This year is just like...

Through the first 4 months of the year, stocks have barely suffered any downside volatility. This seems like 2013 or 2017, two other recent years that were marvelous for trend followers and miserable for pretty much every other strategy.

Buying momentum to start the year has rolled over just about every mean-reversion strategy in 2021, and it's tempting to pick a year that seems similar based on eyeballing a chart. We prefer to take a more objective approach using as much data as possible.

THE CLOSEST HISTORICAL ANALOGS

Using that discipline, we can go back nearly 100 years and look for every 4-month (84 trading-day) start to the year. We'll then filter the years, looking only at those that showed the highest correlation.

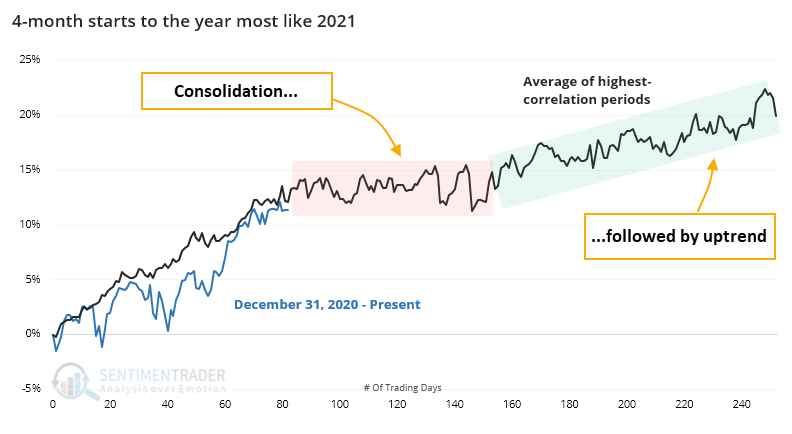

There were 19 years with a correlation of more than +0.75 (on a scale of -1.0 to +1.0). We can see their average price path below.

Once the years got to about this point, they tended to plateau into the summer months before picking up again in the fall. The overall trend was still up and to the right.

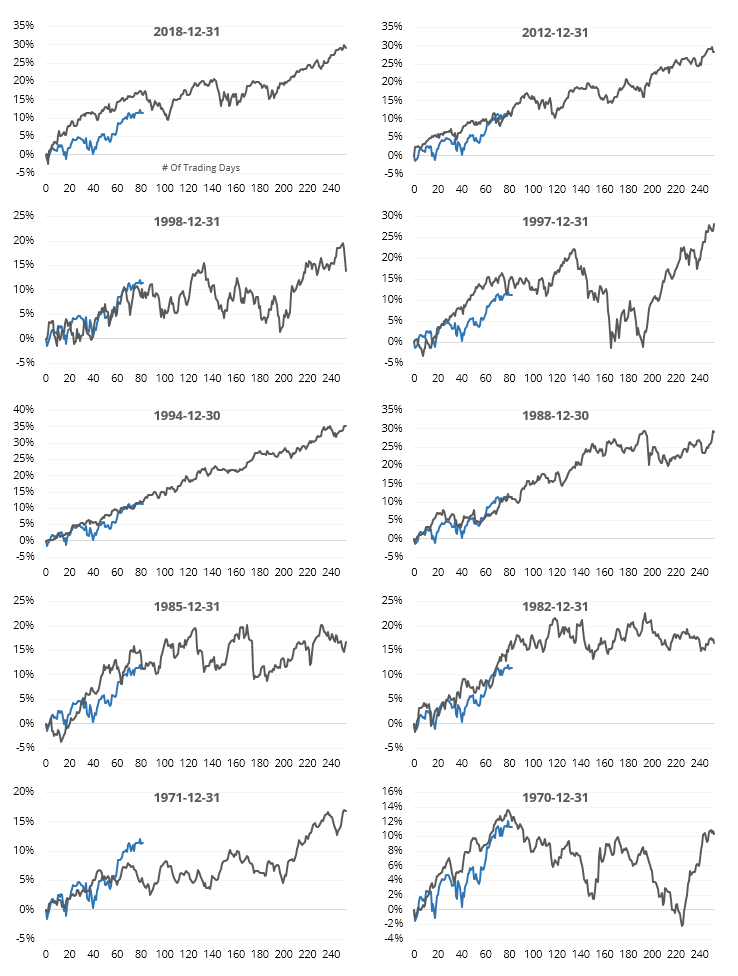

The 10 most recent years that made the cut are shown below.

Most of them tended to see some exhaustion about now, or if they did see a further push, gave it back in the month(s) ahead. The only real exceptions were 1995, which was pretty much an uninterrupted uptrend, and 1989. All the others saw at least some chop.

