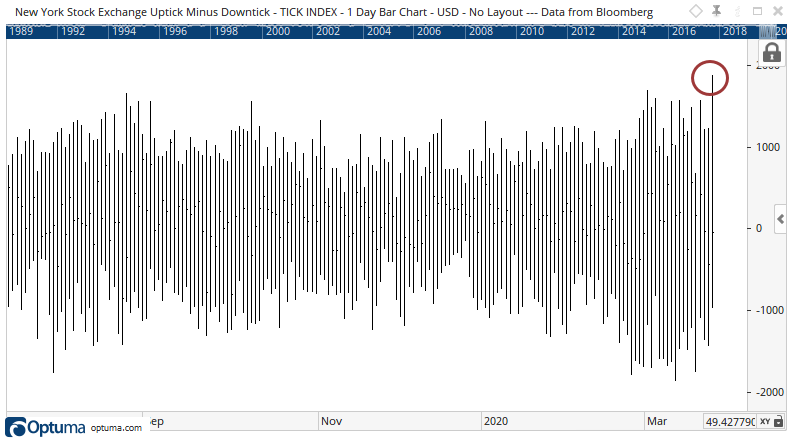

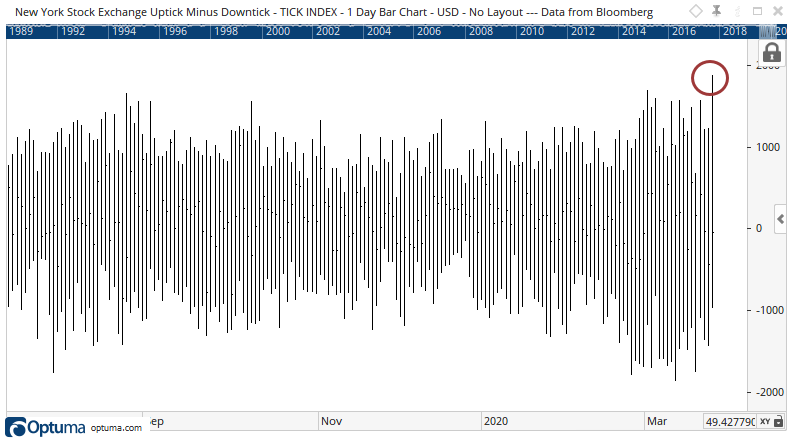

TICK shows record buying pressure

Earlier this month, we saw how the selling pressure was massive - historic, even. In some respects, we'd never seen selling intensity that heavy. One of those respects was the tendency to see more than half of the securities on the NYSE trade on a downtick at the same time.

At the open on Tuesday, we finally saw some potential of a switch in sentiment (or computer algorithms, at least). More than 1,800 securities traded on an uptick, a huge surge from recent sessions.

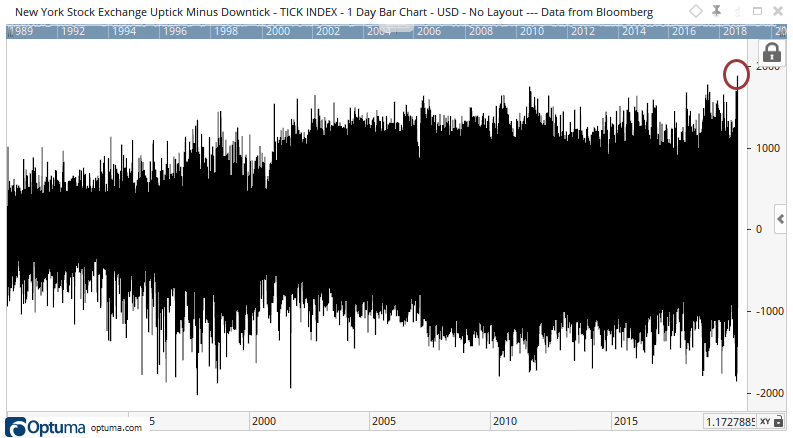

Not just recent sessions, though. It was also the most skewed positive TICK ever.

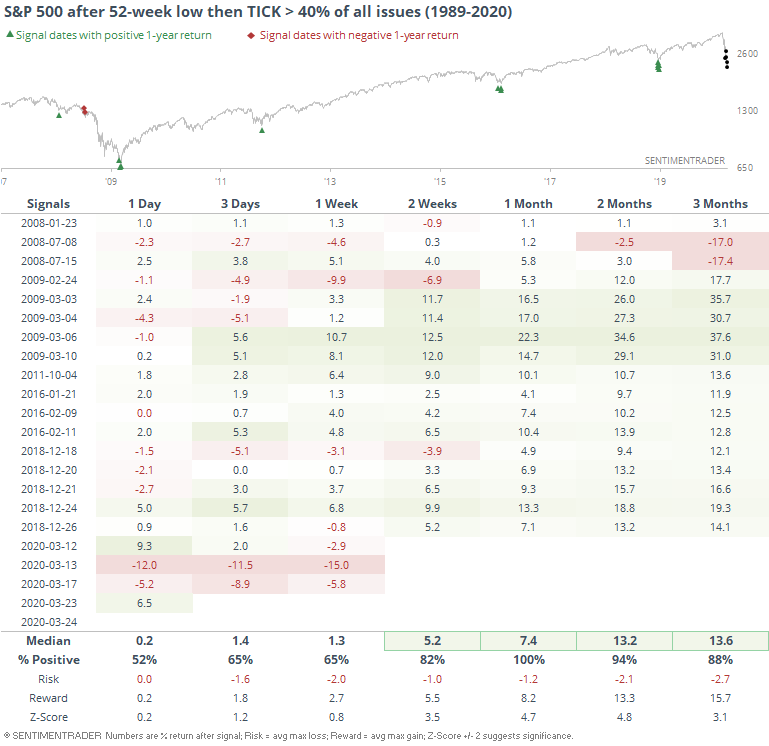

Regardless of what happens into the close, we at least know that today's intraday high TICK accounted for more than 60% of all issues traded (also a record high). Since this is coming on the heels of a 52-week low on Monday, it has the potential to shift sentiment, which historically is what happened, even when looking at smaller TICK readings.

This never happened prior to 2008, even though the data goes back to 1990ish.

A month after every one of the dates when it did manage to trigger, the S&P 500 showed a positive return. A few in 2008 had some extreme volatility, but showed at least a modest gain over the next month. A couple from July that year then quickly failed.

The most distressing part of this is that it also triggered four other times just this month, and every one of those have shown a loss over the next week. We're in a whole other ballgame when it comes to volatility. It seems like Tuesday's surge should be enough to make short-sellers fearful, but we still have to break the pattern of the past few weeks when every green shoot immediately gets trampled.