The Value to Growth Dynamic Looks Oversold

Much of what we've seen on the site for months has favored Value over Growth as the best opportunity to tilt a portfolio for forward returns without trying to predict overall market direction.

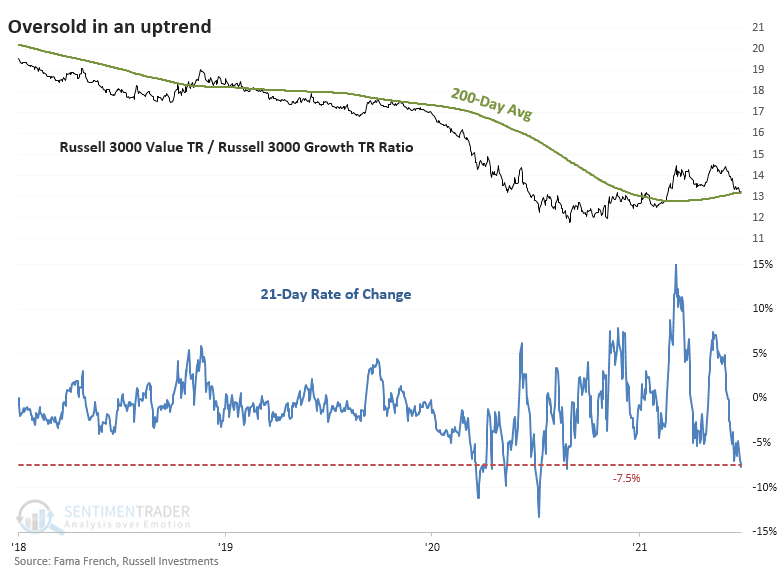

That's been working but took a big hit in June and continues even today. The total return ratio between the Russell 3000 Value Index versus the Growth Index tumbled more than 7.5% over the past month, one of the largest losses in years.

One difference with the recent losses is context - it's happening in an uptrend. Unlike the large rolling 1-month losses during much of 2020, the 200-day average of the Value/Growth Ratio is rising.

TIME FOR VALUE TO REASSERT ITSELF

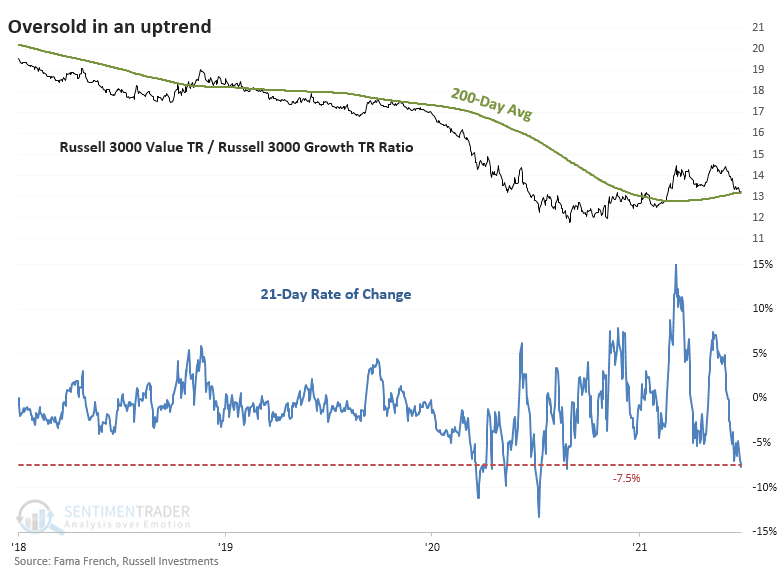

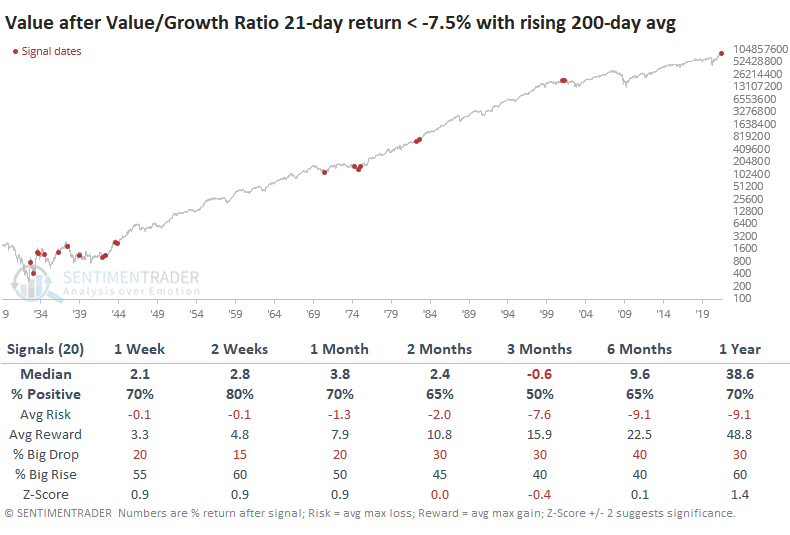

If we focus on large declines in the ratio only within uptrends, we can see that losses this large have typically resulted in the trend reasserting itself rather than sliding into another long-term downtrend.

