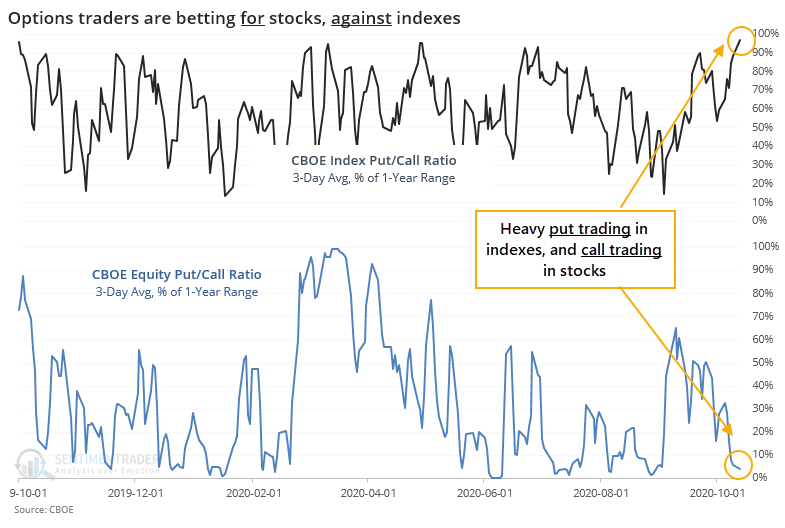

Traders are buying calls on stocks but puts on indexes

Over the past few days, there has been an interesting twist to options traders' behavior. Volume in equity options has heavily skewed toward calls; volume in index options has skewed toward puts.

The 3-day average of the CBOE Index Put/Call Ratio is in the top 95% of its range over the past year. The average of the Equity Put/Call Ratio is in the bottom 5% of its range. Going back more than 20 years, this has never happened at the same time.

When traders behaved this way, then there was a 29% chance of a larger-than-average rise in the S&P 500 at some point over the next month, and 0% chance of a larger-than-average drop. This should not be taken literally - of course, there's a chance of a large decline. The point is to show that historically, there has been a better probability of a big rise than a big decline over that time frame.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- All signals showing when traders were trading index puts but equity calls

- Also what happened when traders were focusing on calls in both types of options

- Oil rig counts are turning up - what that means for energy, oil & gas stocks, and crude oil

- Small business optimism has jumped - what that has meant for small-caps and the broader market