The years with sector and factor performance most like 2021

Key points:

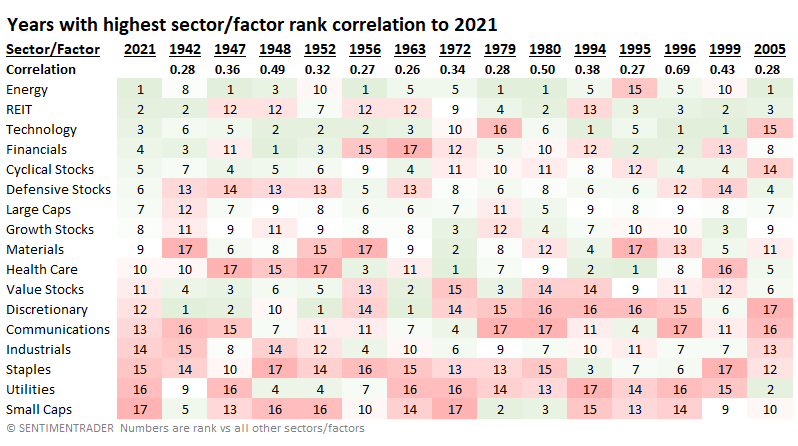

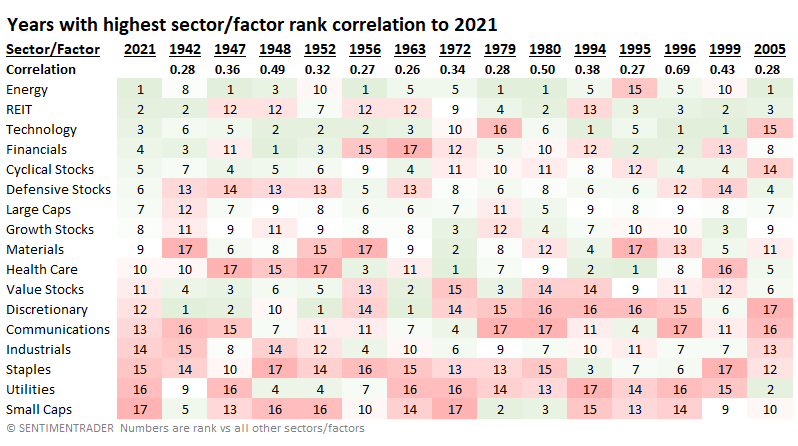

- There have been 15 years since 1928 with sector and factor performance similar to 2021

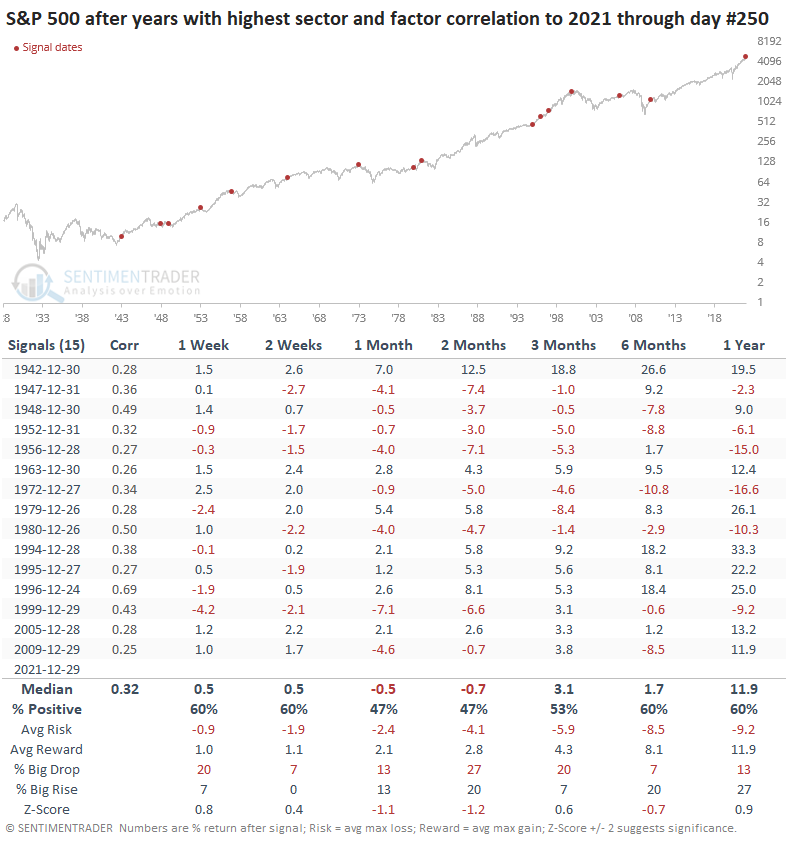

- After those years, the S&P 500 showed modest medium-term returns and decent long-term ones

- Defensive sectors showed better returns overall, as did Small-Cap stocks

The year most like 2021 was...1996

Near the end of the year, we looked at the S&P 500's closest analogs. In terms of pure price performance for the index itself, the highest-correlated year was 1995.

