Thursday Midday Color

Here's what's piquing my interest so far today.

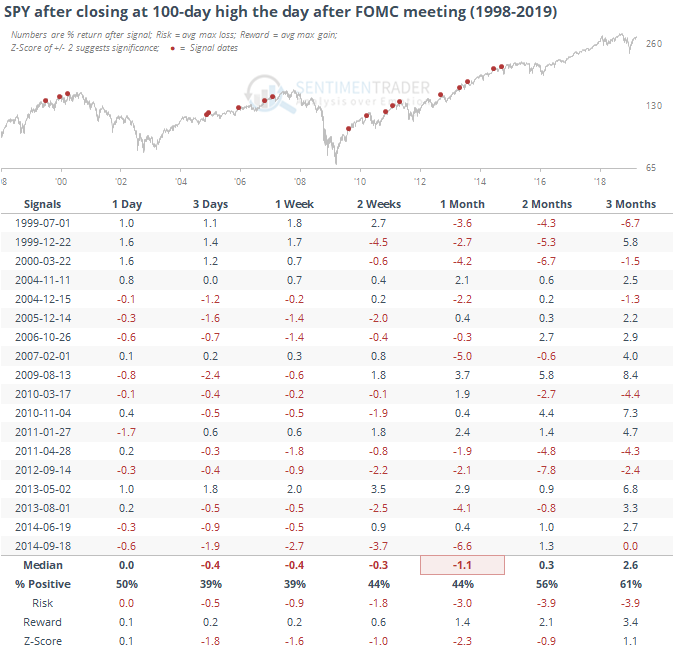

FOMC Reversal

Stocks are trying to fully reverse any weakness from earlier this week. If SPY closes at a new high for this move, it would be the first time traders pushed it to at least a 100-day high the day following a FOMC meeting since 2014. Other times that happened, SPY tended to pull back in the days ahead.

