The tech sector's relative breakout cluster

Key points:

- An index of Technology sector stocks has set a cluster of new highs relative to the S&P 500

- This follows what had been new multi-year lows for the ratio earlier this year

- Similar behavior tended to precede modestly positive returns, especially for Tech versus the S&P

Tech powers the market higher and sets a new relative high

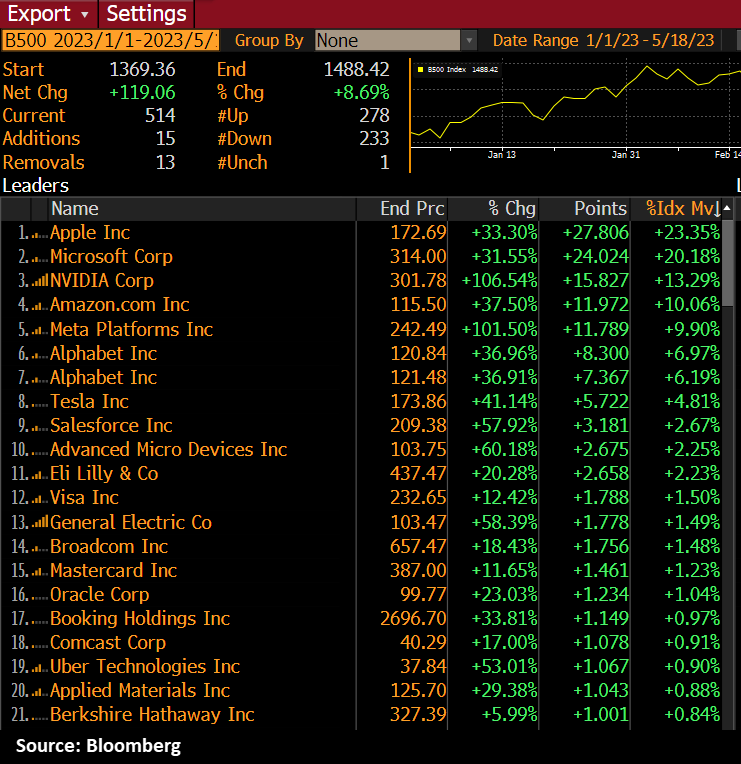

Tech stocks have had an outstanding year, especially the big ones. According to Bloomberg calculations, a handful have accounted for all the gains this year in an index mimicking the S&P 500.

The table below shows, in descending order, how many points and percentages of the index's move were accounted for by the top stocks. If Amazon is included as a "tech" stock, they more than make up the index's total gain for the year. As Dean recently noted, Semi stocks are among those leaders and are breaking out.

