Thursday Midday Color

Here's what's piquing my interest so far on this fading rally day.

Breadth Review

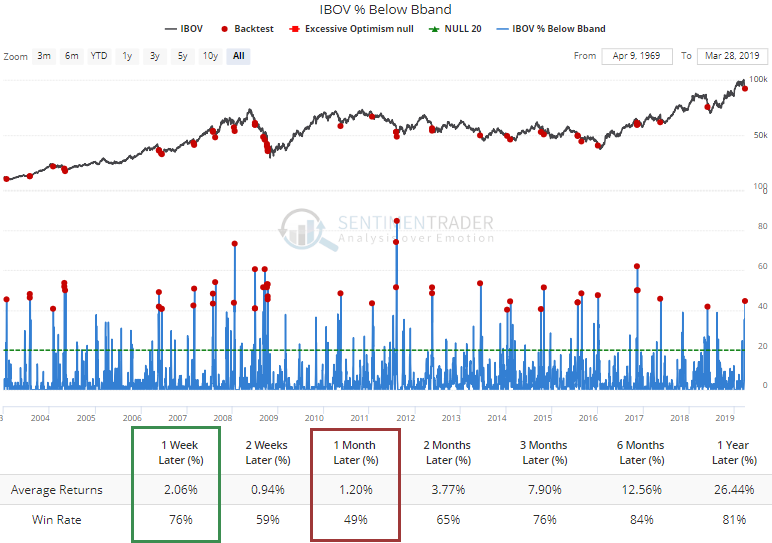

There was a spike in the number of stocks on the Brazilian Ibovespa exchange falling below their lower Bollinger Bands. This happens when stocks are trading in a relatively narrow range then suddenly drop.

Historically, that has led to quick rebounds but more questionable returns during the next month.

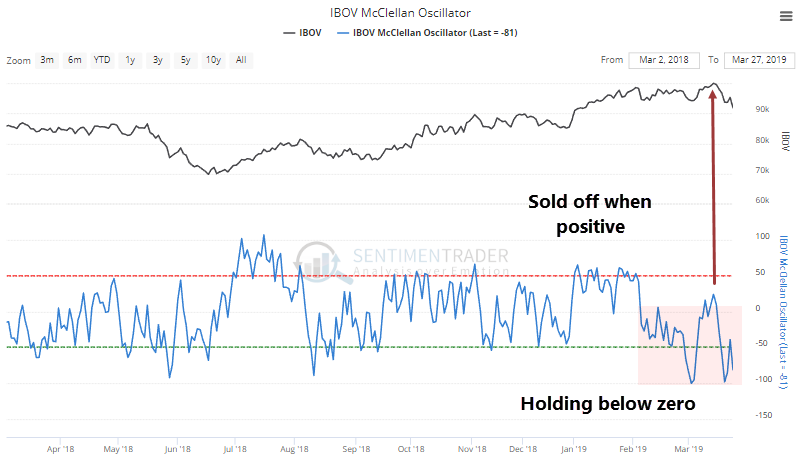

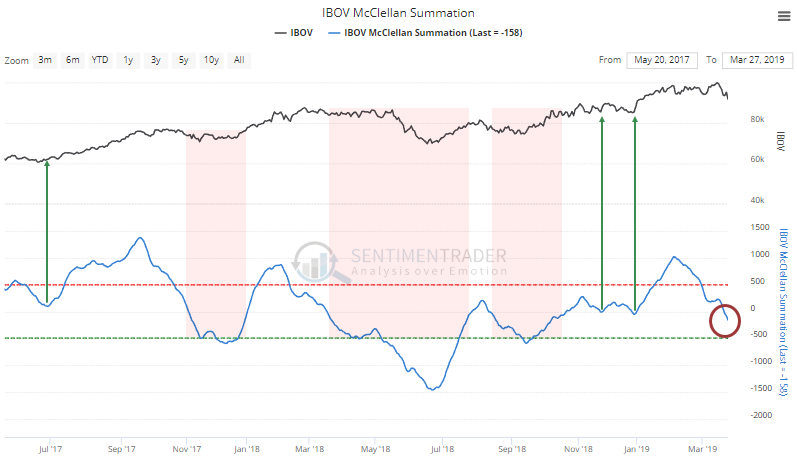

When we looked at the cracks underlying the new highs in this market last week, the main culprit was waning momentum despite rising prices. That's still evident. The McClellan Oscillator has been holding below zero, and stocks sold off as soon as it went positive. That is not what we typically see during healthy market environments.

