment reverses from a period of pessimism issued a buy signal for the 20+ year treasury bond ETF (TLT) on 5/25/22.

A trading model that identifies a reversal in the optimism index

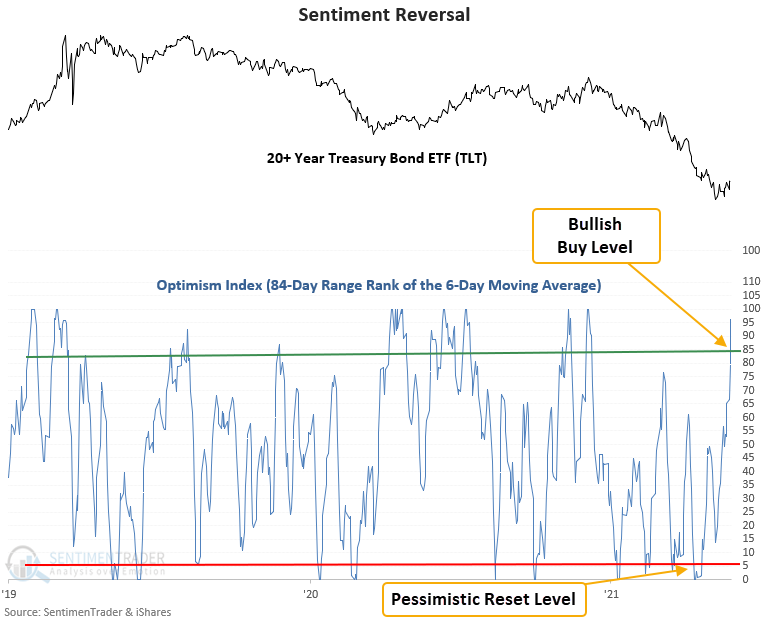

The model applies an 84-day range rank to the 6-day moving average of the Optimism Index for the TLT ETF. The range rank indicator measures the current value relative to all other values over a lookback period. 100 is the highest, and 0 is the lowest. The pessimistic reset condition occurs when the range rank for the Optix Index crosses below the 5th percentile. A new buy signal triggers when the range rank exceeds the 80th percentile, and ETF momentum turns positive within 5 days of the cross.

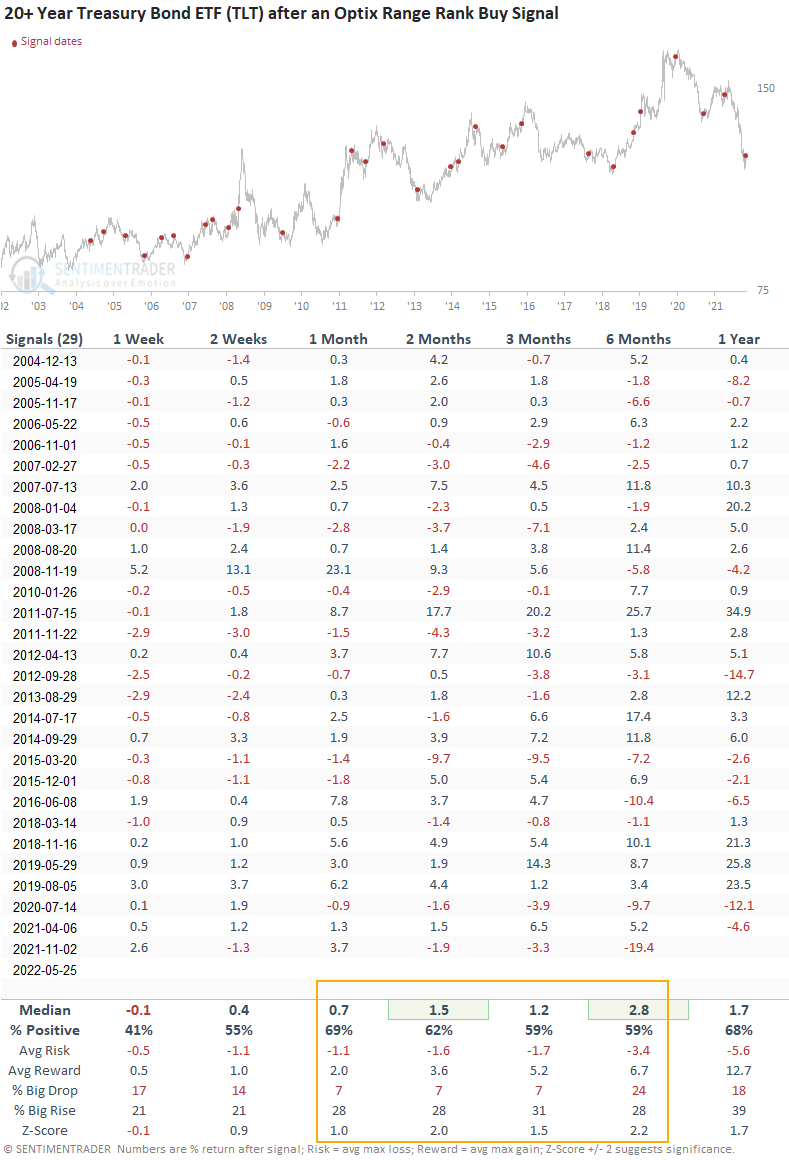

The TLT ETF rallied 69% of the time after other signals

This model generated a signal 29 other times over the last 18 years. After the others, the TLT ETF future returns, win rates, and z-scores were solid across medium-term time frames, especially the 2 & 6-month windows. The signal showed a tendency to struggle in the first week. However, consistency was solid after that, with a positive return at some point in the first 2 months in all but 4 instances.

What the research tells us...

When the optimism index for the 20+ year treasury bond ETF (TLT) reverses from a pessimistic level, it signals that traders have become more optimistic about the future direction of bond prices. Using the Optix index to measure that change in sentiment, similar setups to what we're seeing now have preceded rising prices for the TLT ETF, especially on a medium-term basis.

Economic data has been deteriorating lately, with several notable downside surprises this week. If you're in the camp that the economy continues to slow and inflation has peaked, treasury bonds could be a good bet.