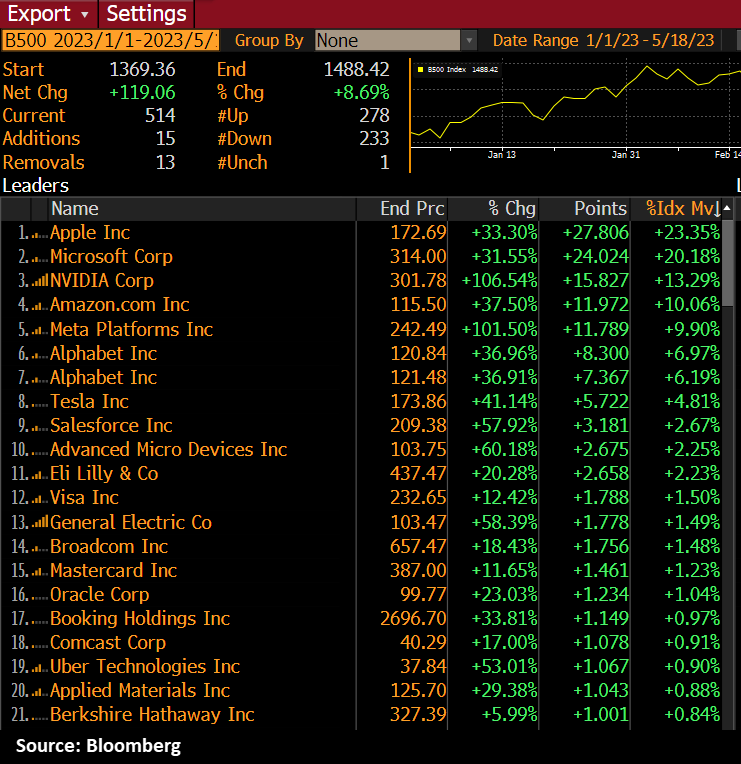

As a result, a proxy index of the Technology sector has not only broken out to a new high relative to the S&P 500, it has continued to shoot higher. It was only earlier this year when the ratio dragged along at a multi-year low.

