The year most like 2021 led to double-digit gains

Key points:

- Price action in the S&P 500 in 2021 is most closely correlated to 1995

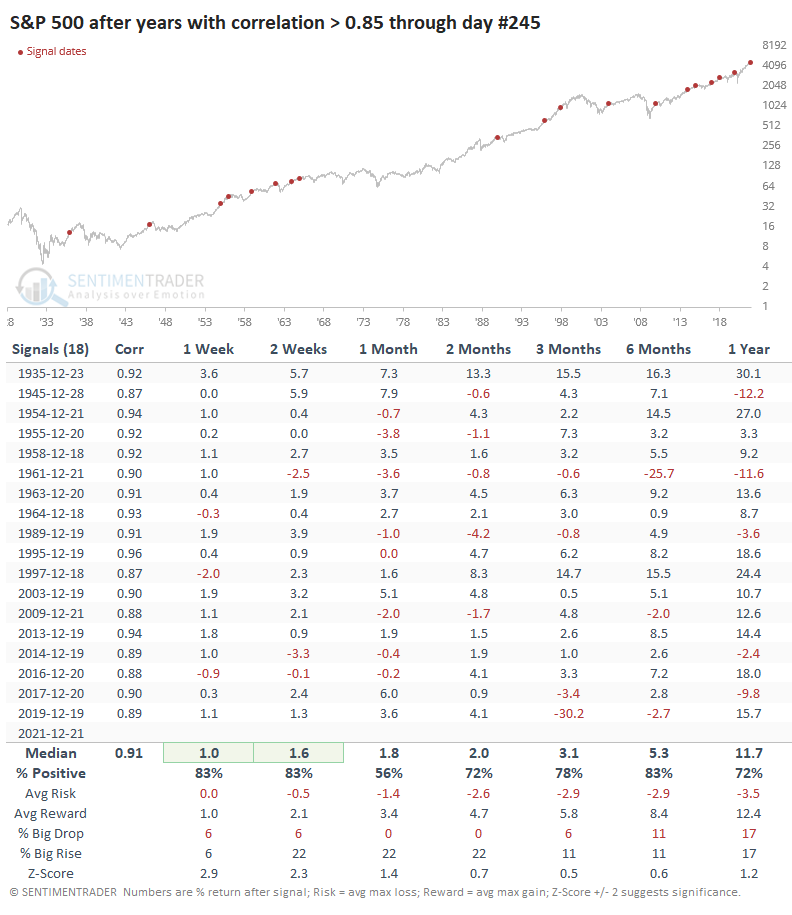

- There have been 18 years with a high correlation to this year

- Forward returns after those years were positive, especially over the next couple of weeks

Just like 1995...and a few others

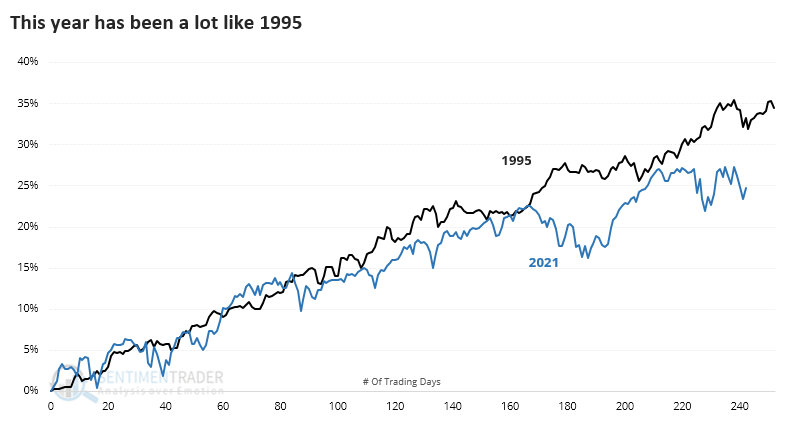

This year has been a lot like 1995. It has been more like that year than any other, at least in terms of performance. In August, we looked at some of the records being set this year during one of the most persistent and consistent rallies of all time. The one year that was consistent with pretty much all of the momentum studies we've looked at this year is 1995.

That year rallied strongly in September while this year stumbled. Otherwise, they followed each other closely, even including some December weakness.

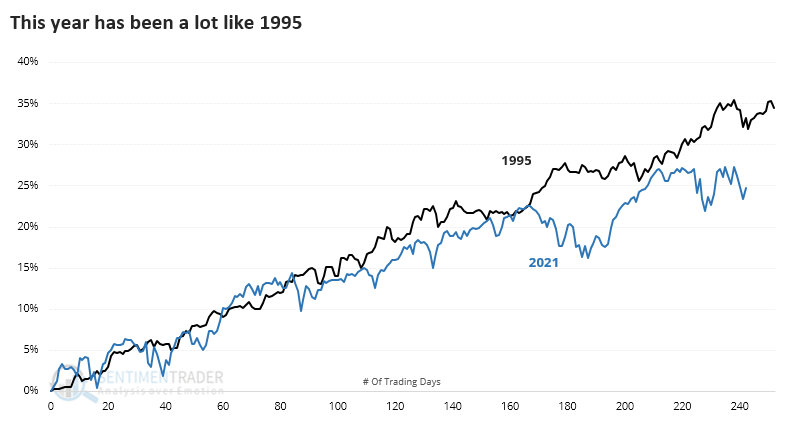

If we go back to 1928 and look at the most highly-correlated years, there have been 18 others with a correlation greater than 0.85 (out of a scale from -1.0 to +1.0). Even with that expanded universe, 1995 still stood out as having the tightest relationship to 2021, almost perfect with a 0.96 correlation.

