Thursday Midday Color - Panic, Few Bulls, Asian Slide

Here's what's piquing my interest so far on this increasingly ugly-looking day.

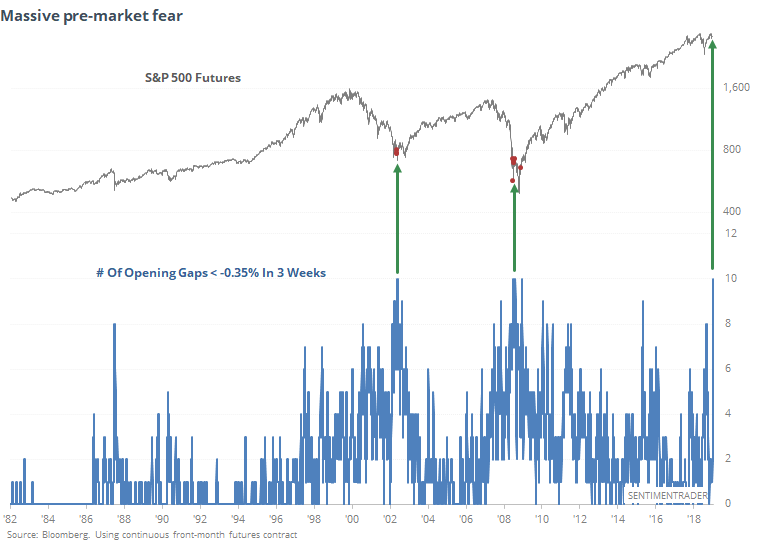

More Gaps

The anxiety surrounding trade worries is the reason most commonly given to traders' overnight anxiety. Whatever the reason, there is no question that they don't want to hang around for the opening of regular trading hours. Over the past three weeks, there have been 10 openings more than 0.35% below the prior day's close.

Since the 1982 inception of the S&P 500 futures market, there have been only two time periods with this much anxiety - the bottom of the 2002 bear market, and the depths of the financial crisis.