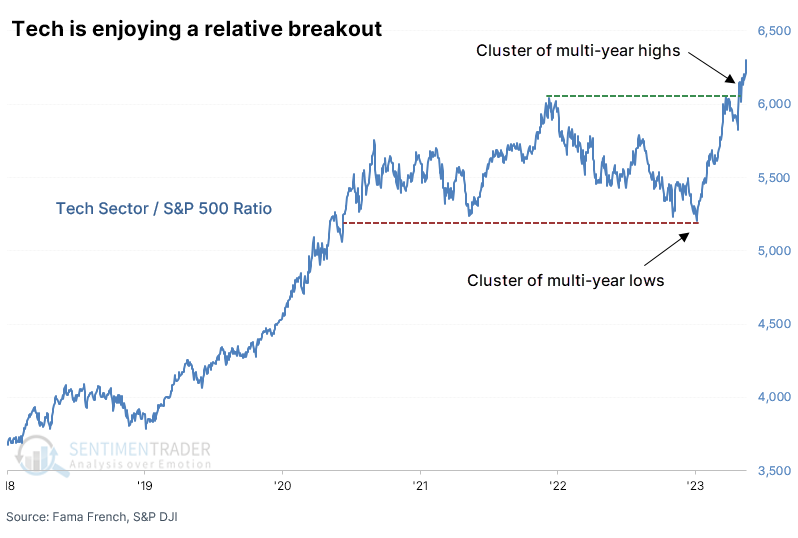

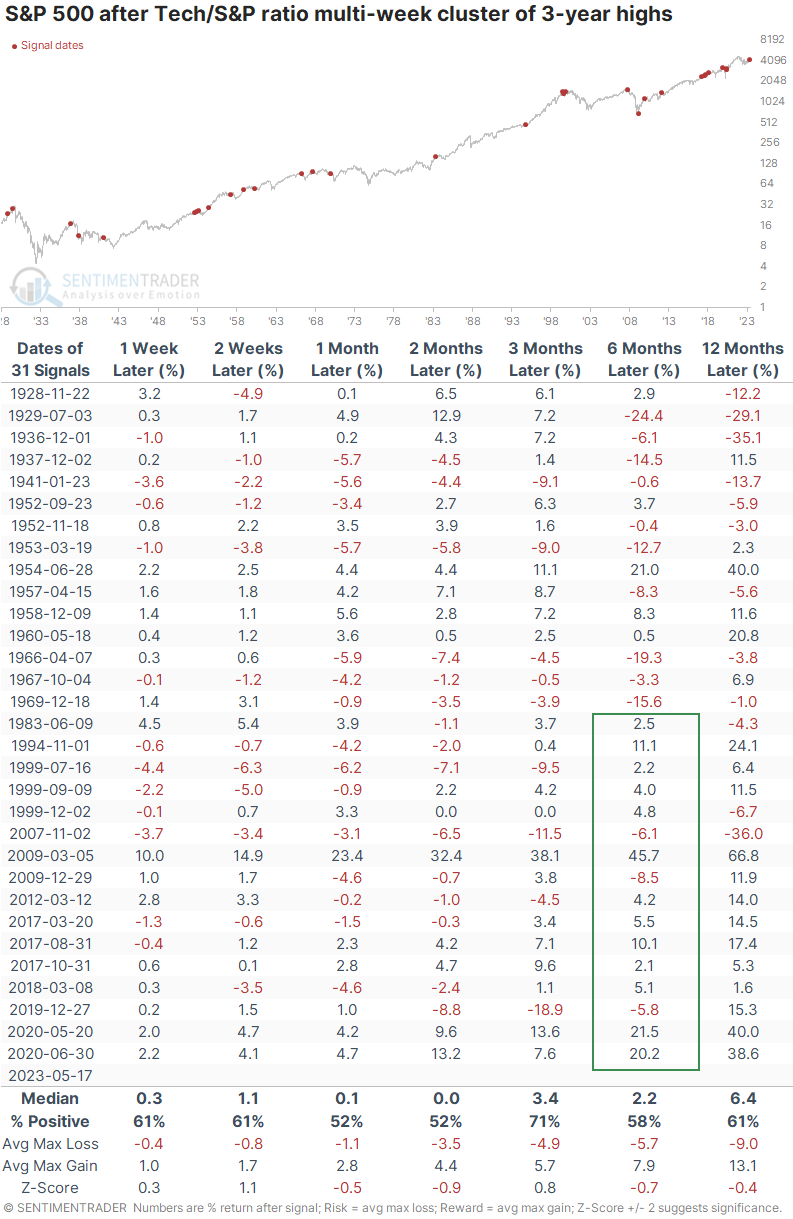

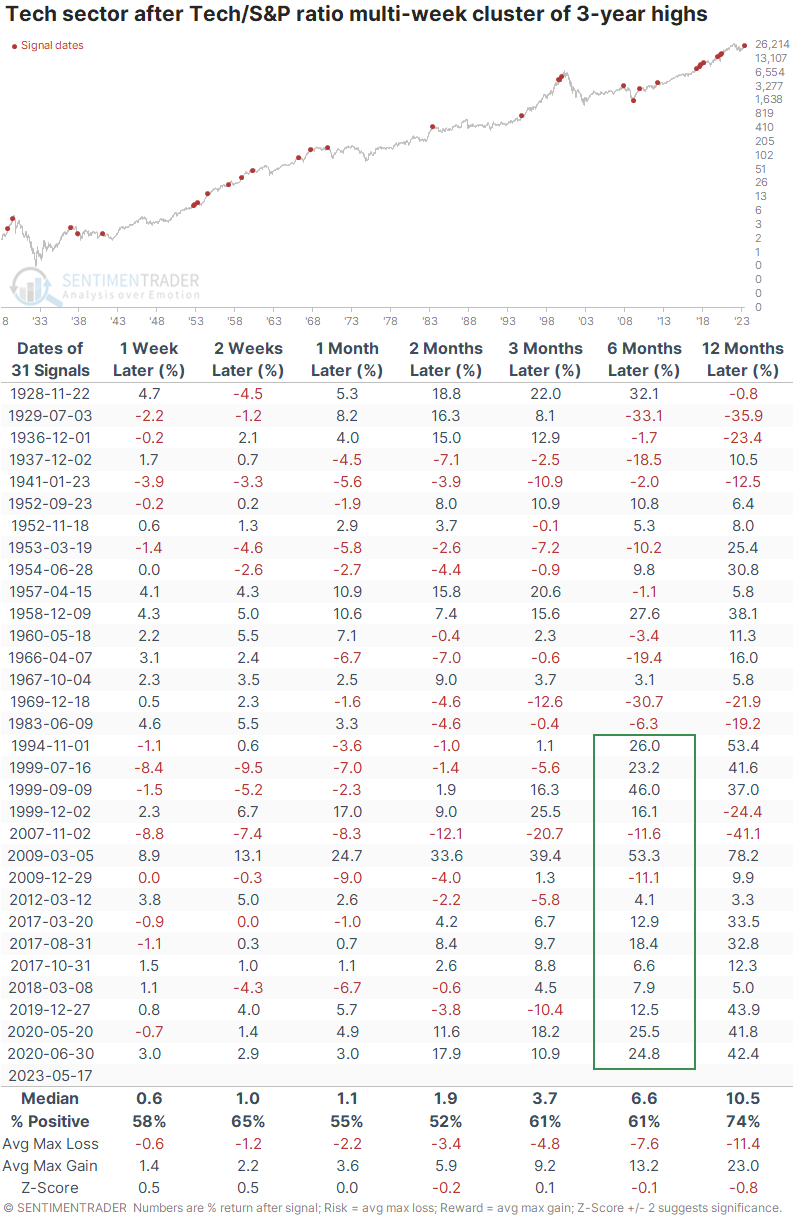

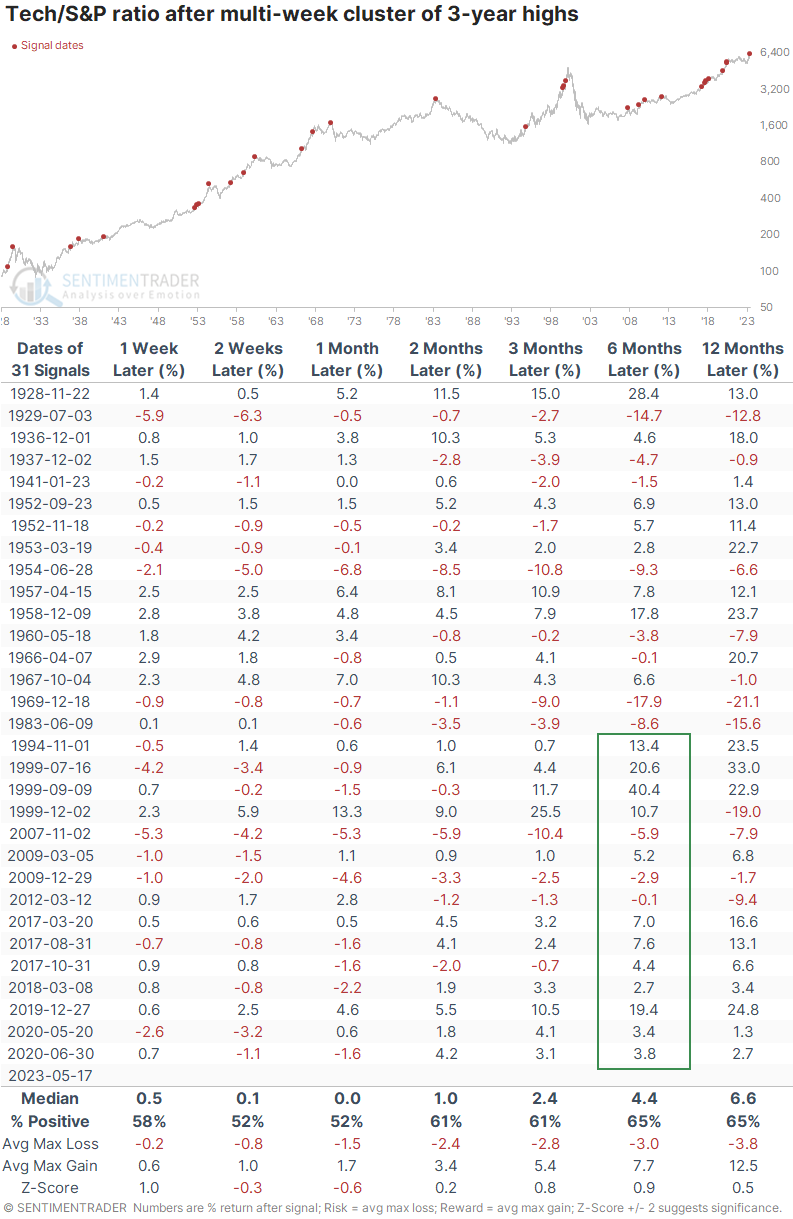

Out of the past 15 sessions, over half of the days have witnessed a new high in the Tech to S&P 500 ratio. The table below shows returns for the S&P after these clustered signals. It proved to be a mediocre sign for the index in general, with returns about in line with random and unimpressive consistency. Over the past 40 years, six-month returns have been much better than prior decades.

