Traders Buy Calls As Smart/Dumb Money Plunges

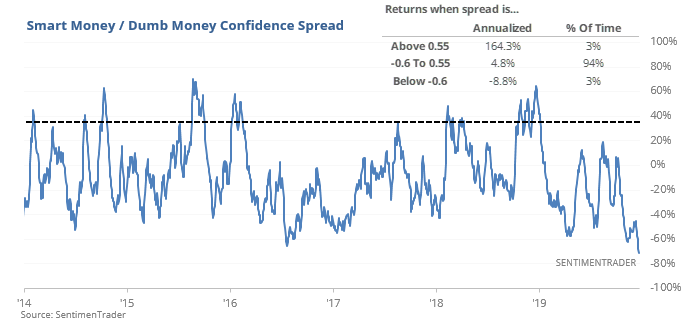

There is now a historic spread between Smart Money Confidence and Dumb Money Confidence, as the Equity Put/Call Ratio plunges.

Historic spread

Building on a true extreme reached late last week, the spread between Smart and Dumb Money Confidence widened further, stretching to a threshold rarely achieved in the past 20 years.

The spread got this wide in the initial investor euphoria exiting the 2001-02 bear market. But the idea that our current environment is anything like May 2003 is highly questionable, so it’s not unreasonable to discount that signal’s positive future returns. The other times this happened, the S&P 500 showed minimal (and only temporary) gains versus higher-than-average risk over the short- to medium-term.

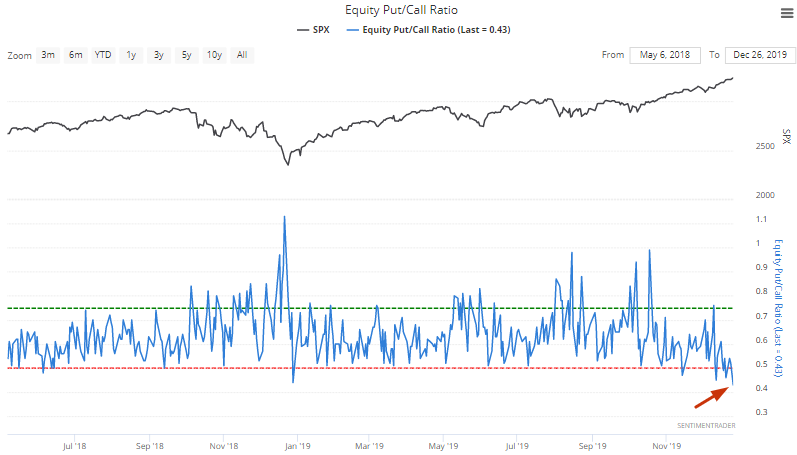

Equity Put/Call

With stocks rallying day after day, the Equity Put/Call ratio has been pushed to its lowest level since June 2014, as more than twice as many call options were traded than put options.

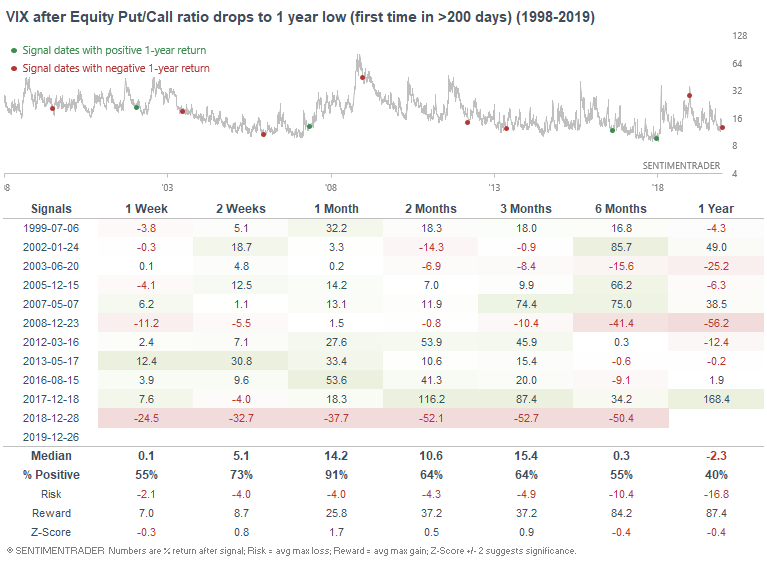

When the equity Put/Call ratio made a 1 year low, the S&P's returns over the next 1-3 months were quite poor.

As one would expect if stock returns were poor, the VIX "fear gauge" almost always spiked 1 month after these events. The only case in which VIX did not spike was last December, after VIX had already surged. Today, volatility has been subdued for a long time.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- 2019 is going down as one of the most consistent years in history for bulls

- ...and with one of the best average daily returns

- Safe-haven gold futures hit a 30-day high even as stocks set records

- 100% of major markets have rallied this year

- Stocks have gone more than 50 days without a big move

- The Nasdaq rally has been relentless

- ...and it's now well above its 200-day average

- What happens when SPY volume is extremely low

- Almost all Brazilian stocks are rallying