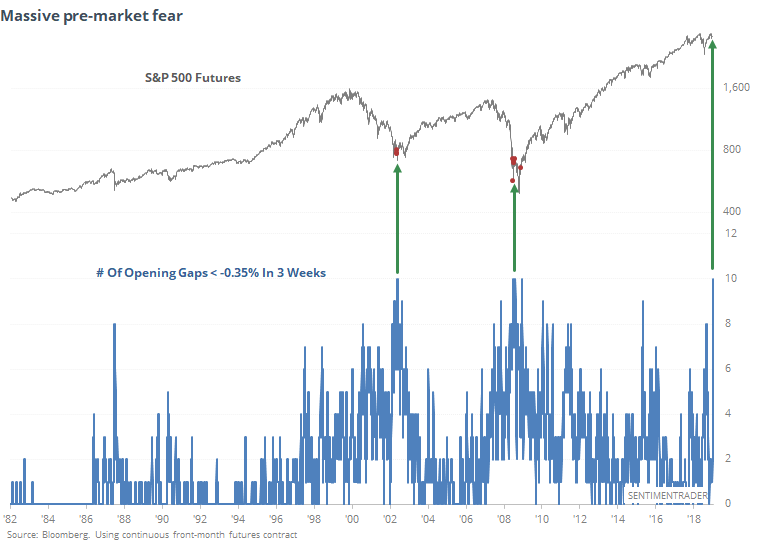

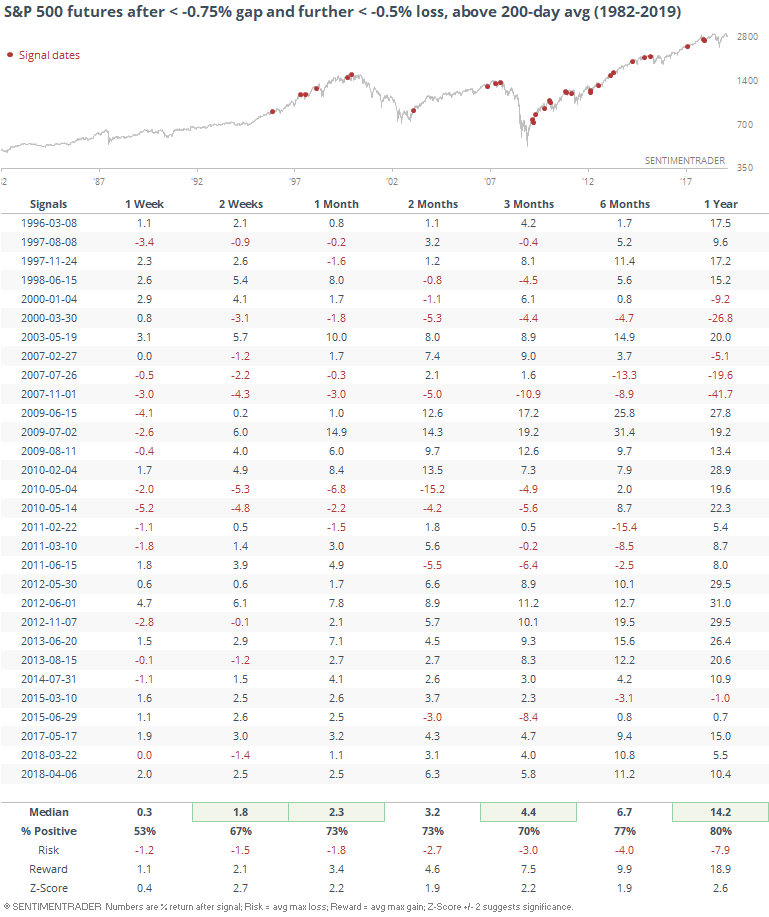

A sample size of two, compelling as it is, makes it hard to have a lot of confidence. In order to get more samples, we have to adjust or loosen the parameters. If we look instead for days like today (so far) that gapped down at least 0.75% at the open and then a further 0.75% into the close, while above the 200-day average, we get the following.

Again, mostly positive returns. It's not looking very healthy today, but historically this kind of panicky pressure has resolved higher, not lower.

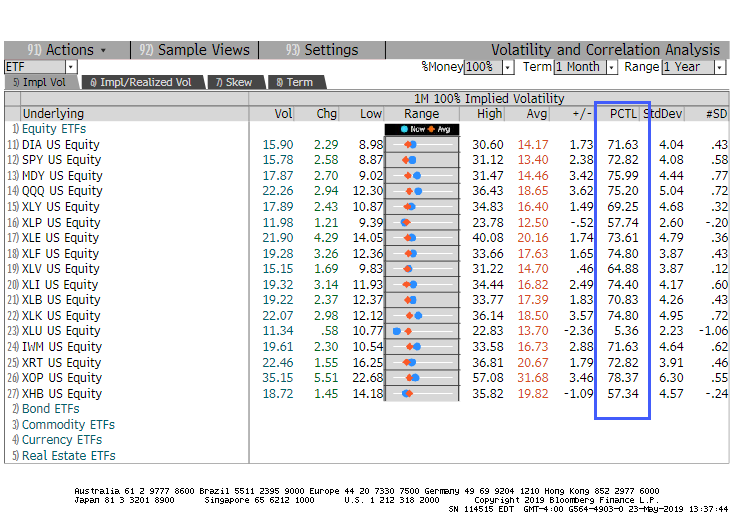

It's a little bit concerning on the surface that while price action is suggesting near-panic behavior, a lot of indicators are relatively tepid. Among the major equity ETFs, for example, options skew has barely budged and remains in the lower 75% of their ranges over the past year.

