This Sector is Seeing Panic-Level Selling Pressure

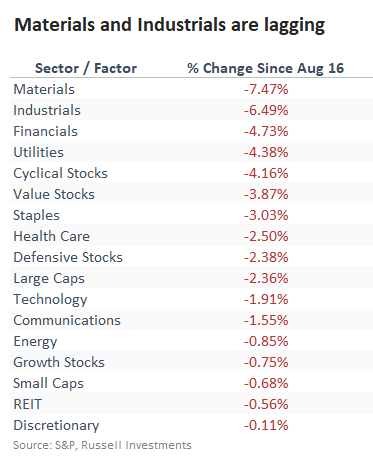

Industrial stocks have had a tough month. Out of the S&P 500's major sectors, Industrials are lagging near the bottom since mid-August in total return. Only Materials stocks have suffered more, and both sectors have lost quite a bit more than even the other laggards.

Longer-term selling pressure has pushed the McClellan Summation Index for Industrials close to zero. Over the past five years, this has been a good buying opportunity...except when it wasn't. When the Summation Index sliced through zero and kept moving, it highlighted harsh environments for buyers until the indicator fell to -1000 and started to curl higher.

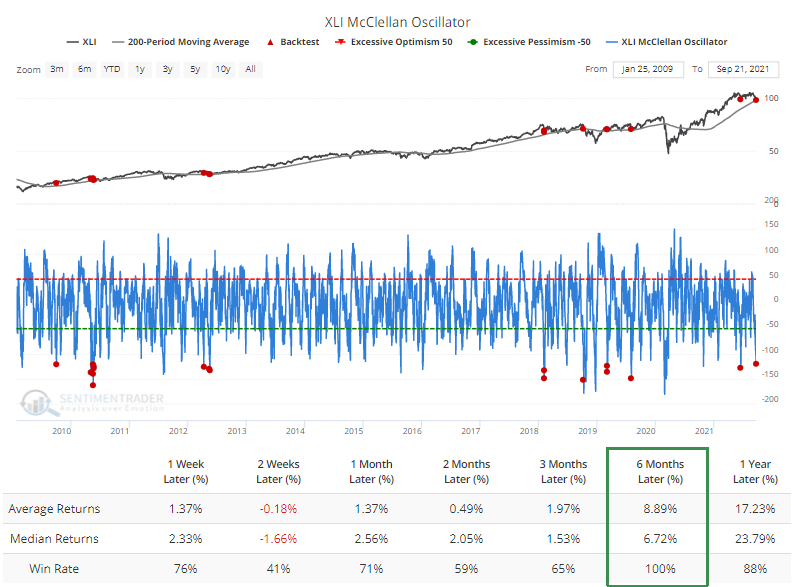

Pressure on the Summation Index is due to the shorter-term McClellan Oscillator plunging to -120. According to our Backtest Engine, a reading this low is truly extreme when the XLI fund was still above a rising 200-day moving average. The others preceded a choppy couple of weeks, but each of them worked higher over the next six months (a roaring bull market as a background doesn't hurt).

When we create a panic breadth composite, we can see that Industrials have just entered the extreme zone.

Panic became even more panicky during the pandemic, but otherwise, it presented a good risk/reward for investors, or at least for traders. Over the past 30 years, its record has been good - not great - when it reached this level. Like most oscillators, more extreme readings tend to lead to more consistent results.

What else we're looking at

- A look at several breadth measures for Industrials and what they suggest about the market environment

- What happens after the panic breadth composite reaches the current level when Industrials have barely corrected

- Tech stocks have given a potential buy signal from washout breadth

| Stat box Depending on your data vendor, more than 80% of volume on the NYSE flowed into advancing stocks on back-to-back days. This kind of breadth thrust has a decent record at preceding further gains. |

