The troops are leading the general

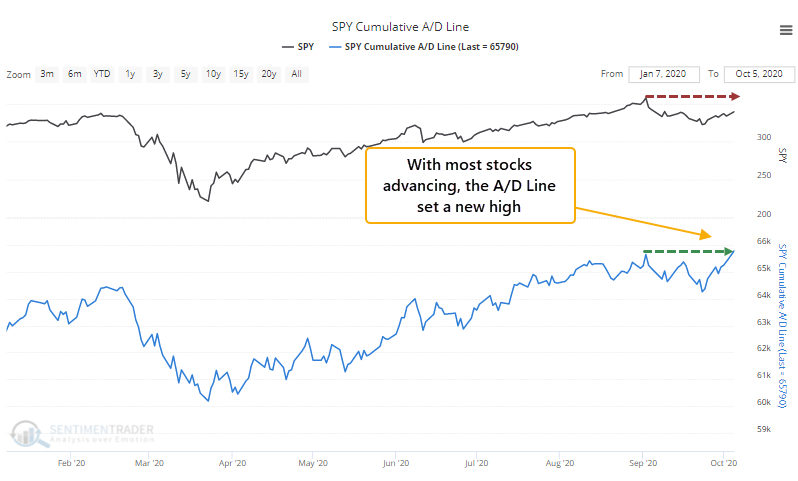

For the first time in a month, there have been enough stocks in the S&P 500 rallying versus declining to push its Cumulative Advance/Decline Line to a 52-week (and all-time) high.

This may be notable, because the S&P 500 itself was dragged lower by some of the big tech stocks that had the air let out of them in September. It's a case where the troops are leading the general.

