Traders suddenly scramble for lottery-ticket hedges

There was a whole litany of concerns tearing at investors heading into October, the "scariest month of the year." It's been scary all right, but only for the new wave of short-sellers.

Heading into Monday, the most important ETF in the world had gapped up at least 0.25% at the open for 3 straight days, as eager buyers pushed stocks higher overnight. Not only that, latecomers kept up the pressure, and the fund closed higher than the open by at least 0.25% each of those days as well. It doesn't seem like much, but it's never happened before.

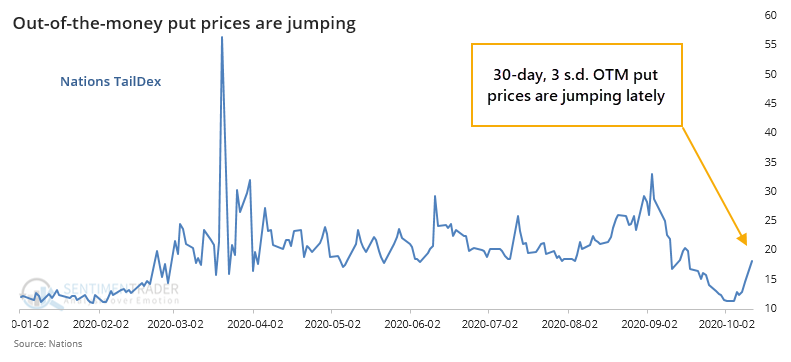

Despite the big gains on Monday, implied volatility actually increased, with a slight uptick in the VIX "fear gauge." As noted by Scott Nations, president of Nations Indexes, this was mostly due to a big jump in extremely far out-of-the-money put options.

At the same time, at-the-money put options have barely budged. This kind of scramble for lottery-ticket hedges on a big up day doesn't happen very often. It was more negative than not in the very short-term, but nothing much beyond a week.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- All signals since 1993 when SPY gaps and rallies for at least 3 days in a row

- What happens when demand for tail risk jumps suddenly despite a market rally

- Short interest on the Nasdaq is the highest in a decade

- Most small-cap stocks are now in uptrends

- Semiconductor stocks have rallied big for 4 days in a row

- What happens when positive economic surprises taper off

- Optimism on several agricultural commodity contracts is extremely high