Trade Gap

With another trade-related bout of optimism, traders are pushing the futures higher. The S&P is poised to gap up more than 0.35%.

That's not large in the bigger scheme of things, but it's occurring when shorter-term sentiment measures are already stretched. The spread between Smart and Dumb Money Confidence was already extreme wide heading into this morning.

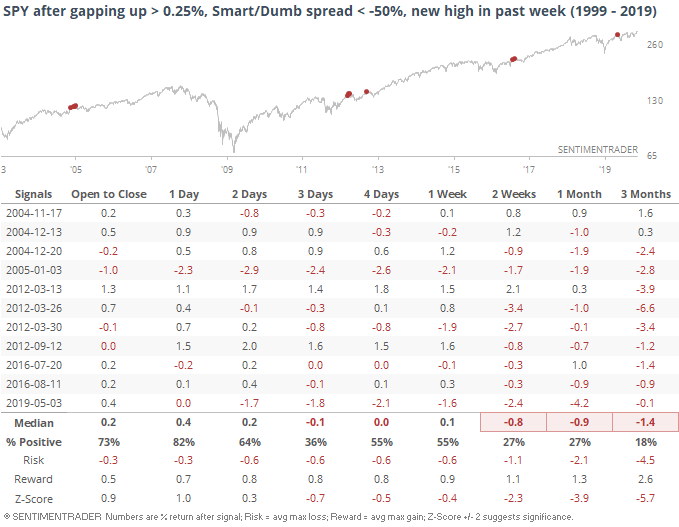

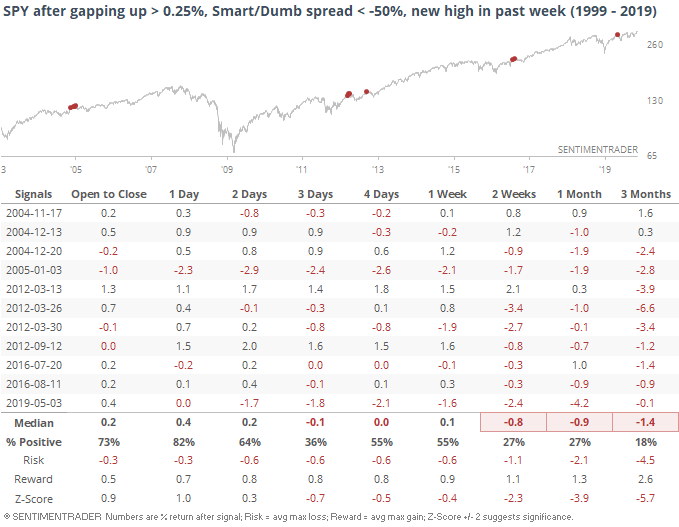

Below, we can see future returns in SPY when the Confidence spread was extreme, and then stocks gapped up at least 0.25%. All returns in the table are as of the morning of the gap up (i.e. this morning). There were no signals prior to 2004).

This kind of buoyancy hasn't happened often, really only five distinct times. It's notable that all of them saw a drawdown over the next 1-2 weeks, and most of them persisted through the next 1-3 months.

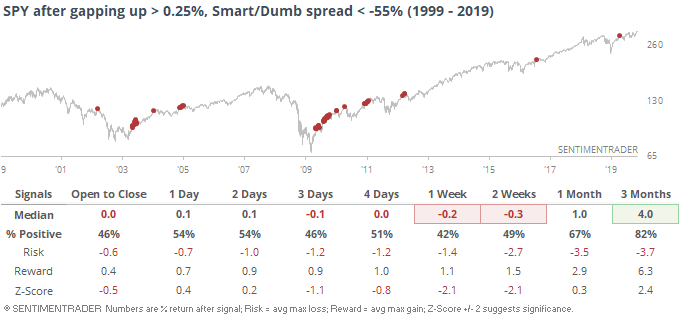

If we ignore the context of stocks recently being at a multi-year high and just look at any gap up following a spread of -55% or worse, then there were 57 signals.

Here, the next couple of weeks were still weak, but because most of them triggered as sentiment rebounded following the 2003 and 2008 bear market lows, the 1-3 month returns were much better. The market context was so different than from where it is now, it's hard to put as much weight on those dates.

Gaps based on news items have a nasty habit of sucking in last-minute traders, and seem to be more prone to failure than "natural" ones occurring on no discernible news event. Maybe this one is different because it seems like a concrete, positive step in the trade disputes, but assuming this time is different has never really served me well over the decades.