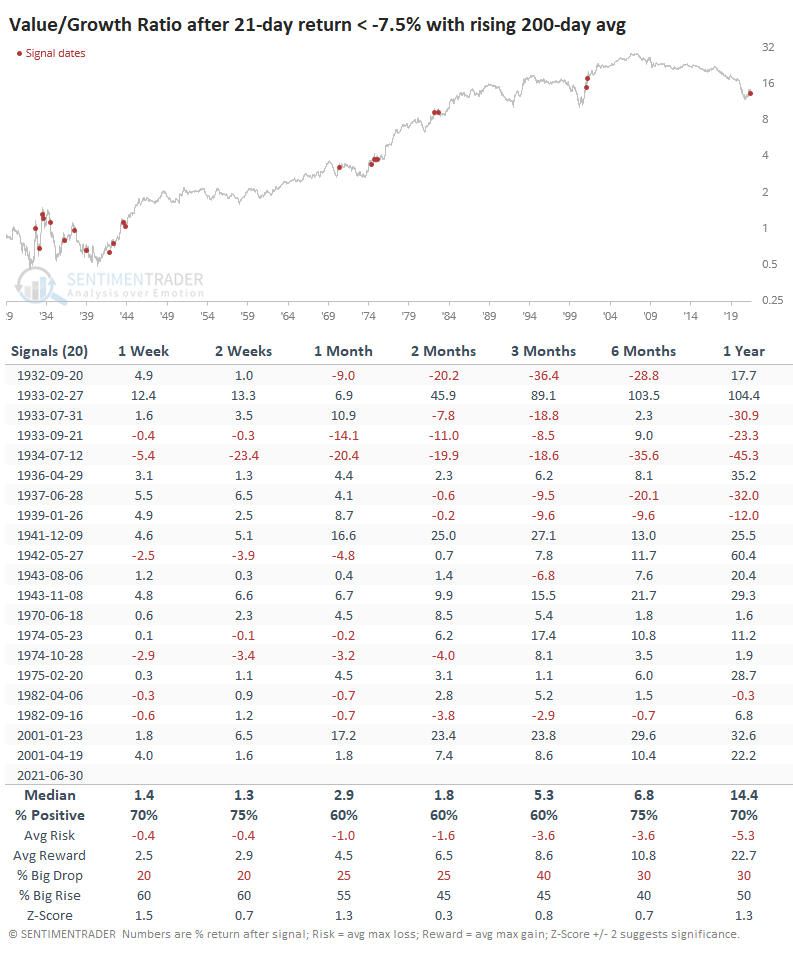

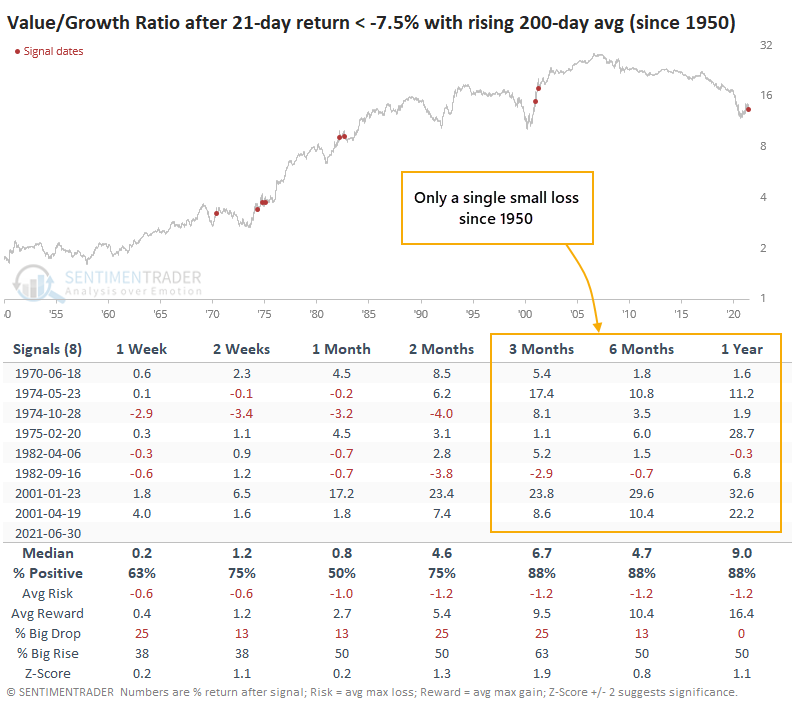

The ratio was extremely volatile in the 1930s, so many of the precedents were triggered then. If we focus on modern markets, say since 1950, then things clear up a bit.

