Thursday Midday Color - Dollar Bets, Big Breadth, Twitter Junk

Here's what's piquing my interest so far today.

Dollar Bets

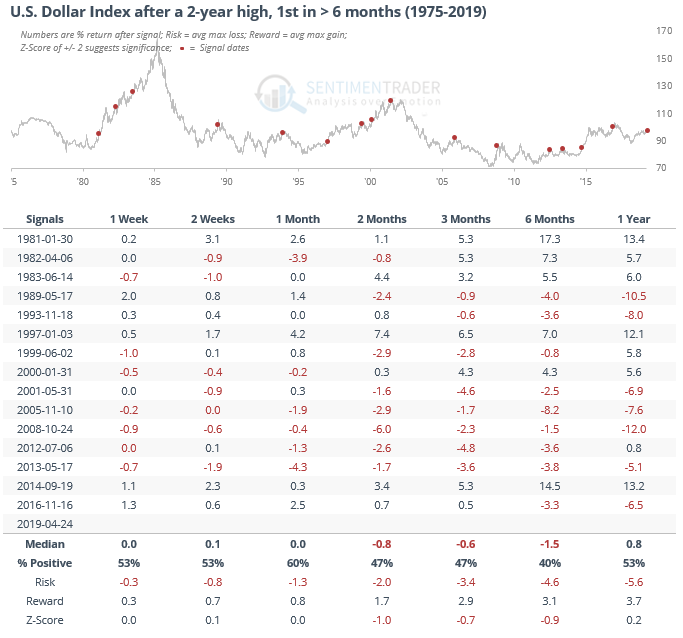

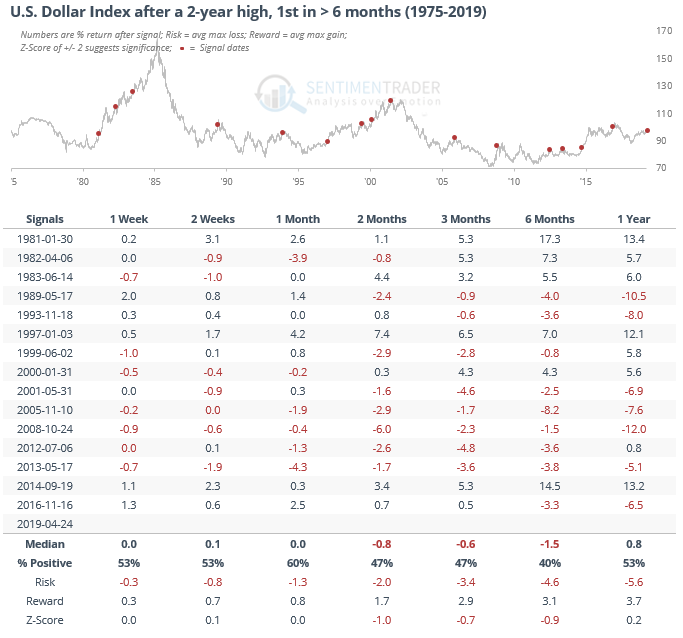

Yesterday's report noted the multi-year breakout in the dollar, which has had a tendency to pull back most of the time over the next 2-6 months. The long-term trend has been about flat, so breakouts have had a tendency to be unsustainable over that time frame.

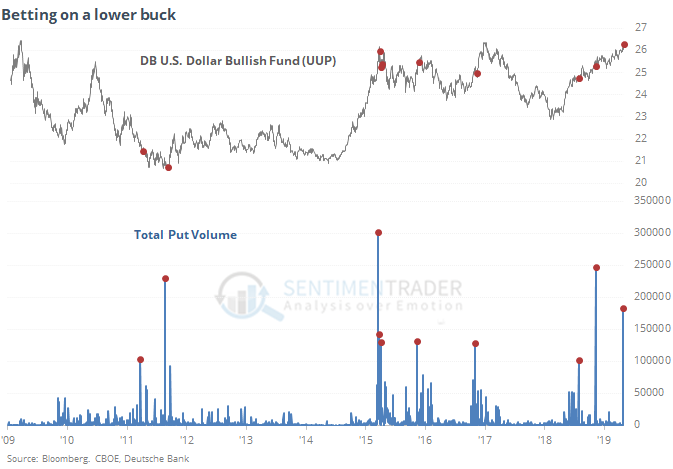

The WSJ notes that some traders are apparently betting on that outcome, with a surge in put volume yesterday. Indeed, it was massive, among the largest in the history of UUP. But whether it means anything is questionable based on previous spikes.

Breadth Review

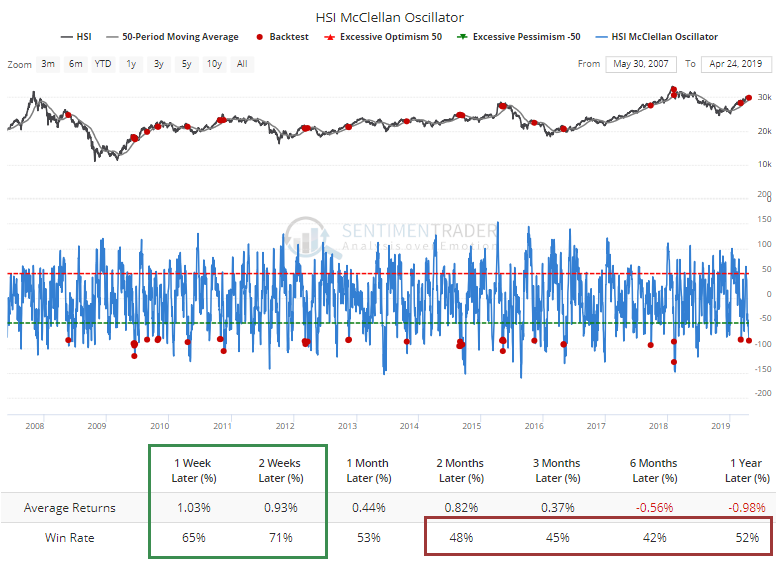

Modest selling on the surface in the Hang Seng belies some underlying tension. The breadth of the selling has been stronger than the index reveals, so the McClellan Oscillator has dived below -80.

When that's happened while the index is still in a strong trend (above its rising 50-day average), the index has tended to see a shorter-term rebound, but many of these signals were the initial thrust of selling that led to below-average longer-term returns.

