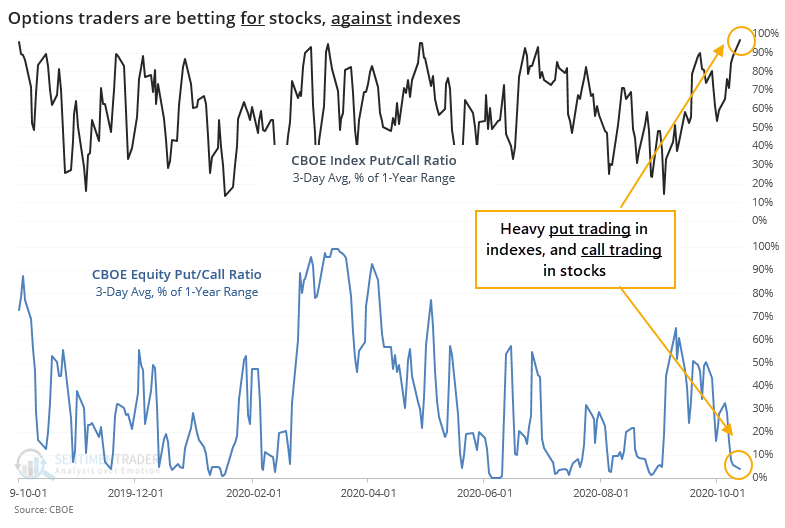

Traders seem positive on stocks, negative on indexes

Earlier this week, we saw that options traders are once again increasing their speculative bets. It's not yet to a level equalling the frenzy in August, but it's getting there.

Over the past few days, there has been an interesting twist to this data. Volume in equity options has heavily skewed toward calls; volume in index options has skewed toward puts.

The 3-day average of the CBOE Index Put/Call Ratio is in the top 95% of its range over the past year. The average of the Equity Put/Call Ratio is in the bottom 5% of its range. Going back more than 20 years, this has never happened at the same time.

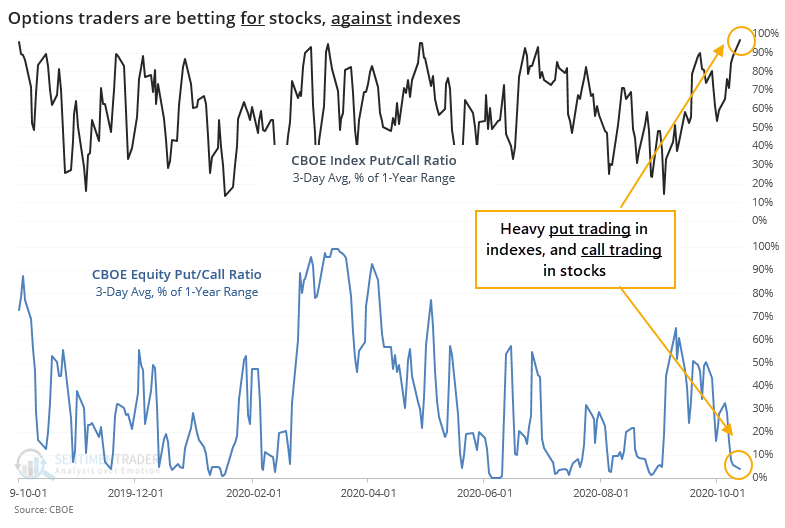

If we relax the parameters to get a larger sample size, then we can get a sense of whether this might be another warning sign.

It really hasn't been. While it's dangerous to assign reasons for any indicator, it looks like traders have started to establish hedges on major indexes as a check against some bets that individual stocks will keep rising. We can't quite know that from the volume figures, but there's a pretty good chance that's what's happening.

When traders behaved this way, then there was a 29% chance of a larger-than-average rise in the S&P 500 at some point over the next month, and 0% chance of a larger-than-average drop. Whenever we see 0% or 100%, it should not be taken literally - of course, there's a chance of a large decline. The point is to show that historically, there has been a better probability of a big rise than a big decline over that time frame.

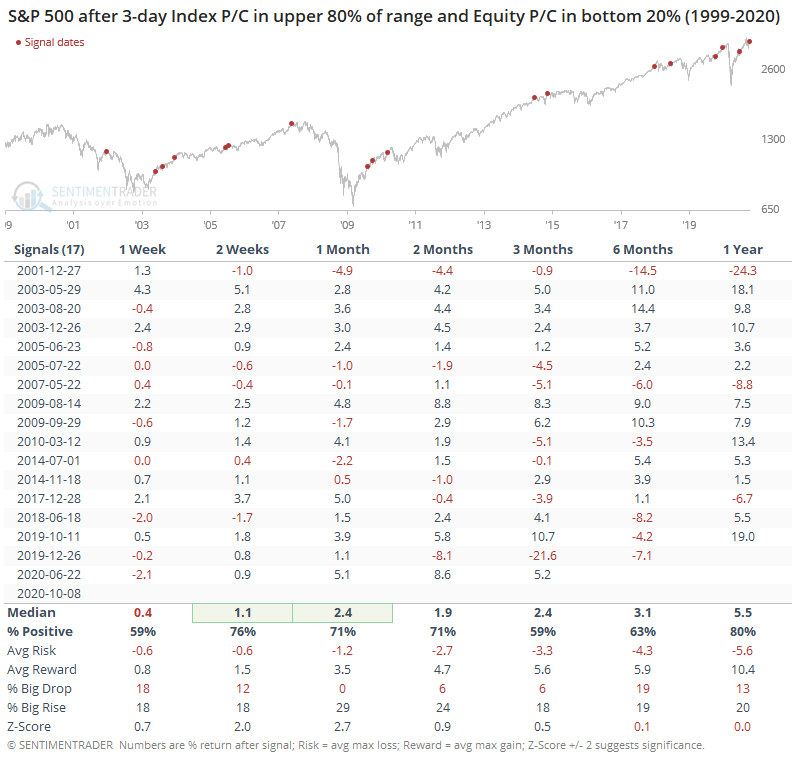

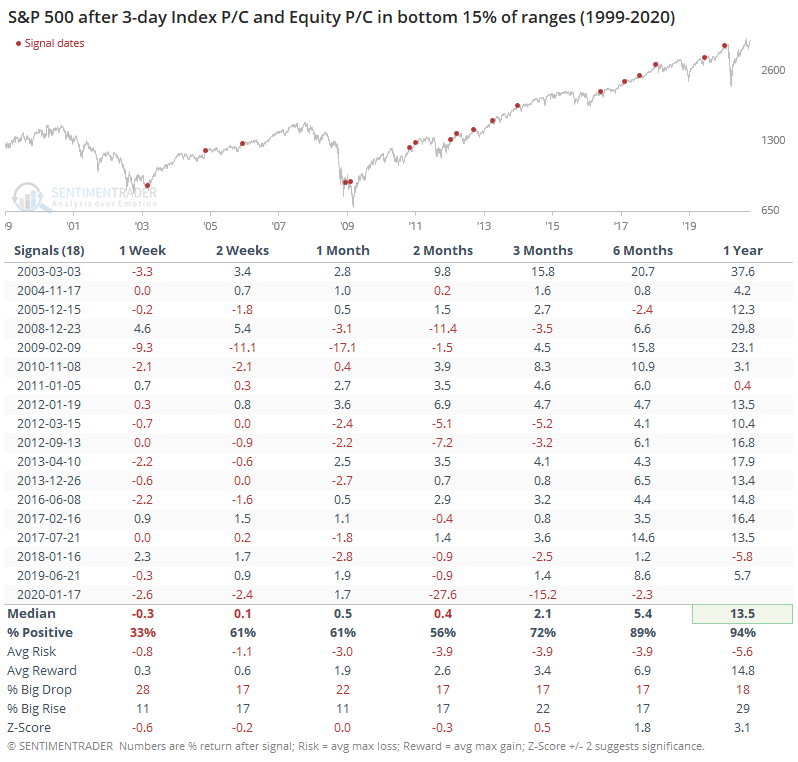

It's usually instructive to also look at the inverse to see if the pattern flips. The table below shows those times when both the Index P/C and Equity P/C Ratios were in the bottom ends of their 1-year ranges.

These signals preceded returns that were quite a bit weaker than the scenario we're in now, adding a bit of confidence to the idea that traders' behavior right now is relatively benign for the shorter-term.

That's hard to square with the data we looked at on Monday, but that tends to have a longer time frame. And it isn't quite at a level as the extremes in August, as well as being in a more positive environment now vs. then.