Thirst for IPOs remains unquenched

Thanks to near-hyperactive excitement over Snowflake's IPO - heck, even Warren Buffett got in on the action - the market for initial public offerings has continued its torrid pace.

The behavior surrounding some of these issues are certainly reminiscent of 20 years ago. I had a courtside seat to retail trading activity in 1999, and some of this week's headlines could just as easily have been from then. The immediate wealth and yet "money left on the table" were huge themes leading up to that peak.

The biggest knock against a 1999 repeat, among many other differences, is simply that we already lived through it and recognize it.

Like Federal Reserve actions during the pandemic took lessons from previous crises, some bankers, founders, and investors don't wish to repeat a crash-and-burn. They're not all money-grubbing, fleece-the-public moguls - most would prefer to capitalize on a welcoming market, but only if it means lasting success.

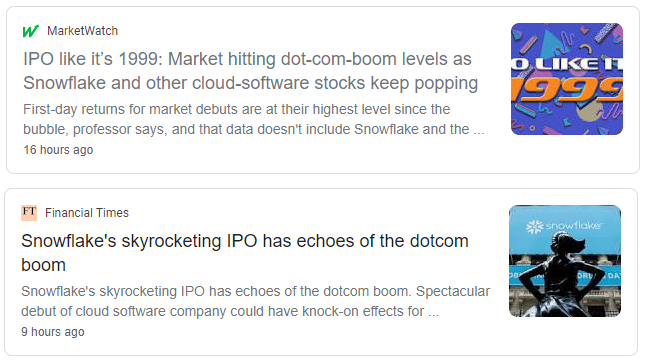

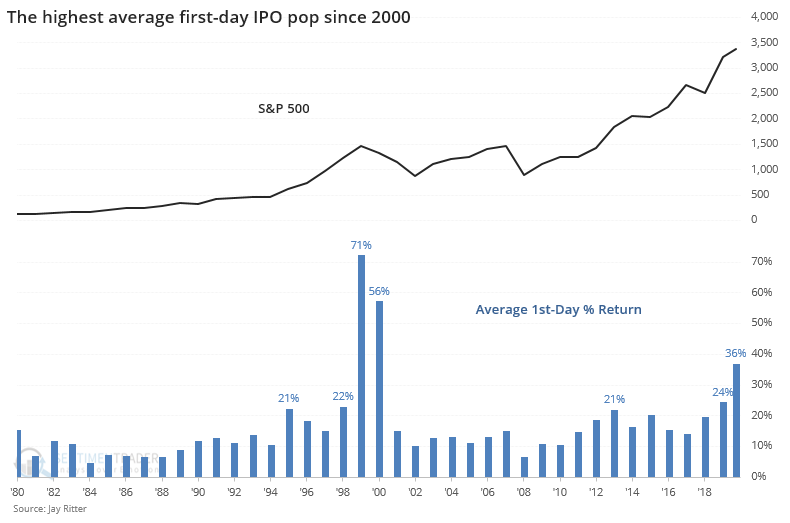

It's not necessarily the number of IPOs that's notable, anyway. It's the amount raised, and the reactions. According to Jay Ritter, Snowflake's reception was the 12th "run-up", or first-day doubling, of 2020. Through this many days of the year, 2020 ranks #3 in the past 40 years, behind (very far behind) 1999 and 2000.

The doubles get most of the attention, but they're not alone. The average IPO has added more than a third to its stock price on the first day. This is through August. Preliminary figures through yesterday suggest this will move upwards of 40%. Again, only 1999-2000 exceeded this kind of investor reception. Of course, there are still several months left in the year so the full-year figure could change drastically depending on the market environment.

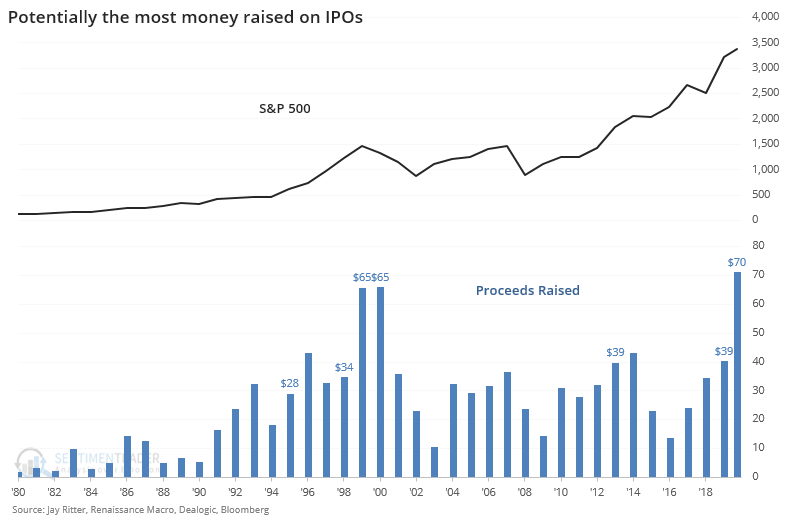

Proceeds raised in 2020 may set a record, but this comes with some caveats. IPO data is kind of like that for corporate insiders - there are a lot of wrinkles, and different firms calculate the data differently, so it may not compare to other sources.

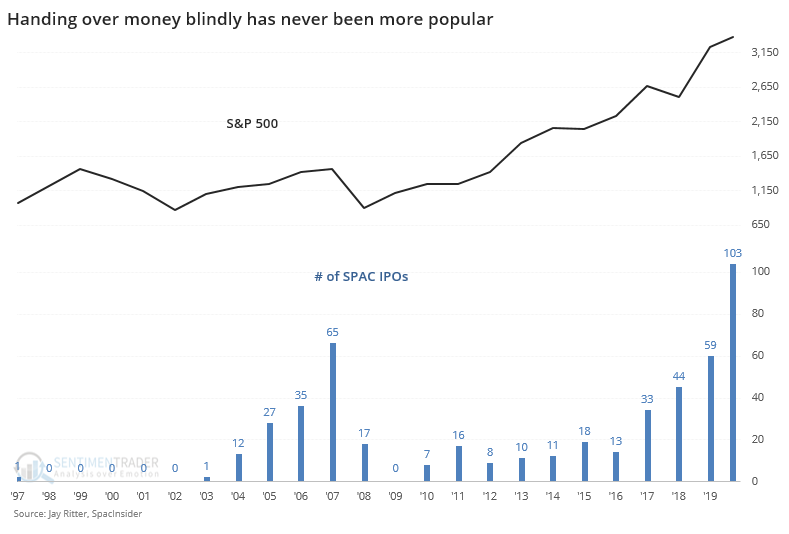

Investor appetite like this, especially considering that it includes a record number of blank-check SPAC companies that are pure speculation, is a definite concern.

It many respects, it's nothing like 1999-2000, as that was a pure all-out bubble. This is not. This is simply a very welcoming market that is starved for action with new blood. That can be a healthy thing long-term. It's more worrisome over a 6-12 month time frame, as history has proven that years with such aggressive speculative activity provide lower returns for investors going forward.