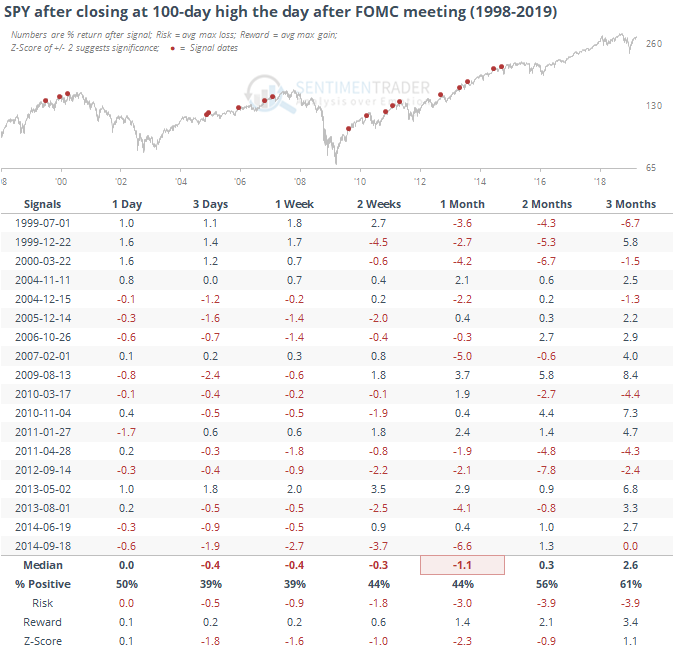

Utilities Pause

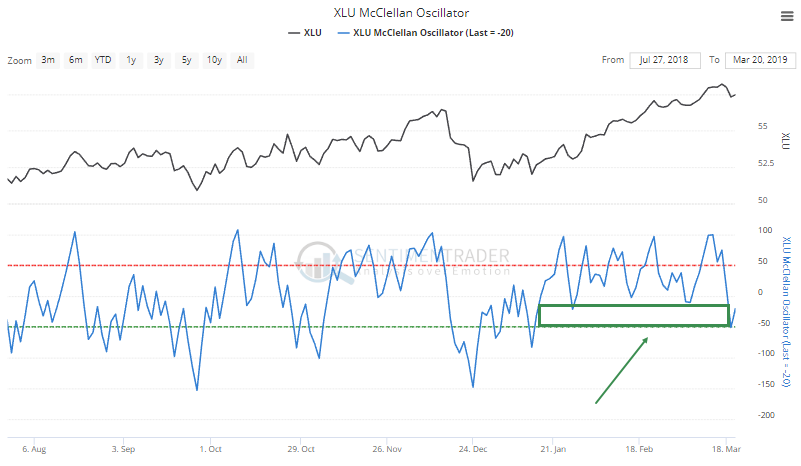

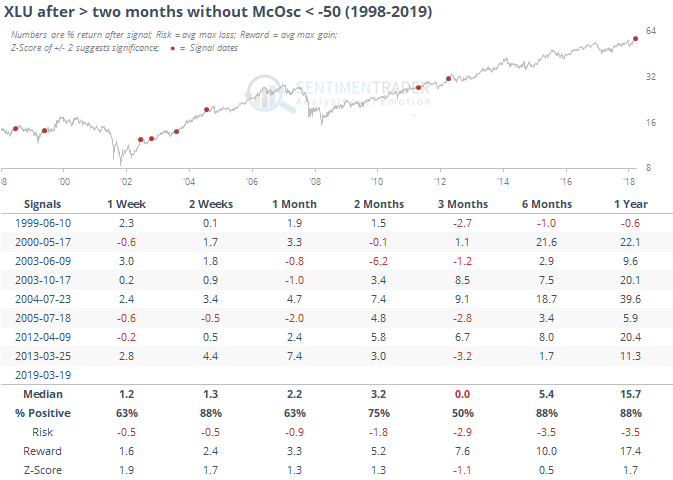

On Monday, we saw how stretched the utilities sector was, with the kinds of breadth readings normally reserved for higher-flying kinds of stocks. When such a staid sector sees those types of readings, it has almost always led to re-adjustments, which we've seen so far this week. The McClellan Oscillator for XLU just dropped below -50 for the first time in a couple of months.

That's a long stretch of positive momentum. When it ends, XLU has usually seen a short-term rebound, but they didn't often last over the next few months. Long-term, though, this kind of momentum was a good sign, like we've seen in the other studies.

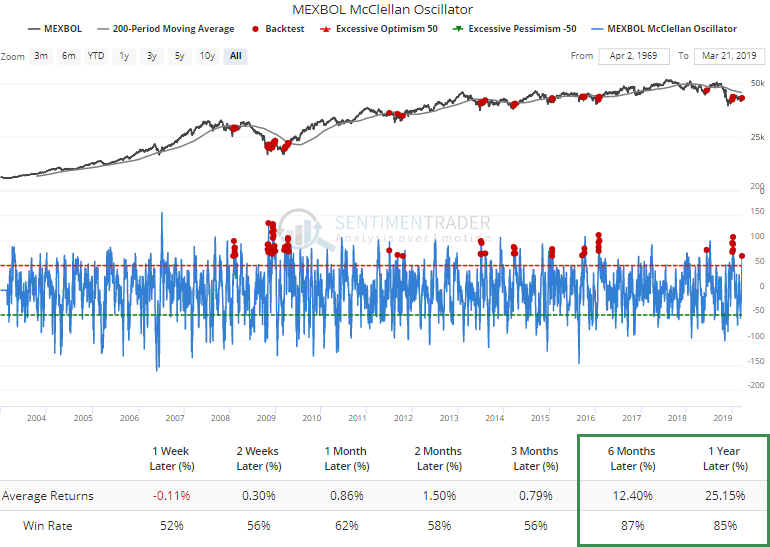

Andale

Mexican stocks have caught a bid, and the Oscillator for the Mexbol index has climbed to nearly 70. When this triggers while the index is still below its 200-day average, it has indicated fairly stretched short-term conditions.

But most of these signals indicated times when investors were first starting to get interested in that market again, and long-term, Mexbol did very well, with excellent and consistent gains over the next 6-12 months.

