This Is the Best Year Ever for Stocks and Commodities

It's been a heckuva year, and it isn't even July. Not only have stocks enjoyed an almost uninterrupted advance, but even lowly commodities have rallied hard.

As the Wall Street Journal notes:

"Stocks and commodities are surging together in a way few on Wall Street have ever seen, a sign that demand for riskier investments remains robust.

The S&P 500 and S&P GSCI gauge of commodities enter the last few days of the second quarter up about 8% and 13% for the period, respectively. This would mark the first time that both indexes climbed at least 5% in five consecutive quarters, according to a Dow Jones Market Data analysis of figures going back 50 years."

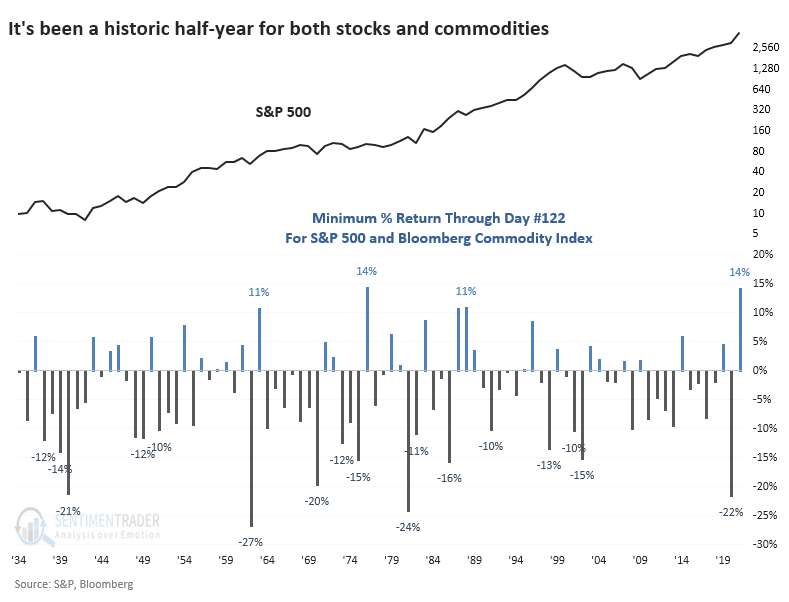

When we look at year-to-date (YTD) returns approximately through the end of June, this year stands out above all others. The S&P 500 and the Bloomberg Commodity Index have each rallied at least 14.2% YTD, surpassing 1976 as the best combined year for the two asset classes.

