There Has Never Been a Better Time to Lose Money

A rising tide lifts all boats in life and markets. And the rising tide of money has lifted the fortunes of many companies that otherwise would have sunk long ago.

As the Wall Street Journal notes:

"The frenzied stock-buying activity that may have saved AMC Entertainment Holdings Inc. from bankruptcy is opening up a potential escape hatch for other troubled borrowers as well.

More companies with steep financial challenges are seeking a lifeline from equity markets, eager to capitalize on the surge of interest in stock buying from nonprofessional investors.

But equity markets now are more open to supporting troubled issuers, in large part because of risk-hungry individual investors eager to speculate, according to bankers and investors following the trend."

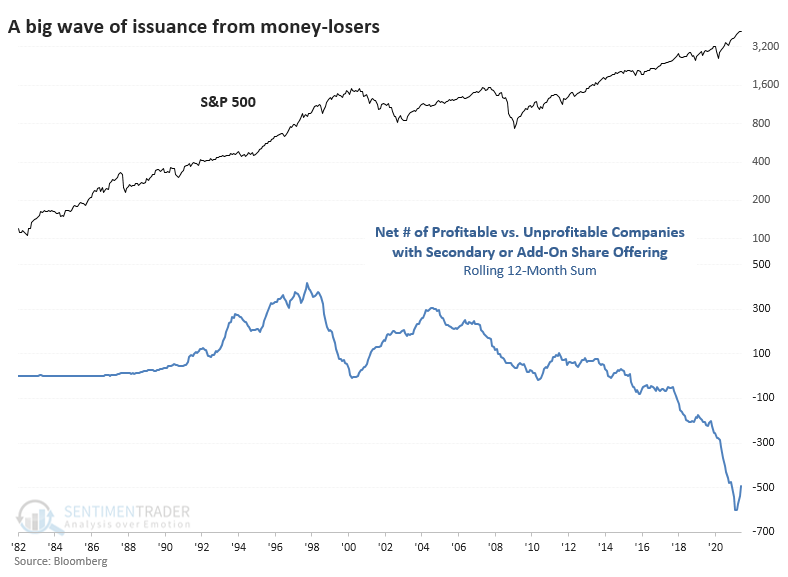

We can see this explicitly in the amount of money raised from secondary and add-on share issuance between money-making and money-losing corporations in the U.S. According to Bloomberg data, there have been 254 profitable companies issuing secondary or add-on shares over the past 12 months. But there have been 748 unprofitable companies doing the same, for a net differential of more than 500 companies.

All of this issuance amounted to more than $27 billion worth of offerings that have been priced. That, too, is a record amount dating back 40 years. As a percentage of the U.S. equity market, this is nothing more than a blip.

That's not really the point.

It's not about the amount of issuance; it's about a market environment that allows this to happen.

What else we're looking at

- A look at net secondary share issuance between profitable and unprofitable companies

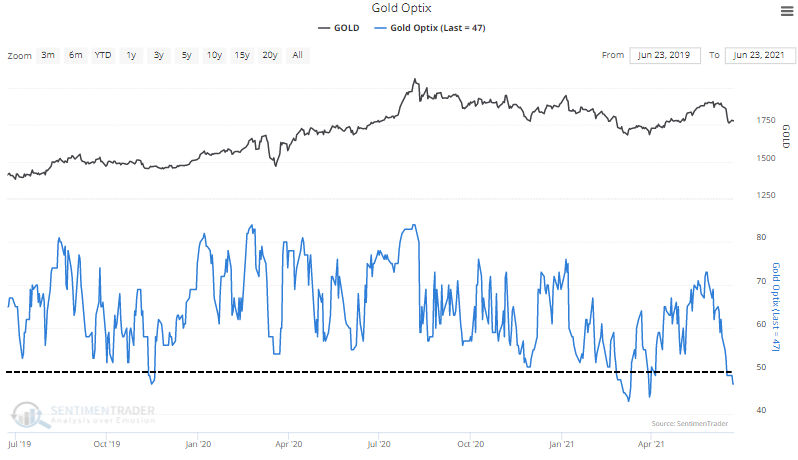

- Factors weighing (and supporting) gold right now

- A signal just triggered in the rotation of growth vs. value

| Stat box As of Thursday, 0 major industries in the U.S. are in bear markets and 100% of them have rising 200-day moving averages. Sustained declines in the S&P 500 tend to be preceded by these figures diverging. We update these charts every day for premium subscribers. |

Etcetera

Gold minor. Earlier this week, the percentage of gold mining stocks that have a rising 200-day moving average fell to a three-year low.

No luster. Our Optimism Index for gold has dropped below 50% for only the fourth time in the past two years.

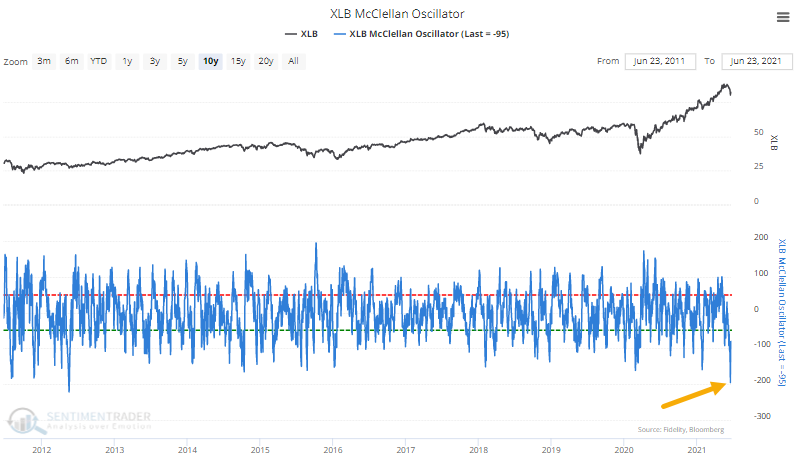

Not so basic. The McClellan Oscillator for Basic Materials, a measure of internal momentum among stocks in that sector, recently fell below -190, the 2nd-lowest reading in 10 years.