The surge in gold miners has not been a good sign for BUGS

Key points:

- The NYSE Gold BUGS index has risen over 10% in the trailing 5-day period

- The surge occurred within 2 months of a 1-year low in the index

- Similar surges have led to weak forward returns

Surges from a low as a trend change signal

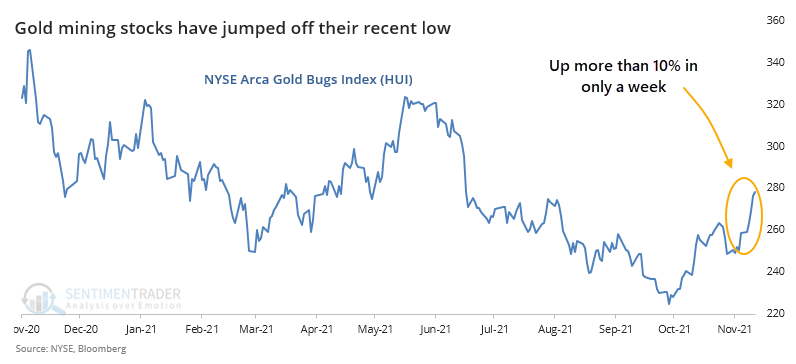

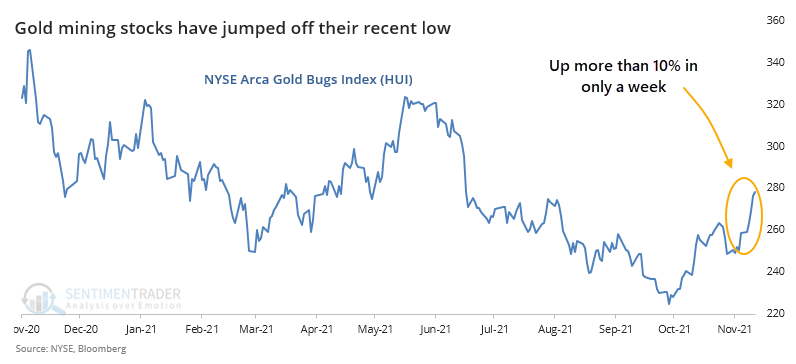

The go-to index for gold miner investors is the NYSE Arca Gold Bugs Index. BUGS stands for Basket of Unhedged Gold Stocks. The index contains companies that do not hedge their gold production beyond 1.5 years to better correlate to gold prices.

Over the past week, the index has jumped more than 10%, within a couple of months of languishing at a 1-year low.

