Timeframe tensions

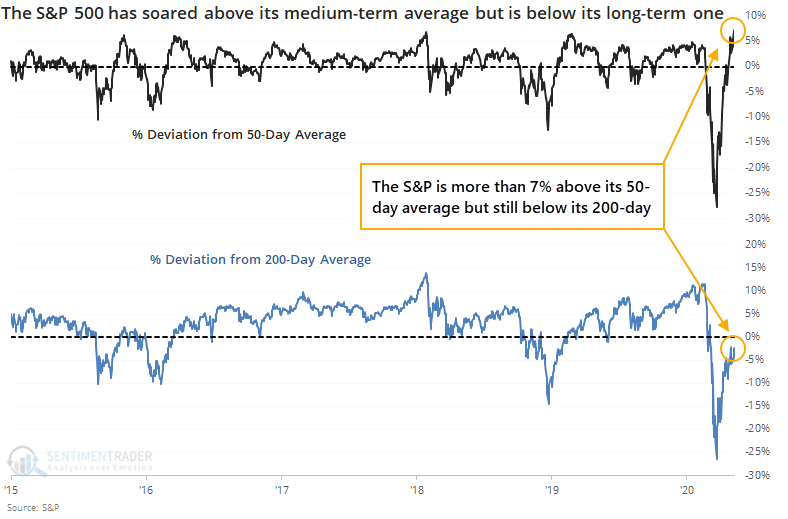

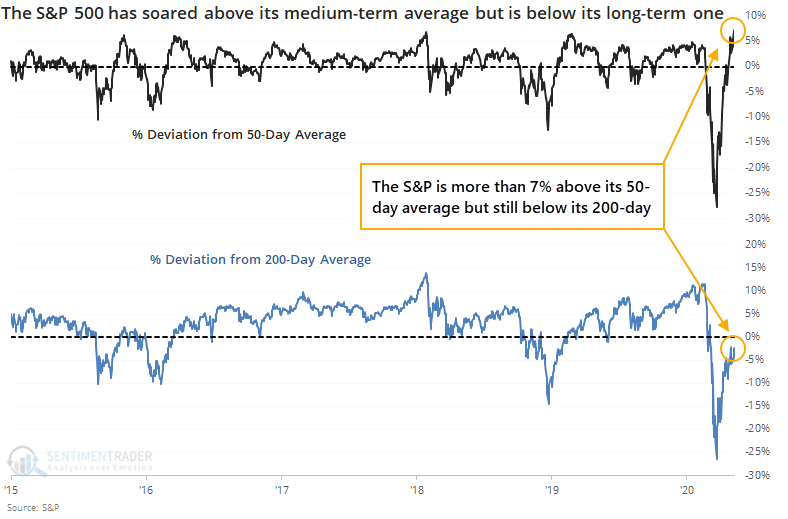

When stocks rocketed higher out of a selloff in the fall of 2011, buyers pushed the S&P 500 more than 7% above its 50-day moving average. It hasn't been that far above its medium-term average in the nearly 9 years since, until Friday.

The biggest difference between that time period and the current one is that the October 2011 rally also pushed the S&P above its long-term 200-day average. This time, stocks declined enough that even with the rally, the S&P is still trading below its 200-day.

This sets up an important battle between time frames. Usually, the longer-term environment has won out, at least over the short- to medium-term.

