This day of the week has been traders' best friend

Stocks gapping up in the morning seems like it has become a seemingly daily occurrence. That's an exaggeration, of course, as "only" 60% of the days in 2021 have started with a gain.

Last May, we saw how stark the difference was between activity outside of regular trading hours versus the daytime session. Excluding transaction costs, a trader would have enjoyed massive gains by buying at the close each day and selling at the open the next day. Someone exposed to stocks only during the day wouldn't have participated in any gains in almost 30 years. It was even starker for the IWM small-cap fund.

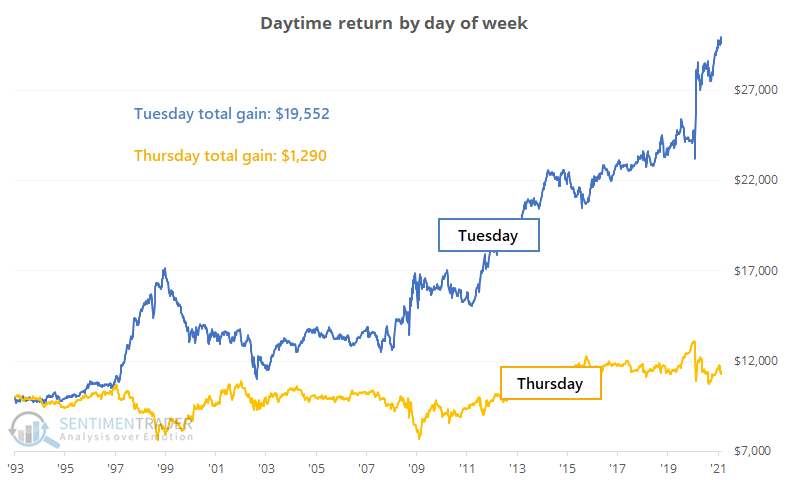

If we want to know which days provide most of the gains, then we can glean some insight from the chart below. For each day of the week, we measured the growth of $10,000 invested in SPY only overnight and only during regular trading hours. The one below shows the return on that $10,000 invested only during regular trading hours on Tuesdays and Thursdays. This excludes dividends.

For shorter-term traders, it's remarkable how consistent the bias has been between weekdays. This can, of course, vary wildly from week to week, but over time it has been a consistent enough phenomenon to note.

| Stat Box Thursday marked the 3rd consecutive session in SPY with a tiny intraday range with well below-average volume. Of the 10 other times this pattern triggered, SPY tended to trade down very short-term but "don't short a dull market" usually paid off longer-term. |

What else we're looking at

- Overnight vs daytime returns in SPY for each day of the week

- Comparing overnight vs daytime returns by day

- Bonds are stuck in a long-term cycle

- Looking at a risk-on / risk-off model using NYSE highs and lows