Thursday Color - Gas, Wall St Strategists, Sector Breadth, Lagging U.S.

Here's what's piquing my interest as stocks meander ahead of a big international meeting and summer holidays.

Gas Stocks

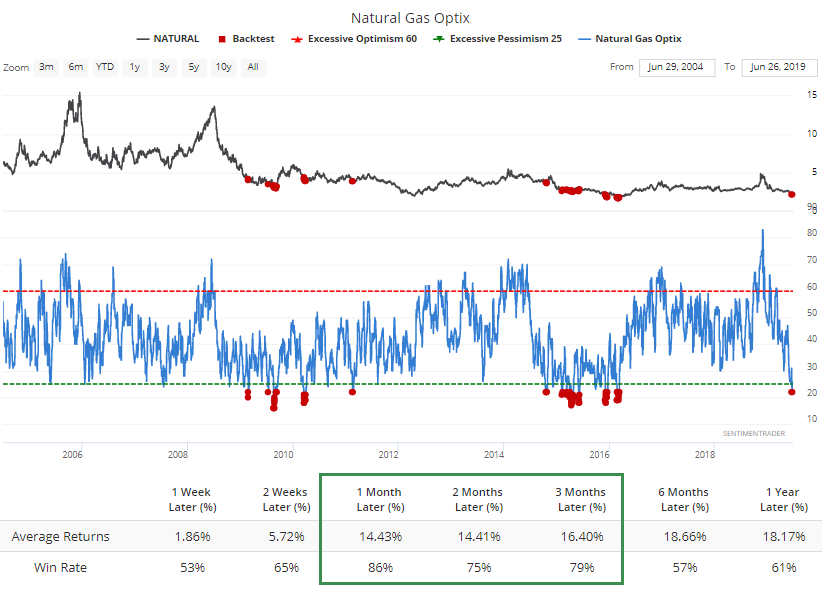

Yesterday, we saw that natural gas was the most-hated commodity, and over the past 15 years it has had a strong tendency to rebound over the next month or so.

