The value thesis

Being 100% honest, I have no idea when tech stocks will underperform/outperform. Just because “value” outperformed in the past does not mean “value” will outperform in the future. Herein lies the biggest problem with factor investing: once a factor has become widely accepted as gospel truth, it usually stops working. But this won’t stop factor ETF companies from selling you their version of the gospel ????

One of the gospel truths these days is that “innovative tech companies will always beat non-innovative non-tech companies” and that “this bull market is still very young”.

For starters, bull markets do not die of age. They die of excess. This is why bull markets can range anywhere from a few months to a decade. Just because “the last bull market was 10 years” DOES NOT mean that the next one will be 10 years. The “next one” is almost never “like the last one”, even though humans have a very strong tendency to extrapolate recent events into the future.

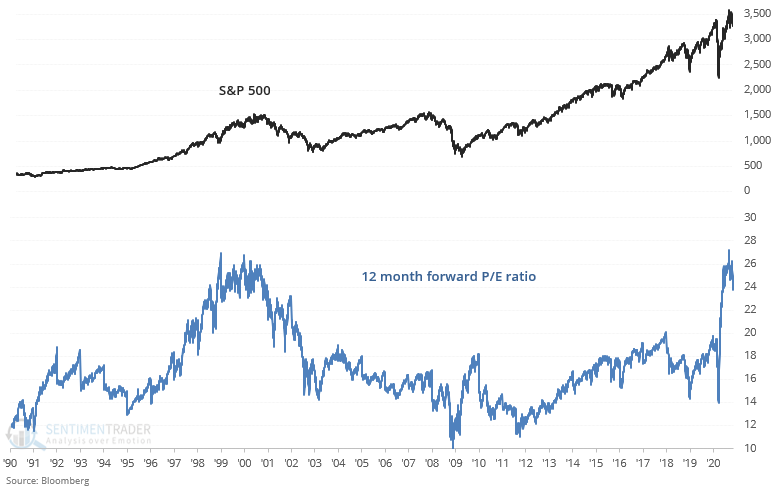

With that being said, the strongest argument for why this bull market will not be like 2009-2020 is that valuations today are much higher than they were 10 years ago:

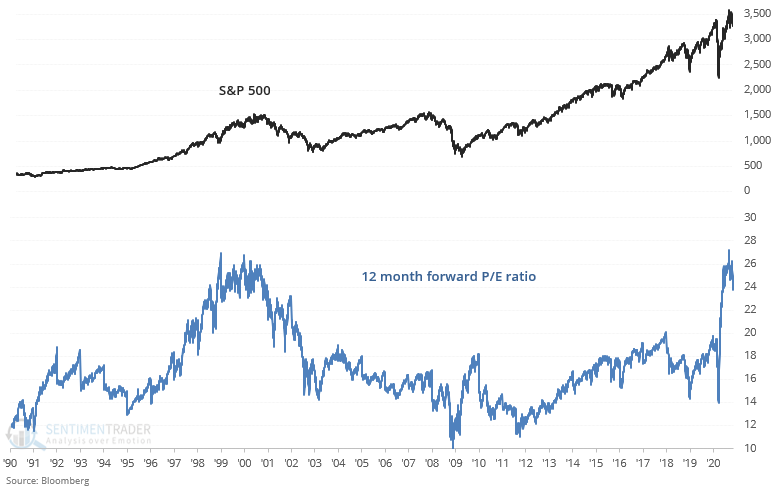

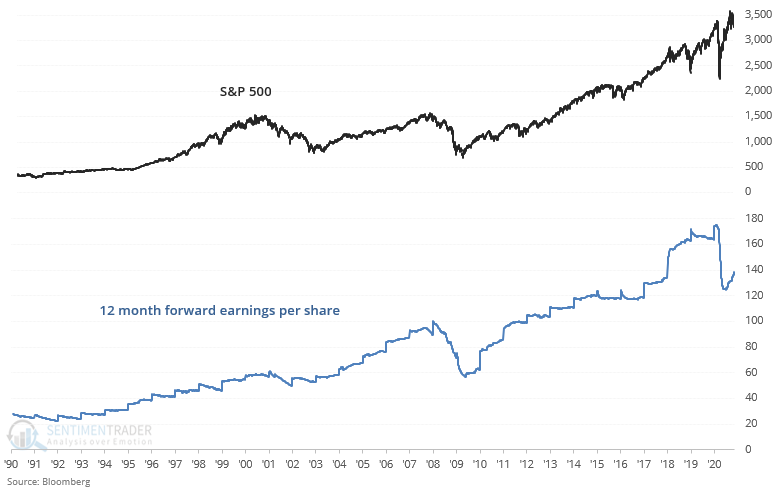

Granted, part of the jump in P/E is because forward earnings collapsed earlier this year. Earnings are now rising back up, meaning if that stock prices don’t move from here, forward P/E will still fall:

One may look at the above P/E ratio chart and think “P/E jumped as well in 2009! High P/E is perfectly normal for the start of an economic expansion!”. Well yes, that is normal. But not this high. Forward P/E today is a third higher than it was in 2009! Moreover, most of the “innovative” tech companies that IPO these days are not profitable. The smart insiders are unloading their high valuations onto public markets.

In my opinion, the next 5 years will be very choppy for markets. Years of high volatility is perfectly normal – something that public market investors outside of the U.S. are completely used to.

So what does this mean? What worked in the past will not work in the future. Trend following and momentum might have been fantastic over the past 2 years – years in which the market went straight up and straight down. But in a choppy market, trend followers are badly hurt by a thousand small losses. In other words, do not blindly follow your trading strategy in all market environments. Nothing works forever.

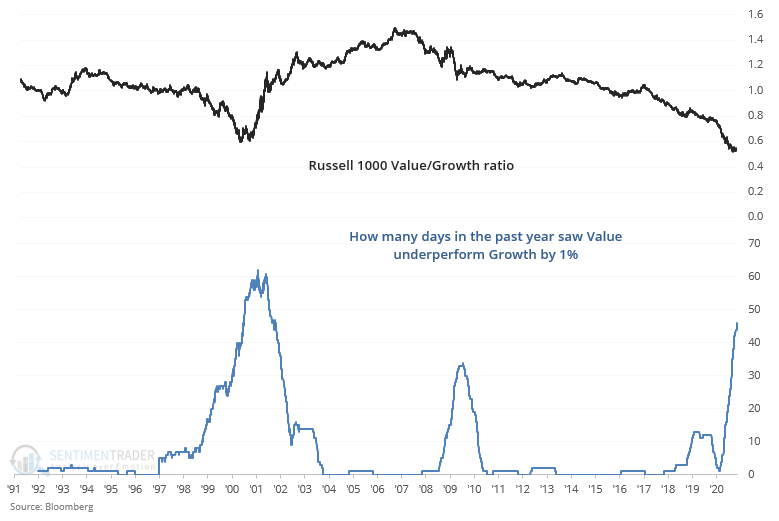

On that note, here’s the Russell 1000 Value/Growth ratio:

The # of days over the past year in which Value significantly underperformed Growth is on par with that of 2000. Does that mean today is “just like 2000 all over again”? No. It just means that value *could* outperform the future. But I’m not willing to bet on that.