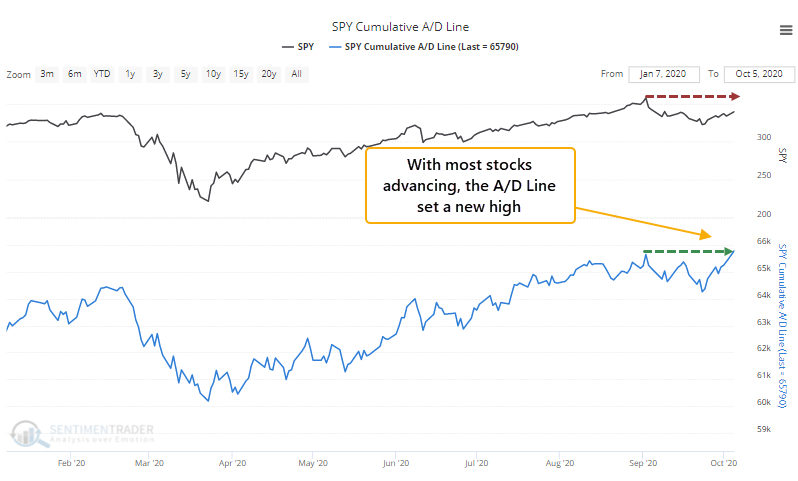

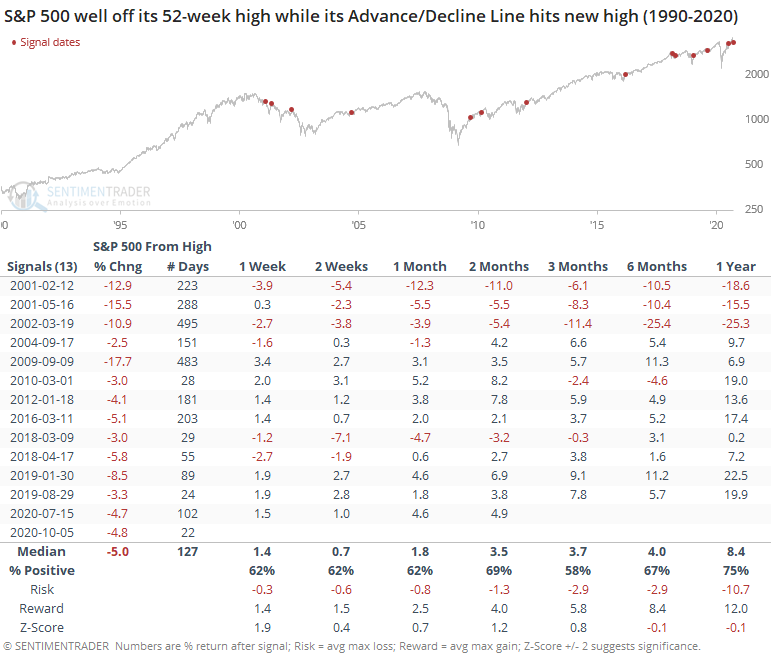

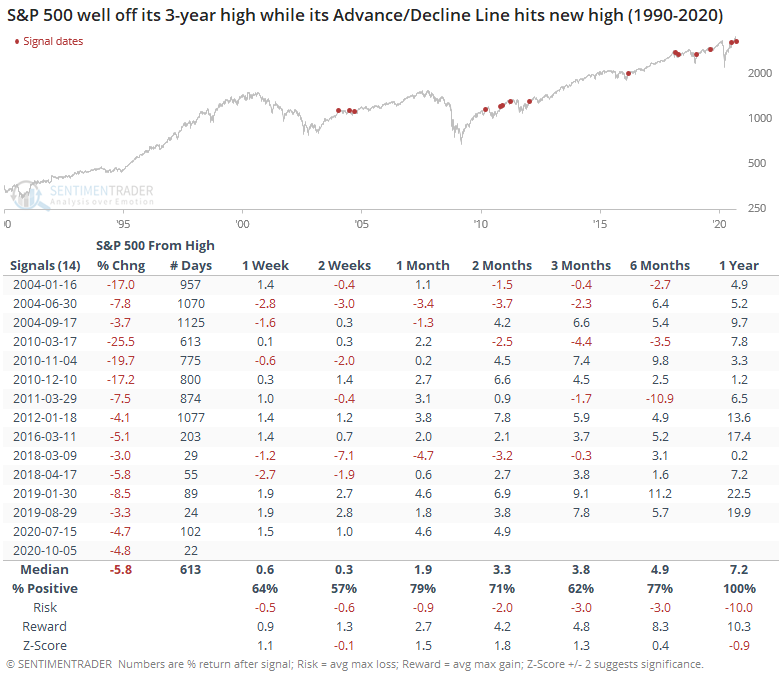

This is supposed to be wildly bullish, so let's check. We'll look for every time when the S&P's A/D Line made a 52-week high for the first time in at least a month, while the S&P 500 itself was more than 2.5% below its own high.

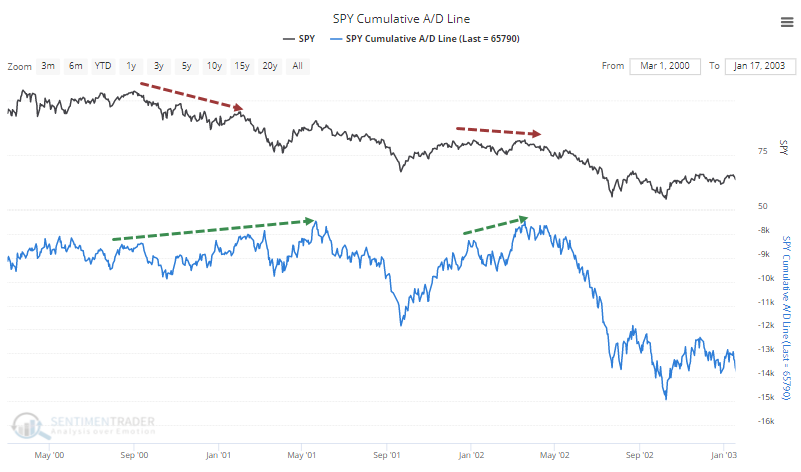

This was mostly a good sign. The only real exceptions were in 2001-02 when the A/D Line kept hitting new 52-week highs even while the S&P itself was mired in a pattern of lower lows and lower highs.

That's being a bit myopic because we're only looking at the A/D Line hitting its highest level in 52 weeks. On Monday, it hit a new all-time high. So if we look at larger extremes, at least over a 3-year time period, then forward returns improve.

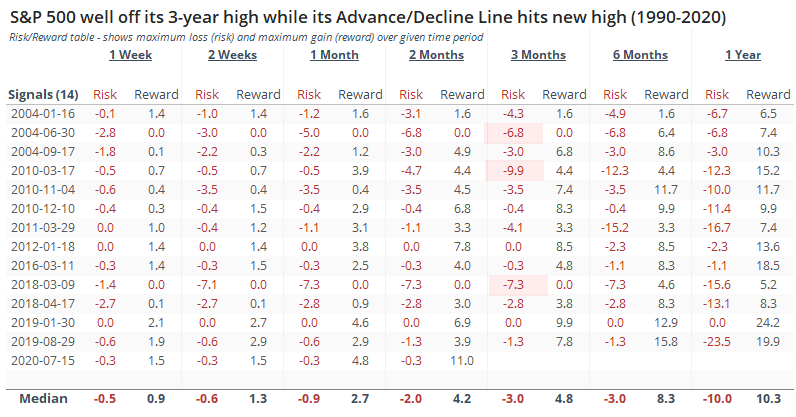

This was not a signal to put all spare cash to work and rush into a leveraged long position. Several of these signals saw medium-term choppiness, but at least the losses were fairly limited. Looking at the Risk/Reward table, only 3 of the 14 signals saw a loss of more than -5% at any point within the next 3 months.

This looks to be one of the cases where improving breadth despite a weak index has preceded better-than-average returns, at least over a medium-term time frame. The broader NYSE Cumulative Advance/Decline Line and the one only including common stocks have not yet set new highs for this move, so it would help if they also got in line in the coming days.