This Chart Shows That Options Whales Have Been Beached

After taking a pounding from almost certain options-related losses following a speculative surge in February, small options traders stormed back at the beginning of June.

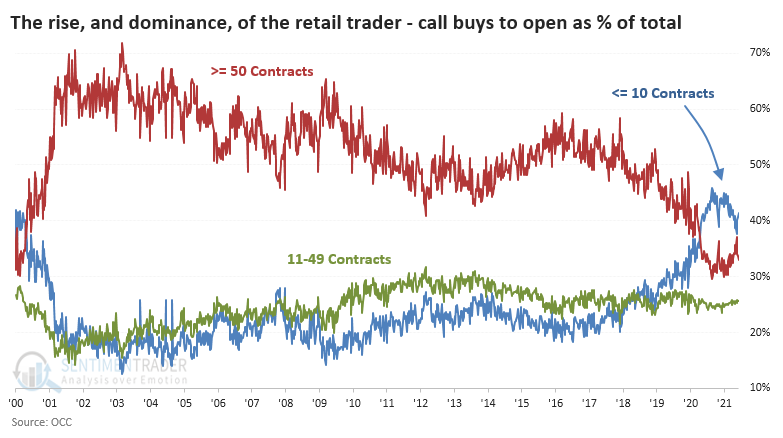

With some indexes moving to new highs last week, these traders have no intent on missing out, with speculative call buying flooding the markets once again. The smallest of traders, those executing 10 or fewer contracts at a time, spent 53% of their total volume on speculative call buying last week, just under their all-time high.

This call buying accounted for over 9% of all NYSE volume and it's not like these traders are hedging by buying some puts, either. When we look at small traders' call buying volume and subtract their put buying to get a net figure of speculative behavior, it's even more egregious.

This is important because unlike any other period in 20 years, the smallest of traders are the dominant factor in speculative options trading, accounting for 40% - 50% of all call buys to open.

If we zoom in on this activity, we can see we changed regimes almost exactly one year ago. Mid-market traders of held steady at about 25% of call buying volume, while institutional-level traders fell from more than 45% of the market to 30% - 35% as the retail trading force took over.

What else we're looking at

- A detailed look at options trading activity last week

- What this might mean for the most active stocks

- Updating absolute and relative trends in industry, sector, and country ETFs

- Looking at a critical juncture for SPY and QQQ

- If the S&P 500 rises in June, it will trigger some remarkable historical precedents

| Stat box Financial stocks got hit on Monday and more than 40% of them fell below their Bollinger Bands, a measure of extreme short-term volatility. When this many stocks fell below their Bands while XLF was still above its rising 200-day moving average, the fund averaged a return of 3.8% over the next month according to our Backtest Engine. |

Etcetera

TIMBER! Lumber is down more than 30% from its high reached in May. The last time our lumber optimism index cycled from above 90 to its current level was Oct. 2020. After, lumber stabilized before prices increased.

Gold[yen] opportunity. The EWJ Japan fund has seen its second-largest inflow in the last two years, taking in $361 million.

The name's Bond. Our risk level for bonds reached nine for the first time since January of 2019. This tends to be more effective in the short- to medium-term, suggesting higher-than-normal risk for bond prices.