The loss of momentum is also evident in the Summation Index, which has moved below zero. The last two times it neared zero, it bounced as stocks recovered. Very generally, markets have trouble holding any gains when the Summation Index is below zero and falling.

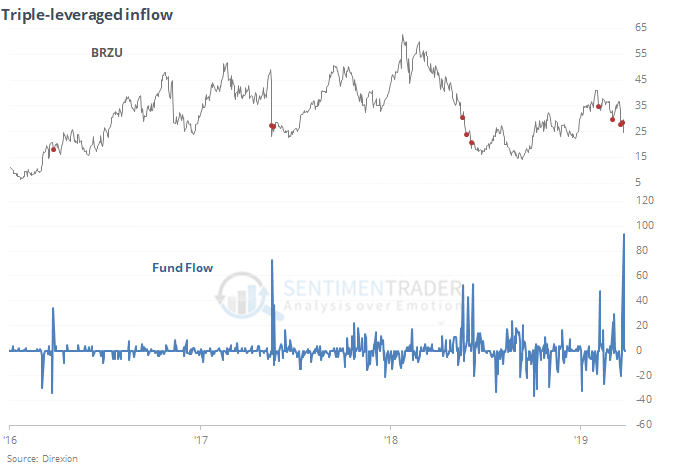

As noted by Bloomberg, the swift loss in Brazilian shares has led to a jump in assets in the triple-leveraged BRZU fund, which is supposed to give traders 300% exposure to the MSCI Brazil 25-50 index.

With fund flows, though, we don't know if the shares are being created to satisfy buyers or short-sellers. And based on past reactions to big inflows, it could be the latter. The fund saw some short-term rebounds after the others.

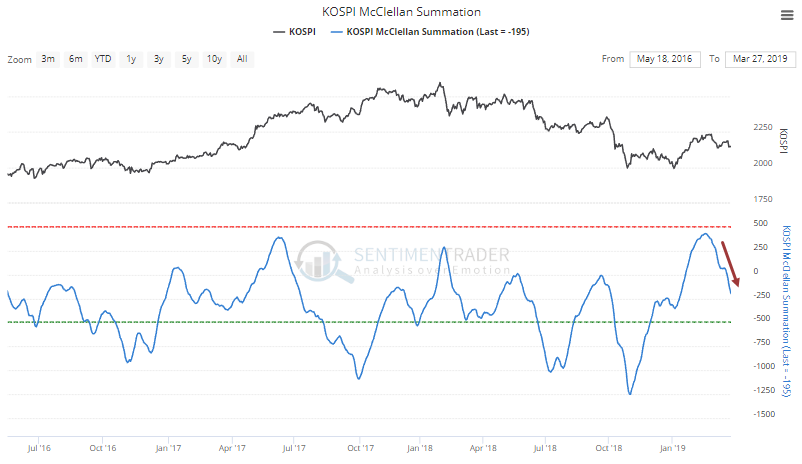

Waning momentum also a worry with the Kospi. It's a good sign that there was enough momentum to get the Summation Index close to +500 but so far it has been continuing to fall into negative territory.

