The welcome return of moderate inflation

Key Points

- The stock market hates uncertainty, and few things cause more uncertainty than soaring inflation

- The U.S. Consumer Price Index 12-month rate-of-change has fallen back into the "moderate inflation range"

- For the first time since April 2021, a simple inflation model has moved back to the bullish side of the ledger

How to measure inflation

A standard measure of inflation is the 12-month change in the Consumer Price Index (CPI). The Consumer Price Index (CPI) is:

- a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care

- used to assess price changes associated with the cost of living

- one of the most frequently used statistics for identifying periods of inflation or deflation

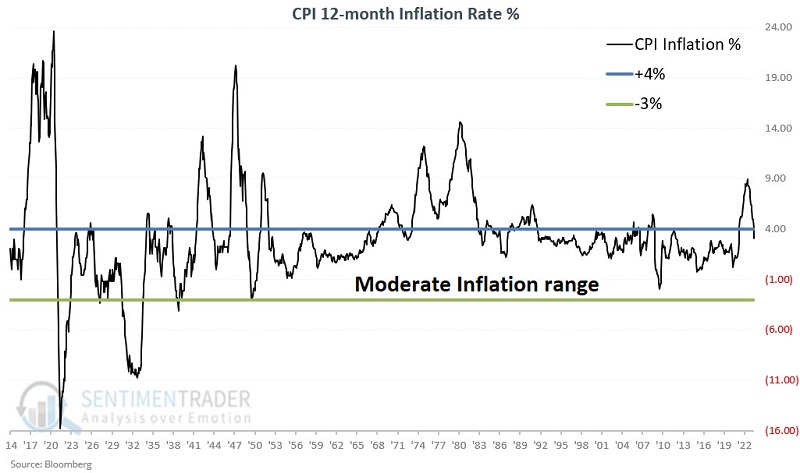

I divide the latest raw Consumer Price Index value by the value for this index twelve months before to arrive at a 12-month % rate-of-change. The chart below displays the historical results of this monthly calculation since 1914. Note the "Moderate Inflation range" range between +4% and -3%. Note also that the inflation rate popped above the +4% level in May of 2021 and dropped below +4%, with the latest reading reported in July 2023.

When to measure inflation

The CPI number for the previous month is typically reported early to mid-month. However, for testing purposes, we will evaluate the latest reported 12-month rate of change in the Consumer Price Index only at the end of each month. So for the model below, the latest reading (+3.09%) will technically not be evaluated until the end of July 2023.

How to evaluate inflation

Like Goldilocks, we want our inflation to be neither hot nor cold in generic terms. A moderate amount of inflation is normal and can even be somewhat beneficial. On the other hand:

- Soaring inflation throws cost estimates out the window and can cause massive economic disruption - something the market rarely takes kindly to

- Likewise, deflation - i.e., a trend of falling prices - can cause a downward economic spiral that is ugly for everyone

The question then is, "What is the right inflation rate?" There is, of course, no such thing, partly because many other factors affect the stock market beyond just inflation. Still, as far as deeming inflation "too high, too low, or just right," we will use a straightforward method called "The 4% Inflation Solution."

The 4% Inflation Solution

Let's look at how the stock market has performed when inflation is:

- greater than or equal to +4% (significant inflation, i.e., "too hot")

- less than or equal to -3% (significant deflation, i.e., "too cold")

- greater than -3% but less than +4% ("just right" or "moderate inflation")

NOTE: In an effort to use symmetrical values, the original version of this model used +4% and -4% as cutoffs for the "moderate inflation" zone. Updated research reveals that +4% and -3% have historically generated better results.

For our test, we will use monthly data from February 1914 through June 2023 for the 12-month rate-of-change in the Consumer Price Index and the monthly closing price for the Dow Jones Industrial Average.

As a baseline, note that since 1914:

- The average 12-month % change for CPI is +3.28%, and the median % change is +2.63%

