This indicator is now giving a warning for stocks

One of the major developments we've been watching for since there was overwhelming evidence of excessive optimism is weakening internals.

That can take any number of forms, and for the most part, we haven't really seen it until very recently.

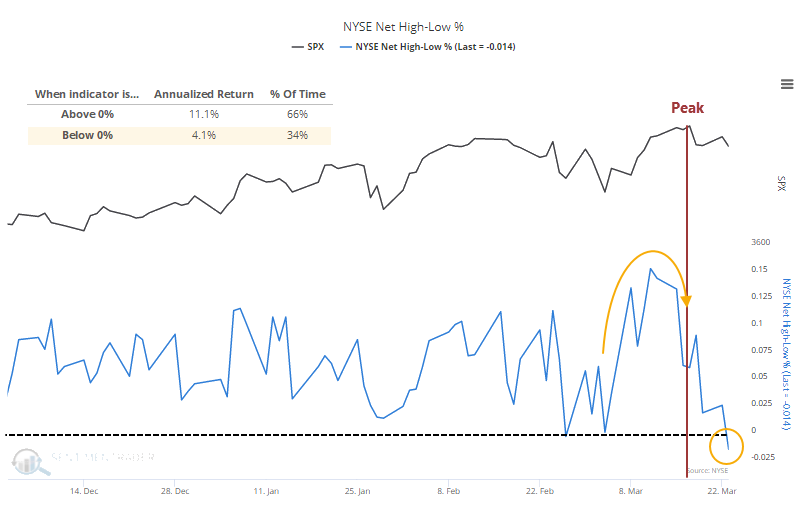

One of the clearest ways to look for this is the net percentage of securities on the NYSE that reach 52-week highs versus 52-week lows. After the surge in new highs in early March, there was a minor divergence as those figures weakened even as the S&P 500 made a new high, but it wasn't major.

More concerning is that by Tuesday, there were more 52-week lows than 52-week highs. We don't care that it was caused by a fall in SPACs or any other excuse - there's always something.

The reason we shouldn't expect a protracted divergence this time is simply how far stocks have traveled. Across all the major equity indexes, and throwing in over-the-counter stocks just because they have seen such a tremendous surge of interest, the median stock is up more than 100% from its lows.

What else we're looking at

- Looking at other peaks in recent years, compared to behavior in the NYSE New High / New Low indicator

- Charts of the median stock gain in the S&P 500, Dow Industrials, Nasdaq 100, Russell 2000, and OTC market

- Comparing 1-year returns across sectors and factors versus a typical 1-year anniversary from a bear market low

- Looking at gold and its 4-year cycle

- What happens when there is a surge in equity inflows relative to stock market capitalization

- An update on our Relative Range Rank for risk-on index ratios

| Stat Box Emerging markets indexes fell into a correction, 10% below their highs, for the first time since hitting new highs in February. This is the 16th time they've done so since 1987. |

Etcetera

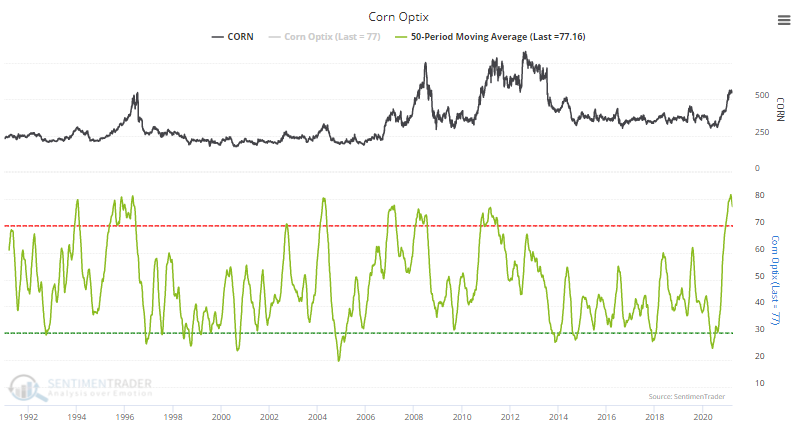

Harvesting gains. Investors in corn futures have been plenty hopeful, driving a 50-day moving average of the Optimism Index close to record highs. That's now starting to turn.

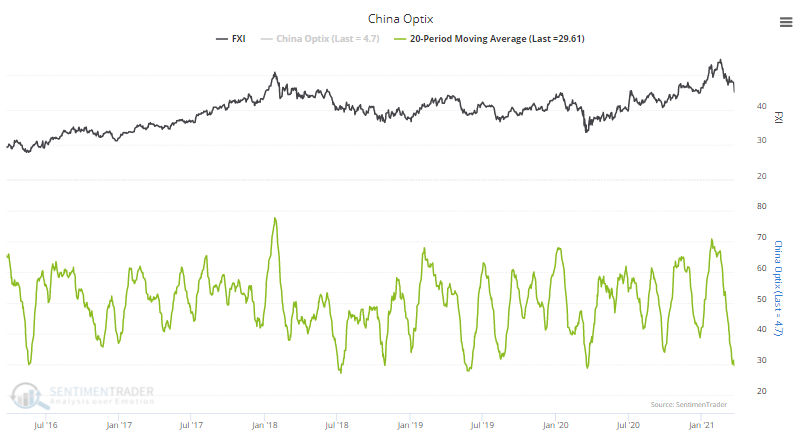

Not feeling good about the buyers, though. Much of the enthusiasm for grains comes from exports overseas to markets like China. Traders in the FXI fund, though, haven't been too keen about stocks in that market, with the 20-day Optimism Index dropping to one of the lowest levels in 5 years.

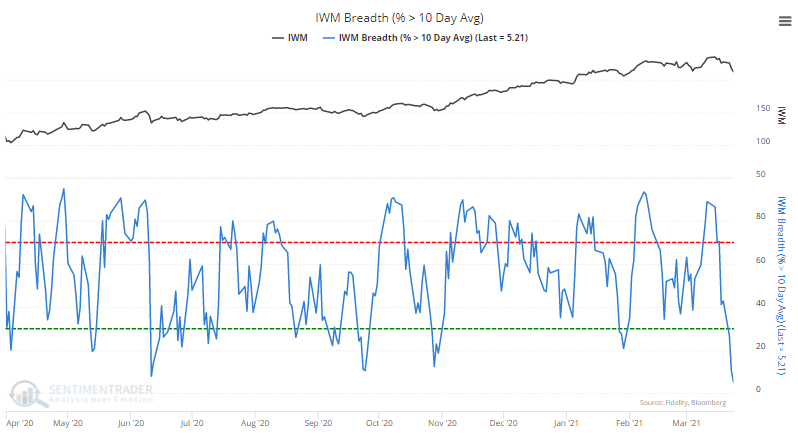

Small-cap smackdown. The carnage in small-cap stocks has pushed so many of them below their 10-day averages that fewer than 5.5% of components in the Russell 2000 remain above those short-term averages, the fewest of this bull market.