There is a battle brewing among industries, sectors, and worldwide indexes

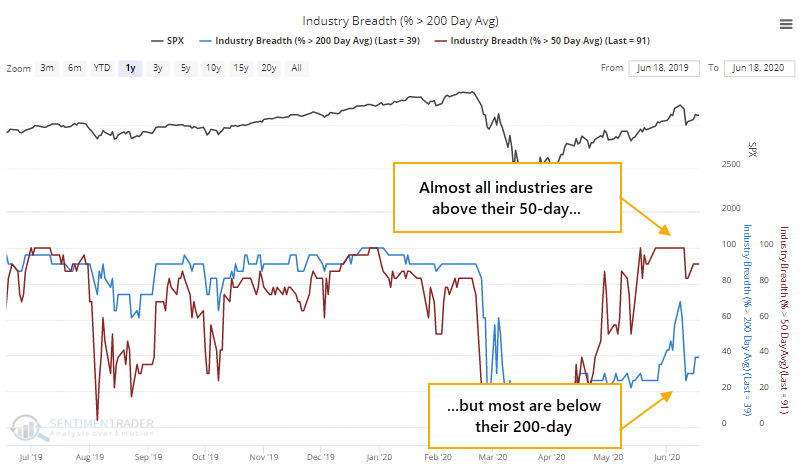

As we monitor the rally for health and watch how many stocks, industries, sectors, and countries are able to hold their trends, we're seeing an unusual battle between time frames.

For about half of the trading days over the past month, almost all industry indexes have managed to hold above their 50-day moving averages, but not even half of them have held above their 200-day averages.

Same goes for the major sectors and major world equity indexes.

Other times when there was this kind of protracted battle between all (or almost all) industries, sectors, or countries trading above their 50-day moving averages while less half of them managed to hold above their 200-day averages, stocks showed some short-term weakness but longer-term strength.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A look at sectors and global equity indexes above their moving averages, and a full signal table of past occurrences

- Big money managers went overweight stocks for the first time in months

- The crude oil term structure is almost back to even

- The Nasdaq's momentum streak is historic

- The monthly RSI for the Nasdaq 100 / S&P 500 ratio has been this high only once before

- The S&P 500 crashed in one day, then went nowhere for a week - what happens next