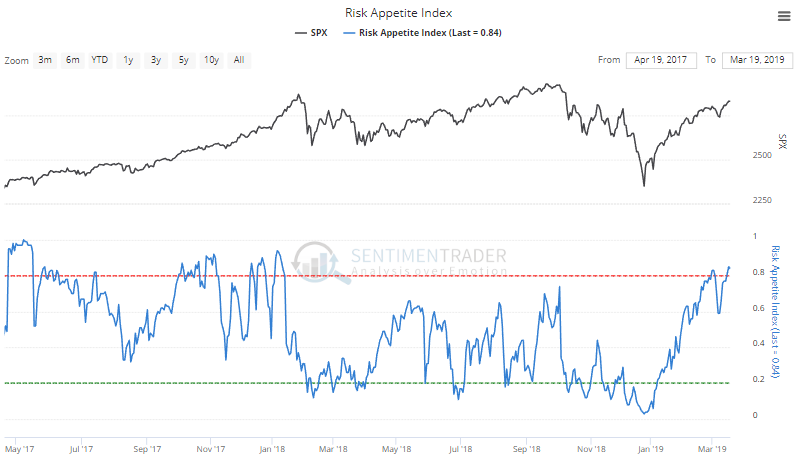

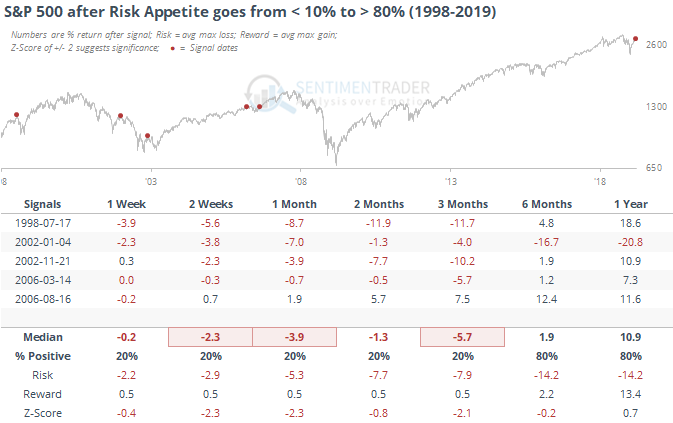

Hungry For Risk

Investors' appetite for risk has returned in a big way. The Risk Appetite Index, which looks at factors like asset volatility, sector returns, and credit spreads, has jumped to 85% from being almost the lowest it can possibly go in December.

This is the quickest cycle from extreme risk aversion to extreme risk appetite since 2001. If we extended the time period for the cycle to the past six months, it still ranks as one of the few times risk has cycled so much in such a short period of time. Most of the others led to poor returns.

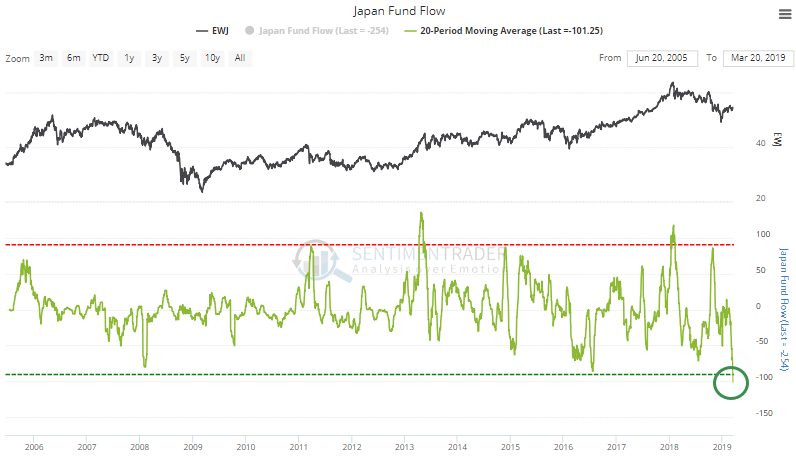

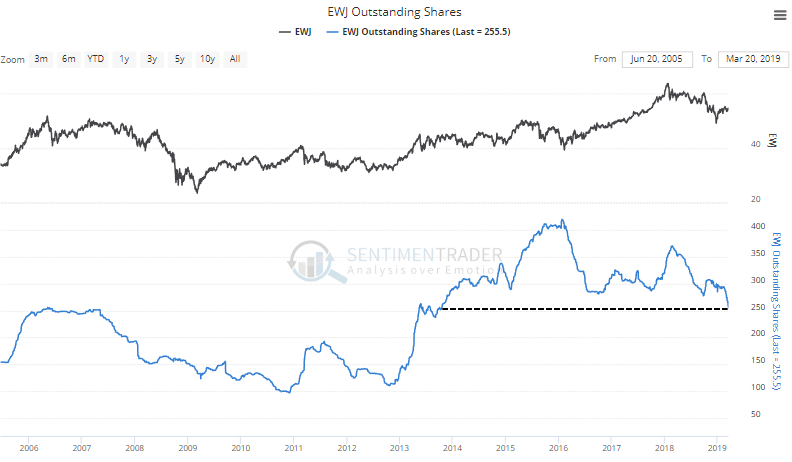

Record Outflow

ETF traders continue to flee the EWJ fund, focused on Japanese equities. It has lost an average of more than $100 million per day for the past month, a record since the fund's inception.

The shares outstanding have collapsed to the lowest level since 2013.

It's possible that some of this isn't related to sentiment, and is just an asset shift to other Japanese-focused funds, like DJX. But those aren't taking in that much money, and EWJ is still by far the largest of the funds with more than 4 times the assets of the next-largest one.