This Indicator Put April in The History Books

Since at least December, there have been two competing forces at work. They've both been so extreme and at opposite ends of the spectrum that we've never really seen the tension quite so high before.

Those two forces are sentiment and momentum. While they are often in conflict, what's unusual about the last few months is that we've seen the type of sentiment normally witnessed near the ends of bull markets. At the same time, we've seen momentum and thrusts normally witnessed at the beginnings of them.

The momentum we've discussed isn't just the price gains in major averages. It's mostly the internal health of the moves, especially since October. Participation among stocks, industries, sectors, and even countries has been stellar - even record-breaking.

Bloomberg notes that April 2021 was the best month in history for one common indicator of market breadth. No other month had seen so many stocks hover above their 200-day moving averages.

"During 18 sessions this month through trading on Thursday, 95% or more of the index's members traded above their 200-day moving average. That's the most days ever observed in a single calendar month and double the previous high of nine days in September 2009." - Bloomberg

The Bloomberg article highlighted the percentage of S&P 500 members trading above their 200-day moving averages. But last month stands out for showing among the best trends ever across short-, medium-, and long-term time frames.

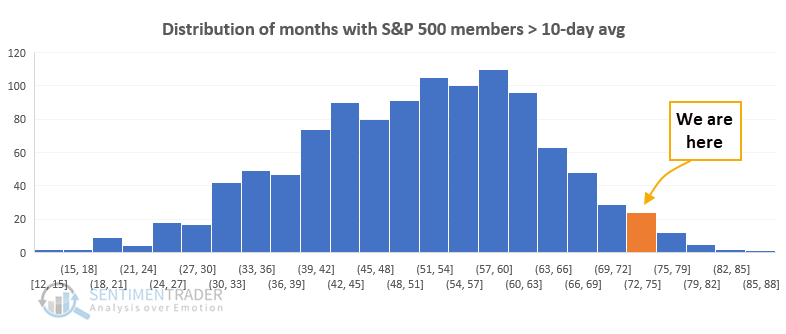

During the entire month of April, 73% of S&P members traded above their 10-day moving averages on an average day. That puts last month near the far right on the distribution curve of all months.

Looking at all three time frames, April 2021 made the top 20 months only with the percentage trading above their 200-day averages.

Even so, last month ranked relatively high on all 3 metrics, as we could see from the distribution graphs above. When we average all 3 together, April 2021 ranked as the 7th best breadth month ever.

| Stat Box The largest ETF in the world, the S&P 500 tracking fund SPY, closed below its opening price for the 7th day in a row. That's tied for the 4h-longest stretch of intraday selling pressure since the fund's inception in 1993. |

What else we're looking at

- Full details on April 2021's place on breadth thrusts all-time

- Future returns following the best monthly breadth thrusts since 1928

- A deeper look into the April Barometer