If we look at performance under the surface, things change a bit. In 2021, Energy and REITs were the highest-ranked sectors, while the Small-Cap factor took up the rear. This is using total return and ranked against the return of all other sectors and factors. In 1995, Health Care and Financials led everything else, though Small-Caps were still weak.

Using the correlation between sector and factor ranks, 1995 doesn't show up as the closest correlation (+0.27 out of a scale from -1.0 to +1.0). That honor belongs to the following year (0.69). Most sectors/factors with high (green) and low (red) rankings in 2021 showed similar rankings in 1996.

Like we saw with the S&P analog, years with the highest sector and factor correlations to 2021 showed strength in the first couple of weeks, then less so.

Some signs of sector mean-reversion

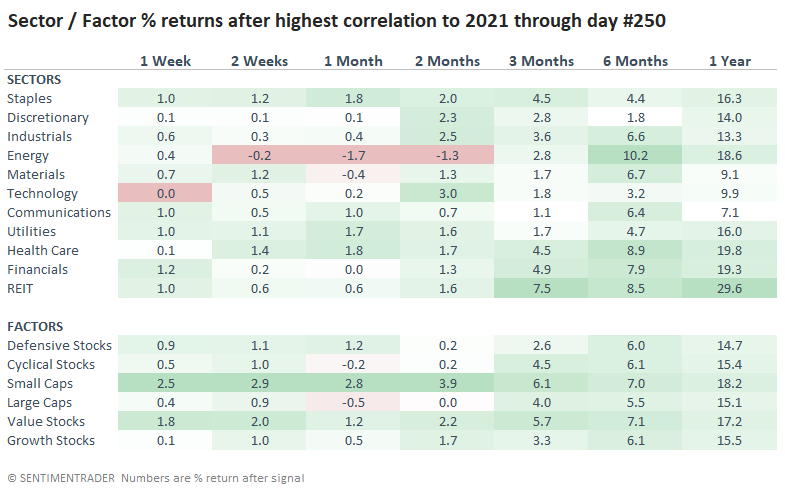

For the sectors and factors themselves, there was some evidence of mean-reversion. Energy stocks were the weakest performers over the next couple of months, while Small-Cap stocks were the strongest. Perpetually suffering Value stocks showed admirable performance as well.

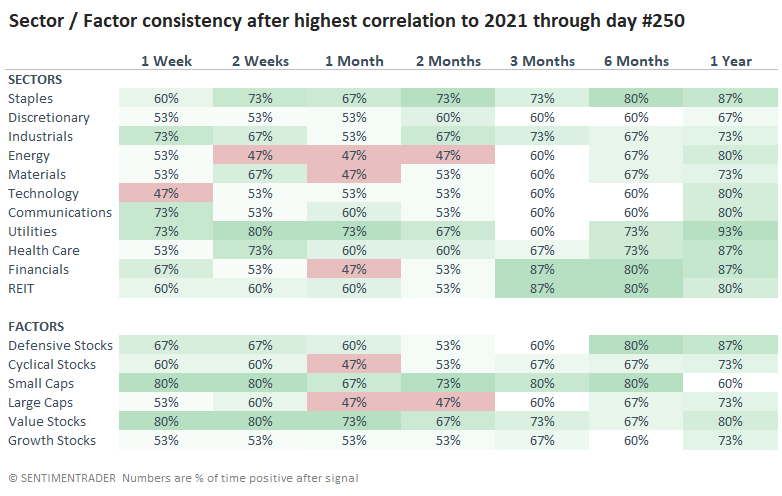

Looking at the consistency of returns - how often the sectors and factors showed a positive return across time frames - there was a bias toward some of the more defensive sectors while higher-beta ones suffered a bit.

What the research tells us...

Bulls might take heart that the price behavior and sector returns most like 2021 can be found in the mid-1990s, right before one of the best runs in equity market history. About the only negatives when looking at similar years were relatively soft returns through February/March but few of them saw more than double-digit drawdowns, at least through the next 6 months.