Traders flee precious metals for their industrial cousins

Traders in ETFs are often considered to be hot money, chasing trends and getting out at the first sign of trouble. In precious metals, that seems to be the case, and they pulled out in a big way over the past month.

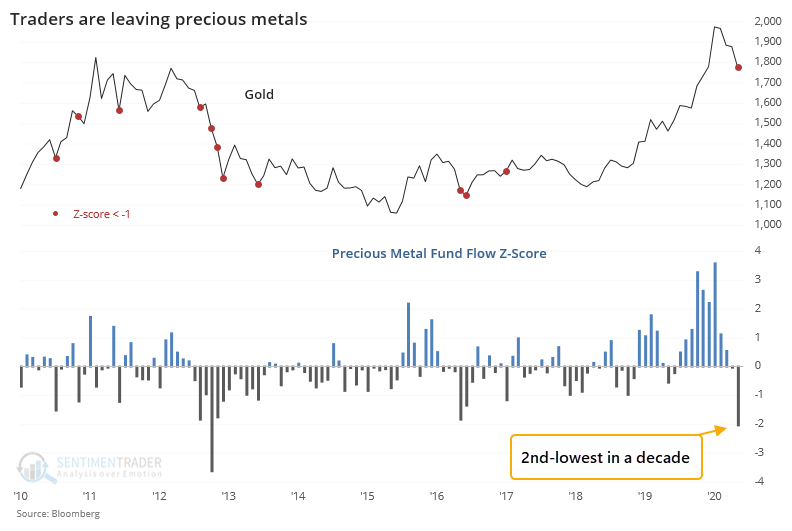

The folks at Arbor Research noted that the z-score on precious metal fund flows hit -2. The z-score measures the current flow relative to the average and standard deviation of previous flows. The more negative the number, the more significant it might be. Over the past month, this has become the 2nd-lowest in a decade.

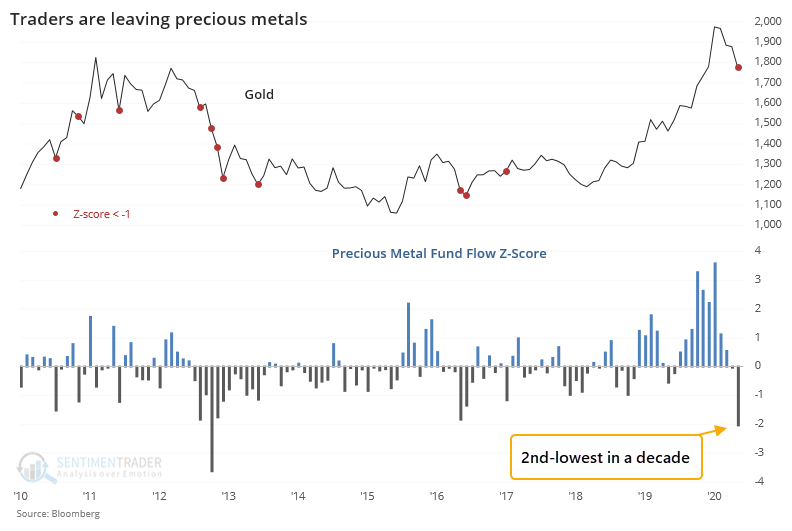

At the same time, they've moved into funds that focus on industrial metals, like copper. It's not all that extreme given some wild gyrations in 2010 and 2011, but it's still positive.

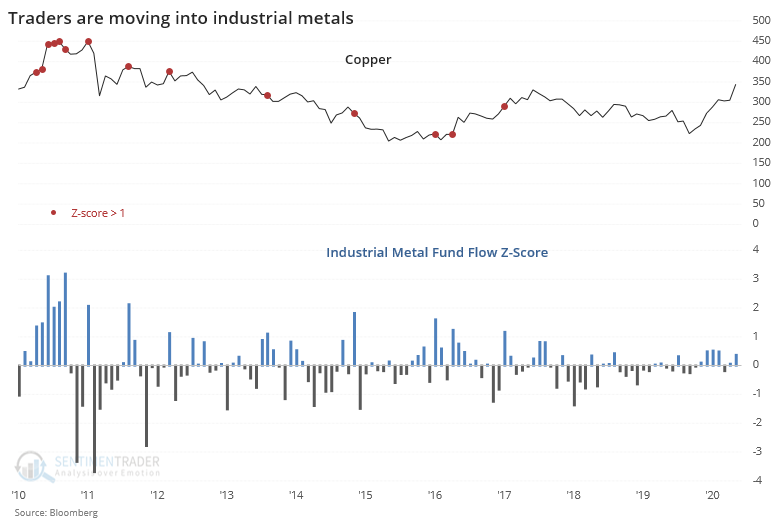

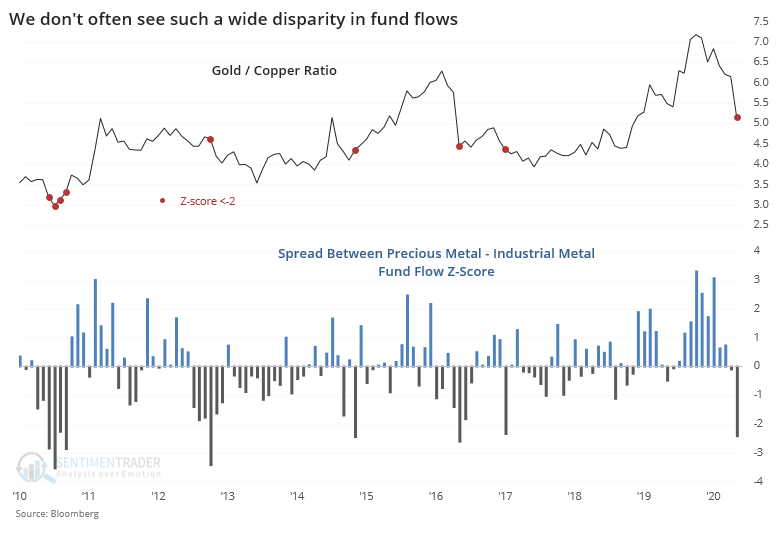

That means the difference in z-scores between precious metals and industrial metals has dropped to a significantly low level, well below -2.