Etcetera

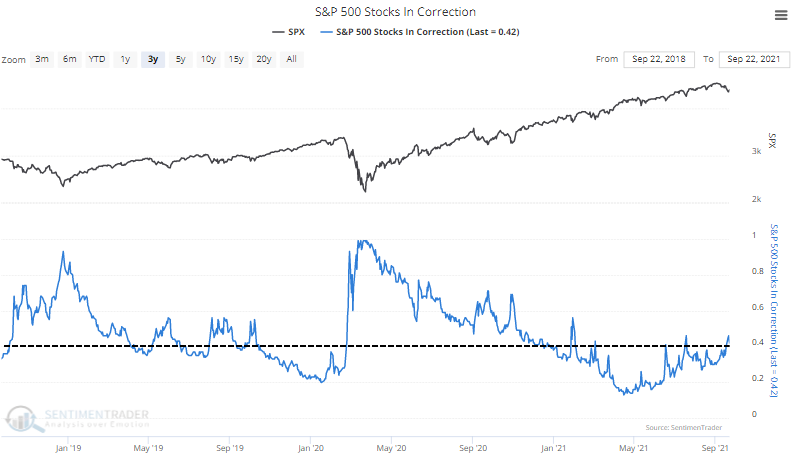

Common corrections. More than 40% of S&P 500 stocks are mired in corrections, though that is declining thanks to a late-week rebound. Unhealthy markets see this figure above 40% and rising.

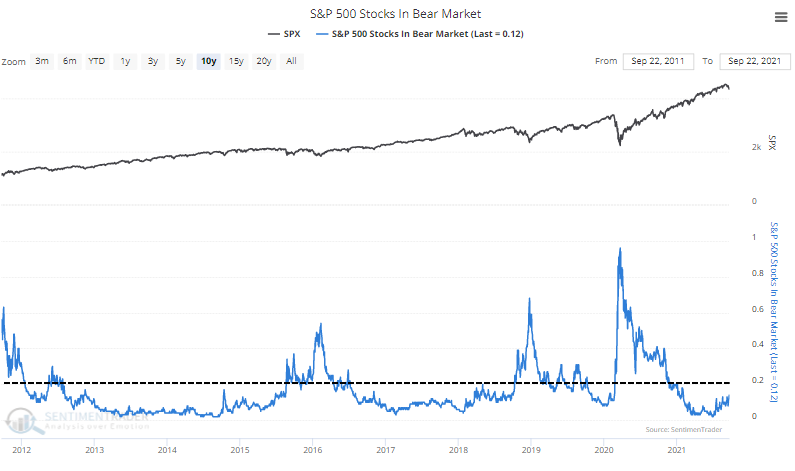

Few bear markets. While many stocks have corrected, few have yet fallen into bear markets. As long as this figure is below 20%, stocks are in a healthy longer-term environment.

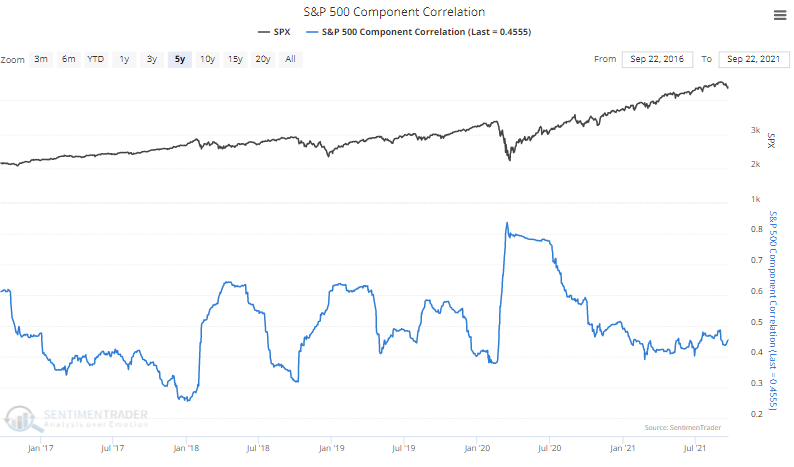

Mediocre correlations. When investors panic, they sell everything. When they're complacent, they trade stocks on their own merits, and correlations among them fall. Currently, correlations among S&P 500 stocks are in the middle of the range, a good place to be.