The unstoppable tech rally

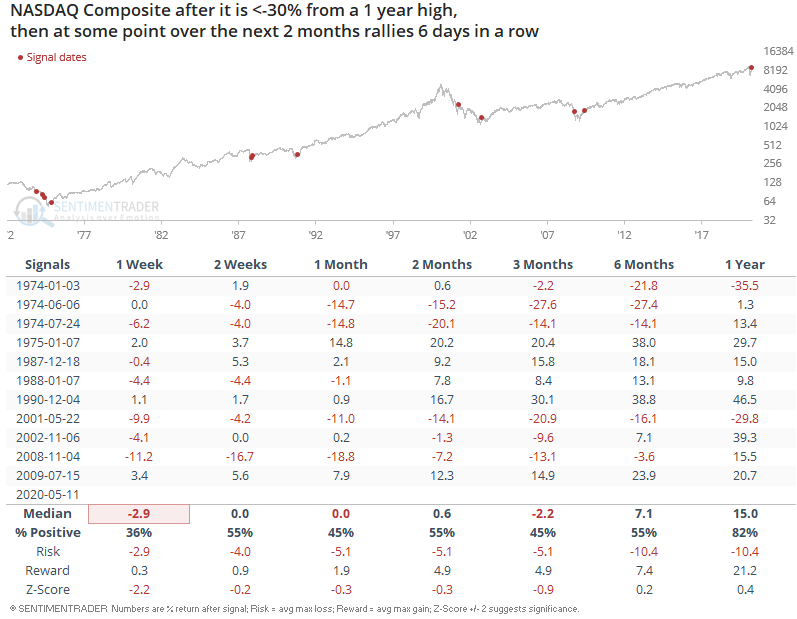

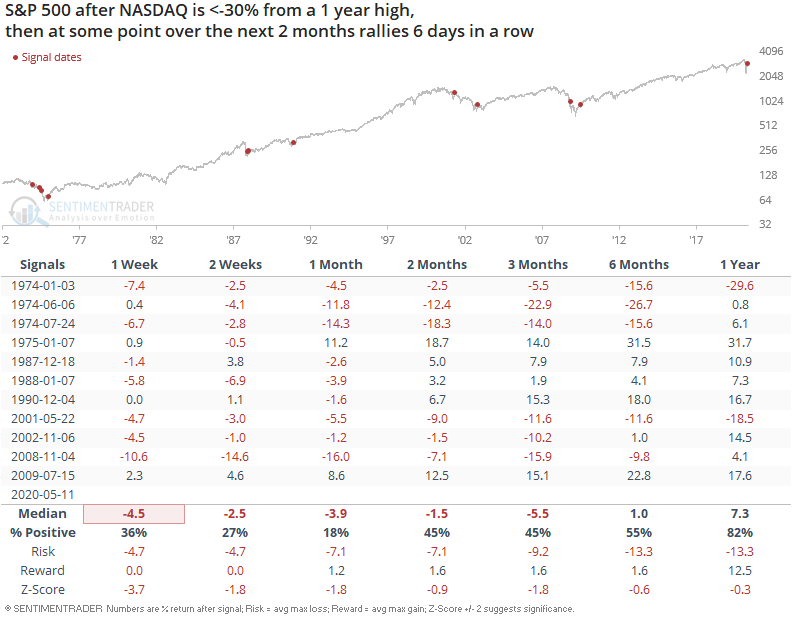

The tech sector continues to rally even as other sectors stall. The NASDAQ Composite has now rallied 6 days in a row. 6 day streaks on their own aren't bearish, but when these occurred after the NASDAQ emerged from bear market territory, the NASDAQ usually suffered in the short term:

As did the S&P 500:

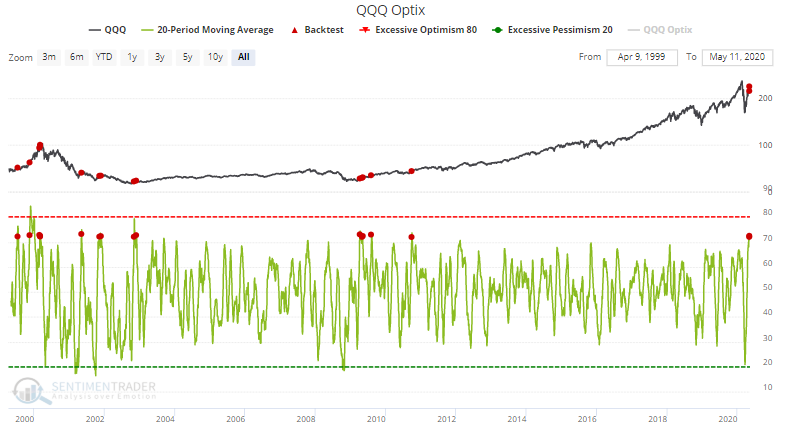

The 20 day average for QQQ Optix is at 72, the highest level in almost a decade:

Similar readings led to mixed returns over the next 3 months.

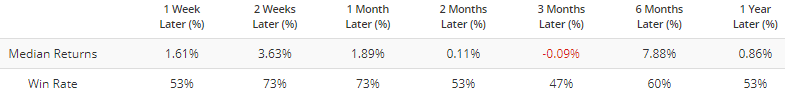

At the same time, traders are piling into Rydex mutual funds, some of which are highly leveraged. Such risk-seeking behavior often led to short term losses over the next 2 weeks:

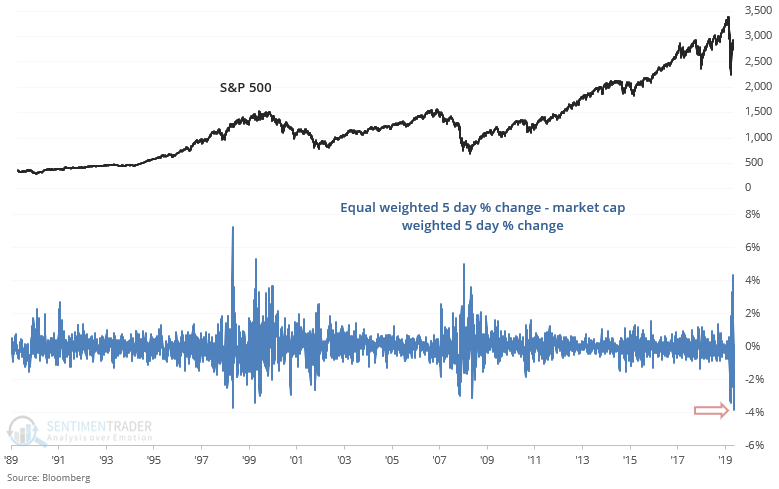

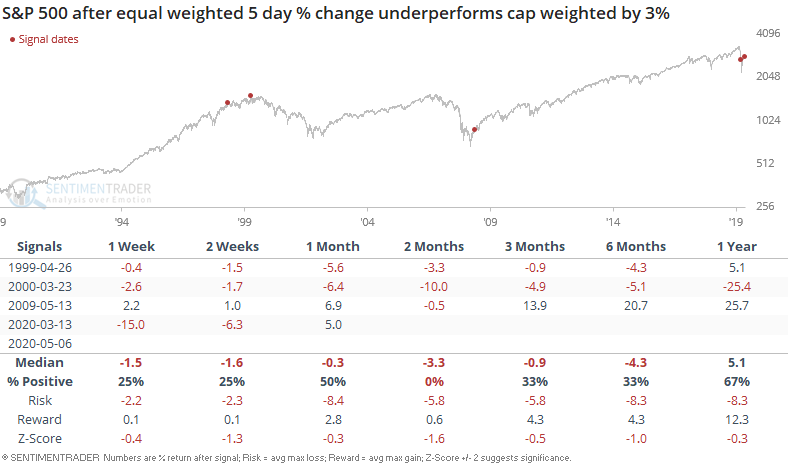

As Liz Ann Sonders noted, the market cap weighted S&P 500 has significantly outperformed the equal weighted S&P 500. This comes as no surprise as market breadth has narrowed and tech stocks lead the rally.

