The S&P 500's Summation Index is in the Worst Possible Position

At various points this year, the majority of stocks have trailed the major indexes. Sometimes, there was a wide divergence between what the average stock was doing versus, say, the S&P 500. Historically, that has preceded declines in the indexes, but 2021 has thrown a whole host of historical markers out the window.

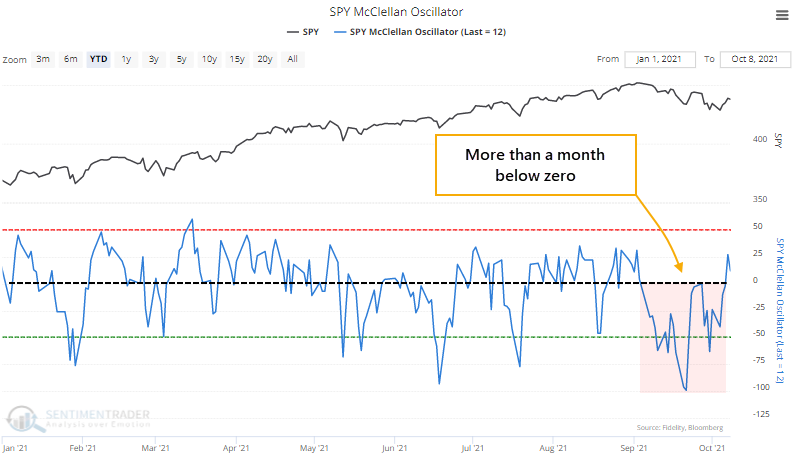

Even so, the internal weakness was enough so that when the S&P actually did start to struggle over a month ago, some of its breadth metrics really struggled. The rally at the tail end of last week started to change that; the McClellan Oscillator for the S&P 500 has turned positive for the first time in a month.

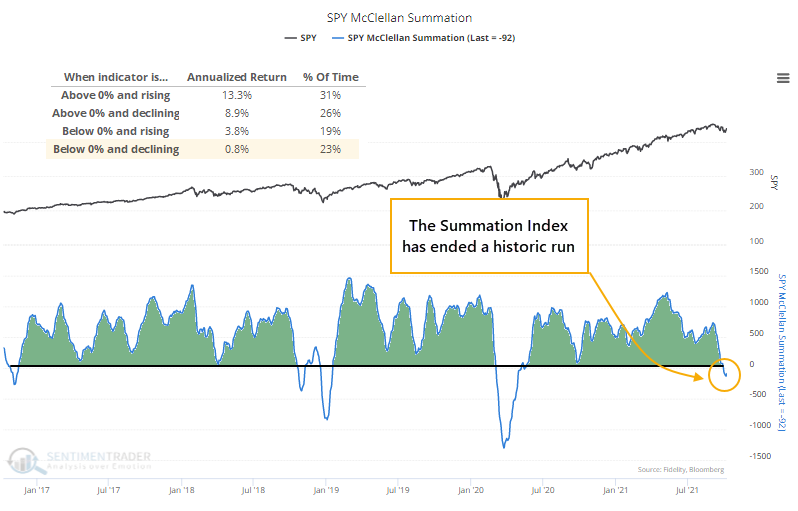

The extended run below zero in the Oscillator caused the longer-term Summation Index to plunge, and it recently dived below its zero line for the first time in well over a year. The worst possible scenario for an index or sector is when its Summation Index is negative and declining - that's when the ugliest selloffs tend to occur.

We can see the stark differences in annualized returns in the S&P 500 since 1926 based on various regimes in its Summation Index, and we're currently mired in the worst tranche. It's trying to curl up now, which helps, but we could breathe easier if it manages to keep rising and crosses above the zero line.

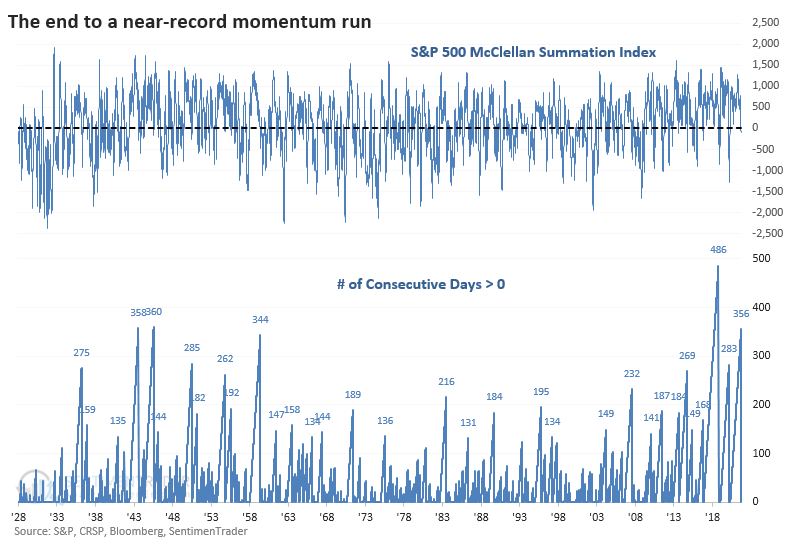

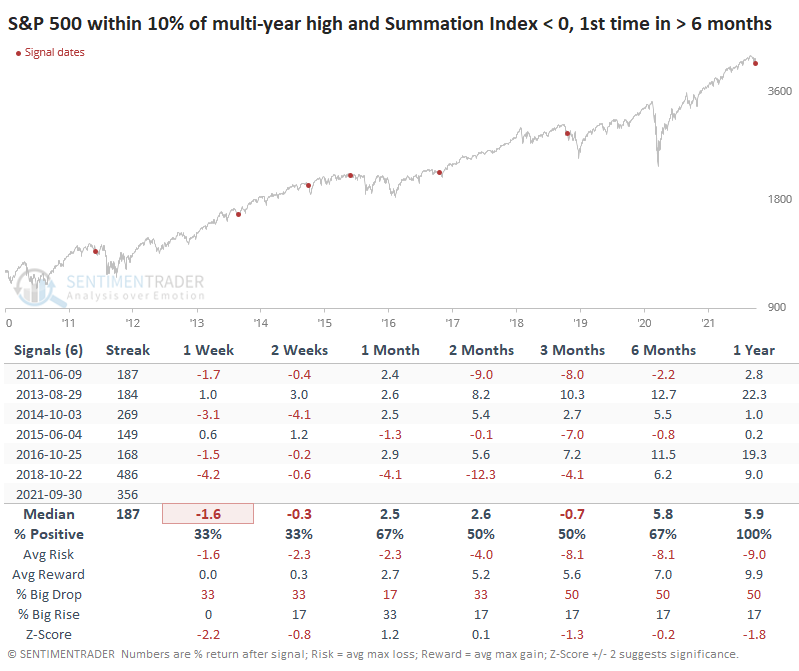

The drop below zero ended the 4th-longest streak in positive territory for the Summation Index since 1926, and it missed making it into 2nd place by only a few sessions.

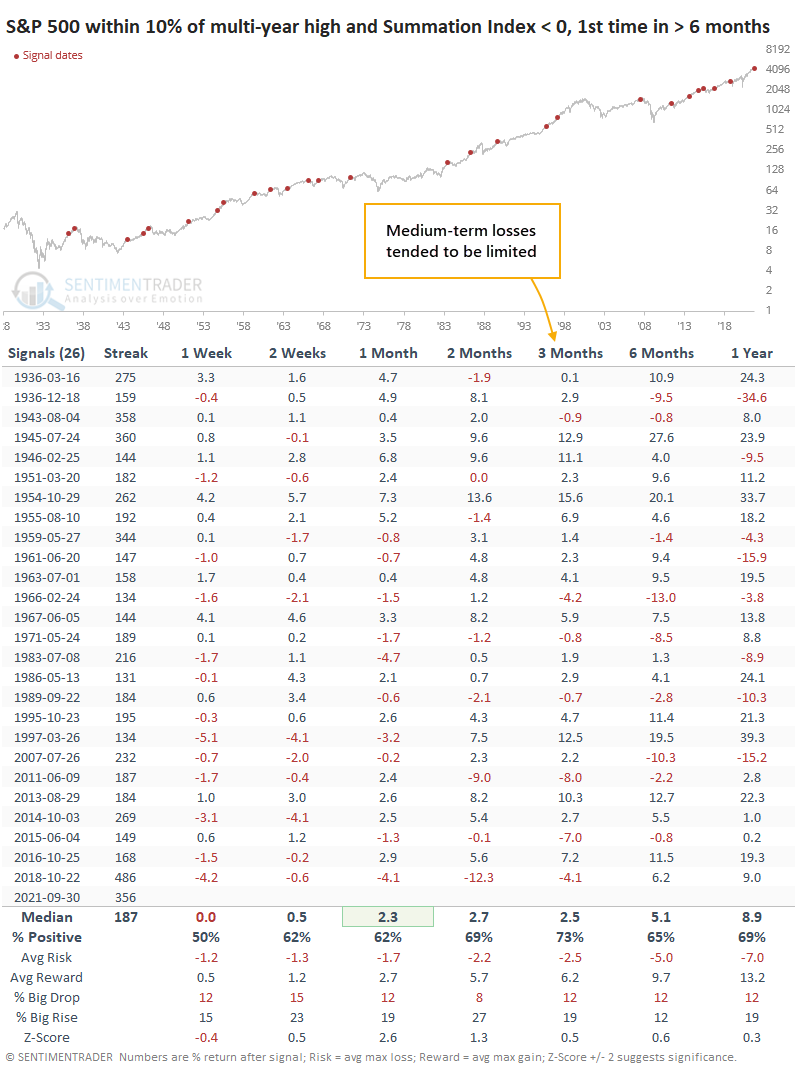

The longest streak ended in 2018, almost exactly three years ago, and ushered in some quick and painful losses. That was more the exception than the rule, though. After other long positive streaks ended, the S&P tended to show positive returns going forward, better than average returns, with generally small losses. Over the next three months, there were only two losers larger than -5%.

If we focus on the handful of signals since the global financial crisis, we can see more of a struggle. After these long positive streaks ended, the S&P fell into correction mode three times and quickly resumed its uptrend three times. That's a wash.

Over the past week, we've looked multiple times at the ends of long streaks of positive momentum. To a one, they showed a positive expectation going forward. After a long time with positive trends and internals, buyers have had a powerful tendency to see the first real pullback as an opportunity. We're amid that "opportunity" now, with solid seasonal trends as a tailwind. The following 2-3 weeks could (and should) be volatile as earnings come into focus and investors get more of a read on the spike in energy prices and potential contagion from foreign debt issues. But looking at the next 2-3 months, the bias should be higher unless something drastic has shifted in the market environment.