The Typical Sentiment Cycle shows panic is rising

Key points:

- Based on a Typical Sentiment Cycle, we've entered the panic phase

- There is a nearly 80% probability we've entered that part of the cycle

- Other moves into that phase during non-recessionary periods typically preceded good returns for stocks

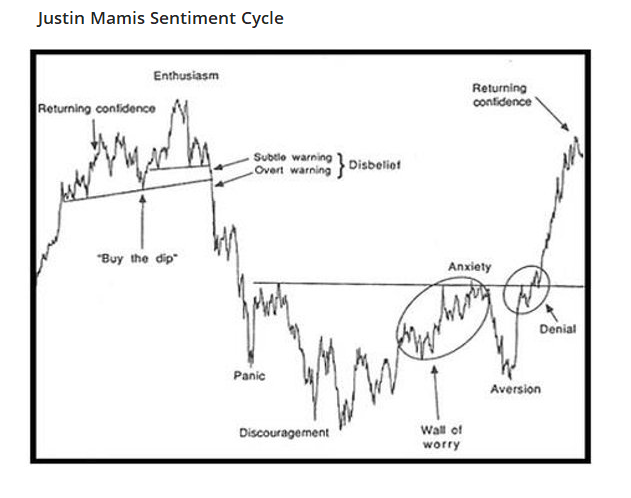

A Typical Sentiment Cycle

Last September, we looked at how correlated the price action was to the four major parts of a Typical Sentiment Cycle. It proved to be a decent guide to likely future returns, based on how investors often behave at various points in the cycle.

A popular heuristic uses some version of the Cycle popularized by Justin Mamis in his 1999 book, The Nature of Risk. The Mamis chart encompasses the price path of U.S. stocks from roughly May 1990 through March 1991.

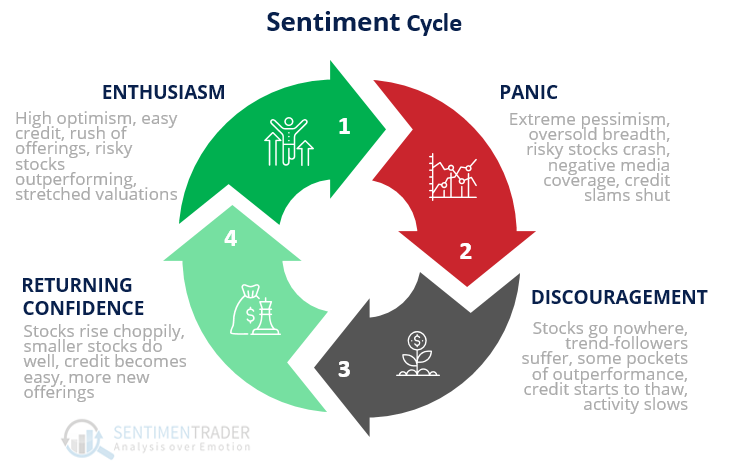

There are essentially 4 major parts to the cycle:

1. Enthusiasm - High optimism, easy credit, a rush of offerings, risky stocks outperforming, stretched valuations

2. Panic - Extreme pessimism, oversold breadth, risky stocks crash, negative media coverage, credit slams shut

3. Discouragement - Stocks go nowhere, trend-followers suffer, some pockets of outperformance, credit starts to thaw, activity slows

