Three-Day Rally Triggers More Short-Term Extremes

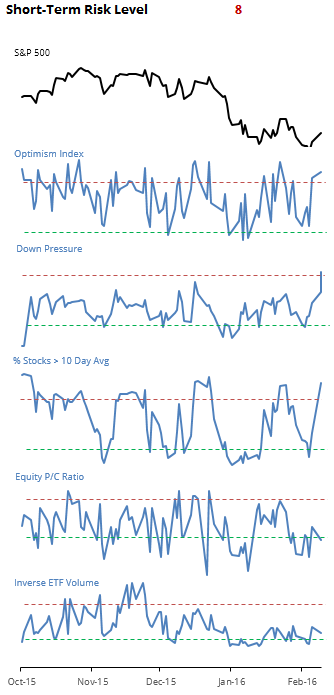

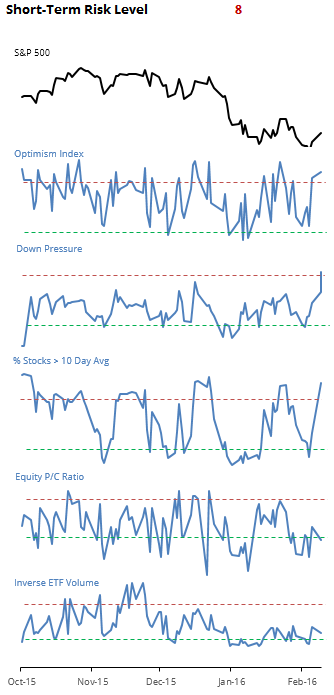

Heading into the last 1/2 hour of trading, we are seeing a spike in several of the short-term indicators that had been holding out the last couple of days. That is likely going to push the risk level up to 8 for the short-term.

There is still a surprisingly large focus on put trading and inverse ETFs as traders are not giving up the ghost in terms of hedging activity. During past rallies, these were just as likely to move to extremes as the other indicators, and it's not happening this time so the risk level is lower than it would normally be.

Over the past year, stocks have had great difficulty maintaining short-term momentum with a risk level of 8. The only real exception was in early October last year. As we always note, when a market is emerging from medium-term pessimism and continues higher in spite of short-term optimism, it is an excellent signal for further gains over the following weeks, and it's something we'll be watching for here.

Besides the headwind from the short-term optimism, there is also the issue noted before the open today related to 3 days in a row of large gaps.