Leaving The Table

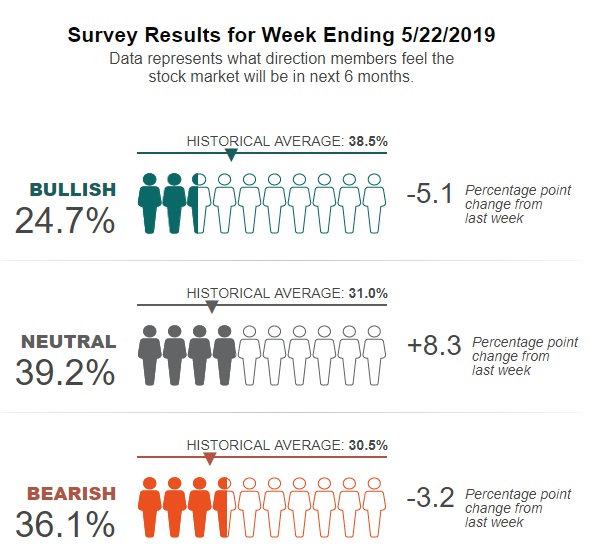

The anxiety shown by pre-market gaps are not the only evidence. We've seen in recent reports that there have been massive outflows from equity funds as well. And while less reliable, individual investors are becoming increasingly pessimistic.

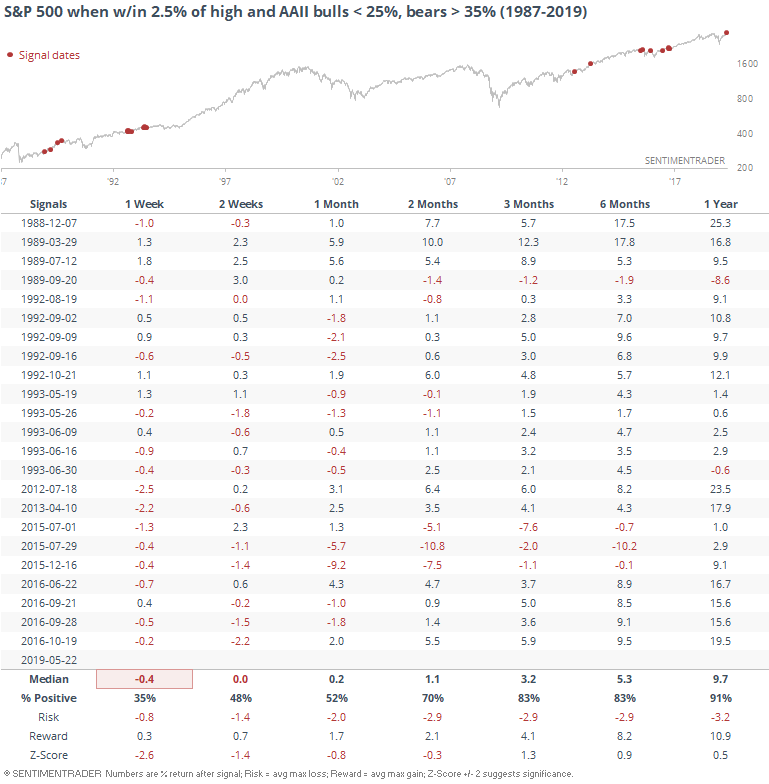

This is the first time in 2 1/2 years when stocks were this close to their 52-week high, yet fewer than 25% of investors were bullish while more than 35% of them were bearish.

Asian Slide

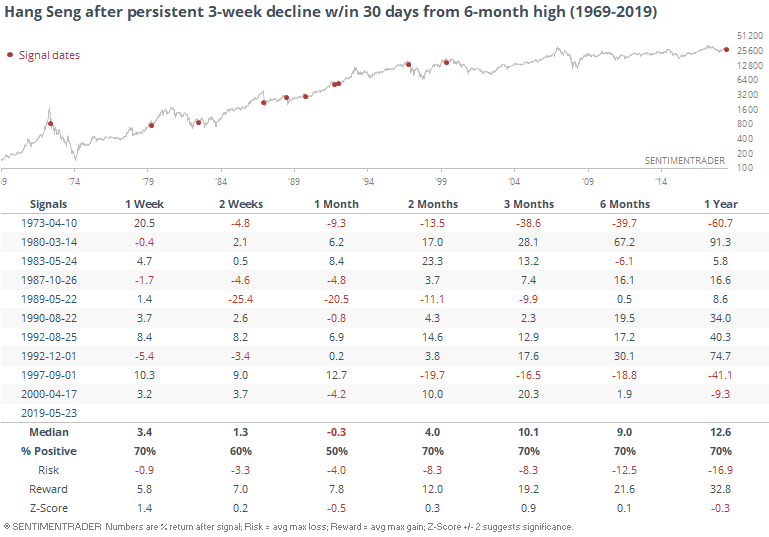

Of all the losses in recent weeks, among the worst have come in Asian-based indexes. The Hang Seng has had a particularly rough ride, almost straight down since hitting a 6-month high less than 30 days ago.

Historically, this kind of move has led to a few major losses (1973, 1989, 1997) but even more nearly immediate rebounds.

Breadth Review

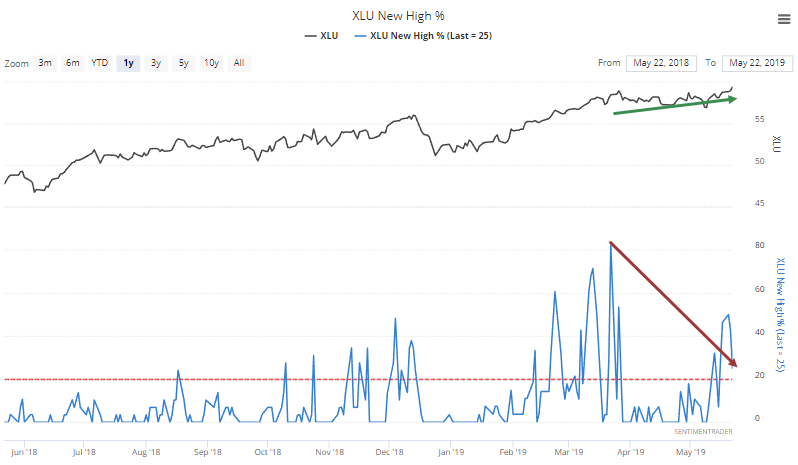

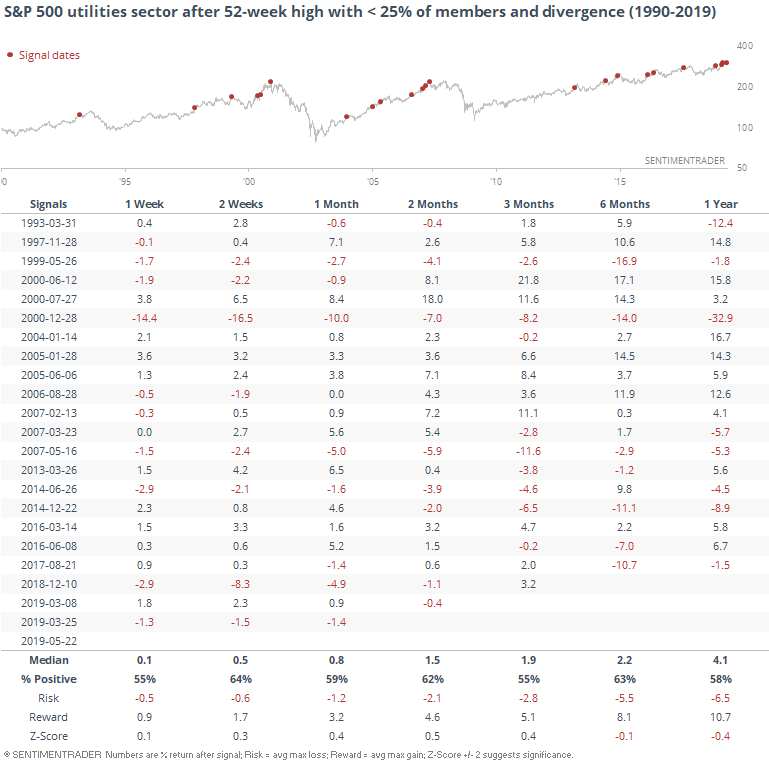

Even with the weakness in many indexes, especially overseas, there haven't been many new extremes of note. One curious development is that even though utilities jumped to a new high, not many of the stocks have gone along for the ride. Fewer than 25% of them hit a 52-week high on Wednesday. That's less than a third the number that hit a high in March.

This kind of divergence can be useful at times, but it's typically more consistent in the broader market than individual sectors. That seems to be the case here, too.

If we see a sustained push in this sector with a jump in breadth extremes, like we did in March, it would be a better caution signal for these stocks.