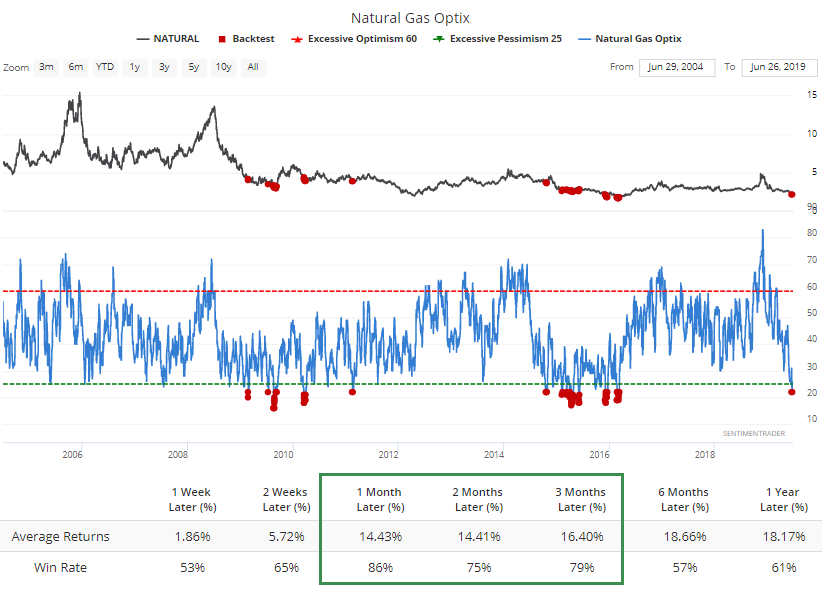

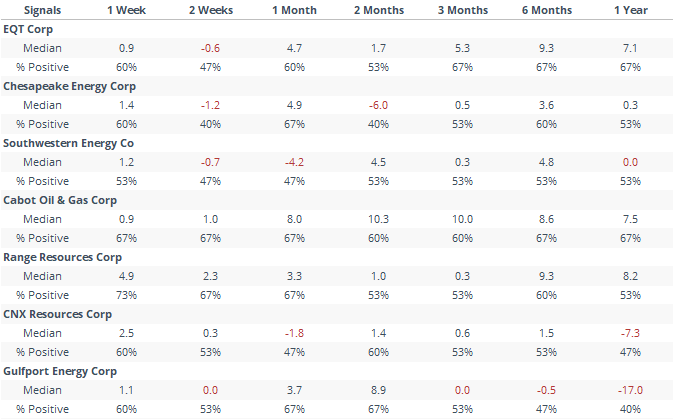

If we look at how gas-influenced stocks tend to perform, the major tended to do better than those more leveraged to the commodity. Below, we can see how the largest energy stocks performed after the Optimism Index on natural gas dropped to 23% or below for the first time in a month.

The most consistent benefactors were BP, Chevron, and Conoco, at least up to the next month or so.

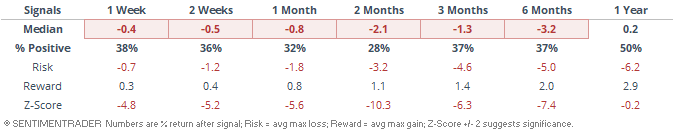

For the smaller players, returns were quite a bit less positive, which is something of a surprise.

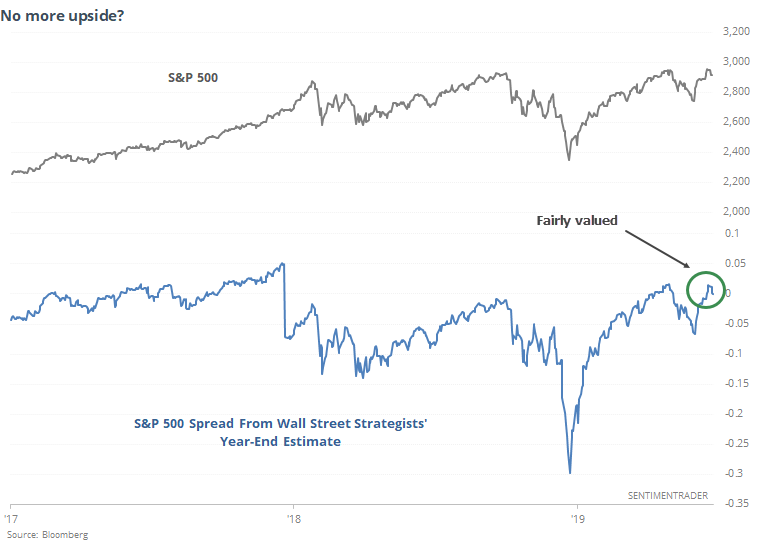

Fairly Valued

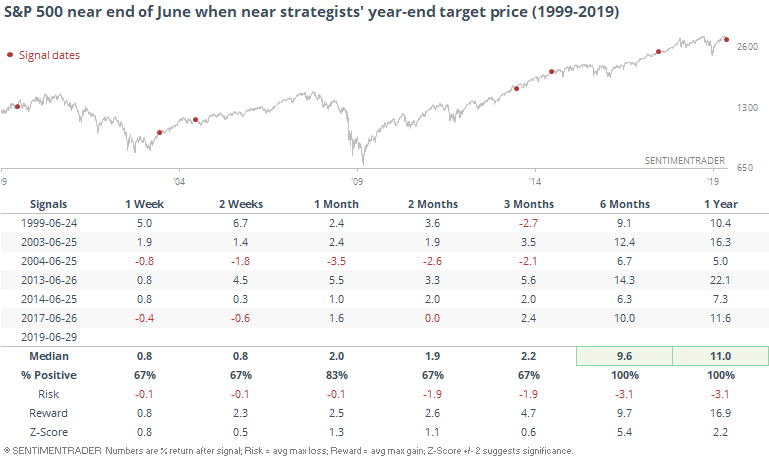

Bloomberg notes that Wall Street strategists haven't been too inspired by recent gains in stocks. They've pretty much left their year-end price targets for the S&P 500 in place, and the index is hovering right around that level now.