WHAT IT MEANT FOR FUTURE RETURNS

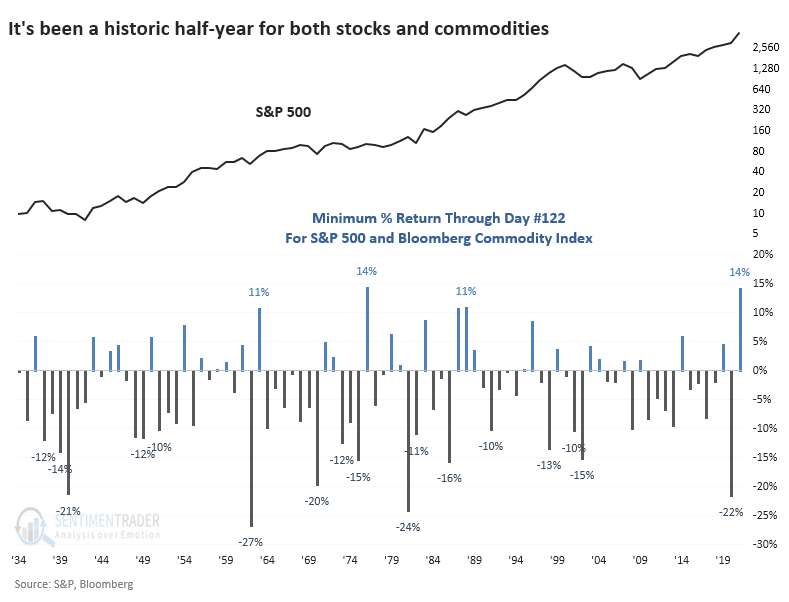

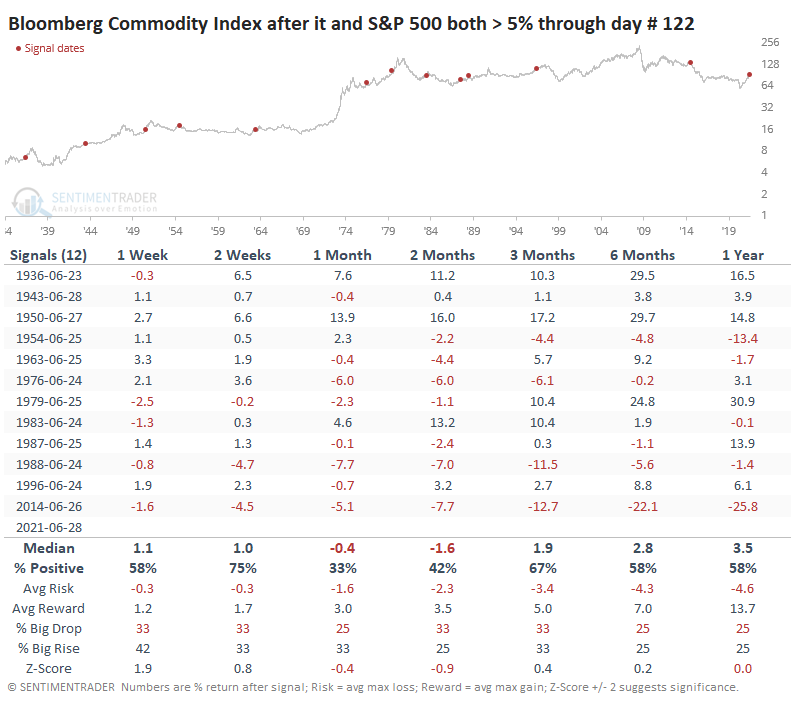

We can see from the chart that there have only been a few times when both stocks and commodities rallied at least 10% through June, the last time being more than 30 years ago. The table below shows how the S&P fared after those dates.

Each showed a negative return somewhere between 2 - 8 weeks later, but only one of them ended up leading to a major drop, which was Black Monday in October 1987.

For commodities, it preceded more consistent weakness, with losses each time over the next two months.

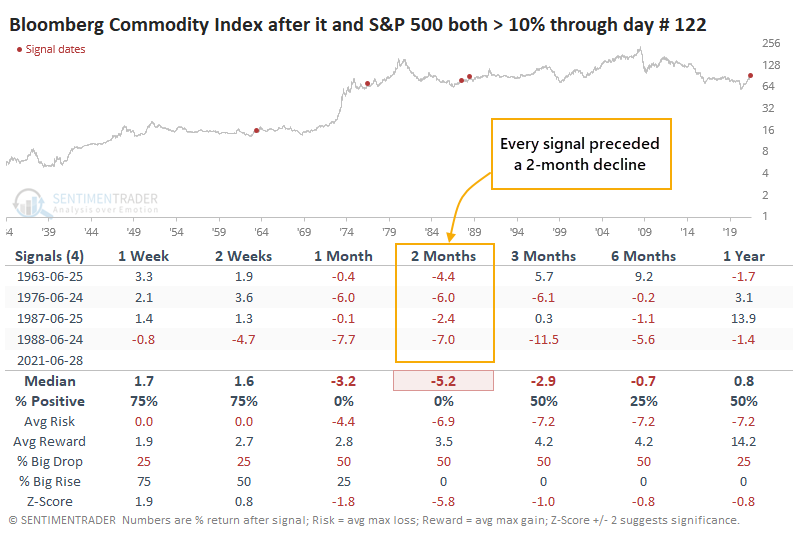

Surely, it's hard to put much weight on a sample size of four, so if we relax the parameters to include any year when both assets were up at least 5% through this part of the year, we can triple the sample.

Over the next couple of weeks, the S&P pulled back or showed only a modest advance, except for 1954. Stocks took off that summer and never looked back. The others see-sawed somewhat but still generally rose over the rest of the year. There were only three losses over the next three months, and they were all relatively small.

It was less benign for commodities, especially over the next 1-2 months.

Over the past 60 years, the Bloomberg Commodity Index declined over the next 1 - 2 months every time but once. There are quite a few headwinds for commodities currently, and this appears to be another.

