TLT Moves To A New High As Traders Rush Into Bonds

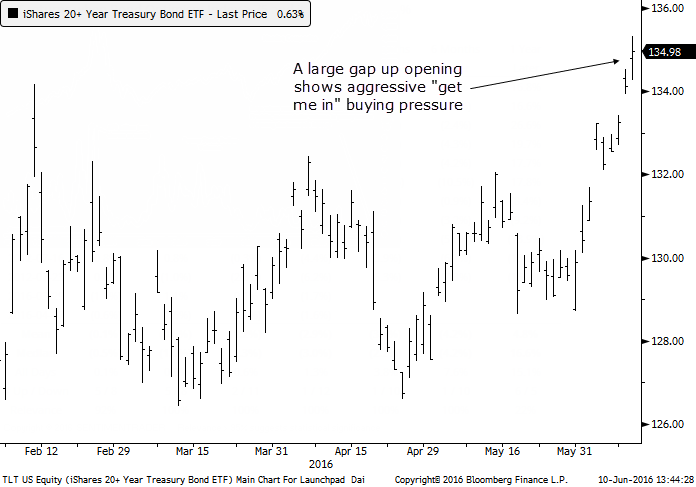

One of the more remarkable moves in markets today is in bonds. The most popular fund tracking the market, TLT, gapped up more than 0.5% (a large open for that fund) and traded to a all-time high.

Gaps in a fund like that often indicate "get me in" buying interest among less sophisticated investors, especially when it is already trading a high price. Since the fund's inception in 2002, whenever it gapped up 0.5% to a one-year high, a month later it was higher still only 15 out of 43 times.

What's also notable is that optimism on bonds is at an almost record high as well. The Optimism Index for bonds, our broadest measure for the bond market, is above 75 and is in the top 0.5% of all daily readings since 1991.

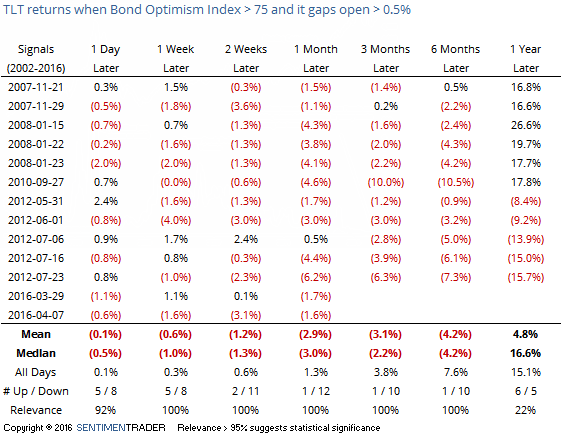

Let's combine these and look for any time that TLT gaps open 0.5% or more on a day that the Bond Optix was above 75. Then we get the following returns:

Not good over the next 1-3 months. On average, the most that TLT managed to rally at its best point over the next month averaged +0.9% while its average loss at its worst point averaged -4.3%, so the risk/reward was clearly skewed to the downside.

Most of the blow-off moves in bonds, TLT specifically, have ended with a large-range bar that showed an intraday reversal, or some small-range days that led to a large down day, so that's something to watch for in the coming day(s). With implied volatility on bonds scraping along near its lowest levels, I'm taking a small flyer on September puts on TLT, a highly speculative trade.