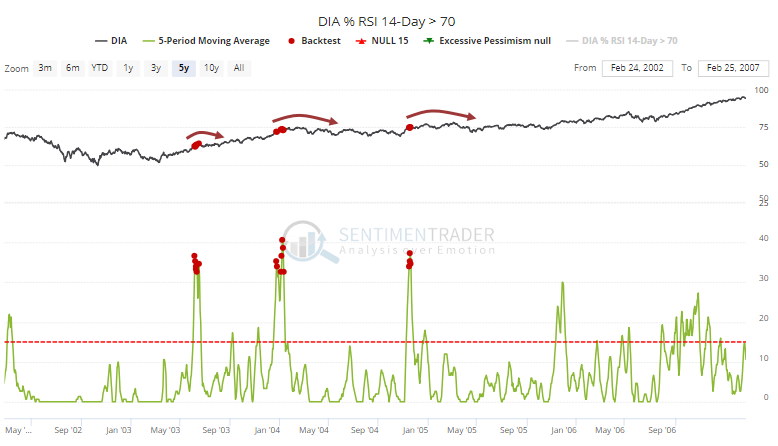

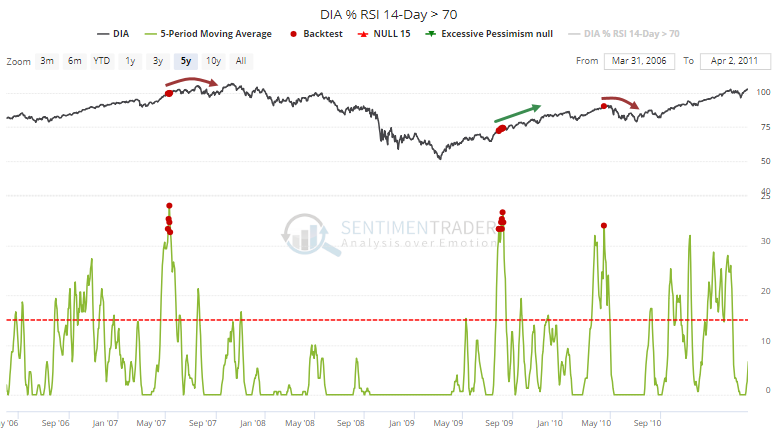

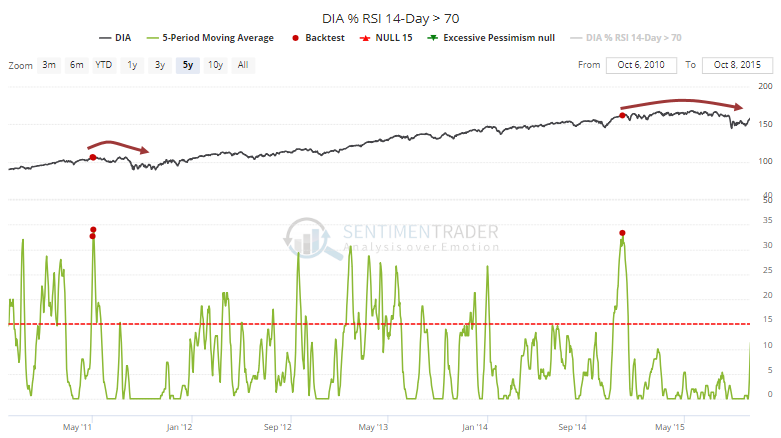

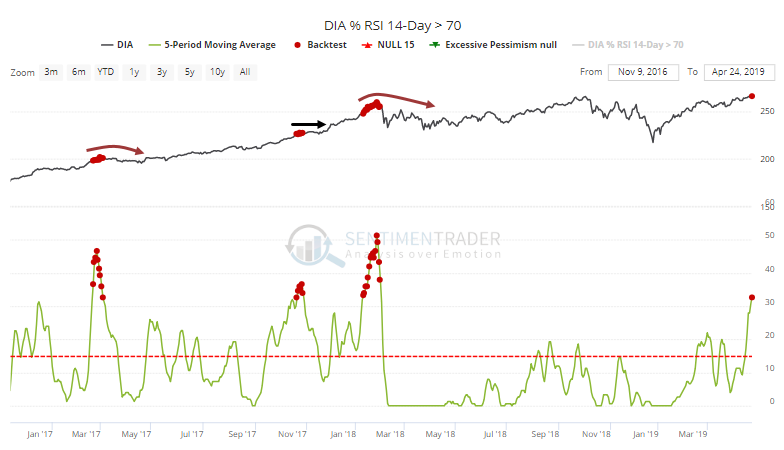

In the U.S. nearly a third of stocks in the Dow Industrials Average have been in overbought territory for the past week. Almost every time that's happened before, the Dow took a breather over the short- to medium-term.

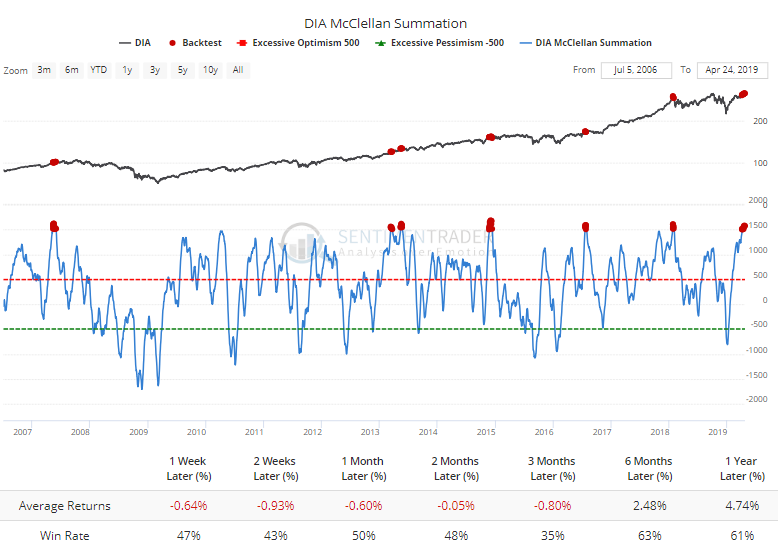

This strong trend has pushed the McClellan Summation Index for the Dow above 1500 for one of only a handful of times in the past 20 years.

