The S&P's Momentum Streak Aided By Industrials

This is an abridged version of our Daily Report.

The S&P’s consistent, rapid rally

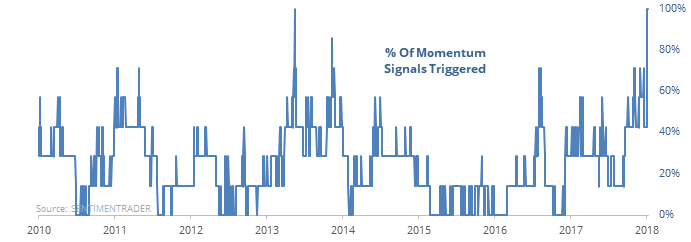

The most important index in the world has rallied consistently for the past 1, 3, and 6 months. It has also picked up its gains, nearing or exceeding its upper Bollinger Band on daily, weekly, and monthly time frames.

Similar markets led to some shorter-term pullbacks, with all but one culminating in v-shaped bottoms.

Industrial-strength momentum

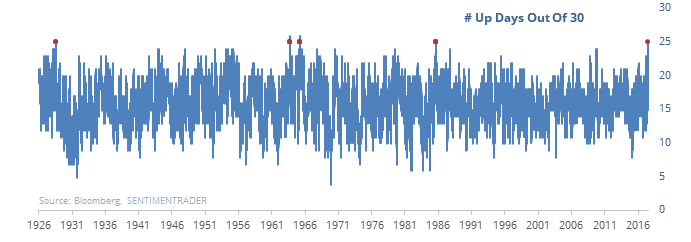

The Industrials sector has rallied almost every day for the past three weeks…and the three weeks prior to that. During the past 30 days, there have been only 5 down days, a remarkable streak not seen in 30 years.

Similar buying clusters at a new high have led to consistent gains going forward.

Here we go with the odd readings again

The NYSE Up Issues Ratio was less than 43% on Monday, well below average for a day when the S&P 500 rose at least marginally and closed at a multi-year high.

More

Adding to the oddities, the VIX “fear gauge” also rose today.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.