The red dots on the chart highlight other times the difference in z-scores was below -2. There were 5 distinct instances, with 4 of them occurring near the end of gold's underperformance relative to copper.

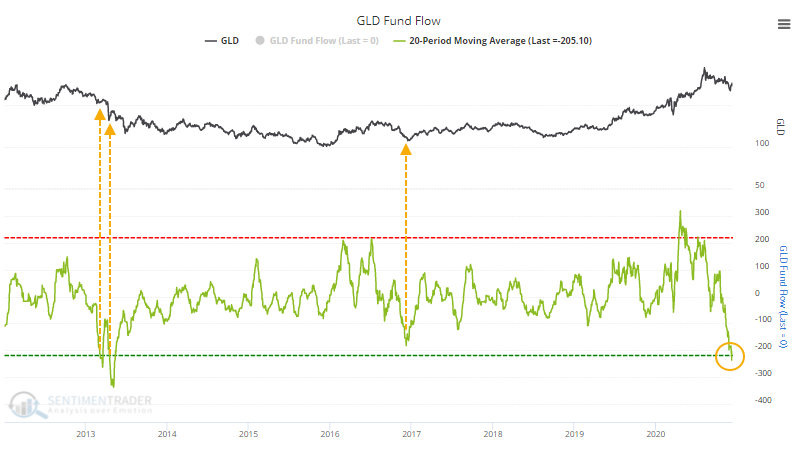

We can see this flow out of gold funds clearly by watching GLD. Over the past 20 days, the fund has lost an average of more than $200 million in assets per day, challenging the worst stretch in its history. A big outflow coincided with the end of a pullback in late 2016, but in 2013 it was closer to the beginning of a decline than the end.

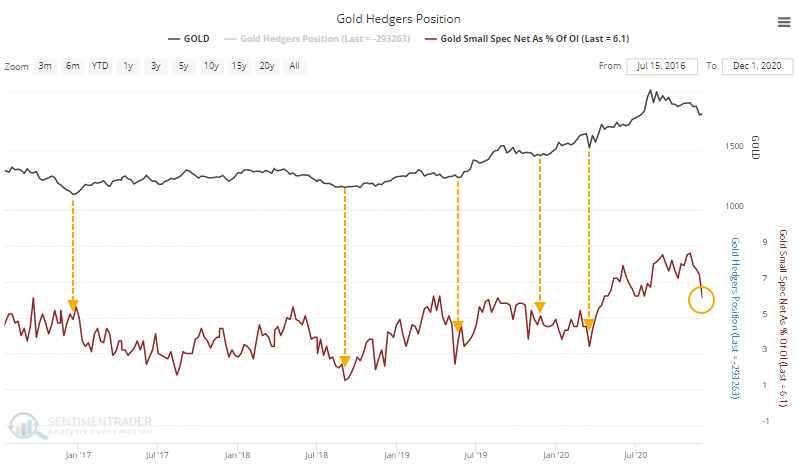

Small speculators in gold futures haven't quite given up, though. As of last Tuesday, they were holding a little more than 6% of the contracts net long. That's down from almost 9% a few weeks ago, but since the 2016 bottom, pullbacks in gold have stopped when these traders were holding 5% or less of the contracts net long. Not a big difference there, but it's something to watch as a sign of give-up among a class of traders who tend to be contrary indicators.

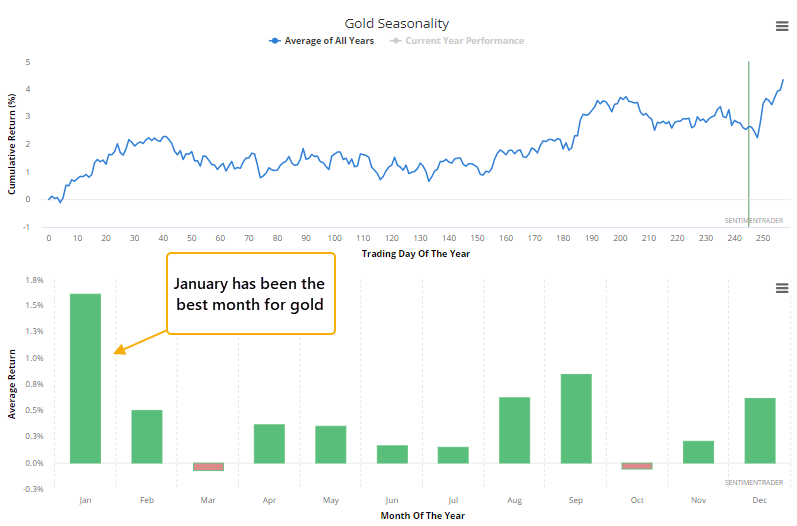

One potential positive is the calendar. Gold, and funds like GLD, are now entering what is traditionally the most favorable seasonal window.

The outflow from precious metals funds should be positive for gold and related investments, especially as we head into what has often been a good time of year for the metal, though it would be more encouraging if there were more signs of pessimism, which are spotty outside of the fund flows. We saw a couple of weeks ago that when positive momentum in this market starts to wobble, it has usually recovered, and it's nearing a point where it really should take hold if it's going to follow through on those tendencies.