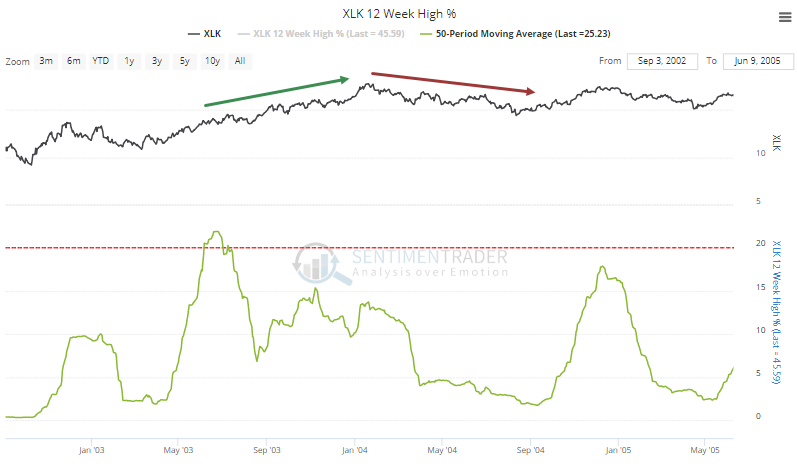

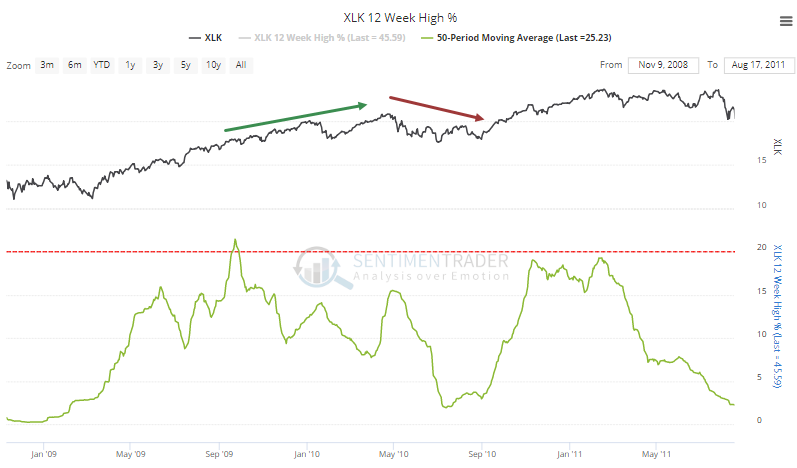

In tech, a remarkable 25% of stocks have hit a multi-month high on an average day over the past 50 sessions. That's the most since at least 2000. The only two other times this rose over 20% were in the immediate aftermaths of the last two protracted bear markets.

Both times, the stocks continued to rise over the shorter-term, but gave back most or all of the gains in the months after that.