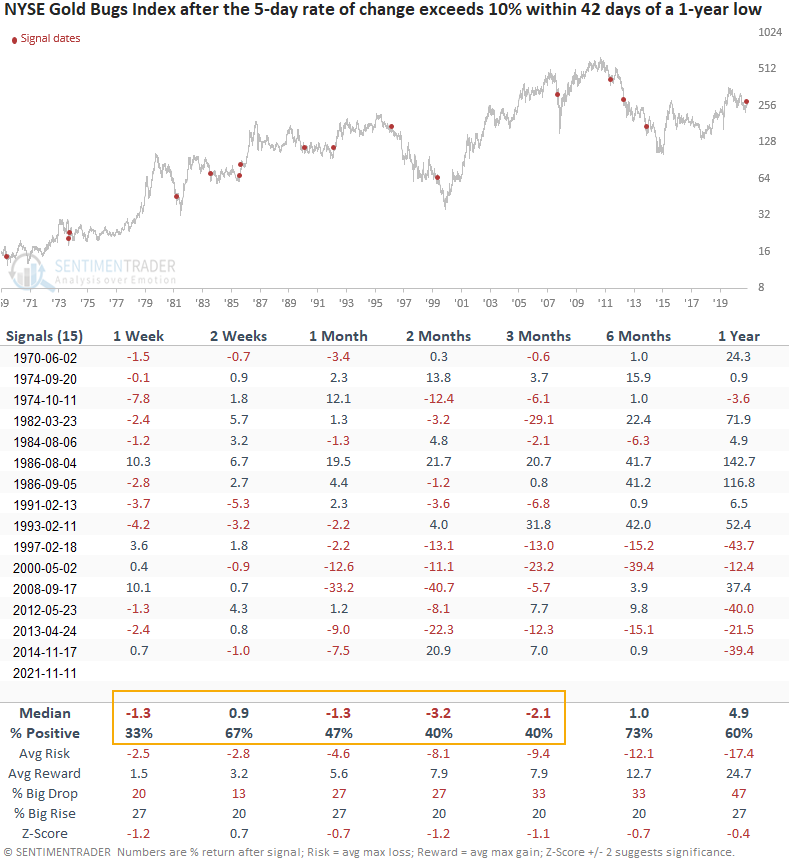

Similar reversals in the miners preceded losses 60% of the time

A similar reversal signal has triggered 15 other times over the past 52 years. After the others, future returns and win rates were weak across short and medium-term time frames. Over the past 30 years, miners declined during the next month after 6 out of 7 signals.

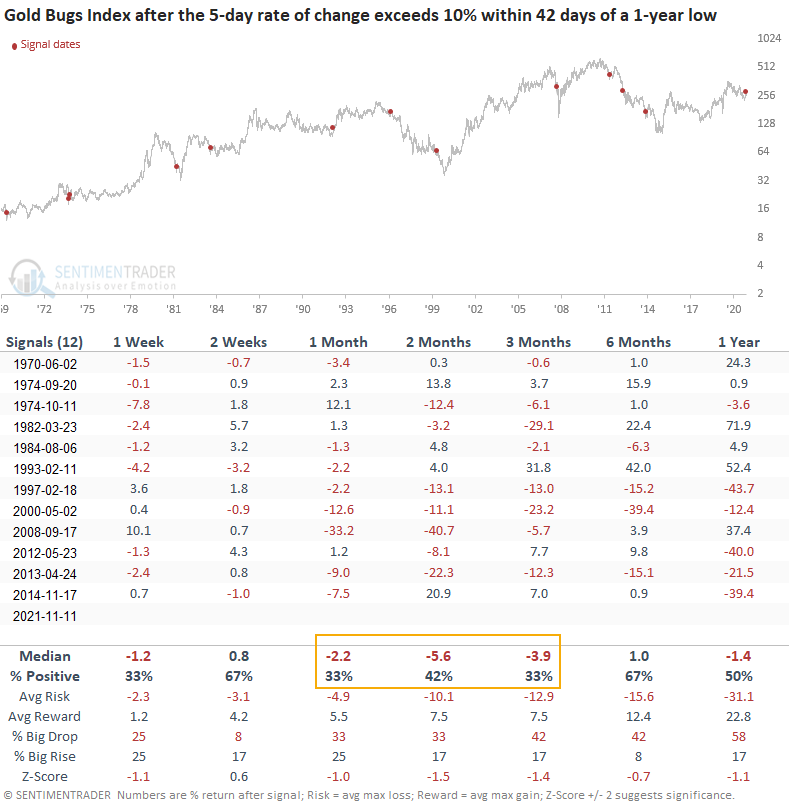

Dollar uptrend signals preceded losses for gold miners 67% of the time

Let's add some context to the study. I will add a Dollar index trend filter to the signals to assess the outlook for gold miners when the Dollar index is in an uptrend, which is the case now.

This signal has triggered 12 other times over the past 52 years. After the others, future returns and win rates were even weaker in the 1-3 month time frame when the Dollar index was in an uptrend. And, once again, the more recent history shows 7 out of 8 losses in the 1-month window. When investing in gold or gold miners, it's important to understand the Dollar index trend.

What the research tells us...

When the NYSE Gold BUGS index surges from a 1-year low, history suggests the momentum is a bounce in a downtrend, especially when the dollar index is in an uptrend. This group has had a very difficult time, especially in recent decades, holding this momentum much longer, with most weakness occurring over the next 1-3 months.