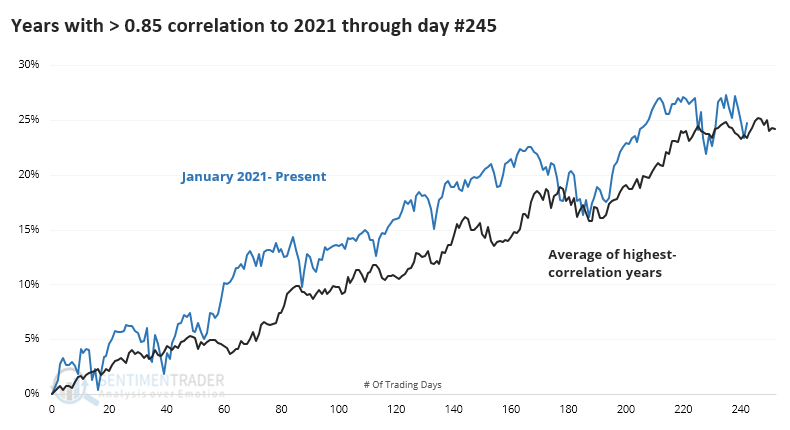

The 10 most recent are shown below.

Mostly a good sign, especially into the New Year

We're most concerned about what these high correlations might mean going forward. Based on those precedents, the answer is positive, at least in the couple of weeks heading into and immediately after the New Year. Over the next 2 weeks, the S&P rallied 15 out of 18 times, and 2 of those saw the losses erased soon after.

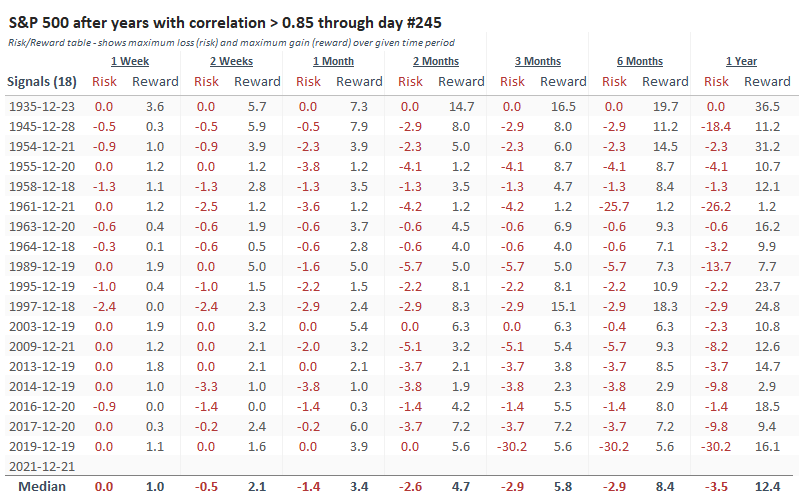

The Risk/Reward Table shows that risk, meaning the maximum drawdown at any point up to that time frame, was limited. Over the next 3 months, only 3 of the signals showed a loss of more than 5% at any point (though 2020 was a doozy).

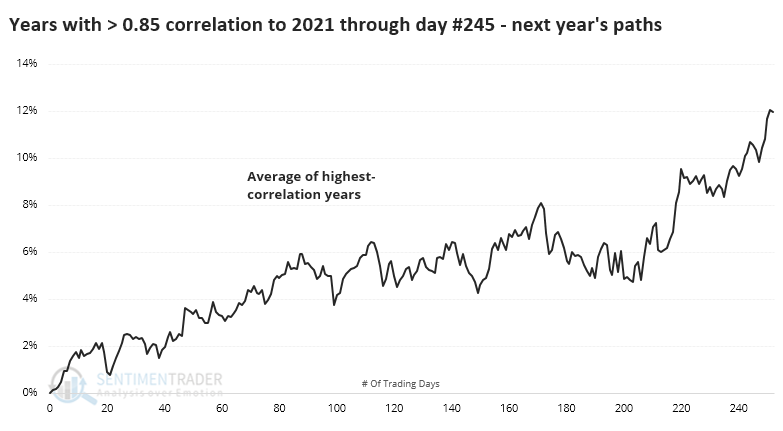

If we look at the average price path of these signals, the following year looked a lot like the past one.

What the research tells us...

Momentum is a real thing in stock indexes, and years like 2021 have tended to lead to further gains. Combined with breadth thrusts following signs of pessimism in a mostly healthy environment, it argues for more gains with limited risk. There are some longer-term concerns, like deterioration under the surface in higher-risk sectors and ample evidence of high valuations and bubble-like behavior. But until we see setups like the current one fail to lead to higher prices, it's too early to suggest that there has been a meaningful change in the environment.