This breadth signal triggered for only the 6th since 1926

Key points:

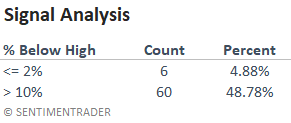

- The NYSE has registered 7 consecutive days with more declining issues than advancing issues

- At the same time, the S&P 500 is 0.29% below a 252-day high

- Similar streaks of negative breadth near a high have suggested a pause

New York stock exchange breadth has been consistently negative of late

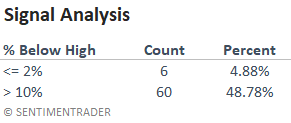

Let's conduct a study to assess the outlook for stocks when declining issues on the New York stock exchange outnumber advancing issues for 7 consecutive days, and the S&P 500 is within 2% of a 252-day high. I lowered the threshold distance below the high to 2% so I could capture more historical instances.

This type of market breadth is rare when the S&P 500 is near a high

For only the 6th time since 1926, declining issues outnumbered advancing issues for 7 consecutive days when the S&P 500 closed 2% or less from its 252-day high. If I eliminate the distance below the high condition, the study returns 123 instances when screening out repeats. Almost half of those signals occurred when the S&P 500 was down 10% or more from its 252-day high.

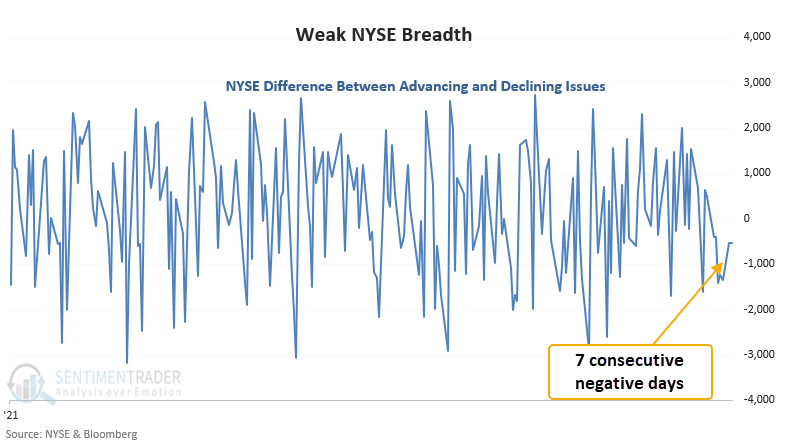

Similar signals preceded short-term consolidations

This signal triggered 5 other times over the past 96 years. After the others, future returns and win rates were weak in the 2-to-8-week time frame. If I optimize a short signal, the test returns 27 days as the best time frame to hold a negative view of the market. And, the S&P 500 closed down in 5 out of 6 instances. The sample size is small.

What the research tells us...

When NYSE breadth is negative for 7 consecutive days and the S&P 500 is near a high, one needs to be mindful that all is not well with market participation. Similar setups to what we're seeing now have preceded negative returns in the short term.