The S&P 500 is uncorrelated with...itself

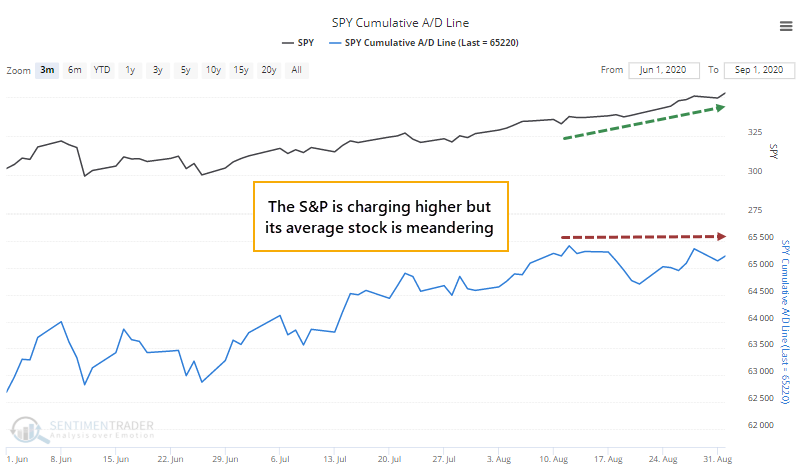

We saw on Monday that the correlation between the S&P 500 index that everyone watches and its equal-weighted cousin had broken down. The two versions of the same index are moving less together than at almost any point in the past 30 years, due to the by now well-documented dominance of the very large tech stocks, and otherwise poor breadth.

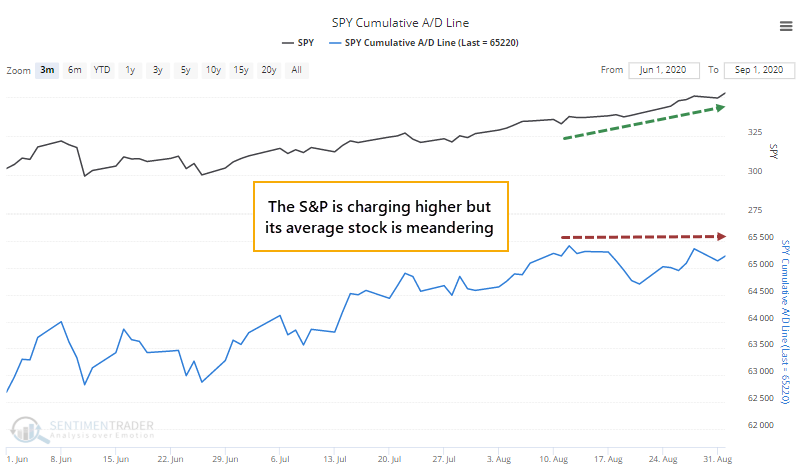

The index is becoming uncorrelated with itself. Isabelnet notes that the correlation between the S&P 500 and its own Cumulative Advance/Decline Line is breaking down. This is a different reflection of the same phenomenon.

This is nearing the smallest-ever correlation between the index and...itself. The only time there was a smaller correlation was September 2000.

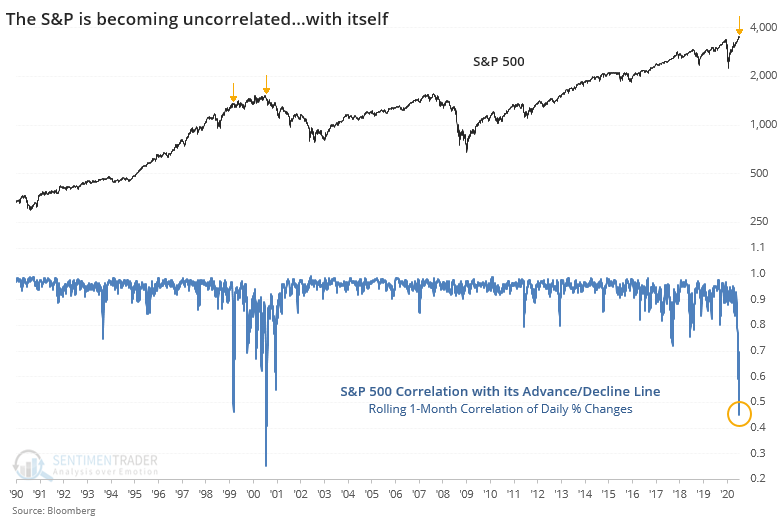

As the Daily Shot notes, this kind of split in the market has also caused a drop in the correlation between value and growth stocks. Going back to 1928, the two factors have never moved quite like this. Over the past month, the two actually have a negative correlation, a stunning historical anomaly.