It was perhaps a modestly better sign for the Tech sector, but still not a solid edge. Over the past 30 years, the six-month returns were among the best, with 13 out of 15 signals sporting a positive return and only 2007 being a significant loser, though the 1999 signal morphed into one.

Tech's relative outperformance may continue

When looking at the relative performance of Tech versus the broader S&P index, the six-month window showed the most consistent outperformance, especially over the past three decades. There were only three times when Tech did not outperform, and the differences were relatively minor.

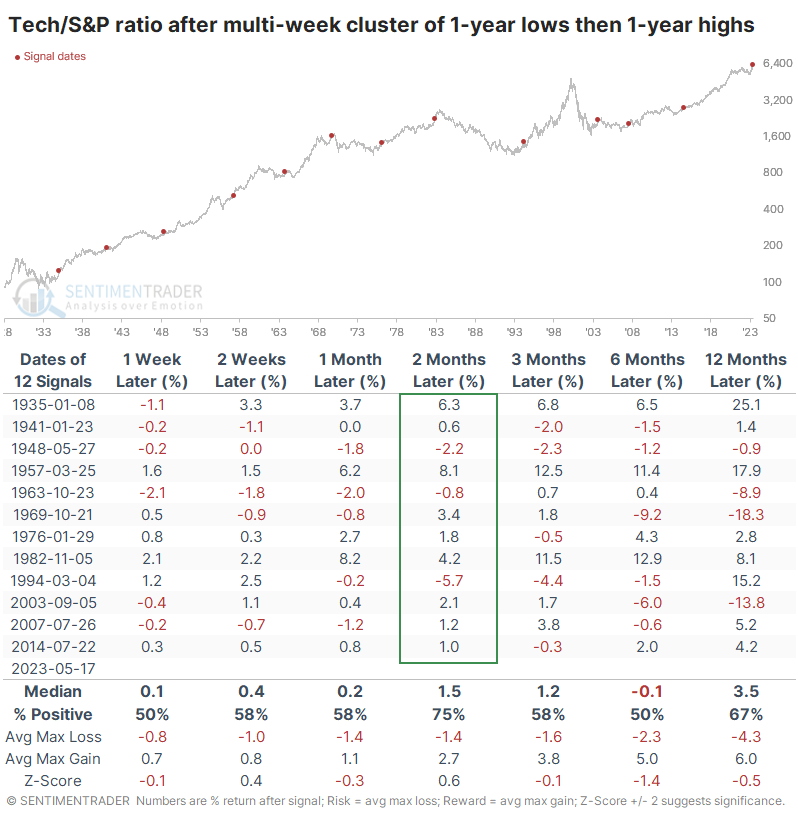

This is the 13th time when there was a cluster of days when the ratio made at least 1-year lows, which then cycled to a cluster of 1-year highs. Once again, this wasn't a very clear signal, but perhaps it slightly favors those bullish on Tech.

When looking at the ratio between Tech and the S&P, these cycles preceded further outperformance most of the time, especially over the next two months. Over the next year, Tech outperformed after 8 of the 12 times, and one of the losers was small.

What the research tells us...

After a bubbly year like 2021, investors naturally look for evidence that it's still in effect. We're nowhere near the absurdities witnessed then; in fact, most indicators suggest we're closer to the opposite extreme than anything. With a handful of Tech stocks driving the overall market higher, there is a chorus of eye-rolling "here we go again" statements. There is some truth to the idea that underlying breadth is only so-so, but there is also not much evidence that it's a reliable sell signal. For Tech stocks themselves, their recent outperformance may be a decent sign that they'll likely keep outperforming, at least over the medium term.