Bond Risk

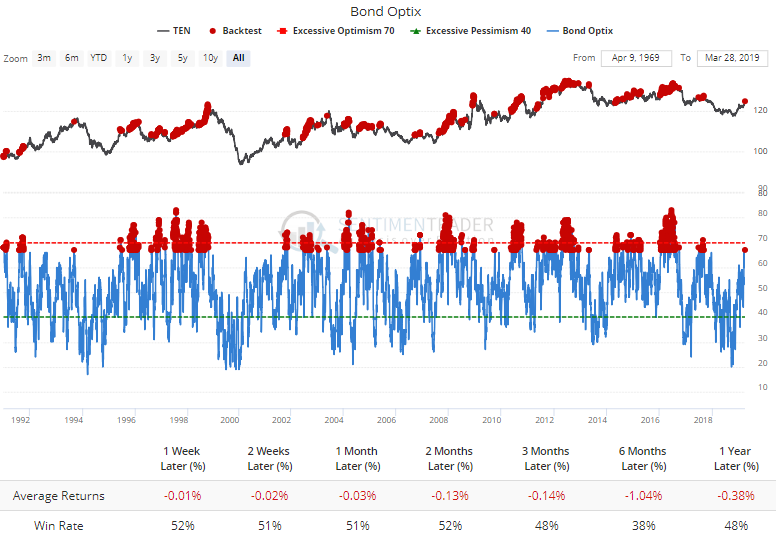

Risk in almost all assets is above-average or even extreme, limiting the number of good risk/reward opportunities out there. With the big move in bonds lately, the risk there has increased as well.

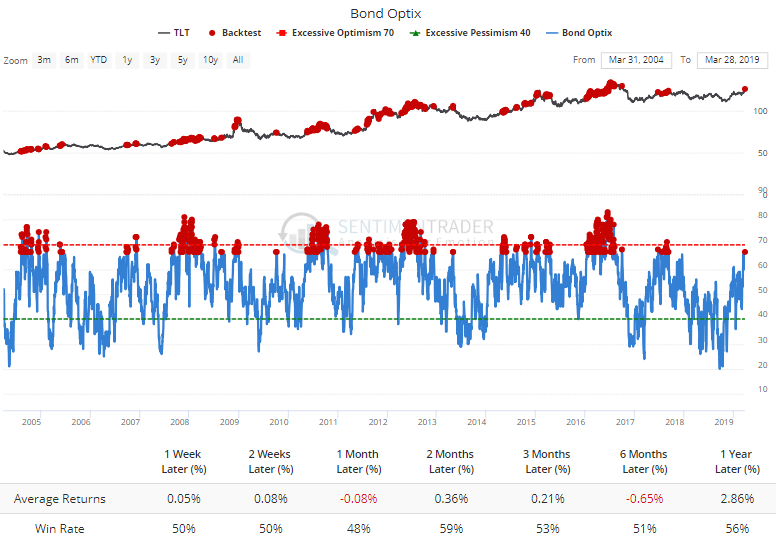

The Optimism Index for the broad bond market is up to 67. That's still a bit below the threshold of 70, but it's still one of the highest levels in two years. Historically, a reading this high has led to negative returns for 10-year Treasury futures.

For a fund like TLT, returns have also been relatively flat at best.

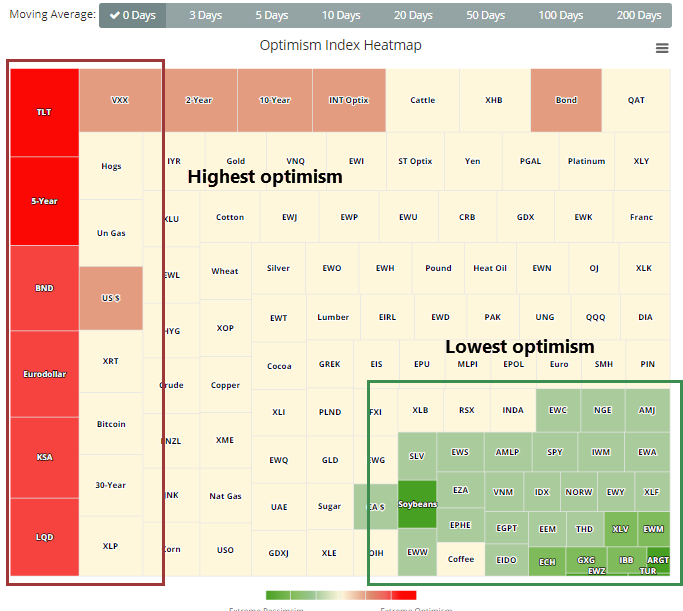

Looking at the heat map of Optimism Indexes, we can see that the highest optimism is currently in TLT.