When looking at each factor's total return across all the signals, Value clearly showed better performance.

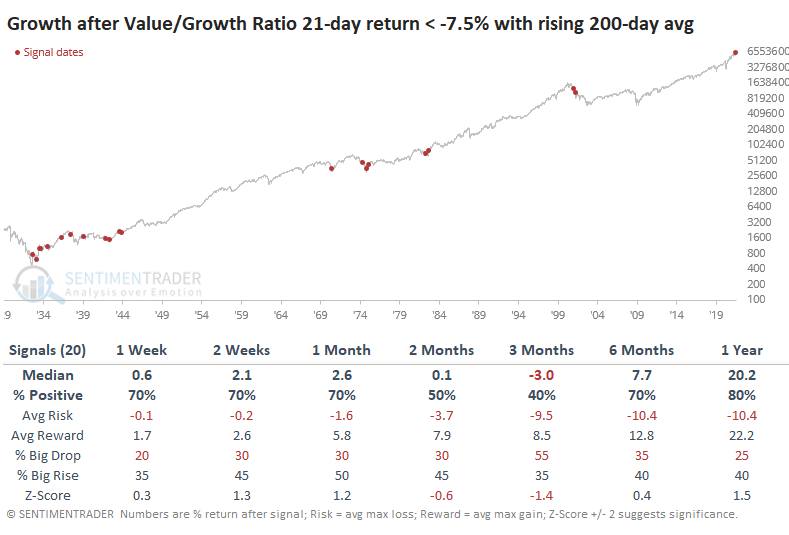

Returns in Growth were less consistent, with a significantly lower median return and higher risk combined with smaller reward.

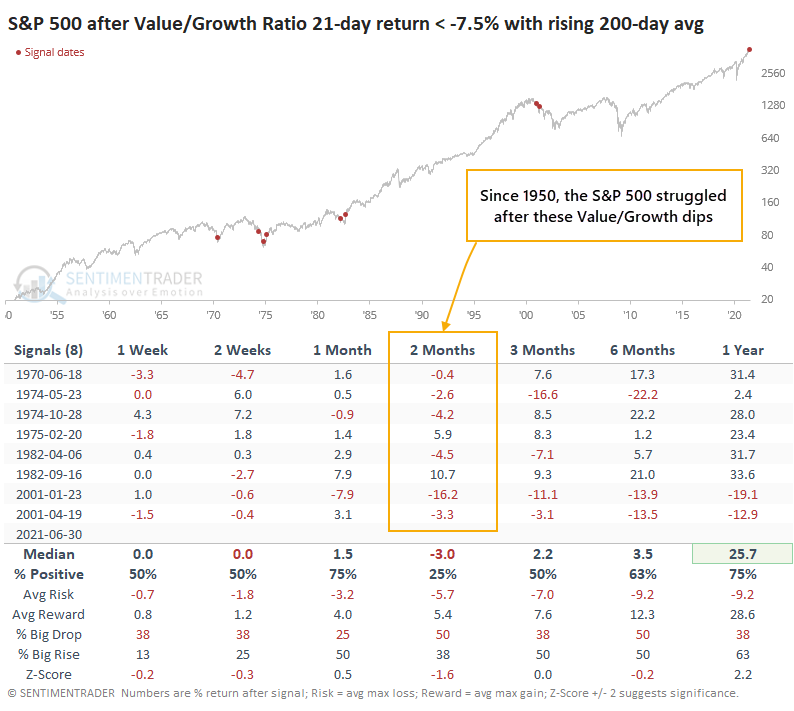

MAYBE (?) A WARNING FOR THE BROADER MARKET

For the overall market, defined by the S&P 500, it was a mixed signal, with inferior returns since 1950. The only signal that preceded large and sustained gains - and it was a biggie - was 1982.

We'd consider this less of a signal for the broad market. It was more consistent for prospects in Value versus Growth stocks. Signals have been pointing that way for months, and the recent setback doesn't look like a reliable reason to abandon it.