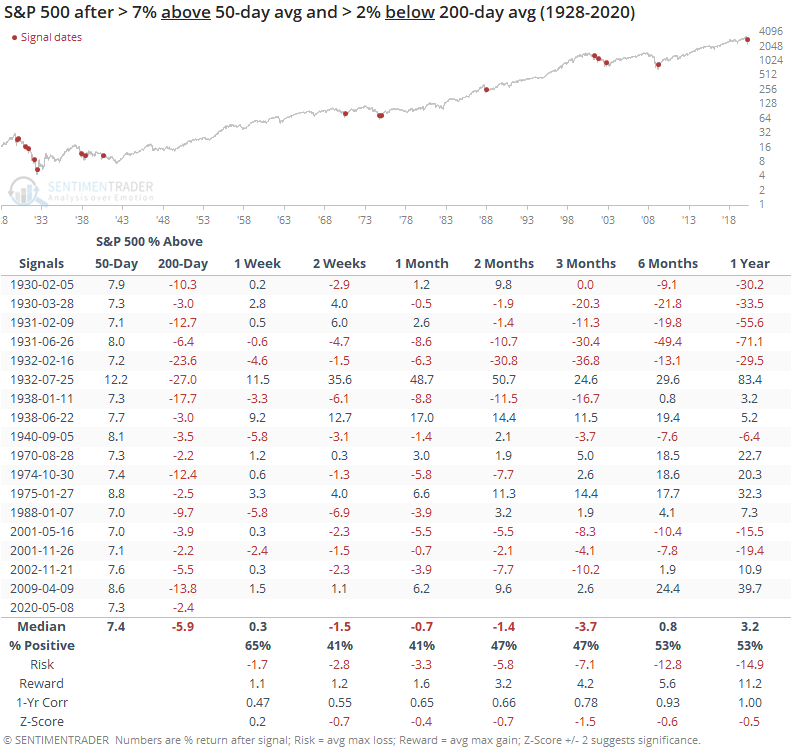

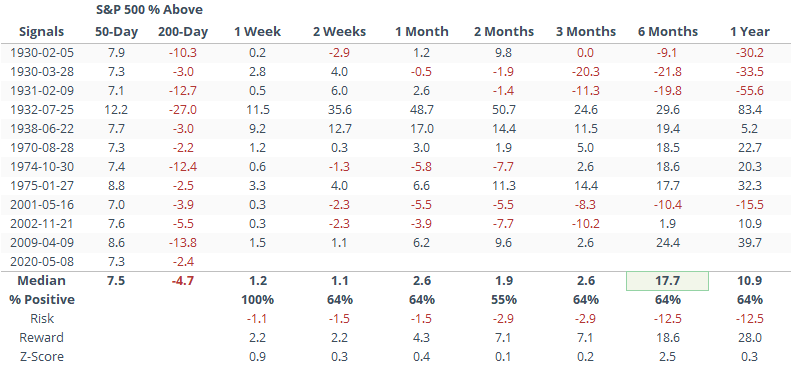

Below, we can see every date since 1928 when the S&P traded at least 7% above its 50-day average while failing to rally to within at least 2% of its 200-day.

Prospects were not great over the next 2-12 weeks. Average returns were bad, consistently negative, and with a very poor risk/reward skew.

You'll see an additional row in the table, titled "1-Yr Corr". This is the correlation between the S&P's return over each time frame and the return 1 year later. There was a 0.47 correlation between its return over the next week and the next year, meaning that there was a relatively good suggestion that if buyers shrugged off the medium-term overbought condition and continued to buy, then it was a good long-term sign.

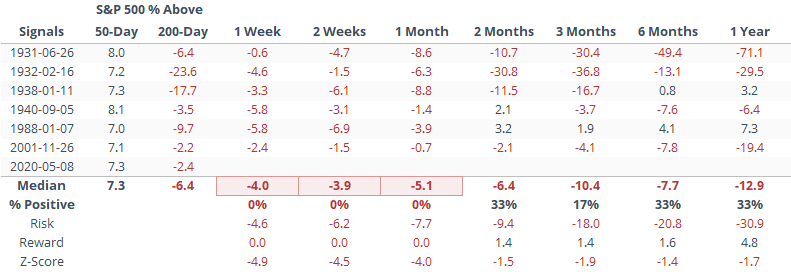

When we filter the table for those signals that showed a positive 1-week return versus those that didn't, then we can see that impact longer-term.

Three months later, only one of them managed to turn around and show a positive return.

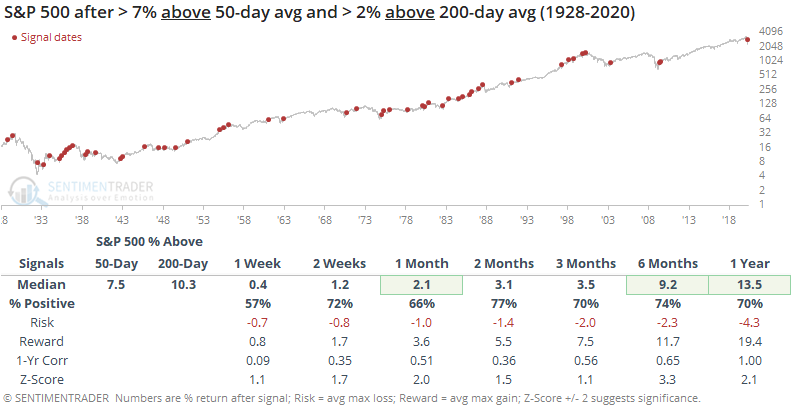

Contrast that with the ones that rallied further over the next week.

Here, the returns were much more positive, and all but one of the negative ones were from the early 1930s. Since then, it's been an even better sign.

There were 53 times when the S&P soared at least 7% above its 50-day average but they were during better longer-term environments when it was more than 2% above its 200-day average as well (instead of 2% below it like now).

After these, returns were much more consistently positive.

The bottom line is that since stocks have rebounded so much during a long-term downtrend, returns over the coming weeks and months are more fraught than if the long-term environment was more positive. And whether investors have enough oomph to keep pushing stocks higher in the coming week(s) will signify whether this is more likely the kick-off of a new bull market, or just a bear market rally.