- The Dow Jones Industrial Average has gained +56,999%

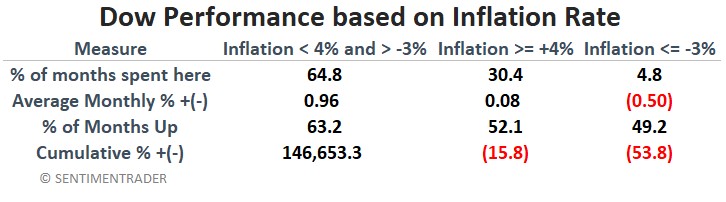

Dow Performance when inflation >= +4%

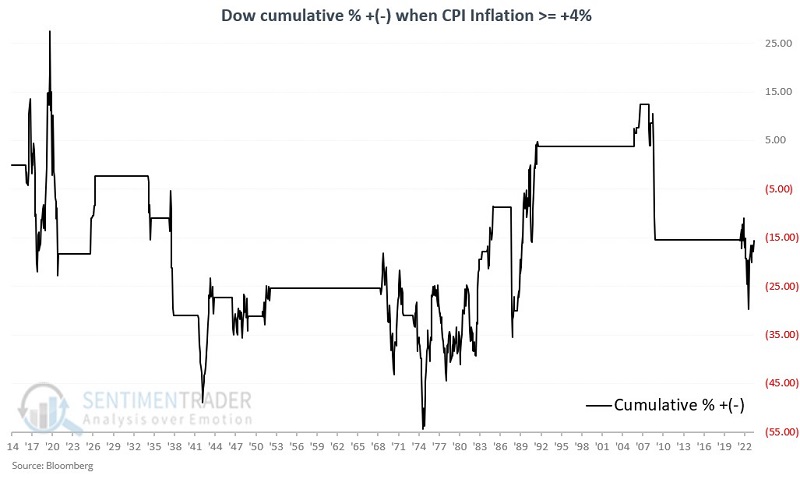

The chart below displays the cumulative price performance for the Dow ONLY during those times when inflation was >= +4%.

The result is a net price decline of -15.8%. In other words, despite the Dow gaining almost 57,000% during the test period, an investor who held the Dow ONLY when inflation >= +4 would have lost money.

As an aside, these results call into question the "stocks are a hedge against inflation" argument. On a buy-and-hold basis, yes, stocks have outperformed inflation over the long term. But as you see in the chart above, the stock market has been a mixed bag - with highly volatile and net negative returns - during actual bouts of severe inflation.

Dow performance when inflation <= -3%

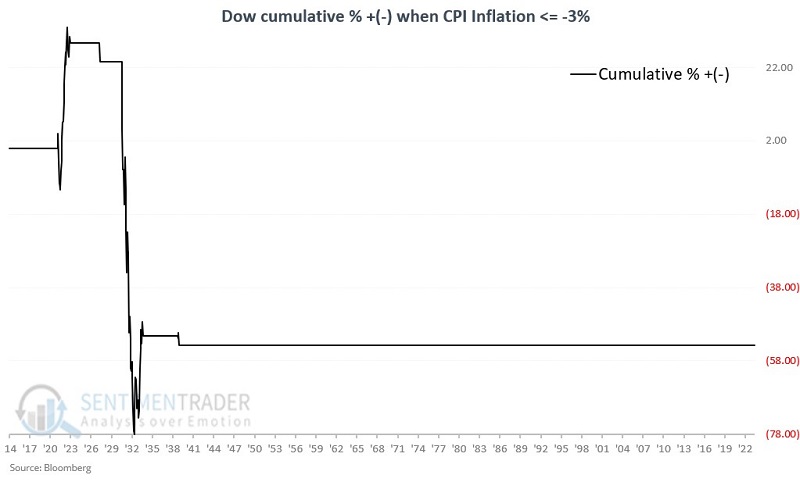

The chart below displays the cumulative price performance for the Dow during those times when inflation was <= -3%, i.e., during periods of severe deflation.

The result is a net price decline of -53.8%. As you can see, the results were disastrous, albeit limited to two periods - one in the early 1920s and another in the early 1930s. Would the stock market react similarly if we plunged again into a deflationary spiral? Here's hoping we never find out, as severe deflation can cause a downward economic spiral. As prices decline, buying demand decreases as buyers wait for lower prices. This reduced demand creates something of a self-fulfilling prophecy as reduced demand results in reduced production, which slows economic growth even more, and so on.

