Time to Keep a Close Eye on Coffee

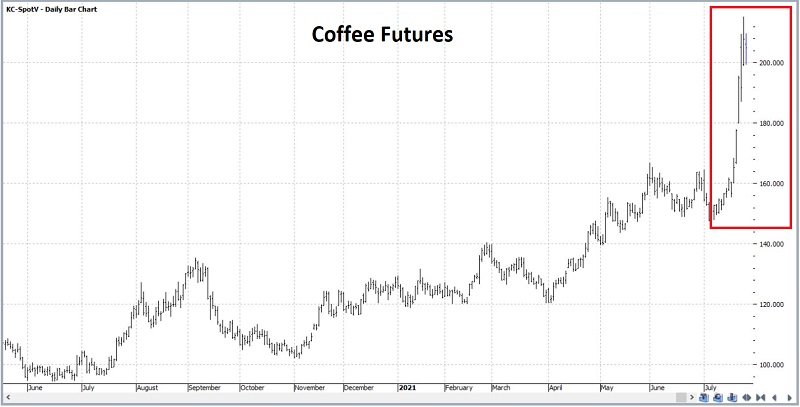

The last 12 months have witnessed a strong resurgence in the price of commodities. The most recent to "blast off" is coffee (Note to myself: Get to the store and stock up quick!! Now, where was I?). In the daily bar chart below (courtesy of ProfitSource), you can see the straight-line trajectory of the recent advance.

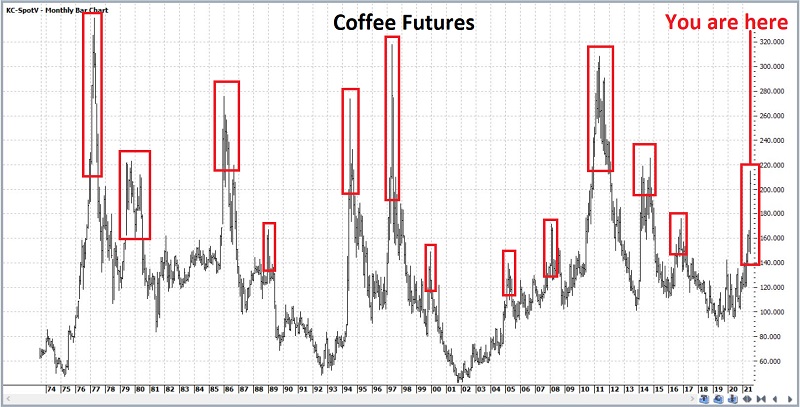

For a bigger picture perspective, see the monthly chart below. As you can see, coffee has a long history of "spiking" higher in price and then collapsing.

In this recent article, Dean highlighted coffee performance following short-term surges in the price of coffee. In a nutshell, the results were not spectacular.

COFFEE OPTIX

Now let's move beyond price and consider trader sentiment. In the test below (that you can run using this link) we:

- Identify days when the 20-day average for Coffee Optix dropped from above to below 60

In a nutshell, this test looks for sentiment to reach a high level over a period of time AND for a reversal in that sentiment. The goal is to identify when "the thrill is gone," and the rally may be over, rather than trying to "pick the top."

The chart below displays the signal days, and the table below displays the summary results.

Things to note:

- Every time frame shows a Win Rate below 50%, with 3 and 6 months winning % of 37%.

- Every time frame shows negative Median Returns.

- There have been 43 previous signals. Roughly 8 (about 19% of them) saw coffee continued to rally sharply in the year ahead. So, a signal from this indicator should NOT be viewed as an "it's automatically time to sell short coffee" signal.

- Only 3 of all 43 previous signals (7% of all signals) did NOT show a negative return during at least one of the time frames listed (1-month, 2-month, 3-month, 6-month, 1-year).

It needs to be pointed out that the most recent signal occurred right BEFORE the most recent rally took off. So again, this particular indication should not be construed as an automatically bearish signal but only as an important warning sign.

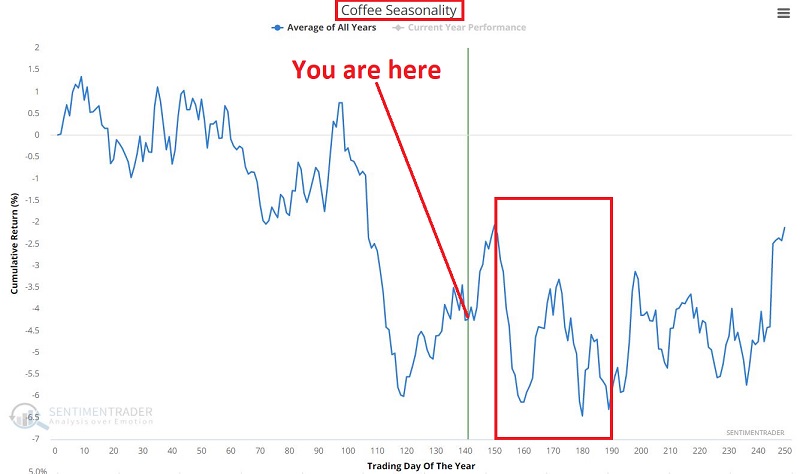

COFFEE SEASONALITY

So, will coffee continue to run for a while and then fall apart? There is no way to know for sure. Still, a glance at the Annual Seasonal Trend chart for coffee below suggests that possibility.

On a seasonal basis, coffee has roughly 8 to 10 trading days left in a favorable period. After that, seasonality becomes something of a headwind. As always, it should be noted that annual seasonal trends ARE NOT a roadmap but merely a glimpse at when a given tradable has tended to trend in the past.

Still, the bottom line on seasonality suggests that traders should fight the urge to get ever more bullish on coffee if it continues to rally in the near term.

FUTURES AND EXCHANGE-TRADED NOTES (ETNs)

The most straightforward way to trade coffee is via coffee futures. Each 1.00-point movement in the price of coffee futures is worth $375. During the recent 14-day runup in price, the value of a coffee futures contract rose by over $20,000. Futures contracts can be sold short just as easily as they can be bought. Trading coffee futures entails a significant degree of risk and is not well suited for new futures traders and/or poorly capitalized traders.

There are two ETNs (Exchange-Traded Notes) that seek to track the price of coffee futures. These ETNs can be traded in a stock account like shares of stock. The two ETNs are:

- Ticker JO - iPath Series B Bloomberg Coffee Subindex Total Return ETN

- Ticker JJOFF - iPath Bloomberg Coffee Subindex Total Return ETN

Please note:

- Neither is heavily traded, with JO averaging less than 100,000 shares traded per day and JJOFF averaging less than 10,000 shares traded per day

- Ticker JO does offer options trading, but these two are relatively thin (less than 1,000 contracts traded per day)

With the trading volume caveats firmly in mind, these ETNs and options on JO nevertheless, can afford a non-futures trader the potential opportunity to trade the coffee market.

SUMMARY

Coffee has achieved "take off." As you saw in the monthly bar chart above, once this happens, coffee is capable of running up a very long way, and a great deal of money can be made by those who have the fortitude to withstand the ride (and who are willing to cut a loss if things go the wrong way). Likewise, selling short into a sharp advance is often the easiest way to lose a lot of money quickly.

That said, both sentiment and seasonality remind us that if coffee is going to "run" this time around, it will likely only run so high and for so long before "gravity" takes hold.

The information discussed above serves as a useful alert to traders that at the first (or possibly second, or maybe even third) sign of trouble, playing the short side of coffee might make a great deal of sense. Until then, remember, the trend is your friend.