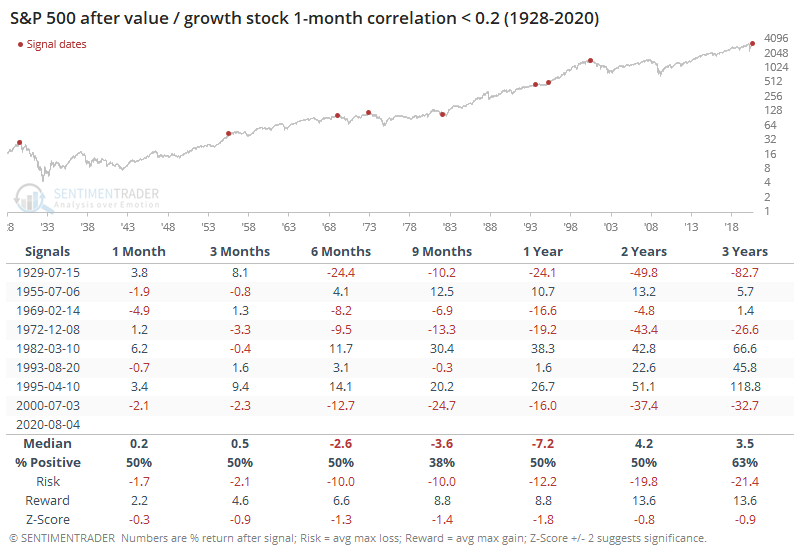

The only other time when the 1-month rolling correlation between daily percentage changes in the two factors dropped close to its current level was, once again, September 2000. That wasn't a great time in history for future returns.

Over the next 9 months, the S&P managed a positive return after 3 out of 8 signals, with a poor average return and risk/reward skew. In 1982 and 1995, there were no ill effects at all, while the others preceded either negative or relatively flat returns over the longer-term.

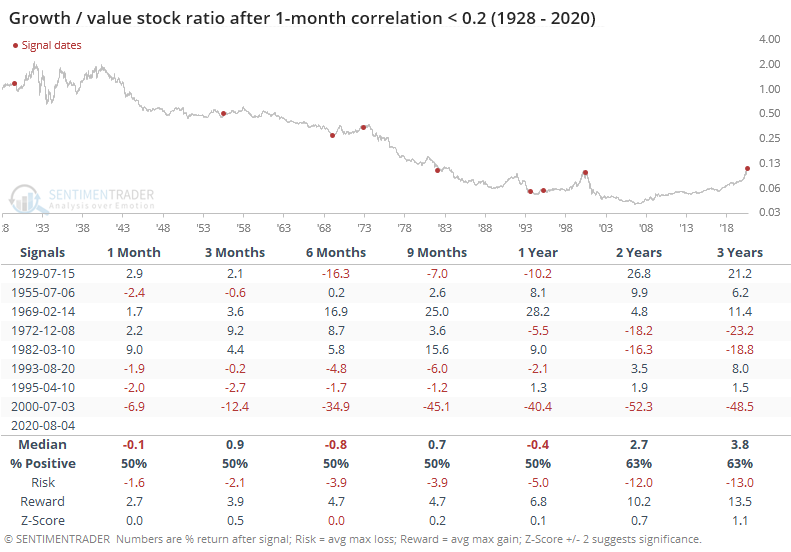

The ratio between the factors favored value over growth but it wasn't consistent.

This is one of the most unique moments in market history. While "unique" in March/April/May was skewed heavily toward extremely positive cases, "unique" over the past couple of months has indicated flat or lower prices. It hasn't mattered a whit, and maybe that will continue. It would also go against whatever few historical precedents are available.