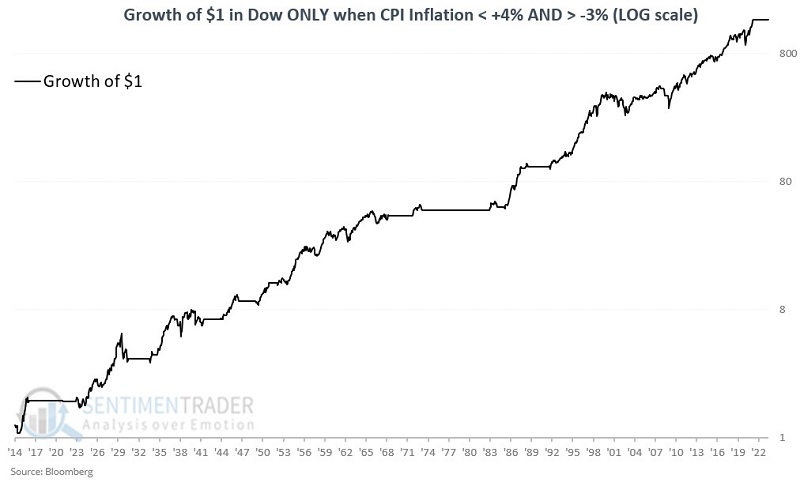

Dow performance when inflation < +4% and > -3%

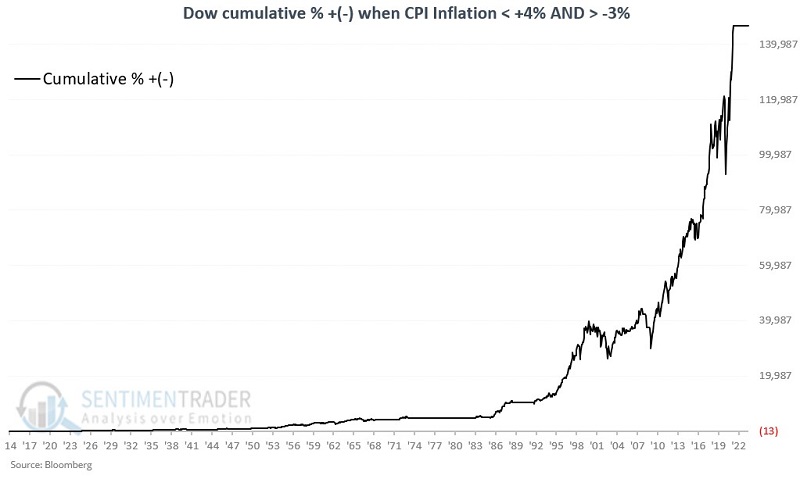

The chart below displays cumulative Dow price performance when inflation is "Not too hot, not too cold" - i.e., between -3% and +4%.

The result is a net price gain of +146,753% (versus +56,999% for buy-and-hold).

To get a better perspective, the chart below displays the growth of $1 invested in the Dow only when inflation is between +4% and -3%, with results drawn on a logarithmic scale (so the distance between $1 and $10 is the same as the difference between $10 and $100).

As you can see in the charts above, just because inflation is moderate does not mean you cannot have bear markets. Inflation is only one factor that can impact the stock market. However, the stock market generally performs much better when inflation is moderate, and the "Lower left to upper right" nature of stock market returns during periods of "moderate inflation" are unmistakable.

Comparative results

The table below puts a few facts and figures to the performance of the Dow during the different periods displayed in the charts above.

Putting the Inflation 4% Solution into action

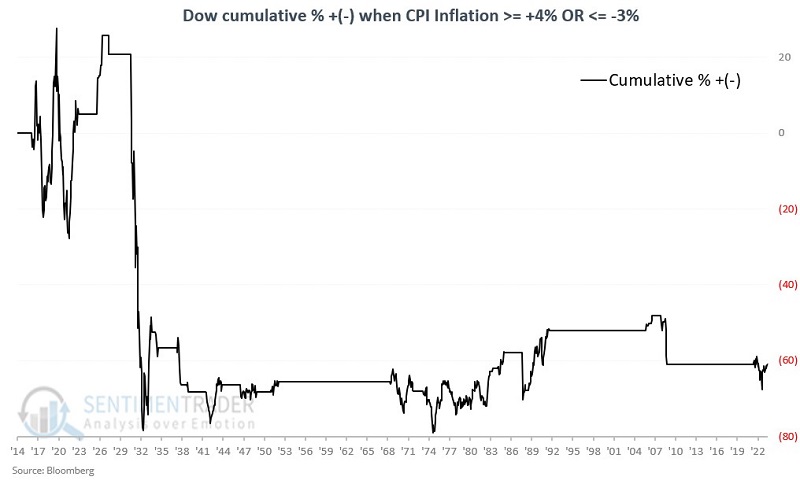

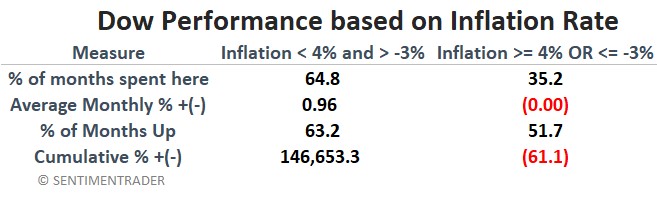

To tie everything together, we will designate the stock market environment as "Favorable" or "Unfavorable" as follows:

- Favorable = If inflation is below +4% AND above -3%

- Unfavorable = If inflation is +4% or higher OR -3% or lower

The two charts above displayed the cumulative price performance for the Dow when the inflation environment is deemed "Favorable" (in linear and logarithmic scale). The chart below displays the cumulative price performance for the Dow when the inflation environment is deemed "Unfavorable."

The table below compares Dow Jones Industrial Average price performance during Favorable versus Unfavorable periods.

What the research tells us…

In the long run, the good news is that stocks have outpaced inflation over the past 100+ years. But the bad news is that stock market performance has been negative when inflation has been abnormally high or low.

In the short run, the good news is that CPI inflation has fallen back into the "moderate inflation range" between +4% and -3%. At the end of July 2023 (as this model is only updated once a month at the end of the month), the model highlighted above will return to the favorable side of the ledger for the first time since April 2021.

The key takeaways: 1) The argument that stocks are "a hedge against inflation" only applies to buy-and-hold investors willing to ride every bear market to the bottom and back. 2) Abnormal inflation does not guarantee that stocks will perform poorly. But long-term performance results for the Dow Jones Industrial Average during extreme inflationary or deflationary periods suggest that abnormal inflation must be viewed as a negative for the stock market.