Trading the S&P 1500 2-day RSI % below 30 indicator

A few months ago we added a few indicators based on how many components of the S&P 1500 have RSI values below 30 and above 70. You can find these indicators here:

- % S&P 1500 RSI 2-day > 70

- % S&P 1500 RSI 2-day < 30

- % S&P 1500 RSI 14-day > 70

- % S&P 1500 RSI 14-day < 30

This morning, I took at a look at the % S&P 1500 RSI 2-day < 30 indicator to see if I could build an interesting strategy with it. Turns out, my 'simple extreme buy/sell' approach that I've shared a number of times before works pretty well.

Strategy Description

- Trading vehicle: S&P 500 ETF (SPY)

- Start Date: Jan 3 2005

- End Date: April 17 2017

- Initial Cash: $100,000

- No margin

- Commission is $0.01 per share

- Entry rules:

- Buy when the % S&P 1500 RSI 2-day < 30 is >= 70% (meaning that 70% of S&P 1500 components have a 2-day RSI less than 30).

- The day after a buy signal is given, buy at the open with a market order

- Each position is "all-in", meaning we buy as much as our cash balance allows

- No stop

- Exit rules:

- Sell when the % S&P 1500 RSI 2-day > 70 indicator is >= 50% (meaning that 50% of S&P 1500 components have a 2-day RSI greater than 70). While the 'extreme' of this indicator is 70%, I chose 50% as a means to try to remove get out of the position before any large selloff might occur.

- The day after a sell signal is given, sell at the open with a market order

Strategy Results

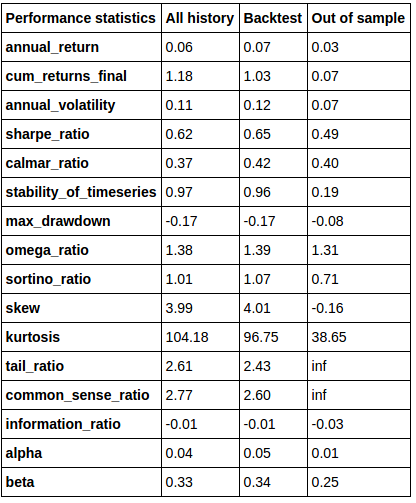

- Annual Return is 6.54%

- There were 72 total trades with 79% of those trades profitable.

- The average time-in-trade is 8 days with the median time-in-trade is 7 days.

- Average return of each trade is 1.06%. Median return of each trade is 1.50%

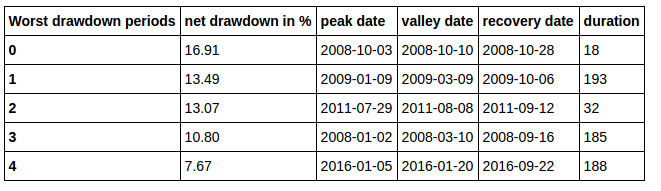

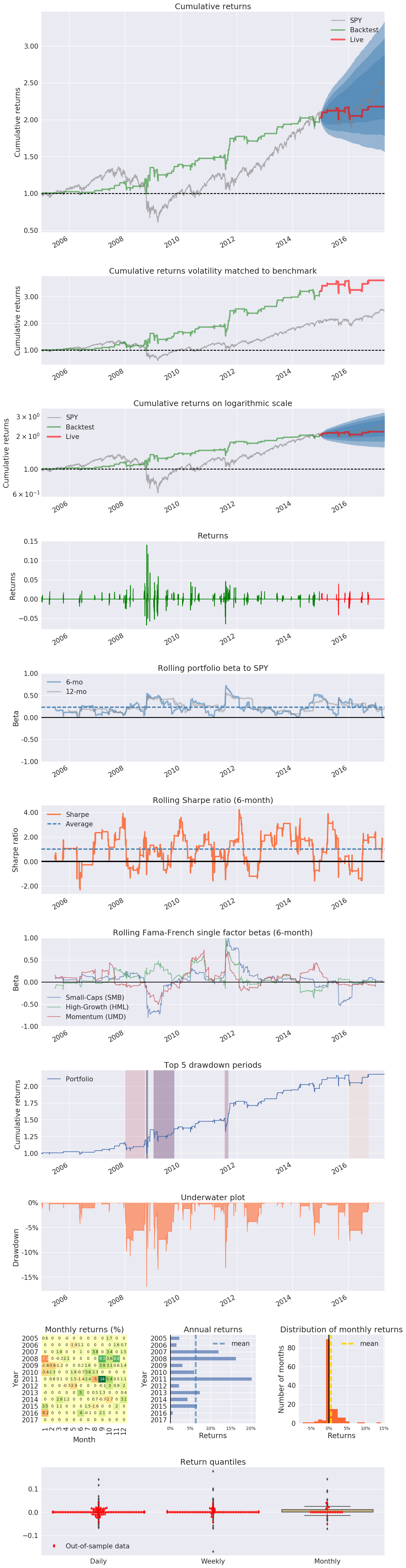

- The backtest was run over 124 months with 28 months left out for out-of-sample testing.

The out-of-sample performance isn't quite as good as the in-sample performance , which I suspect has to do with volatility during this time-frame (but would be open to other interpretations).

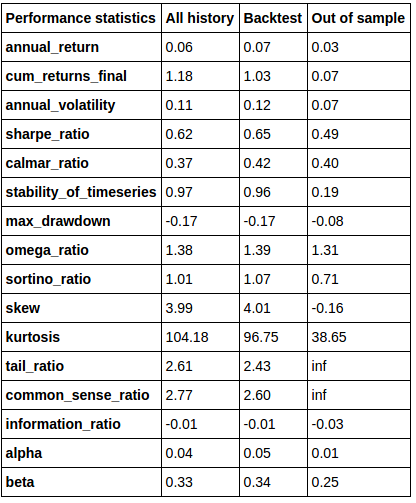

Additional trade stats/charts provided below. The annual return values in Table 1 are decimal values, rather than %'s - multiple by 100 to get actual annual return %'s.

[caption id="attachment_1216" align="aligncenter" width="416"] Table 1: Performance Statistics (decimal values, not percentages)[/caption]

Table 1: Performance Statistics (decimal values, not percentages)[/caption]

[caption id="attachment_1217" align="aligncenter" width="600"] Table 2: Drawdown Information[/caption]

Table 2: Drawdown Information[/caption]

[caption id="attachment_1218" align="aligncenter" width="600"] Figure 1: Performance Charts[/caption]

Figure 1: Performance Charts[/caption]