FUTURE RETURNS AFTER THE MOST SIMILAR YEARS

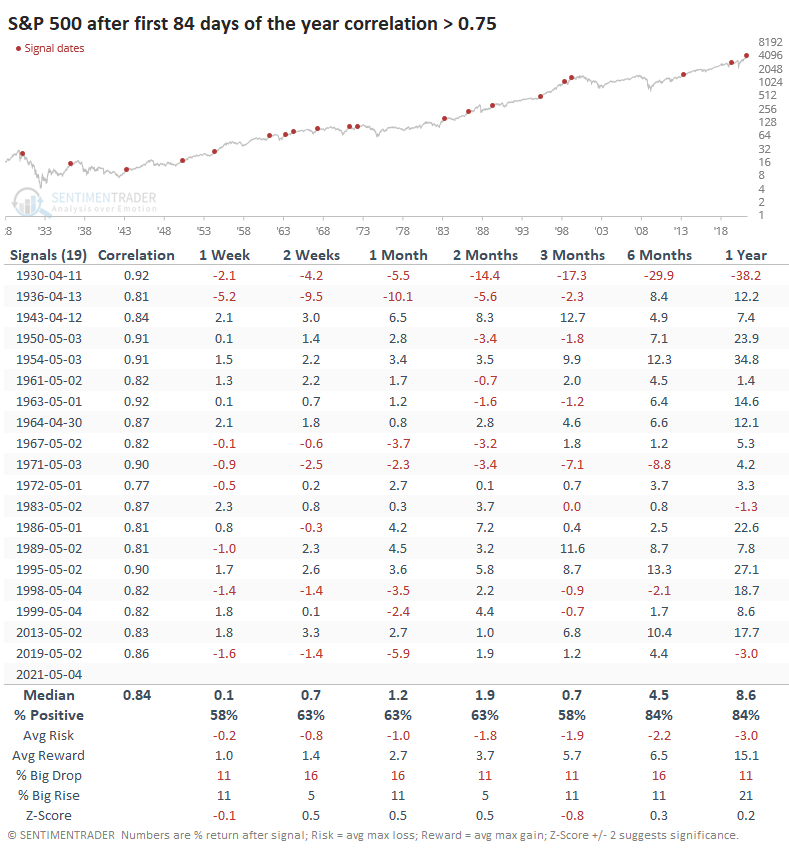

The table below shows the S&P's future returns as of day #84 for the years with the highest correlation so far to 2021.

Returns weren't bad, but they weren't great either, especially for the first few months.

Over the next 3 months, the S&P averaged a return of only +0.7%, below a random 3-month return. The risk/reward wasn't bad at all, and over the next 6-12 months, there was only one terrible loss.

ANOTHER CHALLENGE - LOTS OF COMPANY

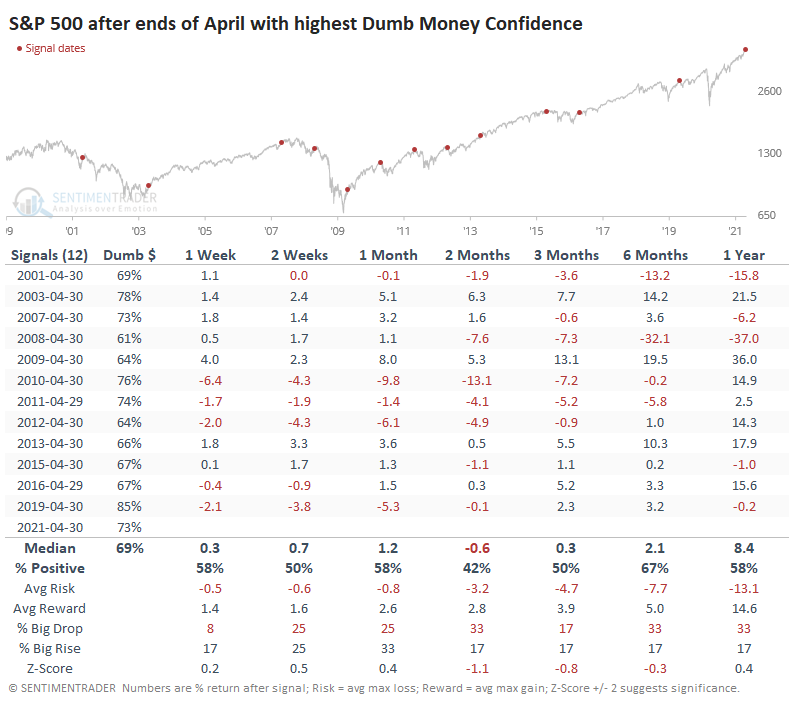

An additional challenge for the short- to medium-term this year is the high level of sentiment. The table below shows the S&P 500's future returns entering May with the highest levels of Dumb Money Confidence.

The only two years that didn't see weakness, or only a minimal gain, through June were 2003 and 2009. Both of those, of course, were the first years of a bear market recovery.

Confidence has been high for months, with no ill effect on price action. As we saw in February, the "dumb money" has been smart to a degree we've never seen before, so that's a caveat.

Given the recent record of stocks struggling in the early summer with high optimism and the long record of it struggling after the most similar 4-month starts to the year, it suggests a low likelihood of a runaway upside market.