This happened 3 other times over the past 30 years, and all of which led to losses over the next 2 months:

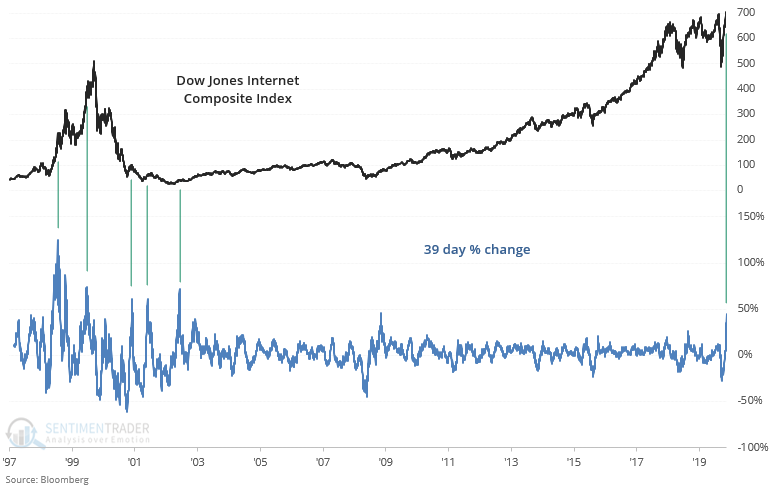

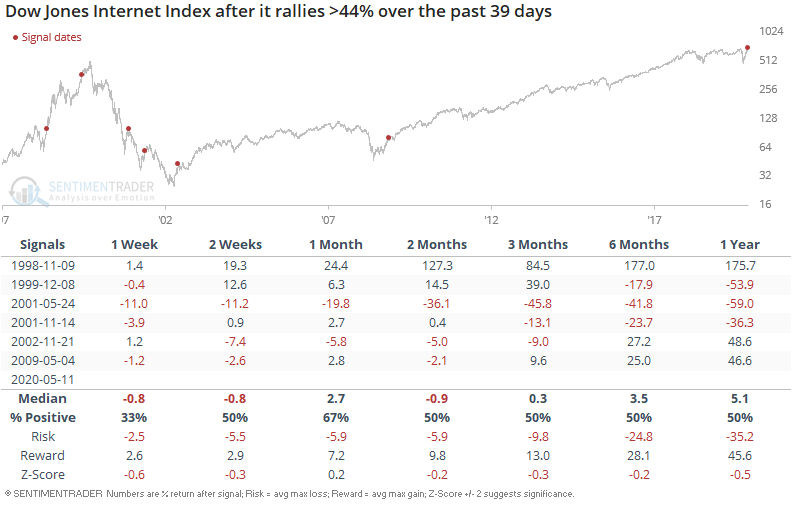

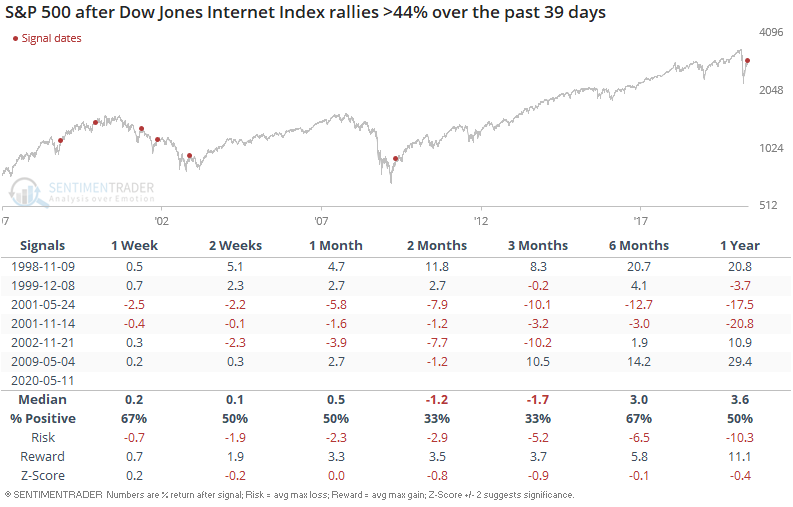

The Dow Jones Internet Composite Index made a new all-time high. This is the largest 39 day rally since the previous bull market began in 2009:

Similar large rallies saw mixed returns going forward, with returns in bear markets being decidedly bearish:

This was bearish for the S&P 500 over the next 2-3 months:

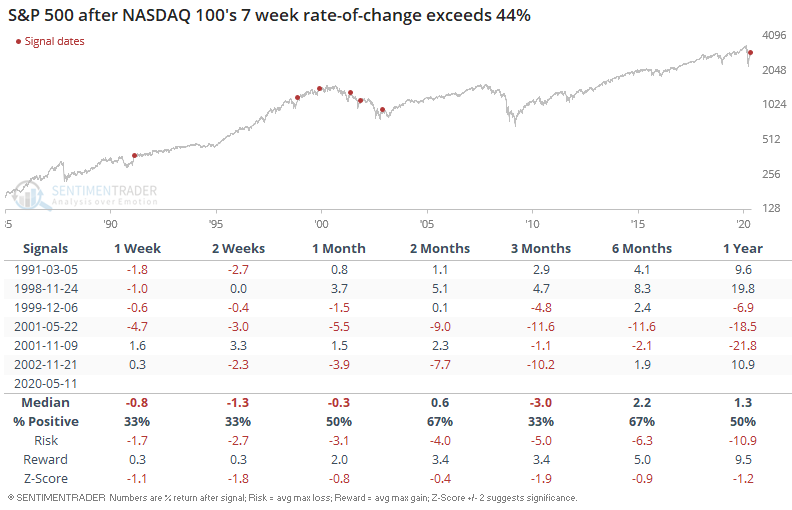

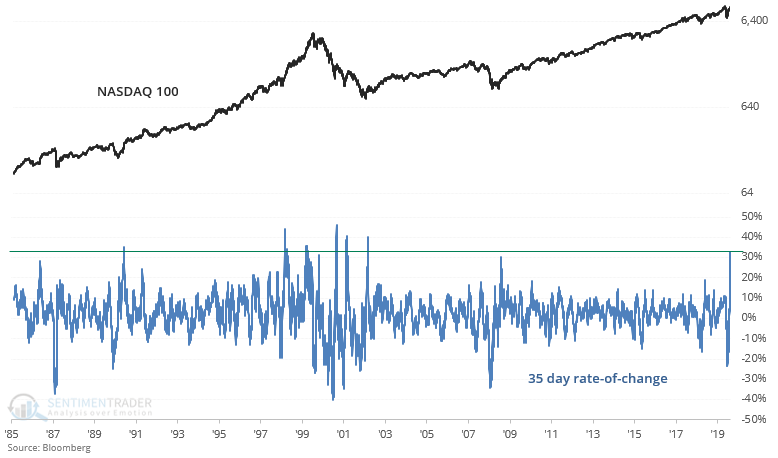

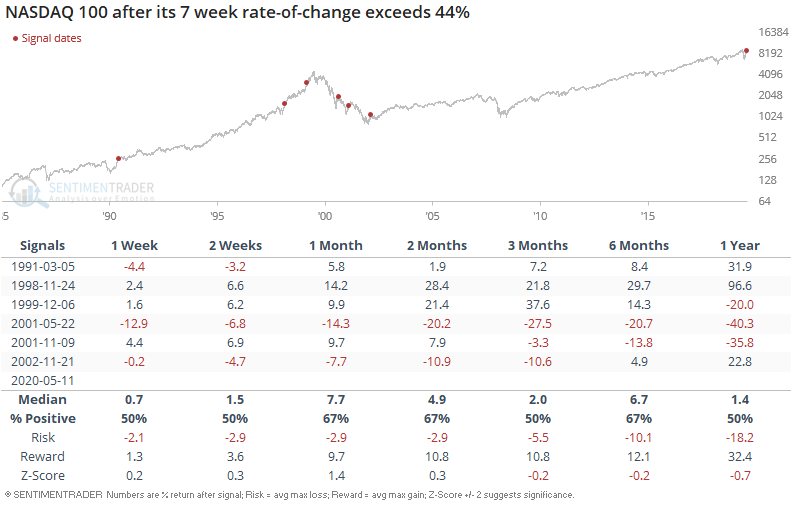

And lastly, the NASDAQ 100's 7 week rate-of-change is at its highest in almost 2 decades:

This led to mixed returns for the NASDAQ 100 going forward:

And usually led to short term losses for the S&P 500: