The yield curve has done this 4 times in 40 years

U.S. consumers are increasingly confident about the future relative to the present. They feel that their current troubles are temporary and the economy will soon be growing again.

The Wall Street Journal on Wednesday showed that this difference in confidence based on time frames has had an extremely strong correlation to the yield curve.

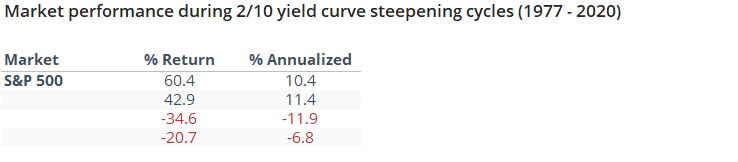

There have been four times in the past 40 years when consumer attitudes showed this kind of a pattern, and four times it preceded a super-steepening cycle in the 2-year / 10-year Treasury yield curve.

For stocks, the first two cycles led to double-digit annualized gains. The last two, not so much.

We took an in-depth look at other assets, sectors, and factors, and found only one that consistently performed well during all four cycles, consumer staple stocks like Coca-Cola, Procter & Gamble, and Kroger.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Tables showing dates of yield curve super-steepening cycles, with performance of assets like gold, along with sectors and factors

- Newsletter writers are becoming optimistic again

- Assets flowing into gold and silver ETFs have surged

- There is a historic extreme in worldwide growth versus value stocks