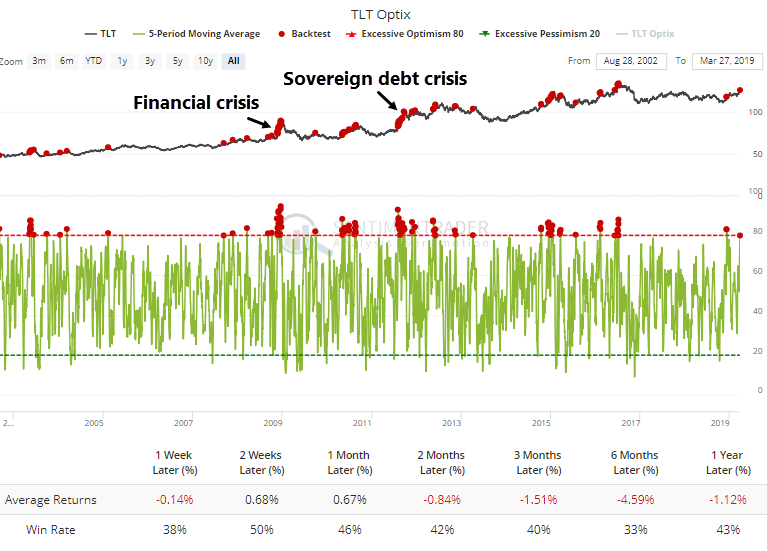

The 5-day average is now above 80, which again has led to iffy returns for the fund.

The two times that optimism got this high on TLT and yet it managed to sustained some gains were during two of the most tumultuous times in markets, during the 2008 financial crisis and 2011 sovereign debt crisis when the USA's creditworthiness was being questioned.

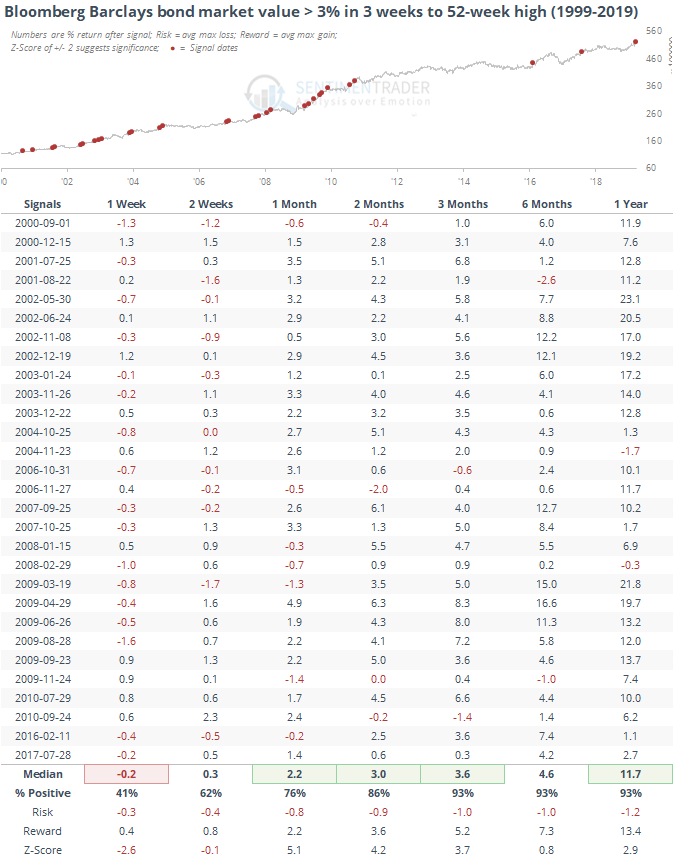

Bloomberg notes that the aggregate market value of global corporate investment-grade and high-yield bonds has jumped by an enormous amount in only the past few weeks.

In the very short-term, that has been a bit of a worry, but longer-term, the bull market in those assets continued strongly.