Junk Tweets

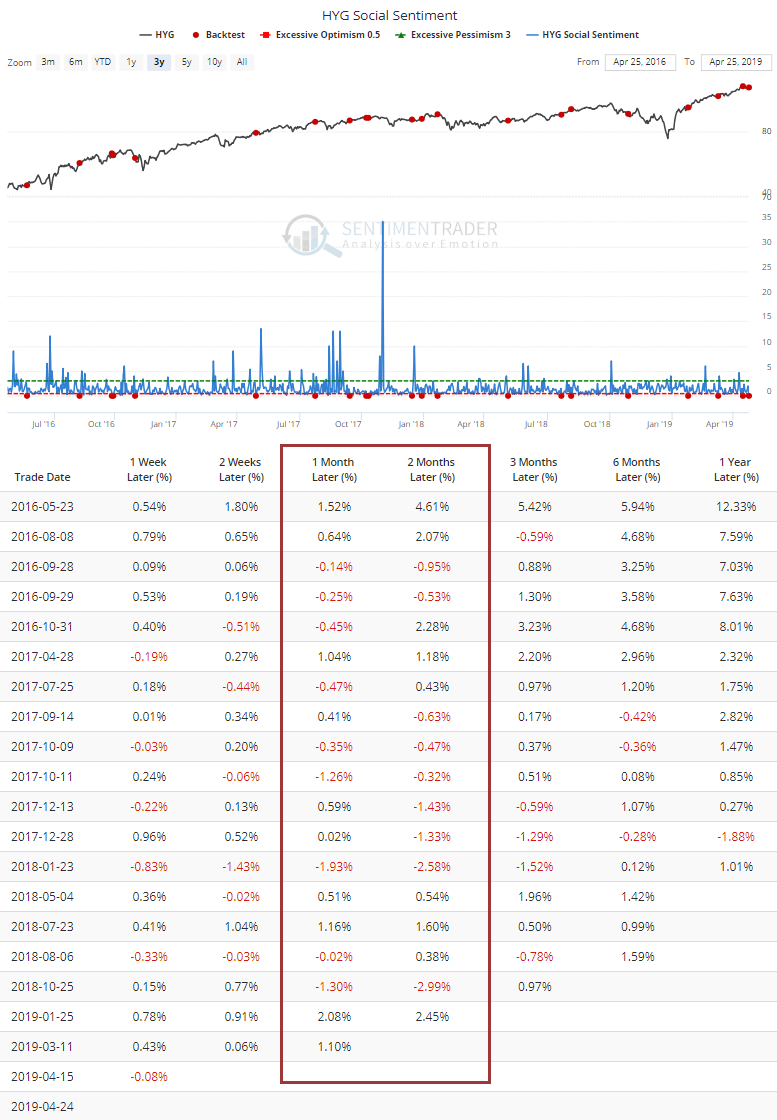

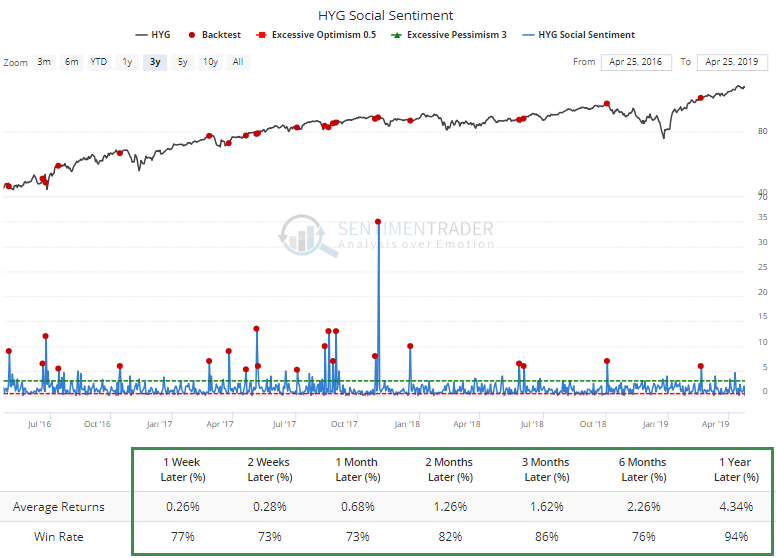

The FinTwit community is getting pretty optimistic on high-yield (junk) bonds. The Social Sentiment score for both JNK and HYG is 0, meaning according to Eric's algorithm, everyone tweeting about junk bonds was bullish.

Because less-liquid funds get tweeted about less often and social sentiment is less reliable, this tends to work better on the most liquid funds. And when the Social Sentiment score for HYG was 0 over the past few years, the fund tended to show a negative return 1 or 2 months later.

Contrast that to times when Social Sentiment was 5 or higher, meaning users were 5 times more likely to tweet something negative vs. positive about junk bonds.

Not Bullish

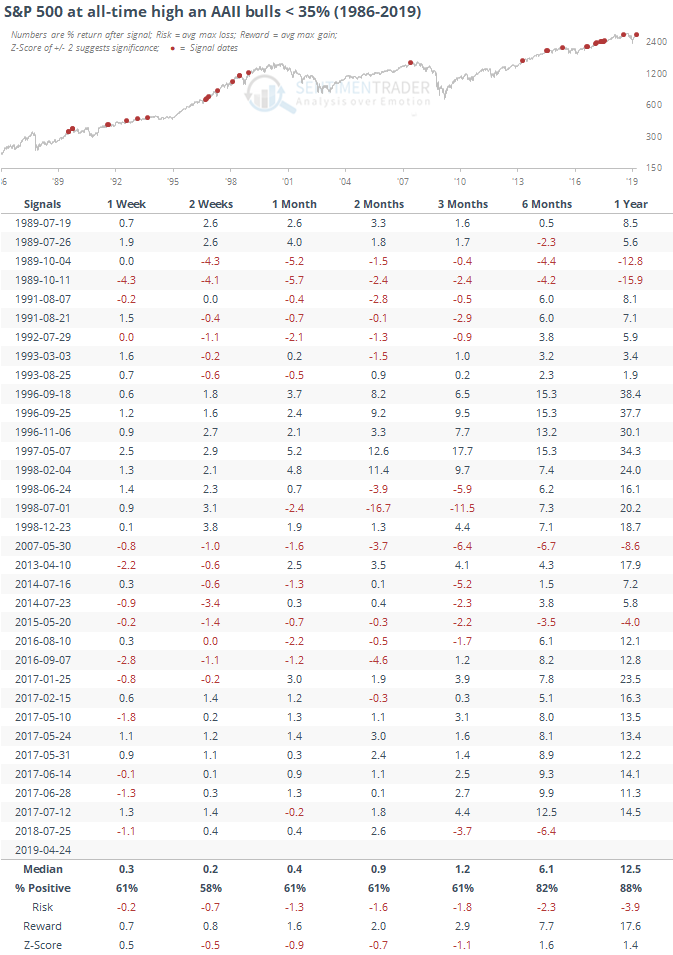

Individual investors are "not bullish" according to the latest AAII sentiment survey, with lots of neutral and bearish responses. But with stocks at an all-time high (using Wednesday closes), that's not necessarily a good thing.