4. Returning Confidence - Stocks rise choppily, smaller stocks do well, credit becomes easy, more new offerings

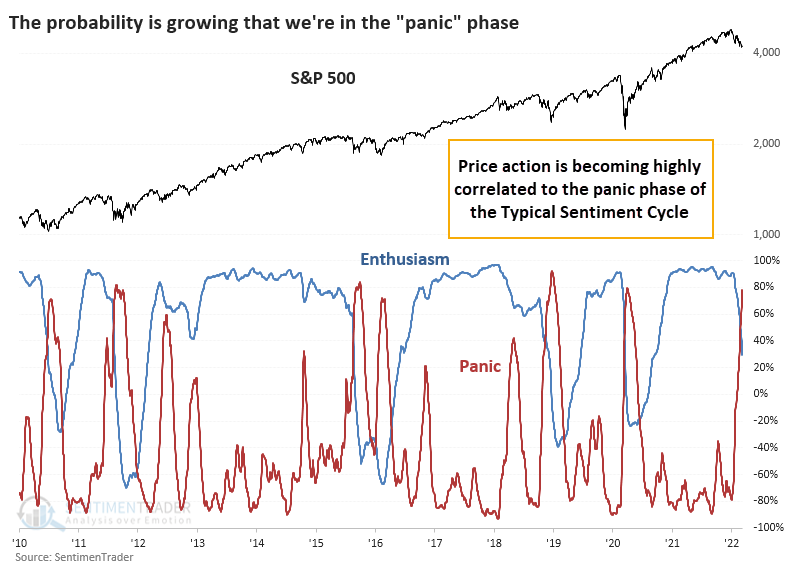

Where we are now - panic

Instead of eyeballing things, we can compare recent market activity to various parts of the Typical Sentiment Cycle and see how investors are behaving relative to an "ideal" cycle. Based on that analysis, they're panicking. The S&P 500's price action just climbed above a 75% correlation to the panic phase.

With Monday's session being one of the most atrocious across most markets in months, this is going to rise even quicker into panic territory.

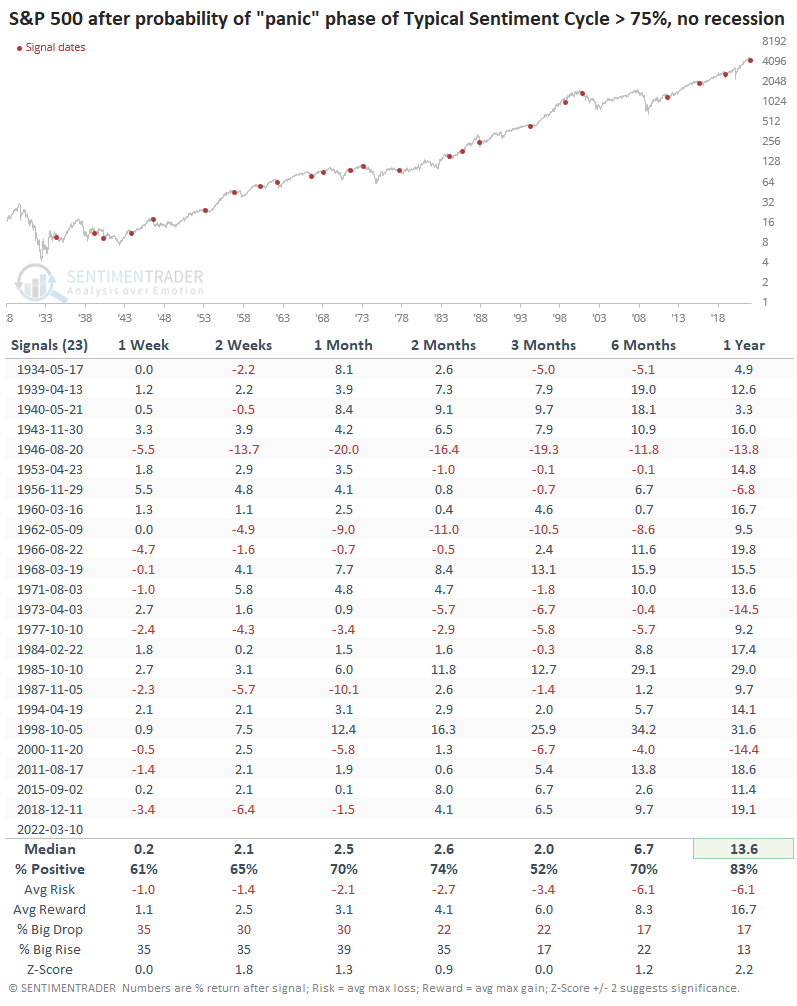

After the probability of being in the "panic" phase rose above 75% for the first time in at least a year, the S&P 500 performed okay. It did quite a bit better if the U.S. economy was not in a recession at the time. While economists will argue about whether we're about to fall into one (war, unfriendly Fed, spiking commodities, isolationist trade policies, near-inverted yield curve), it's virtually impossible that the NBER will declare that we're in one right now.

The entry into the panic phase of the cycle didn't mean that stocks rebounded quickly and sustainably every time. It preceded quick double-digit losses in 1946, 1962, 1987, and 2018. But, overall, reward exceeded risk, and the probability of a big rise exceeded that of a big drop. Just not by as much as we'd like to see to consider it an edge.

What the research tells us...

Based on a multitude of sentiment guides and price action itself, it's clear that investors are pessimistic at best and on the verge of outright panic. To see a multi-week to multi-month rebound, it's not necessary to witness a final flush that finally triggers panic selling, though it would be easier to make that case if we do get some true readings showing whites-of-their-eyes kinds of washouts.