This hasn't been an issue for stocks. When the S&P had done so well through mid-year that it already met strategists' target for the entire year, it tended to keep going. Over the next six months, approximately to year-end, the S&P added to its gains every time.

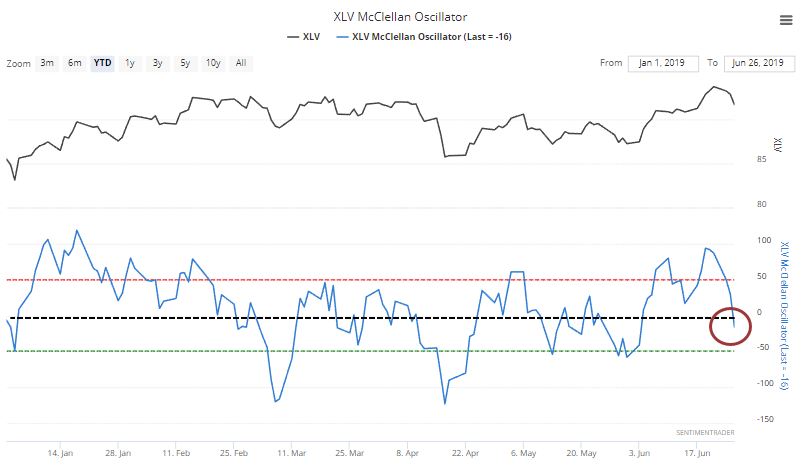

Breadth Review

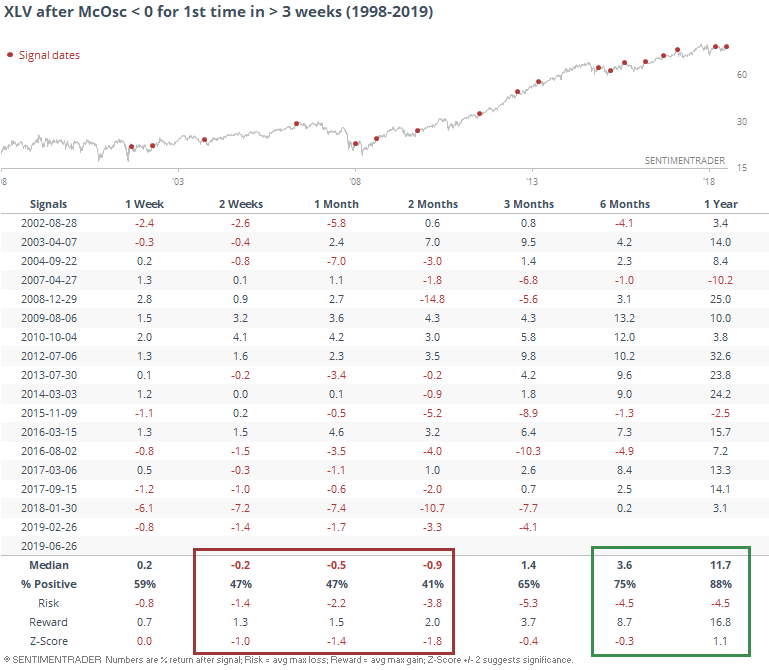

With the pullback in recent days, some sectors are showing waning underlying momentum. In health care, the McClellan Oscillator has dropped below zero for the first time in several weeks, after having been well above the overbought threshold.

The XLV fund has struggled during the next 2-8 weeks under similar conditions.

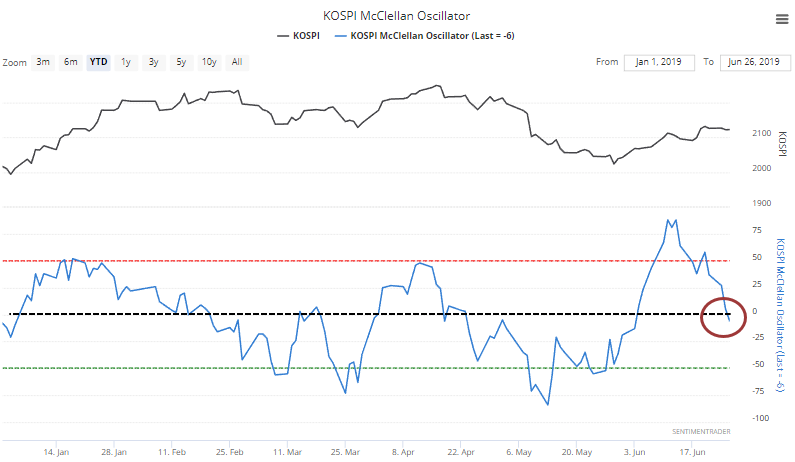

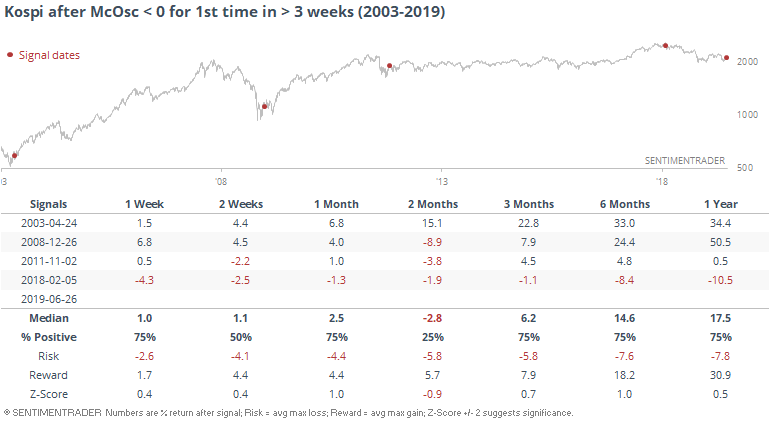

Same thing is happening in Korean stocks, with the Kospi.

There was a big exception here, though. When it triggered in 2003, it was only the beginning of the recovery from the bear market.

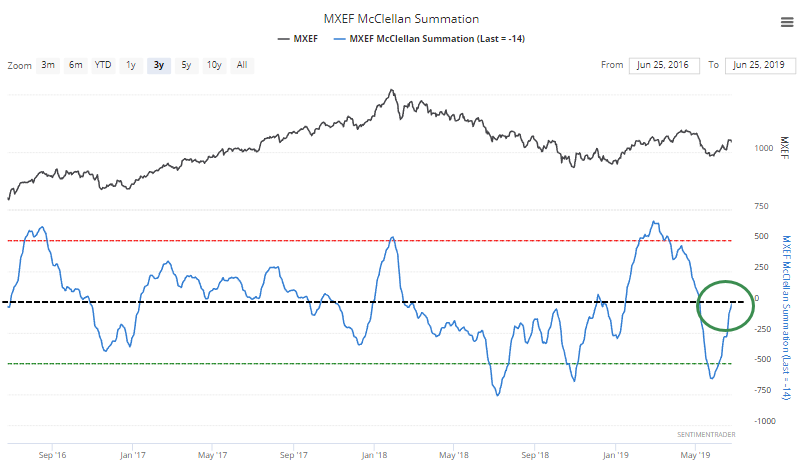

Other markets are showing some longer-term improvement, like emerging markets. The McClellan Summation Index for those stocks is about to pop above the zero line for the first time in more than 30 days, having recently been oversold.

It's been tough for these stocks to hold their nascent momentum over the short-term, but proved to be a good longer-term sign of recovery.

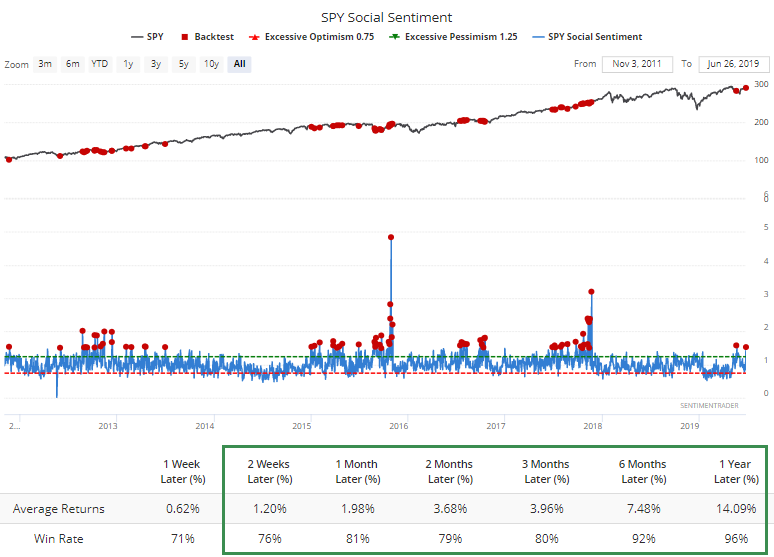

Twitter War

In light of yesterday's note showing President Trump picking up his pace of celebrating a good stock market, "everyone else" is taking the other side.

It's interesting to note that Social Sentiment for SPY jumped to 1.5 yesterday, meaning there were 150 negative messages about the fund for every 100 positive ones.

The gauge tends to be more reliable for the more liquid ETFs (since there tends to be more messages about them), and such a high level of negative Tweets has been a good sign.

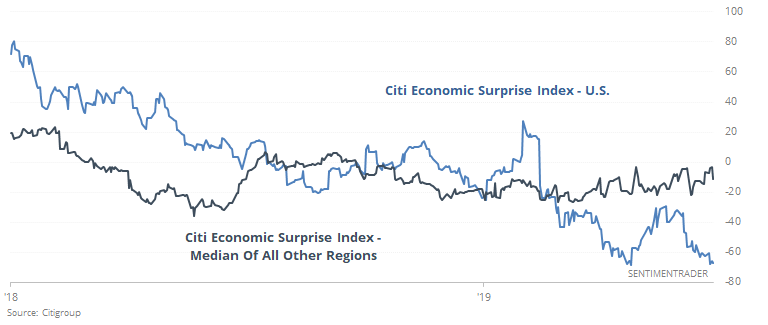

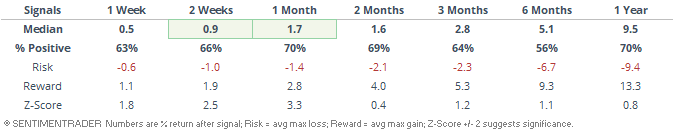

Biggest Loser

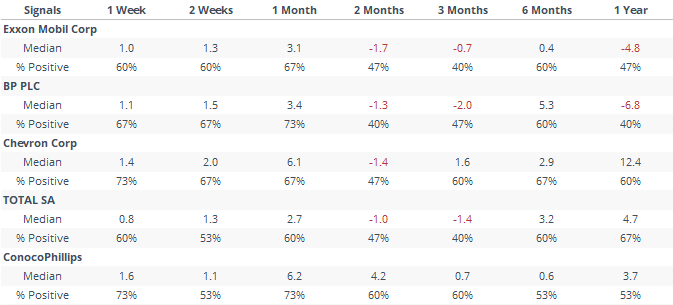

In recent days, we've looked at how the poor economic reports (relative to economists' expectations) in the U.S. have impacted future returns of various assets.

The fine folks at Bespoke note that now the U.S. is the worst of all the surprise indexes that Citi tracks.

Not only is it lower than all others, it's lower by more than 55 points from their median.

That sounds horrid, and it kind of is, but it's not that uncommon. Over the past 16 years, there have been 254 days when this has been the case.

It wasn't a negative for future returns in the S&P 500.

The dollar struggled, though.