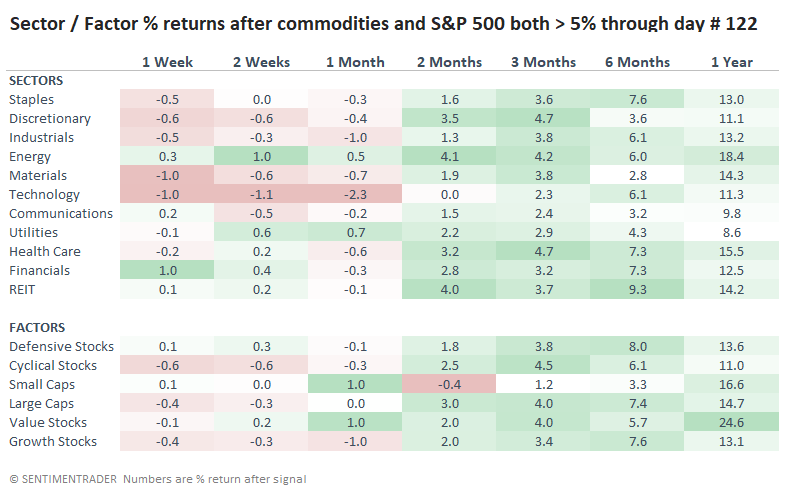

GOOD FOR ENERGY, BAD FOR TECH

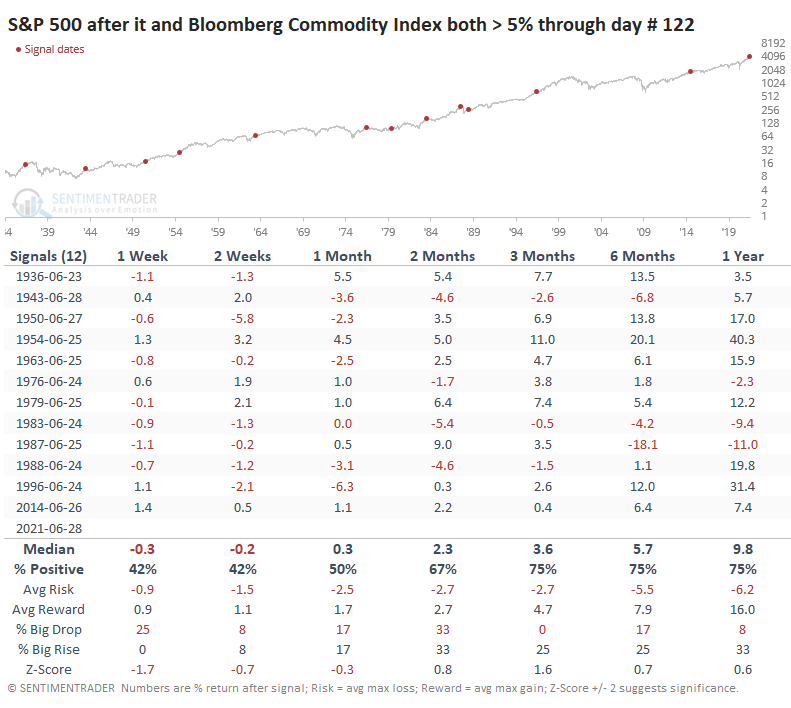

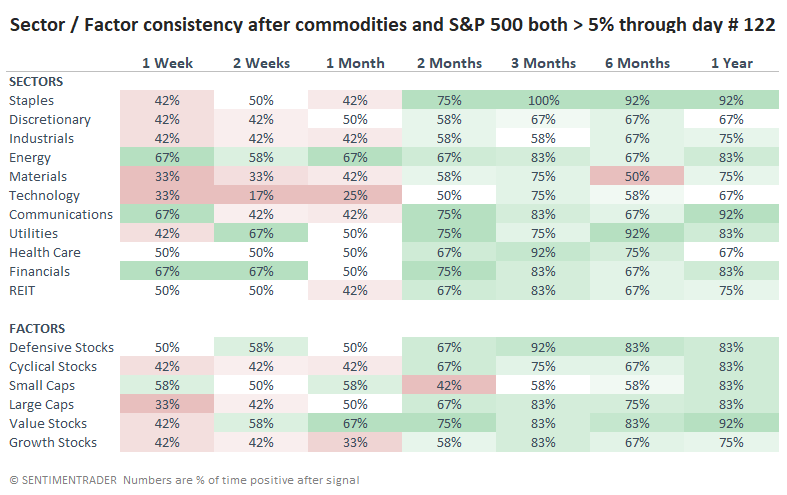

For sectors and factors, this kind of stock + commodity momentum preceded the best gains for the Energy and Utilities sectors, with Technology, Cyclical, and Growth stocks being challenged the most.

We can see that in their consistency, too. This is the percentage of time each sector or factor rallied over each time frame.

Momentum is a strong force, and even though stocks often struggle a bit starting around mid-July, these kinds of years have typically resulted in a decent continuation of the trend over the longer-term. It was a different story for commodities, though, which tend to be much more influenced by the supply/demand dynamic.